Improve user activity enrich your own product system

Author:Ecological Ya'an Time:2022.08.31

Recently, the Alipay "borrowing" sector has added "credit card cash withdrawal" functions. Some banks have tested the "credit card cash withdrawal" function on Alipay and WeChat platforms for small -scale tests.

After checking the relevant service agreement, the reporter found that the cash withdrawal amount and interest rate were reviewed by the bank. Alipay and WeChat did not charge any additional fees. The use of related funds was also carried out in accordance with the bank's capital management and control requirements.

People in the banking institutions in our city believe that the current banks have begun to try to cooperate with the Internet platform to "cash withdrawal", mainly to enhance their own users' credit cards, and for Alipay and WeChat platforms, they have also enriched their loan assistance services. It is conducive to improving user stickiness.

Cash out quota and interest rate

All are reviewed by the bank

Recently, some banks have moved their "credit card cash withdrawal" function to WeChat and Alipay platforms, which means that users can perform credit card cash operation online in the future without need to pass the ATM machine. The reporter's investigation understands that this function is currently in a small -scale test stage on the two platforms.

"Credit card cash withdrawal is a formal pre -borrowing cash service provided by the issuing institution. It is one of the basic functions of the credit card. It has been cash withdrawal for many years. In the past, users could use the bank ATM, bank APP and other channels. Now banks have begun to try to cooperate with the Internet platform. It is mainly to improve its own user's use of credit cards, "said a bank institutional industry in our city.

After testing, the reporter found that on WeChat, users can withdraw cash on the credit card repayment page and bank public account; on Alipay, search for "credit card cash", through the service collection page, enter the bank applet for related operations. At present, Alipay has access to Everbright Bank and Pudong Development Bank.

In addition, WeChat and Alipay's pages and service agreements show that this service is provided by the bank, and the amount and interest rates are reviewed by banks. The Internet platform does not charge any additional fees. The cash withdrawal funds are limited to consumption and must not be used to invest in wealth management, buying houses, etc. The cardholders can use credit card withdrawal services within the cash withdrawal amount given by the card issuer. They can choose two types: "single month" and "monthly division".

In terms of funding channels, the funds withdrawn can only be withdrawn to the bank debit cards bound by myself, which means that the use of relevant funds will be carried out in accordance with the bank's capital management and control requirements.

Expand credit card

Cash out online channel

"The cash withdrawal of credit cards with the Internet platform 'cooperation with the Internet platform is conducive to increasing users' activity and business volume for the banking side; for WeChat and Alipay, it has expanded the service of borrowing products and enhanced user stickiness and business value It is also conducive to the platform party to further understand the real needs of users. "The relevant person in charge of the Credit Department of the ICBC Ya'an Branch believes that Alipay and WeChat online credit card cash withdrawal functions are essentially loan services, providing traffic and purchasing channels. For Alipay and WeChat, it not only enriches its own product system, increases product diversity, but also benefits income increase.

The above -mentioned person in charge said that WeChat and Alipay's online credit card withdrawal function actually expanded online access channels for the traditional credit card cash business; for users who often use WeChat and Alipay, they can use cash withdrawal more convenient and efficiently. Functions; for WeChat and Alipay, they can further improve the business matrix and enhance user experience and activity.

There are also some people in the banking institutions that predict that more banks may join the online credit card cash withdrawal team in the future, and such cooperation may gradually expand to a broader third -party channel. Requirements, etc., credit cards will have higher channel qualification requirements.

"Credit cards are licensed financial products, and they should be more cautious in terms of cooperation channel selection and business expansion." Relevant person in charge of the Ministry of Gold by the Agricultural Bank Ya'an Branch believes that the demand scenario of credit cards and consumer credit products such as borrowing are very similar, open and open, open The cooperation entrance is more convenient, which has a small impact on the loan -aid market. As a channel party, the Internet platform needs to pay more attention to the compliance of product display, and assist banking institutions to do a good job of compliance and control of capital flow.

Reporter Jiang Yangyang

- END -

New species!There are new discoveries in Yunnan again

recentlyIn Honghehani Hani and Yi Autonomous PrefectureJinping Miao Yao people and...

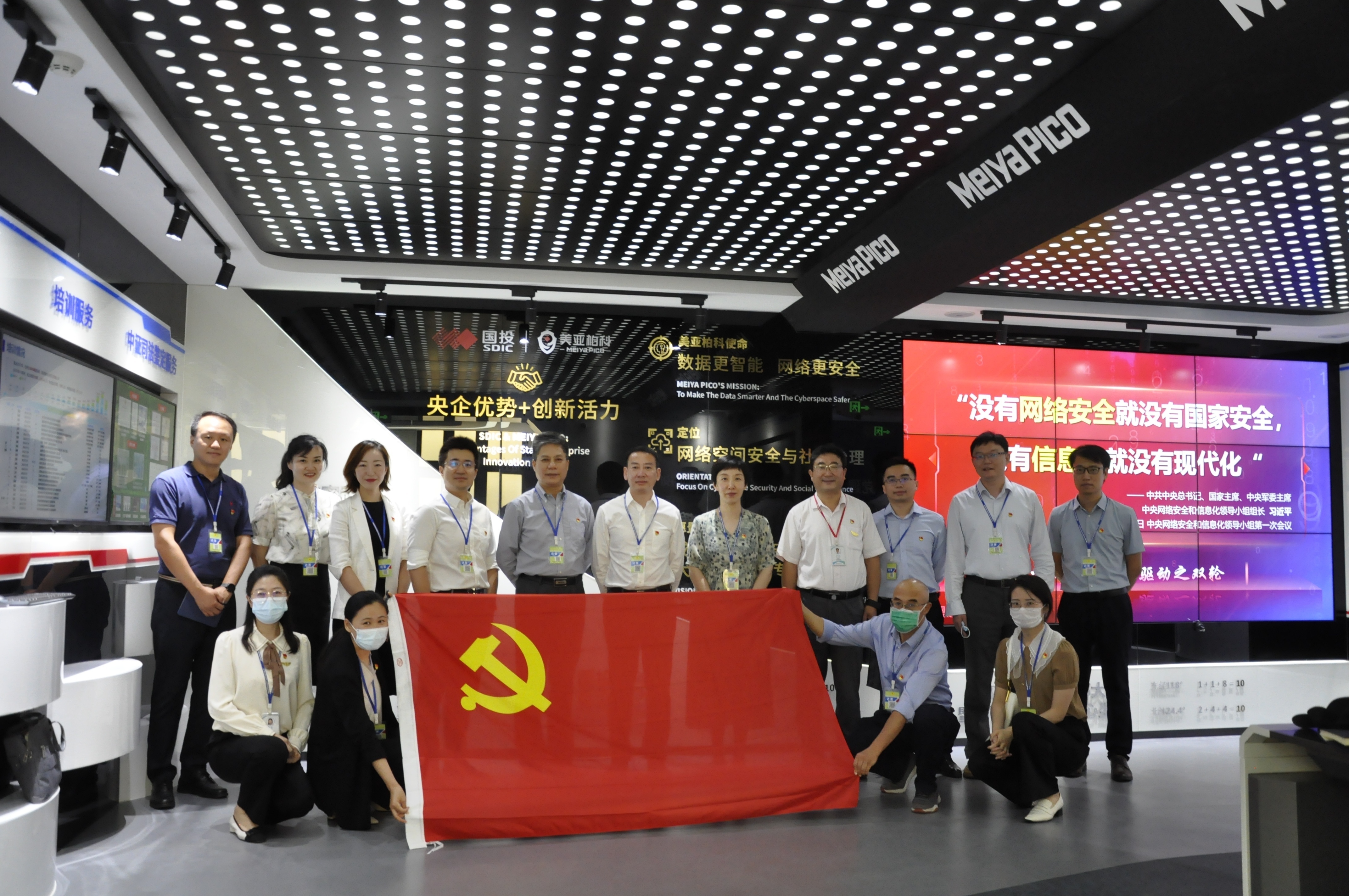

Lenovo Holdings and SDIC Enterprises carry out party building work exchanges in mixed ownership enterprises

On July 20, Gao Qiang, deputy secretary of the Party Committee and Secretary of th...