The historical connection parties in Zhishang Technology's faithful contradictions appeared in the past the mysterious disappearance of the product to make a way for shareholders

Author:Jin Ziyan Time:2022.08.18

"Golden Syllabus" Southern Capital Center Ning Zhi/Author Floating Sheng/Risk Control

In 2017, Switch products were born in the air and were highly sought after. As of the end of 2021, Switch's cumulative sales reached 101 million units, and the cumulative sales of less than 5 years have been close to the cumulative sales of the first generation of PS products, becoming the most popular game equipment for Nintendo. Among them, Shenzhen Zhishang Technology Co., Ltd. (hereinafter referred to as "Zhishang Technology") in 2021 should be used in Nintendo's product revenue to account for more than 60 %.

This time, it is to be solved to the listing of technology or many problems. As one of the founders of Zhishang Technology, Hu Shenghua, who has long controlled a company named Shenzhen Zhishang Microelectronics Co., Ltd. (hereinafter referred to as "Zhishang Micro Electronics"), about the "identity" of the company, to Shangshang Technology Technology The letter was "unclear." It can be seen through the web review function that Zhishang Micro Electronics once introduced Zhishang Technology's predecessor, but Zhishang Technology had positioned Zhishang Mi -Electronics as its sales department in the historical official website.

And the study of the Southern Capital Center of "Jin Xieyan" found that the main products of Zhishang Technology may include power management equipment products, and then this type of product may become one of the main products of Zhishang Microex. Does the power management equipment product "disappear" in the prospectus of Zhishang Technology, does it mean that Zhishang Technology has peeled the power management equipment business to Zhishang Microelectronics? For this product taboo, is it to "give way" to Zhishang Mi -Electronics? In accordance with the principle of facts, is it a related partner of Shangwei Electronics to the related parties of Shang Technology? Various questions are yet to be checked.

1. The income is less than 1 in two consecutive years.

There is no desire, no visibility, but the speed of desire is not to reach. In the past two years, behind the growth of performance, Zhishang Technology's proportion of operating income in 2021 has exceeded 40 %.

1.1 2020-2021, the net profit of the science and technology revenue of technology shows a growth trend.

The signing date is the prospectus (hereinafter referred to as the "prospectus") and the signing date on December 31, 2021 (hereinafter referred to as the "December 2021 Version of the Finals"), 2018- 2018- In 2021, Zhishang Technology's operating income was 414 million yuan, 462 million yuan, 499 million yuan, and 615 million yuan. From 2019 to 2021, Zhishang Technology's operating income increased by 11.75%, 7.9%, and 23.29%year-on-year.

From 2018 to 2021, Zhishang Technology's net profit was RMB 377.057 million, 35.5028 million yuan, 65.524 million yuan, and 91.8492 million yuan. From 2019 to 2021, the net profit of the technology of Technology increased by -5.84%, 84.56%, and the respective year-on-year increases, respectively. 40.18%.

Behind the growth of performance, in 2021, the net science and technology ratio and cash ratios were less than 1.

1.2 The operating net cash flow in 2021 drops to negative value, and the cash is less than 1 consecutive years than 1 consecutive years

据招股书及2021年12月版招股书,2018-2021年,致尚科技经营活动产生的现金流量净额分别为4,984.44万元、7,897.77万元、6,231.92万元、-872.57万元,销售商品、 The cash received by labor services was 491 million yuan, 576 million yuan, 476 million yuan, and 495 million yuan.

After calculation of the Southern Capital Center of "Jin Securities", from 2018-2020, the net income of Shangshang Technology was 1.32, 2.22, and 0.95, respectively; from 2019-2021, the cash withdrawal ratio was 1.19, 1.25, 0.96, and 0.81, respectively.

In other words, the net ratio of Shangshang Technology was less than 1 in 2020. And from 2020 to 2021, the cash ratios of Shangshang Technology was less than 1.

1.3 In 2021, the proportion of revenue for receipt of payments exceeds 40 %, and higher than the average level of peers

In fact, during the reporting period, the phenomenon of sales of technology was intensified.

According to the prospectus and the December 2021 version of the prospectus, from 2018-2021, the receivables of Shangshang Technology were 41.944 million yuan, 556,800 yuan, 90,600 yuan, and 1.282 million yuan. The yuan, 126.4188 million yuan, 163.657 million yuan, and 273.486 million yuan, the receivable financing was 0 yuan, 3.307,400 yuan, 11.449 million yuan, and 50.993 million yuan, respectively.

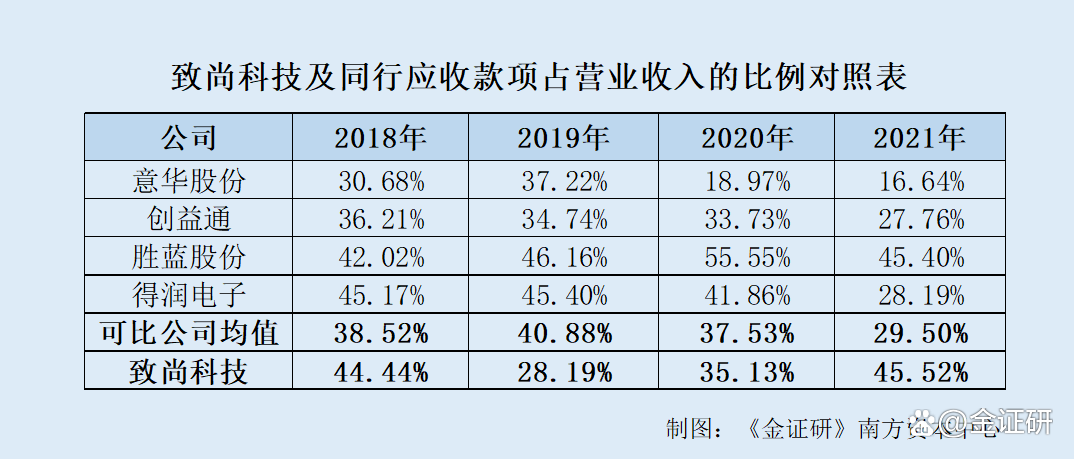

After calculation by the Southern Capital Center of "Jinzhengyan", from 2018-2021, the total value of the receivables, accounts receivable, and receivable financing (hereinafter referred to as "receivable") of the receivables, receivables, and receivables were 184 million respectively. Yuan, 130 million yuan, 175 million yuan, and 280 million yuan, receivables account for 44.44%, 28.19%, 35.13%, and 45.52%of its current operating income.

According to the prospectus, the comparison company selected by Zhishang Technology is the Wenzhou Yihua connection plug -in Co., Ltd. (hereinafter referred to as "Yihua Co., Ltd."), Shenzhen Chuangyitong Technology Co., Ltd. (hereinafter referred to as "Chuangyitong"), Shengsheng) Blue Technology Co., Ltd. (hereinafter referred to as "Shenglan Co., Ltd."), Shenzhen Dekun Electronics Co., Ltd. (hereinafter referred to as "Derun Electronics").

According to Yihua's 2019 and 2021 reports, from 2018-2021, Yihua's receivables are 26.6568 million yuan, 0 yuan, 0 yuan, 25.6597 million yuan, and accounts receivables were RMB 399,131 million, 54.14295 million yuan, and 541.998 million yuan, 67,2408,900 yuan, receivable financing was 0 yuan, 62.403 million yuan, 77.838 million yuan, and 490.304 million yuan, and operating income was 1.388 billion yuan, 1.623 billion yuan, 3.268 billion yuan, and 4.49 billion yuan. According to the calculation of the Southern Capital Center of "Golden Syllabus", from 2018 to 2021, the total receivables of Yihua shares were 426 million yuan, 604 million yuan, 620 million yuan, and 747 million yuan, respectively, accounting for their current operating income, respectively, respectively. It was 30.68%, 37.22%, 18.97%, and 16.64%.

According to the Venture Congress and 2021 reports, from 2018 to 2021, Chuangyitong's receivables were 2.2318 million yuan, 1.9597 million yuan, 9.986 million yuan, and 16.148 million yuan, and the receivables were 13,087,900 yuan, 15,129.37 10,000 yuan, 1457.801 million yuan, 132.232 million yuan, receivable financing was 0 yuan, 0 yuan, 0 yuan, and 47.307 million yuan, respectively, with operating income of 368 million yuan, 441 million yuan, 462 million yuan, 499 million yuan, 499 million yuan Essence

According to the calculation of the Southern Capital Center of "Golden Syllabus", from 2018 to 2021, Chuangyitong's receivables were 133 million yuan, 153 million yuan, 156 million yuan, and 139 million yuan, respectively, accounting for their current operating income, respectively. It is 36.21%, 34.74%, 33.73%, 27.76%.

According to the prospectus of Shenglan Co., Ltd. and 2021, from 2018 to 2021, Shenglan's receivables were 28.9341 million yuan, 1,766,64,100 yuan, 54.685 million yuan, 6,457,700 yuan, and the receivables were RMB 242.034 million, 30,505.38. 10,000 yuan, 453.1247 million yuan, 52.215 million yuan, receivable financing of 0 yuan, 11.6454 million yuan, 400,000 yuan, 36.798 million yuan, operating income of 645 million yuan, 724 million yuan, 915 million yuan, 13.03 13.03 100 million yuan.

According to the calculation of the Southern Capital Center of "Golden Syllabus", from 2018 to 2021, the total receivables of Shenglan shares were 271 million yuan, 334 million yuan, 508 million yuan, and 591 million yuan, respectively, accounting for their current operating income, respectively. It is 42.02%, 46.16%, 55.55%, and 45.40%.

According to the 2019 and 2021 reports, from 2018 to 2021, the receivables receivables of Drun Electronics were 1.359 billion yuan, 146 million yuan, 211 million yuan, and 73 million yuan. The yuan, 1.714 billion yuan, and 1.635 billion yuan, the receivable financing financing was 0 yuan, 1.059 billion yuan, 1.19 billion yuan, 431 million yuan, and operating income was 7.454 billion yuan, 7.486 billion yuan, 7.272 billion yuan, 7.587 billion yuan, 7.587 billion yuan, 7.587 billion yuan Yuan.

After calculation of the Southern Capital Center of "Jin Si Yan", from 2018 to 2021, the total receivables of the Electronics Electronics were 3.367 billion yuan, 3.398 billion yuan, 3.044 billion yuan, and 2.139 billion yuan, respectively, accounting for their current operating income, respectively. It is 45.17%, 45.4%, 41.86%, 28.19%.

It is not difficult to find that from 2018-2021, the average value of the comparison company receivables in the same industry in the same industry in the same industry is 38.52%, 40.88%, 37.53%, and 29.5%, respectively. The proportion of revenue from the revenue does not increase, and the average level of peers is higher.

From the above situations, behind the growth of the operating income and net profit of technology, it may face the dilemma of intensified sales.

2. The founding shareholders have long controlled to Zhi Shangwei Electronics for a long time.

The male rabbit's feet are rushing, and the female rabbit's eyes are blurred. Hu Shenghua, the founding shareholder of Zhishang Technology, has long controlled a company with "Zhishang" with a long -term control. It can be found by the official website of Zhishang Science and Technology that the company may have a relationship with Zhishang Technology.

2.1 One of Hu Shenghua's founder of Zhishang Technology, the middle school classmate of Chen Chaoxian, a real controller Chen Chaoxian

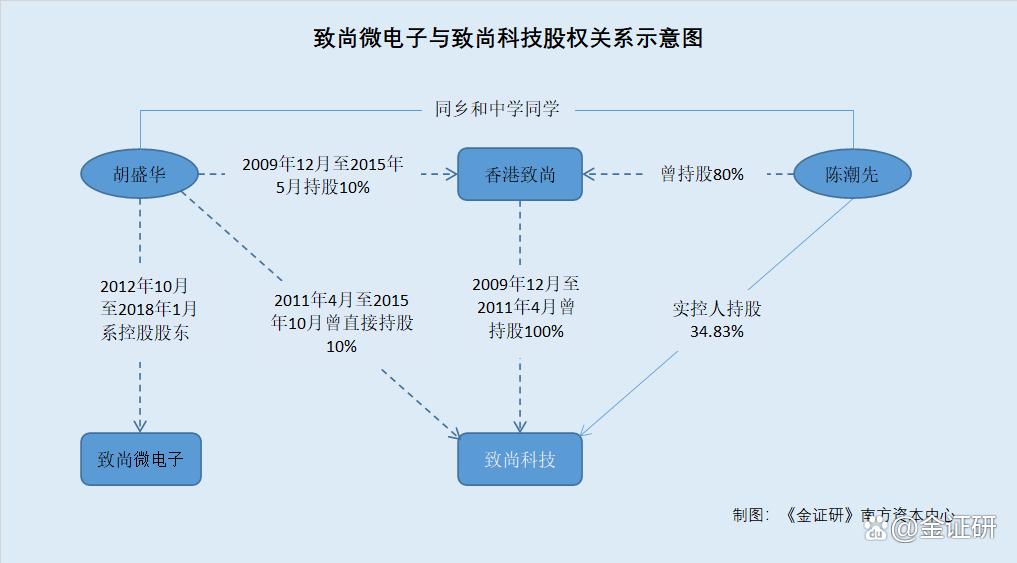

According to the prospectus, Zhishang Technology's predecessor Shenzhen Zhishang Technology Co., Ltd. (hereinafter referred to as "Zhishang Limited"), formerly known as "Zhishang Technology (Shenzhen) Co., Ltd.", was established on December 8, 2009. When it was established, it was established. It is a foreign -invested enterprise invested by Hong Kong Zhishang Technology Co., Ltd. (hereinafter referred to as "Hong Kong Zhishang").

At the time of the establishment of Zhishang limited, Hong Kong Zhishang held a limited equity ratio of 100%.

In other words, Zhishang Co., Ltd. was founded by Hong Kong Zhishang.

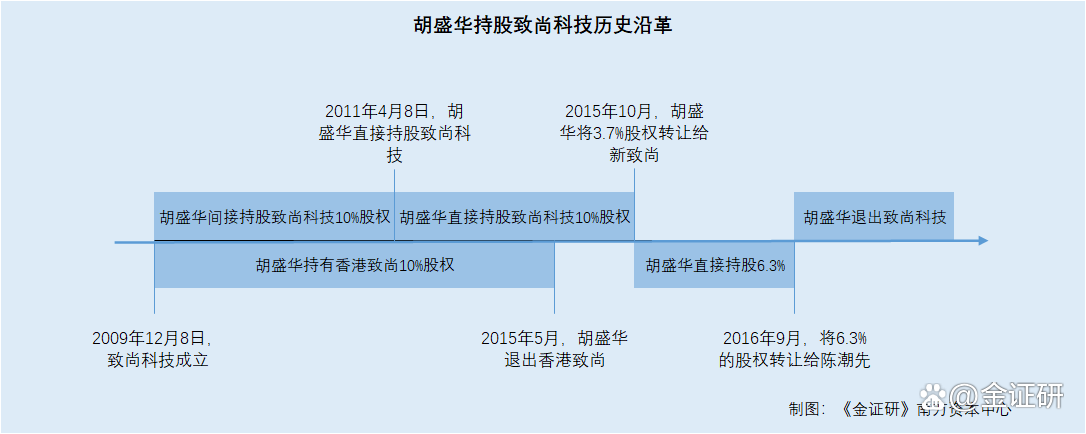

According to the signing date on July 15, 2022, the "reply to Shenzhen Zhishang Technology Co., Ltd.'s first public issuance of shares and the review and inquiry letter of the application document on the GEM" (hereinafter referred to as the "First Round Inquiry Letter" ), Hong Kong Zhishang was established on October 16, 2009. At its establishment, the shareholders were Chen Chaoxian, Hu Shenghua, Qiu Wenlong, Yamada Yoshihito (Yamada Qingren) and Hayashi Nobumatsu (Lin Shensong). In March 2011, Yamada Yoshihito and Hayashi Nobumatsu (Lin Shensong) transferred the equity to Chen Chaoxian. In May 2015, Hu Shenghua and Qiu Wenlong transferred their equity to Chen Chaoxian. And before Hu Shenghua withdrew from Hong Kong, his shareholding ratio of Hong Kong was 10%.

It can be seen that in more than five years from October 16, 2009 to May 2015, Hu Shenghua had 10%of Hong Kong Zhishang's shares.

According to the Shenzhen Public Credit Center, on April 8, 2011, before the change of the equity of Zhishang Technology, he held 100%of Hong Kong's shares. After the change, Hu Shenghua held 10%of the shares, Qiu Wenlong held 10%, and Chen Chao first held 80%of the shares.

That is to say, from December 8th to April 8th, 2009, Hu Shenghua indirectly held 10%of the equity of Zhishang Technology through Hong Kong. On April 8, 2011, Hong Kong Zhishang withdrew Zhishang Technology, and Hu Shenghua directly held 10%of the shares of Zhishang Technology.

Since then, Hu Shenghua has also transferred the equity of Zhishang Science and Technology he held.

According to the second round of review and inquiry letters on the second round of review of shares in Shenzhen Zhishang Technology Co., Ltd. and the second round of review of the listing of the GEM "(hereinafter referred to as the" Two Ring Question Inquiry "), Chen Chao and Hu Shenghua paid the equity transfer price through bond debt offset. Hu Shenghua transferred 3.7%of the equity of Zhishang Technology to Shenzhen Xinzhi Shang Investment Enterprise (Limited Partnership) (hereinafter referred to as "New Zhishang") in October 2015. Zhishang Technology's 6.3%equity was transferred to Chen Chaoxian.

From the above, it can be seen that from April 8th to October 2015, Hu Shenghua held 10%of the shares of Zhishang Technology; from October 2015 to September 2016, Hu Shenghua held 6.3%of the shares of Zhishang Technology. After September 2016, Hu Shenghua withdrew Zhishang Technology and transferred its equity to Zhi Shang Technology's actual controller Chen Chao.

According to the prospectus, as of July 10, 2022, Chen Chao first was the controlling shareholder and actual controller of the current technology. Equity, a total of 34.83%of the equity of Zhishang Technology.

It should be pointed out that Hu Shenghua and Zhishang Technology Real Estate Chen Chaoxian, a middle school classmate.

According to the first round of inquiry letters, Hu Shenghua and Chen Chao were fellow and middle schools. The two sides have maintained a good personal relationship for many years.

In this context, Hu Shenghua became the controlling shareholder of a company with similar names to Zhishang Technology in 2012. The "story" is about the company.

2.2 October 2012-January 2018, Hu Shenghua's controlling shareholder

According to data from the Market Supervision and Administration Bureau, on September 5, 2012, Zhishang Micro Electronics was established.

Soon after, Zhishangwei Electronics changed its equity change.

According to the Shenzhen Public Credit Center, on October 19, 2012, Zhishang Micro electronics shareholders changed from Zeng Xuefei and Hu Xinhua to Hu Shenghua and Hu Xinhua. After this change, Hu Shenghua held 95%of the shares.

According to data from the Market Supervision and Administration Bureau, on November 27, 2014, Hu Shenghua's shareholding on Zhishang Micro Electronics was changed from 95%to 85%; on December 30, 2015, Hu Shenghua's shareholding on Zhishang Micro Electronics Change to 90%.

In 2018, Hu Shenghua withdrew from Shangwei Electronics.

According to data from the Market Supervision and Administration Bureau, on January 22, 2018, to the shareholding of Shangwei Electronics, from "Hu Shenghua holds 90%of the shares and Chen Ayang holds 10%", it is changed to "Shenzhen Minying International Management Consultant Co., Ltd. 80%of the shares, Chen Ayang holds 10%, Xie Wanfeng holds 10%. "

It can be seen that from October 19th to January 21, 2018, Hu Shenghua's controlling shareholder of Zhishang Micro Electronics.

2.3 Regarding the information about Zhishang Micro Electronics, the prospectus of Shangshang Science and Technology "has not seen"

According to the information of the Market Supervision and Administration Bureau, as of July 22, 2022, to the inquiry date, Zhishang Microelectronics is still durable.

According to the prospectus, the information about Zhishang Micro Electronics is "no trace".

In fact, the historical revolution of Zhishang Technology and Zhishang Micro Electronics, the relationship between the relationship between the two parties is "wrong" or "intertwined".

2.4 March 18, 2013, the copyright owner of the official website of Zhishang Technology became Zhishang Microelectronics

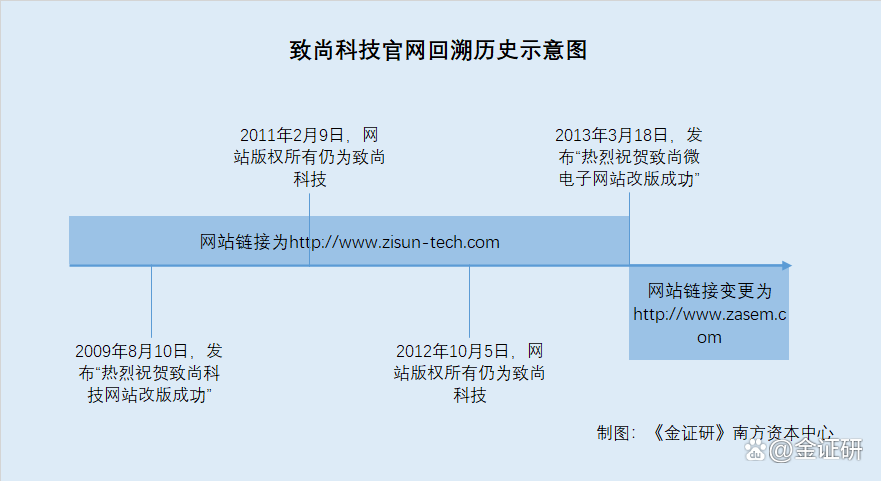

According to the Internet ARCHIVE retrospective website http://www.zisun-tech.com, on February 9, 2010, the copyright of the website is Zhishang Technology (hereinafter referred to as "Zhishang Technology Official Website"), and the record number is 10020803 in Guangdong ICP. Essence Archive traceable data shows that as of October 5, 2012, the copyright owner of the official website of Zhishang Technology was still Zhishang Technology. However, four months later, the owner of Zhishang Technology's official website changed to Zhishang Micro Electronics.

According to Archive back traceability, on March 18, 2013, Zhishang Technology official website released a information about "Congratulations to the success of the revision of Zhishang Microelectronics Website".

The revision information shows that Zasem Microelectronics (referred to as Zasem) was formed by the joint venture of Taiwan's IC design company, entrepreneurial investment, and microelectronics industry. It is a company that is mainly engaged in the development and sales of integrated circuit products in the field of power management and LED. Copyright: Zhishang Microelectronics: http://www.zasem.com (hereinafter referred to as "Zhishang Micro Electronic Official Website").

It can be seen from the above -mentioned webpage retrospective information that on March 18, 2013, Zhishang Technology's official website was revised and changed to the official website of Zhishang Mi -Electronics.

The problem is not only there. Zhi Shangwei Electronics once claimed that Zhishang Technology was its predecessor.

2.5 Zhishangwei Electronics once stated in the revised official website that Zhishang Technology is its predecessor

According to the official website of Archive Back to the Shangwei Electronics, on July 4, 2019, the information of Zhishang Micro Electronics's own development history shows that Hong Kong was established in 2007, and it was established in 2008. Technology.

It is not difficult to find that when Zhishang Mi -Electronics introduced its own development process, the main body of the content was Zhishang Technology.

Not only that, Zhishang Micro Electronics claims to be Zhishang Technology.

According to Archive's retrospective information, Zhishang Micro Electronics's official website shows that Zhishang Micro Electronics (formerly known as Zhishang Technology) was established in 2004 and has hundreds of employees. Formed; companies engaged in the development and sales of integrated circuits in the field of power management and LED.

In other words, according to the above -mentioned webpage historical information, from the perspective of Zhishangwei Electronics, it is the same company as Zhishang Technology, and Zhishang Technology is its predecessor.

But different, Zhishang Technology introduced Zhishang Microelectronics as its sales department.

2.6 Zhishang Technology has identified the sales department of Zhishang Microelectronics, which is the contradiction between Zhishang Microelectronics

Through the official website of Zhishang Technology, you can jump to another official website (hereinafter referred to as "Zhishang Technology B Official Website").

According to Internet Archive back to the official website of Shangzhang Technology B, on September 4, 2013, the copyright owner of the official website of Zhishang Technology b is Zisun Technology Co., LTD.

It should be pointed out that Zisun TechNology Co., LTD is the English name that Zhishang Technology has used.

According to the official website of Archive, on October 13, 2012, the English name used in the introduction of the company of Zhishang Technology was Zisun Technology (hereinafter referred to as "Zisun").

That is to say, the above two websites are the official website of Zhishang Technology, and jumps can be achieved between the two.

According to the official website of the Internet ARCHIVE back to the official website of Shang, September 4, 2013, the headquarters of the headquarters of the technology was located in C105, Building4, 466 Jihu RD, Bantian, LongGang Distribe, Shenzhen, China. The office address (OFFICE Address) is located in No.1908 ~ 1909 Block B, Zhantao Building Mingzhi Road, Longhua Distribut, Shenzhen, China, and the contact number of the sales department is 86-755-23352366.

According to the official website of the Internet ARCHIVE back to the official website of the Shang, on February 8, 2015, the headquarters of the Headqueter was located in C105, Building4, 466 Jihu RD, Bantian, Longgang District, Shenzhou, China. The office address (OFFICE Address) is located in No.1908 ~ 1909 Block B, Zhantao Building Mingzhi Road, Longhua Distribut, Shenzhen, China, and the contact number of the sales department is 86-755-23352366.

However, the contact number of Zhishang Technology's above -mentioned sales department pointed to Zhishang Microelectronics.

According to data from the Market Supervision and Administration Bureau, from 2014 to 2015, the contact number of Zhishang Micro Electronics was 0755-23352366.

It can be seen that the telephone number of the sales department introduced by Zhishang Technology B is Zhishang Micro Electronics. At that time, Zhishang Technology determined that Zhishang Microex was its sales department.

It can be seen from the above that Zhishang Technology has identified Zhishang Microex as its sales department, which is obviously contradictory with the "Zhishang Technology Department Zhishang Micro Electronics" in the introduction of Zhishang Micro Electronics Company. What about the real situation of Zhishang Mi -Electronics?

Based on Zhishang Micro Electronics, Hu Shenghua Holdings, Hu Shenghua and Zhishang Technology, the founding shareholders of Zhishang Technology for a long time, have been familiar with the actual controller of Zhishang Technology for many years. For Zhishang Technology, what is Zhishang Micro Electronics? Under what circumstances did it be established? The problem is still continuing.

3. In the past, the main products were "mysterious disappearance", or were split to Zhishang Micro Electronics for the founding shareholders

Back to history, what is the relationship between Zhishang Technology and Zhishang Micro Electronics? Through the products of the two may "see one or two."

The study of the Southern Capital Center of "Jin Si Yan" found that there have been overlap in history in history, and all of the products management equipment products are existed. Now Zhishang Technology has no product.

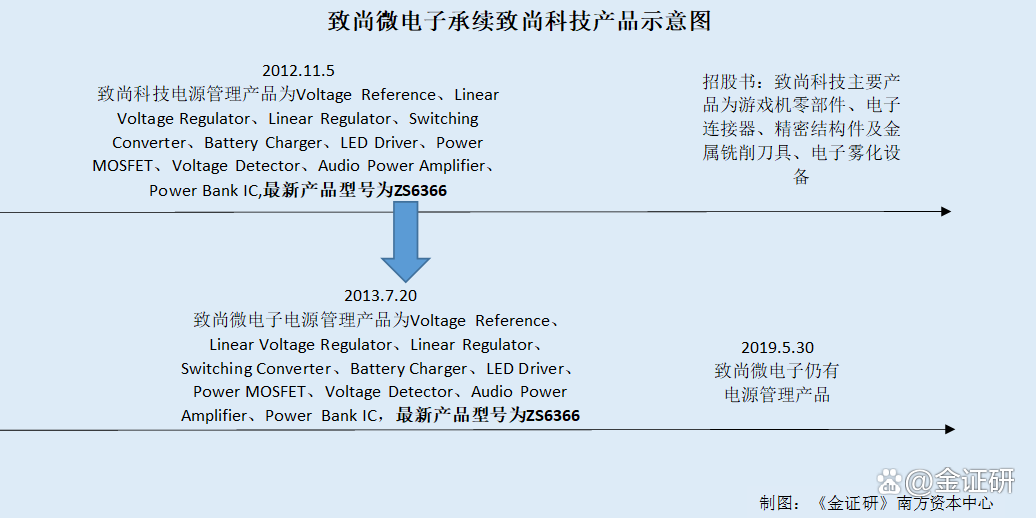

3.1 Power management equipment was one of the main products of Zhishang Technology, including products with models of ZS6366

According to Archive's official website to the official website of Shangzhi, on June 21, 2012, the main products of Zhishang Technology were power management IC, hard alloy tungsten steel knives, and USB3.0 products. Among them, the power management equipment products include Voltage Reference, Linear Voltage Regulator, Linear Regulator, Switching Converter, Battery CHARGER, LED DRIVER, POWER MOSFET, Voltage Detector, Audio Power Amplifier, Audio Power Amplifier, Audio Power Amplifier, Audio Power Amplifier, Audio Power Amplifier, Audio Power Amplifier, Audio Power Amplifier, Audio Power Amplifier,

Among the power management equipment products, the latest product model is ZS6366. This is a portable power management IC product that integrates lithium battery charging circuit system, DC/DC boost circuit system and battery power display function system.

After half a year

据Internet archive回溯致尚科技官网,2012年11月5日,致尚科技的产品分别为Voltage Reference、Linear Voltage Regulator、Linear Regulator、Switching Converter、Battery Charger、LED Driver、Power MOSFET、Voltage Detector、Audio Power Amplifier, Power Bank IC. The latest product model is also ZS6366.

It can be seen that the power management equipment products were once one of the main products of Shangshang Technology, and the representative products include ZS6366.

3.2 As of the date of signing the prospectus, there is no power management equipment product in the main products of Zhishang Technology

However, as of July 10, 2022, there was no power management equipment products in the main products of the main products of the technology.

According to the prospectus, as of July 10, 2022, the main products of Zhishang Technology include game console components, electronic connectors, fiber fiber connectors, precision structural components and metal milling tools, electronic atomization equipment, etc.

So, Zhishang Technology Power Management Equipment Products "Where are you going"?

3.3 In the introduction of the official website of Zhishang Micro Electronics, including power management equipment products

据archive回溯致尚微电子官网,2013年7月20日,致尚微电子的产品分别为Voltage Reference、Linear Voltage Regulator、Linear Regulator、Switching Converter、Battery Charger、LED Driver、Power MOSFET、Voltage Detector、Audio Power Amplifier, Power Bank IC, of which the latest product model is ZS6366.

It can be seen from the above situation that in 2013, after changing the copyright owner of Zhishang Technology's official website, the main products of Zhishang Micro Electronics also include power management equipment products, and the product types of Zhishang Technology before the revision of Zhishang Technology and website revision The models are consistent.

Does the above situation mean that the Department of Science and Technology has split the related business of its power management equipment to Zhishang Microelectronics? Or did Zhishang Technology's website copyright owner change to Zhishang Microelectronics, and Zhishang Micro Electronics did not change the content of the website? unknown.

It should be pointed out that until 2019, power management equipment products in the main products of Zhishang Micro Electronics.

3.4 As of 2019, the "figure" of power management equipment products in the official website of Zhishang Micro Electronics has traced back to Shangwei Electronics. , ZS6091, ZS6078.

Among them, the ZS6300 is a mobile power supply, which integrates a portable power management IC of lithium battery switching charging management, DC-DC voltage voltage restricted flow, battery power display, button control and lithium battery protection. ZS4523 is an active control of a patent application control scheme to achieve a speedless sensor constant -cooked current. High -precision current detection resistance can be used to be able to accurately limit the current charging application and adapter. ZS5889 is an intelligent charging recognition IC applied to the USB charging management circuit. ZS6091 is an integrated circuit that can perform constant current/constant voltage charging management of lithium iron phosphate batteries. ZS6078 is a PWM antihypertensive mode single -section of iron phosphate charging management integrated circuits that can be used for power boards. advantage.

It is not difficult to see that ZS6300, ZS4523, ZS5889, ZS6091, ZS6078 are all power management IC products. Until 2019, the main products of Zhishang Microelectronics may still include power management equipment products.

In other words, the historical information of the official website of Zhishang Technology and Zhishang Micro Electronics can be seen that the main products of Zhishang Technology may include power management equipment products, and then this type of product may become one of the main products of Zhishang Micro Electronics. Combining Zhishang Technology determined that Zhishang Microelectronics is its sales department, and Zhishang Micro Electronics will introduce Zhishang Technology as its predecessor. Does the two companies have been controlled by the same control? Does Zhishang Technology transfer the above related businesses to Zhishang Microelectronics?

What is intriguing is that the information about power management equipment products is "no trace" in the prospectus of Shangshang Technology. Has Zhishang Technology peeled the power management equipment business? Do you want to "let the way" for Zhishangwei Electronics without mentioning the words? Looking back at the history of the two parties, the relationship between the two. Should Zhishang Technology be in accordance with the principle of facts in the essence, and the disclosure of Zhishang Micro Electronics is the affiliate? All are unknown.

Seeing a falling leaves, and knowing that the old age will be twilight; seeing the ice in the bottle, and knowing the cold of the world. Under the "sharpening" of the capital market, to the capital technology, it will usher in the "feet" of investors.

- END -

Mount Fuji spray fire to 252?Academician Liu Jiaqi: Impossible

Text | China Science News reporter Feng LifeiMount Fuji in Japan is about to erupti...

Cloud Science Course | Issue 287: Can Mars use wind power?

Data-version = 0 data-vwidth = 1920 data-vHeight = 1080 transcoding = 1 style = width: 400px; As one of the eight major planets of the solar system and one of the four planets in the