The price is endless, how can LCD panel companies break the situation?

Author:Yu Bin Time:2022.06.20

Edit | Yu Bin

Produced | Chaoqi.com "Yu See Column"

After more than ten years of high -speed development, the LCD panel market this year can be described as happy and worries. What is happy is that domestic companies continue to maintain a leading advantage worldwide. OMDIA data shows that in April this year, five domestic panel manufacturers, namely BOE, TCL Huaxing, Huike, Rainbow Optoelectronics, and Nanjing China Panda, their LCD TV panels account for 68.5%of the global market. This year's share accounts for more than 70%. The global panel industry is experiencing an unprecedented cold winter.

In the first half of this year, on the one hand, the rising price of commodities in the global commodity caused by the epidemic continued, and the problem of poor supply chain has not been effectively resolved. In addition, the situation of the local area is still tight. The factors will push the production and sales cost of the panel.

On the other hand, consumer demand is continuously weaker, and the purchasing power of consumers has also declined to a certain extent. This is the main reason for the current pressure of the display panel market. industry.

Data from Ovarwo shows that the shipping volume of global TV panels in April this year was more than 20 million pieces, a decrease of 4%year -on -year, and a significant decrease of 13%from the previous month. From a global perspective, the demand for market opposite panel demand declined It will still last for a long time.

The result that is more than required is that the price is lower than the cost. The price of LCD TV panels and IT panels has continued to decline for more than one year and half a year, especially the price of large -size panels above 43 inches or more. The price is generally lower than the production cost. From September last year to May this year, the price of the 43 -inch LCD panel fell 46%, and the price of 55 and 65 -inch panels fell by 34%.

The lower price of panels has brought a lot of benefits to consumers. People can buy their favorite TV products with less expenditure. At the "6.18" shopping festival this year, the price of LCD TV is already at the lowest point. The price of 55 -inch, 65 -inch, and 75 -inch LCD TVs is 1,299 yuan, 1999 yuan, 2999 yuan, and the price of 86 -inch and 98 -inch LCD TVs has dropped to 5555 yuan and 14299 yuan.

However, in the long run, this will have a large negative impact on the development of the panel industry. When the cost and price are inverted for a long time, the losses of panel companies will increase, cash flow pressure will increase, and profitability will be greatly weakened. It may cause enterprises to not invest funds to carry out the upgrading and development of new technologies and new products. The innovation capabilities of enterprises will naturally be affected. For such a long period of time, the industry's reshuffle will be inevitable.

Since the beginning of the year, the situation of LCD panel companies has been relatively difficult, and there has been an embarrassing situation of increasing income and increasing income. Since the third quarter of last year, the net profit growth of BOE and TCL technology has slowed significantly. It is particularly obvious. TCL Technology achieved revenue of more than 40 billion yuan, an increase of 25.81%year -on -year. The net profit attributable to the mother was nearly 1.4 billion yuan, but the year -on -year decreased by 43.89%.

BOE achieved revenue of more than 50 billion yuan, an increase of 0.4%year -on -year, and the net profit attributable to the mother was nearly 4.4 billion yuan, a year -on -year decrease of 16.57%. In contrast, BOE achieved a revenue of nearly 220 billion yuan last year, an increase of 61.79%year -on -year. The net profit of home was nearly 26 billion yuan, an increase of 412.96%year -on -year. Compared with the two, the contrast between profit is not large. The leading enterprise is still the case, and the situation of other companies can be imagined.

Leading enterprise plans to reduce production to relieve price and inventory pressure

According to the current development trend, the market demand and panel prices in the second quarter of this year are still not optimistic. Even if there is a "6.18" shopping festival and the blessing of consumer stimulus policies in various places, the decline will continue in the second quarter, but the amplitude will be the amplitude. Narrow.

It is expected that with the improvement of various conditions in the second half of the year, the price of the board below 55 -inch will stop or rise to varying degrees, and the price trend of large -size panels will also need to pay attention to de -inventory.

Reducing panel output has become a common choice that companies have to be adopted. The panel market is undergoing a wave of reduced production that has not been encountered in recent years. The number of panels purchased has dropped from 13 million to less than 9 million pieces.

Under the pressure transmission, panel companies have to start action. Following South Korea, domestic panel companies in June have also begun to adjust large -scale panel output. It is expected that the panel industry will reduce about one -sixth to five to five to five to five. About one output.

Qunzhi Consulting predicts that the amount of large -sized LCD panels worldwide in the second quarter of this year will decrease by 3.3%month -on -month. Compared with the second quarter of the third quarter, it will decrease by 7%. In addition to the large reduction in production, the scope of production reduction also surpasses the past in the past. It covers panel products from the 5th generation to 10.5 generations, and the production reduction time may last for a long time. The TCL Huaxing plans to extend the production reduction time to September. BOE and Huike will be predicted according to market demand.

Data from Qunzhi Consultation shows that the production capacity of the global display panel this year is as high as 12%year -on -year, which is the fastest year -on -year increase in production capacity in recent years, but market demand is declining, which has brought a lot to various panel companies. Stress, from the perspective of segmentation, the production capacity of large -sized TV panels is overcapacity. In the first three quarters of last year, the shipping volume of TV panels accounted for more than 70%. According to the data of Lotur Technology, in the first quarter of this year, the global TV shipment shipment was 47.5 million units, a year -on -year decrease of 6.5%. This is the third quarter. %above.

The reduction of the shipment of upstream TV manufacturers and the increased de -inventory pressure will inevitably reduce the purchase volume of LCD TV panels. Therefore, this will be the target of the key adjustment of each panel enterprise in the future. Based on the above two factors, it is not difficult for us to find that this year, each this year is each. The production capacity of panel companies is still relatively large.

Correspondingly, the value of the A -share market of several faucet companies has fallen a lot. As of June 9, the stock price of BOE A (000725.SZ) fell from 6.03 yuan per share in the same period last year to 3.68 per share. Yuan, TCL Technology (000100.SZ) fell from 7.5 yuan per share to 4.23 yuan per share.

This shows that the panel industry, especially leading enterprises, has always received close attention from the market. The next step of how companies combine market demand to successfully complete the adjustment of product structure and production capacity. This is worthy of further observation of all parties.

Doing the trend, we can stand up to the invincible place

LCD panel companies are experiencing the most difficult moments in the history of the industry. Facing the pressure brought by the downward market, panel companies are adjusting their business ideas. On the one hand The production efforts of high value -added panels such as 120Hz, high -end commercial and e -sports have increased the proportion of non -TV panel business revenue to 24%.

Huike launched the production line of Article 10 of Changsha in Changsha, mainly producing ultra -high -definition large -size display panels such as 4K and 8K. On the other hand, TCL Huaxing expanded the production capacity of small and medium -sized panels, such as LTPS LCD panels, tablet computers, vehicle monitors, etc., etc. At present, the proportion of non -mobile phone revenue of enterprises has reached 54%.

During the predicament, all panel companies are adjusting their business focus. TCL Huaxing is gradually reducing the proportion of LCD TV panels in revenue, increasing the revenue proportion of high value -added panels, and enterprises have strengthened the research and development of flexible OLED panel business Production capacity has launched new products such as flexible OLED folding screens.

BOE also accelerated the production speed of the flexible OLED panel. In the first quarter of this year, the shipping volume of BOE flexible OLED smartphone panels was about 16 million pieces, an increase of nearly 50%year -on -year. More than 100 million pieces, and the operation of the flexible OLED business will continue to improve.

In June, Samsung Show will officially bid farewell to the LCD panel business, and plans to establish an 8.5 -generation OLED panel production line. Samsung shows that the 8.5 founding factory that has closed the last LCD TV panel in early June, officially withdrawn from the LCD business. In the future At the core of the business, the output of QD-OLED panels this year is expected to reach about 1 million to 1.5 million pieces. The second QD-OLED panel production line is planned to be put into production in the second half of 2023.

"Yujian column" believes that when the industry is in a trough period and the market demand is weak, it is even more needed to maintain strategic determination and combine its own characteristics to increase technical investment and promote transformation and upgrading. Enterprises, or upstream supply chain companies, should be based on the business ideas of steady progress, maintain the basic disk of production and sales, and try to avoid blindly follow the trend and blind expansion.

The dilemma of the two will also force the company to pay attention to the new demand of the new consumer format on the panel, and at the same time accelerate the pace of adjustment of the scale of production capacity and the adaptive adjustment of the product structure, such as reducing the production capacity of TV panels, increasing OLED panels, mid -to -high -end series and high value -added panels The proportion of production capacity, through the optimization and adjustment of its own product capacity, reduce losses, obtain more profit space and living space.

On the basis of strengthening capacity, product structure, and supply chain control capabilities, the three must also accelerate the pace of technological innovation, increase the research and development of new products, and continuously improve the additional products through continuous technology upgrades and product iterations. Value and the overall competitiveness of the enterprise.

Conclusion

Unlike previous years, the environment of the panel market this year is not very good. Facing the severe challenges of the global supply chain and consumer market hovering, the price of LCD panels has always been down. The current situation is like going against the water. Only accelerate the marching of high -performance, high -value -added LCD display and OLED display technology, accelerate the development of new product research and development and product structure adjustment, so that we can stand firm in adversity.

- END -

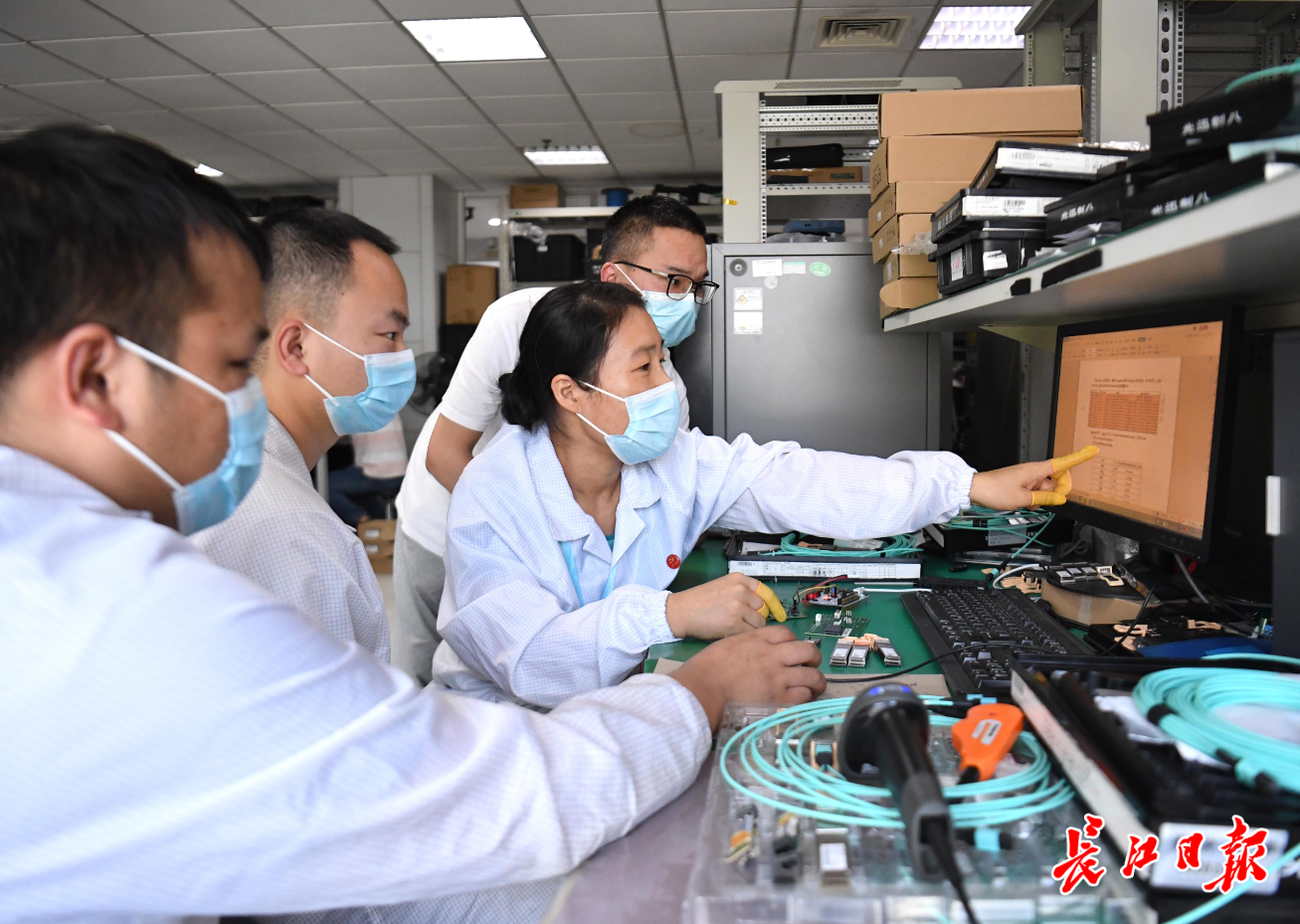

Optics Valley "Chasing Light"

In China Xinke Group Wuhan Guangxun Technology Co., Ltd., the high -end optoelectr...

Science and technology bloggers@科 科: Looking forward to excellent digital rural design and restructuring the future life of the countryside

Cover reporter Ma MengfeiOn June 20, Li Hui released an experience video of a new ...