Fintech Investment and Financing Weekly | 36 fintech companies financing 3.15 billion yuan; payment and insurance technology are more active

Author:Zero One Finance Time:2022.08.22

Produced | Zero One Think Tank

Author | Zhao Jinlong

Catalog I. Financing Overview (1) 36 fintech companies' financing of 3.15 billion yuan (II) Early financing was more active, without round C or later financing (3) 11 U.S. projects were invested, and the total amount of financing returned to the first (4) district (4) Twelve financing in the blockchain field, payment and insurance technology are more active. Two and 12 fintech companies have been acquired by three or 27 financial technology companies.

1. Financing overview

(1) 36 fintech companies financing 3.15 billion yuan

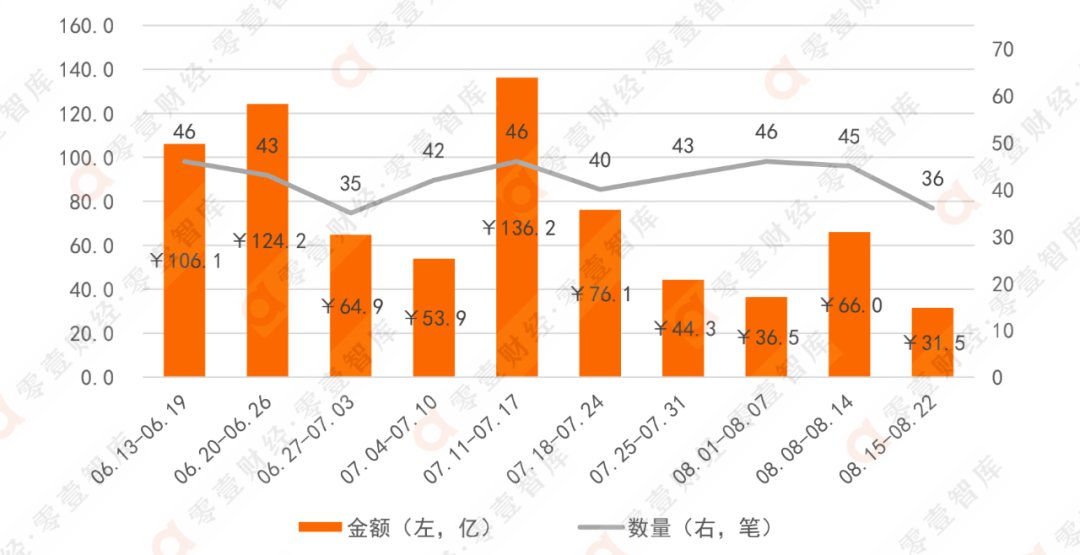

According to the incomplete statistics of the Zero 1 think tank, last week (August 15th, 2022-August 21, 2022) global fintech-related equity financing incidents were 36, a decrease of 20%month-on-month; It was only 3.15 billion yuan, less than half of the previous week, and it was a new low.

Figure 1: The trend and amount of financing in the past 10 weeks

Data source: Zero One Think Tank

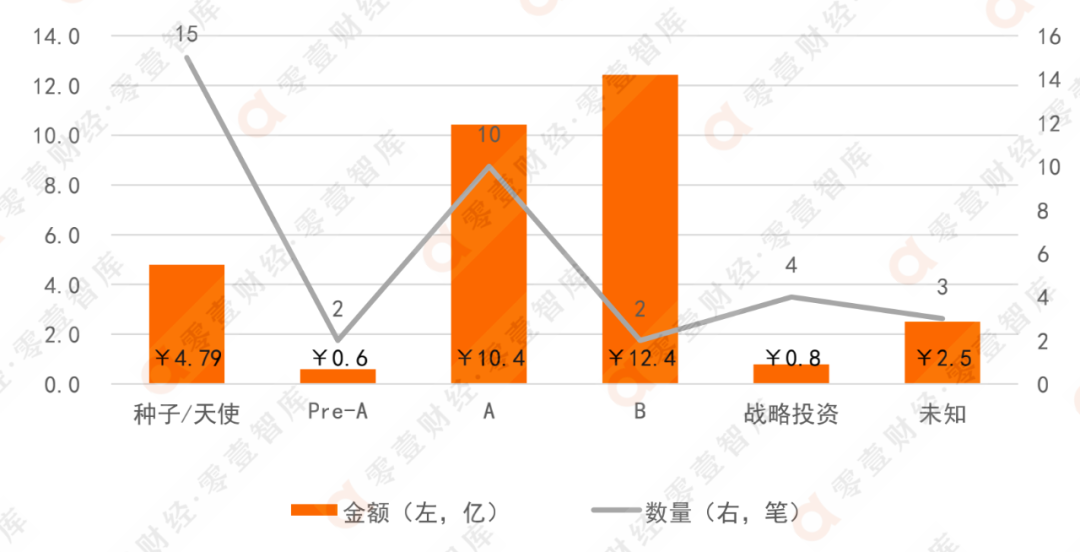

(2) Early financing is more active, without round C or future financing

Last week, 27 financing (crowdfunding to round A), with a total of about 1.58 billion yuan in financing; 2 rounds of financing 2, totaling 1.22 billion yuan, without round C financing. There are 4 strategic investment, with a total financing of about 80 million yuan. Early financing was more active, and later financing continued to decrease.

Figure 2: The amount and amount distribution of financing at each stage

Data source: Zero One Think Tank

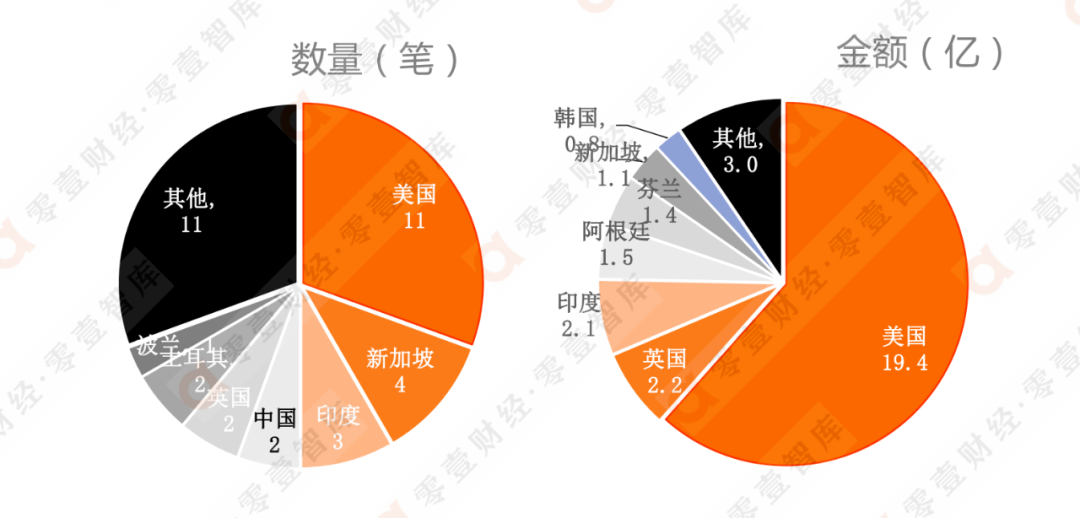

(3) 11 projects in the United States have been voted, and the total financing amount returns to the first place

From the perspective of the number of projects, there are 11 projects in the United States, followed by 4 Singapore, 3 India, and 2 in China, the United Kingdom and Turkey. Judging from the disclosure of financing amount, the United States returned to the first place for 1.94 billion yuan; followed by 220 million yuan in the United Kingdom and 210 million yuan in India. China is only 10 million yuan, and the legal artificial intelligence technology and insurance service providers have completed nearly 10 million yuan Pre-A round financing, with a valuation of nearly 100 million yuan.

Figure 3: The distribution of financing quantity and amount of each country

Data source: Zero One Think Tank

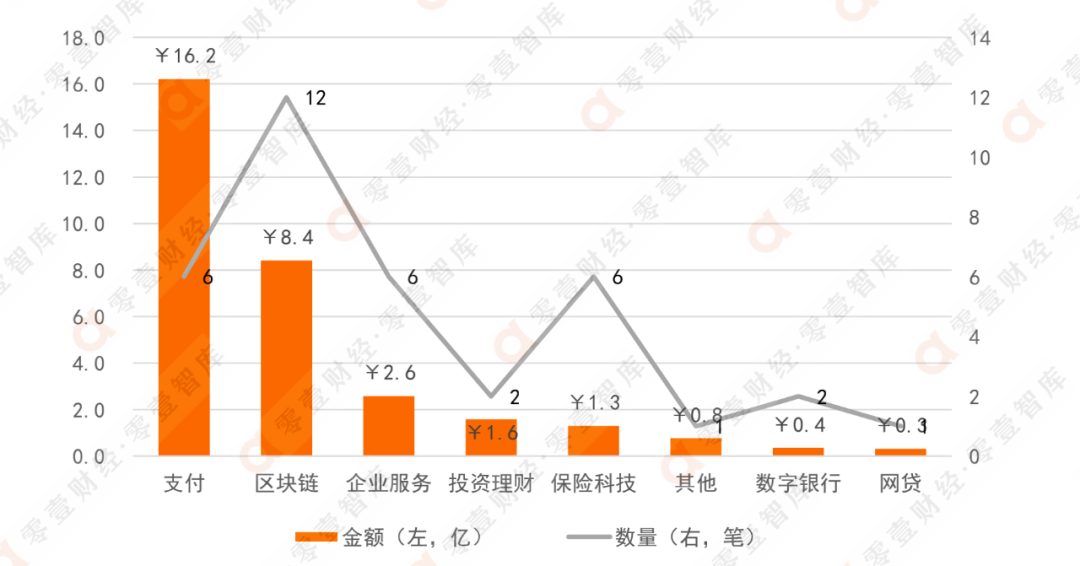

(4) 12 finances in the blockchain field, and the payment and insurance technology are more active

According to the field, the number of financing in the field+financial sector is still the largest, up to 12, followed by payment and insurance technology, all 6. The financing amount in the payment field is the highest, reaching 1.62 billion yuan, and the insurance technology field is early financing, with a total amount of only 130 million yuan.

Figure 4: distribution of financing quantity and amount of each track

Data source: Zero One Think Tank

2. Twelve fintech companies are acquired

According to the incomplete statistics of the Zero 1 think tank, 12 fintech companies were acquired last week. Among them, the remittance processor REMITLY acquired Rewire, a cross -border payment service provider at $ 80 million, and ETORO, a multi -asset social investment network platform, purchased an option transaction application Gatsby at a price of about 50 million US dollars.

Table 1: Summary of Fintech M & A Information

(2022/8/8-2022/8/14)

Data source: Zero One Think Tank

3. The stock price of 27 fintech companies fell, and the two declined by more than 10%

According to the incomplete statistics of the Zero 1 think tank, of the 29 domestic financial technology companies in China last week, the stock price of two companies only increased slightly, and the stock prices of the remaining 27 companies fell. The biggest decline was Jianan Technology and Finance, with a range of more than 10%.

Table 2: Data information of financial technology listed companies

(August 14, 2022)

Data source: Zero One Think Tank

Statistical explanation

1. The fintech company defined in this report refers to the use of big data, artificial intelligence, cloud computing, blockchain, mobile Internet, biometrics and other technologies as banks, insurance, securities, payment, loans, crowdfunding and other finance and categories Financial and new financial institutions provide products and technical solutions.

2. The equity financing referred to in this report includes the private equity financing before Pre-IPO of the equity crowdfunding, seed/angel, Pre-A, A, A+to Pre-IPO, excluding ICO, IEO, STO, convertible bonds, mergers and acquisitions, new acquisitions, new acquisitions, new acquisitions, new acquisitions, new acquisitions, new acquisitions, new mergers and acquisitions, new mergers and acquisitions Three boards, new three boards, IPO, IPO+, etc.

3、本报告对于未披露具体金额的融资处理方式为:未透露=0,数十万=50万,数/近百万=100万,数/近千万=1000万,数/近亿/ 100 million yuan and above = 100 million, billions = 1 billion.

4. In order to facilitate statistics, when currency conversion, this report ignores short -term changes in the exchange rate. The conversion method between different currencies is: 1 dollar = 7 yuan, 1 euro = 8 yuan, 1 pound = 8.8 yuan, 1 rupee = 0.09 Yuan, 1 won = 0.006 yuan, 1 plus dollar = 5 yuan, 1 Swiss franc = 7 yuan, HK $ 1 = 0.8 yuan, 1 Swedish Crane = 0.8 yuan, 1 yen = 0.06 yuan, 1 Australian dollar = 4.86 yuan.

5. All the data in this report comes from the public channel disclosure. Due to possible omissions or delay, we will trace back to the previous statistics, and no longer update the release of the published reports.

End.

- END -

"Li" on the weekend, turn on the TV and send Dyson

What is happiness?Happiness is a day after work, you can eat hot meals when you re...

Lucy task: What will the answer will be the secret of the "time capsule" of the solar system?

Lucy is a group of scientists named the ancient human fossils unearthed in 1974. T...