In the first half of 2022, the net profit of returning to the mother fell 109.39% year -on -year Nanlin Electronics responses in the first round of inquiry: the demand for downstream consumer electronics is weak

Author:Daily Economic News Time:2022.08.16

By back to a chip design company with global storage chip giants SK Hynix and Datang Telecom (SH600198, a stock price of 6.99 yuan, and a market value of 9.183 billion yuan) -Shanghai Nanlin Electronics Co., Ltd. (hereinafter referred to as Nanlin Electronics) is seeking sprint Beicha List. Recently, the company replied to the first round of inquiries of the Beijing Stock Exchange.

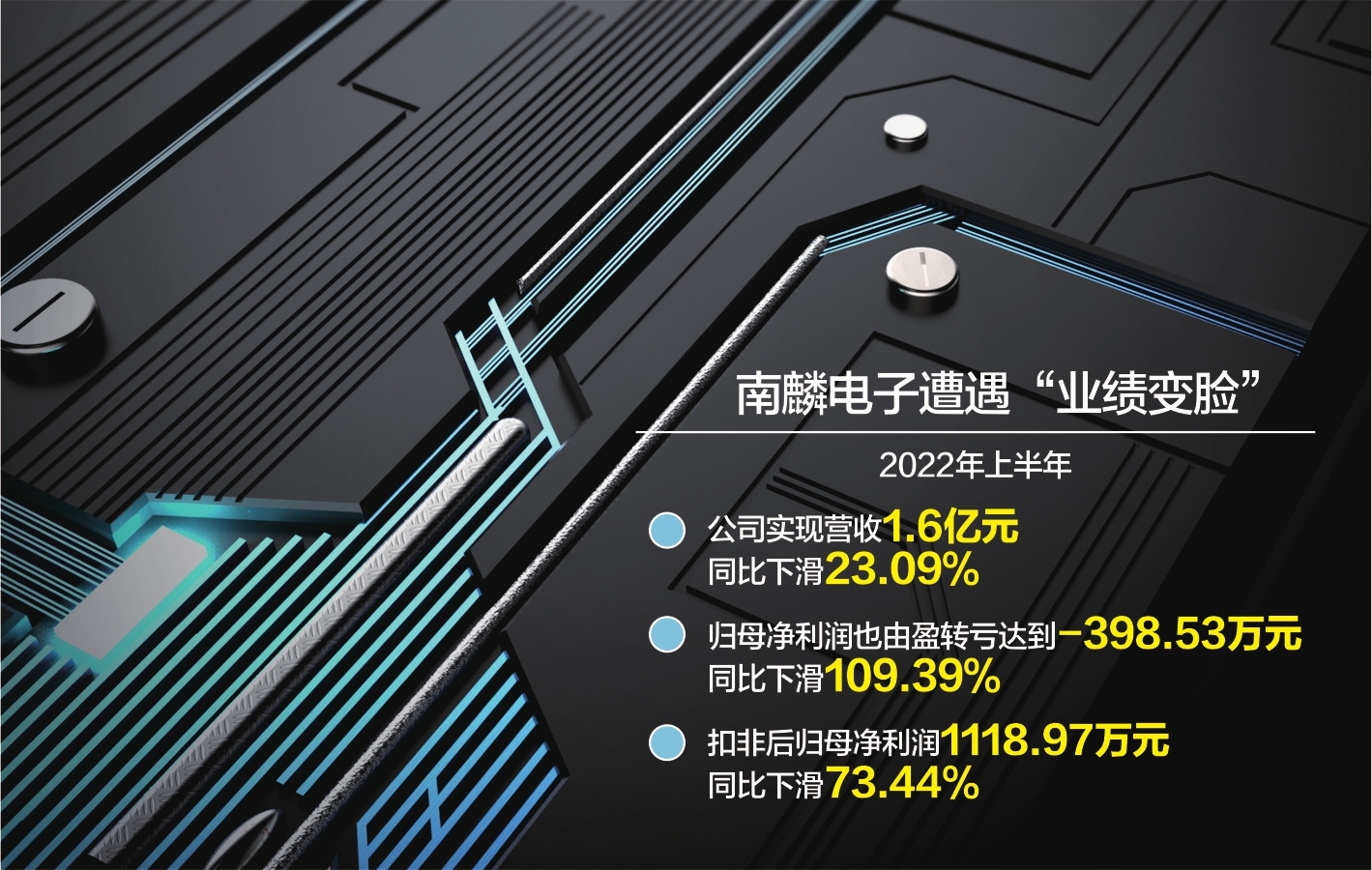

However, while sprinting the Beijing Stock Exchange, Nanlin Electronics encountered "performance change". In the first half of 2022, the company realized revenue of 160 million yuan, a year-on-year decrease of 23.09%, and the net profit of the mother-in-law also changed from profit to 39.853 million yuan, a year-on-year decrease of 109.39%; the net profit after deduction was 11.1897 million yuan , Year -on -year decreased by 73.44%.

Regarding the "performance change", Nanlin Electronics said in the first round of inquiry letters to the Beijing Stock Exchange that it was mainly because the demand for downstream consumer electronics in the first half of 2022 was relatively weak. Triangle ", and the local epidemic has affected the company's logistics and business.

Data source: Reporter organized Liu Hongmei map

Demand in the field of consumer electronics

Established in 2004, Nanlin Electronics is a design enterprise focusing on simulation and digital model hybrid integrated circuits and power devices; the company's main business is the development and sales of integrated circuits and power devices; Vehicle chips, power devices and IPM and signal chain chips. According to Nanlin Electronics official website, there are more than ten product series, including more than 200 varieties, and more than 1,500 products sold.

The prospectus (declaration draft) shows that among the top ten shareholders of Nanlin Electronics, SK Hynix Semiconductor (China) Co., Ltd. and Datang Telecom Investment Co., Ltd. are held by 2.64%and 3.8%respectively.

Nanlin Electronics has a wide range of products, mainly covering many end applications such as consumer electronics, security electronics, medical electronics, vehicle electronics, smart cities, home appliances, and wearable electronic equipment.

The company's end users include Xiaomi Group (HK01810, the stock price of HK $ 11.680, a market value of HK $ 291.5 billion), OPPO, Midea Group (SZ000333, a stock price of 52.60 yuan, a market value of 368.1 billion yuan), Anke Innovation (SZ300866, shares of 66.82 yuan, and a market value of 27.157 billion yuan ) Well -known enterprises such as Little Bear Electric (SZ002959, a stock price of 49.87 yuan, and a market value of 7.780 billion yuan). In 2021, Nanlin's various products sold more than 2.5 billion.

At present, Nanlin Electronics's products are mainly used in consumer electronics and other fields. In 2021, the company's general power management chip (mainly used in consumer electronics, communication and other fields) and power devices and IPM products (mainly used in consumer electronics and industrial control and other fields) contributed 46.91%and 28.38%of revenue respectively; The company's third largest business is a special car chip, and the business contributed about 19.86%of revenue in 2021.

In the first half of 2022, in the context of Russia and Ukraine's conflict and domestic epidemic situation, the needs of consumer electronics such as mobile phones, laptops, and home appliances were down, especially mobile phones. According to the data from China Xintong Institute, from January to June 2022, the overall shipments of the domestic mobile phone market had a total of 136 million units, a year -on -year decrease of 21.7%.

In this context, in the first half of 2022, Nanlin Electronics achieved revenue of 160 million yuan, a year-on-year decrease of 23.09%; net profit of home mother was -3.9853 million yuan, a year-on-year decrease of 109.39%; net profit after deduction was 11.1897 million Yuan, a year -on -year decrease of 73.44%.

Nanlin Electronics also explained in the prospectus. It said that in the first half of 2022, the epidemic of various places repeatedly broke out, and Shanghai (Headquarters), Wuxi (where the production subsidiary was located) and Shenzhen (where the sales subsidiary were located) were affected by the epidemic. Affected by the epidemic, consumers have also reduced their willingness to buy some consumer electronics products.

Three consecutive quarters of net profit declined

In terms of quarterly, the net profit of Nanlin Electronics has declined since the fourth quarter of 2021.

Specifically, in the fourth quarter of 2021, the first quarter and second quarter of 2022, the net profit of Nantin Electronics fell 216.34%, 159%, and 88.54%year -on -year, respectively.

However, the only thing that can be regarded as favorable is that in the second quarter of 2022, the decline in the net profit of Nanlin Electronics narrowed. In the fourth quarter of 2021 and the first quarter of 2022, the company's net profit was losing money, but in the second quarter of 2022, the company turned to profit. Essence

If Nanlin Electronics wants to "turn around", the most important thing is to look at the needs of the lower reaches, especially whether the demand for consumer electronics can be restored. However, in terms of the current market's expectations for mobile phone shipments in 2022, most of the outlook is more pessimistic.

Recently, Huatai Securities has lowered the forecast of global and domestic smart machine sales forecasts to 1.24 billion and 280 million, respectively, a year -on -year decrease of 8.8%and 15.0%, respectively. The third -party institution IDC predicts that global PC sales in 2022 will decrease 8.2%year -on -year to 320 million units.

In addition to the consumer electronics field, the special vehicle chip business, which was highly hoped by Nanlin Electronics, also performed poorly in the first half of 2022.According to Nanlin Electronics, in the first half of 2022, the company's special vehicle chip revenue fell by 12.41%, and the gross profit margin also fell by 5.18 percentage points.In response to Nanlin Electronics IPO and the company's performance in the second half of 2022, on the afternoon of August 12, the reporter of "Daily Economic News" called Nanlin Electronics, and the other party stated that "the relevant announcement is subject to the announcement."

Daily Economic News

- END -

The 2022 Intelligent Audiovisual Conference will be held in Qingdao on August 16th

People's Network Qingdao, August 10th. From August 16th to 18th, the 2022 (GIAC) intelligent audiovisual conference with the theme of New Future of Symbiosis Numbers will be held in Qingdao City, Sh...

Beijing Astronomical Museum's "Beauty of the Starry Sky" imaging platform work collection notice

The vast universe, stars flashed. The beautiful moment we captured, deep and intox...