The results of the second quarter inspection were announced.

Author:Division Society Time:2022.08.20

On August 19, Hong Kong Hang Seng Index Co., Ltd. announced the results of the second quarter of the Hang Seng Index's review results. 4 companies of Baidu Group, China Shenhua, Chow Tai Fook, and Hansen Pharmaceutical were included in the Hang Seng Index. 73.

The constituent stocks of the Hang Seng Index are the most representative stocks in the market, and the total market value accounts for about 90%of the total market value of the Hong Kong Stock Exchange. Therefore, the Hang Seng Index is an important indicator for measuring the price of the Hong Kong stock market, and has always been recognized as the "barometer" of the Hong Kong stock market.

It is worth noting that, unlike Tencent and Ali technology companies, Baidu with AI attributes was first included. Previously, there was no AI classification.

Affected by this good news, Baidu (BIDU) US stock market rose 2.5%before the market. In the case of the Nasdaq index fell 2.01%as a whole, the closing of the market still rose against 0.62%.

The Hang Seng Index series of ingredients are adjusted once a quarter, and there are high requirements for the market value and liquidity of ingredients stocks. How does Baidu gain favor for the HSI?

"The second growth curve" rises

Baidu was included in the Hang Seng Index this time, showing the recognition of Baidu's performance, and it was also the embodiment of Baidu's confidence in Baidu.

From the perspective of financial report performance in recent years, Baidu's "second growth curve" represented by cloud and autonomous driving business is rising. Looking back at last year's performance, Baidu's non -advertising business grew brightly, an increase of 71%year -on -year, prompting Baidu's total annual revenue of 124.49 billion yuan, a year -on -year increase of 16%.

Among them, Smart Cloud achieved a total revenue of 15.1 billion yuan in 2021, an increase of 64%year -on -year. In the first quarter of this year, another steady answer sheet was delivered, with revenue increased by 45%year -on -year. According to IDC data, Baidu has ranked first in the AI public cloud service market for 6 consecutive times.

Li Yanhong once said at the first quarter of 2021: "In the next 3 years, Baidu's non -advertising business will gradually exceed the advertising business." Baidu's attitude of seeking a new life is self -evident. Baidu will be redefined as an AI ecological type Company, this is also the highlight of this HSI's income.

Baidu officially entered the cloud computing market since 2016. It belongs to the beginning and later.

At present, with the differentiated advantages of combining cloud services and artificial intelligence, Baidu Intelligent Cloud has cut in from the key scenarios of the industry, and has created many benchmark cases in important industries such as industry, finance, and smart cities. Its intelligent transportation solutions have also been practiced and verified in more than 50 cities across the country. Among them, AI control technology has achieved the world's leading position.

Baidu re -developed, which can be seen from the research and development investment. The financial report data shows that in the first quarter of 2022, Baidu R & D investment was 5.6 billion yuan, an increase of 10%year -on -year. In the past two years, Baidu continued to increase its investment in R & D investment. In recent quarters, it has basically accounted for more than 20%of the total revenue.

When adjusting the ingredients stocks, the Hang Seng Index generally pays more attention to the display of the advantages of the industrial chain. Overseas quantitative research on the industrial chain is generally concentrated in two aspects. The first is to evaluate the position of a company in the entire industrial chain; the second is to examine the impact of the fundamentals of downstream companies on the upstream.

Here I have to mention another major motivation to drive Baidu's non -advertising business.

Running of the autonomous track

At the moment, Baidu's most noticeable is its autonomous driving business.

In early August, Chongqing and Wuhan just issued a pilot policy for unmanned commercialization of autonomous driving, and Baidu exclusively obtained the first batch of demonstration operations in the country. Baidu is the earliest domestic company to lay out autonomous driving, and it is also one of the few companies that provide AI technology such as AI chips, software architectures and applications in the world.

Based on the investment and development investment of technological research and development based on pressure -stricken and marathon, Baidu has precipitated three major growth engines, including a steady basic disk represented by the mobile ecology, an emerging business represented by intelligent cloud, and represented by intelligent driving and small degree. Stayed business.

In terms of commercialization of autonomous driving, Baidu has been at the forefront. For example, its Robotaxi platform radish runs fast, and officially toll operations have been launched in Beijing, Chongqing, Yangquan, Wuhan and other places. The cumulative order volume has reached 1 million orders. The average daily single and monthly total single volume is growing steadily.

The cost problem that has always been blocked in the scale of unmanned vehicles is now solved. In July of this year, the sixth -generation unmanned vehicle Apollo RT6 released by Baidu. The total cost of each car was 250,000 yuan, 50%lower than the previous generation Apollo RT5, and announced that it can be mass production and on the road next year.

After the policies of domestic autonomous driving are gradually liberalized, it means that the popularity of unmanned driving will be faster than people think, and Baidu's unmanned imagination space is also increasing.

On the other hand, Baidu's Apollo Autonomous Driving Platform (ASD) business is gradually entering the right track.

According to the Baidu Q1 financial report performance exchange meeting, according to its internal data, the total sales of ASD solutions have exceeded 10 billion yuan, and the data was 8 billion yuan last quarter.

At present, Baidu ASD's smart driving products, such as independent parking AVP products, have completed mass production delivery in Weimar W6, Great Wall Haval Beast, and GAC Safety Safety models. Wait for car companies to cooperate to gradually mass production.

The rapid growth of ASD orders also allows Baidu to see a clear ASD intelligent pilot profit roadmap.Baidu is expected to increase the growth rate of backlog orders in the next 2-3 years, with the expansion of the car OEM customer base, the growth rate of backlog orders will be further accelerated.After being included in the HSI, it means that Baidu will gain a greater market influence, attract the attention of more investment institutions and the allocation of stock funds, thereby helping the business strong development. The long -term impact will be left to time to verify.

- END -

Zhang Xiaoquan's "broken knife" sold 60,000

Recently, Zhang Xiaoquan rushed on the hot search due to the broken knife incident...

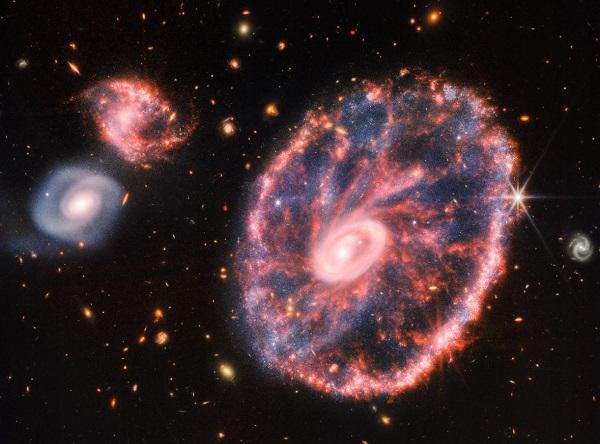

CBS: Amazing!Weber Space Telescope capture 500 million light -year -old foreign car wheel galaxies gorgeous image

China Well -off. August 3rd. The amazing image taken by the old horse James Weber ...