China Telecom's net profit in the first half of the year will increase by 3.1% year -on -year in the second half of the year will increase the investment ratio of the digital economy sector

Author:Daily Economic News Time:2022.08.16

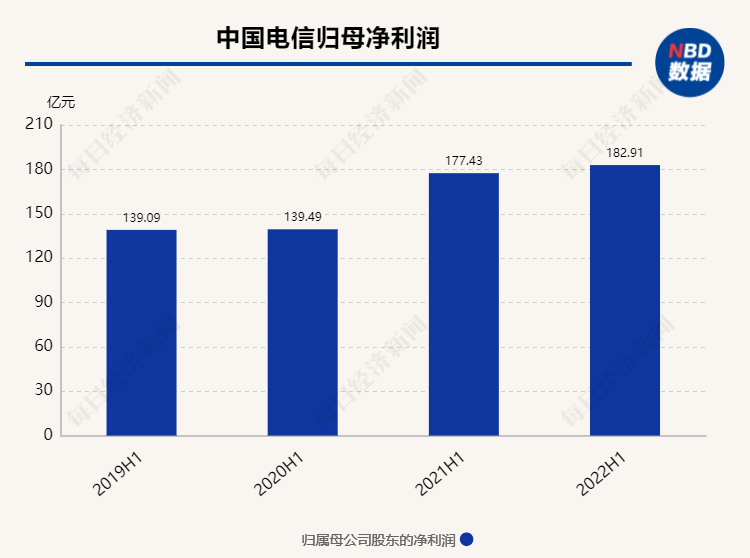

On the evening of August 16, China Telecom (SH601728, stock price 3.75 yuan, market value of 343.15 billion yuan) released the performance data of the first half of 2022. During the reporting period, China Telecom achieved operating income of 240.2 billion yuan, an increase of 10.4%year -on -year; net profit attributable to shareholders of listed companies was 18.3 billion yuan, an increase of 3.1%year -on -year. At this point, the performance of the three major operators in the first half of this year has been released. From the perspective of the year -on -year growth rate of net profit of home, China Telecom is significantly lower than China Mobile and China Unicom.

In addition to the traditional communication business, the cloud business with revenue is doubled year -on -year in the semi -annual report. Curvy, executive director, chairman and chief executive officer of China Telecom, said at the performance briefing held by the same day that the integration of cloud nets with clouds as the core is the company's strategic cornerstone. In recent years Sober understand that the amount of income and resources is not the key capability, and the competitiveness of the cloud business is in technology.

Since the slowdown in the growth of the traditional telecommunications business, operators are trying to find new growth points. Judging from China Telecom's financial report data, the cloud business has shown potential. However, in the fields of digital governments and network security, operators' competitors are not only each other, but also a number of head Internet companies that have already entered the industry and have a large number of shareholders and R & D technology. How the market will evolve in the future still remains to be observed.

The net profit increase of the three major operators

The performance data shows that in the first half of this year, China Telecom's operating income was 240.2 billion yuan, an increase of 10.4%year -on -year; of which service income was 221.4 billion yuan, an increase of 8.8%year -on -year; the net profit attributable to shareholders of listed companies was 18.3 billion yuan, a year -on -year increase of 3.1 %. At this point, the three major operators have been released in the first half of the year.

It is worth mentioning that with China Mobile (SH600941, the stock price of 62.16 yuan, a market value of 1.3 trillion yuan), China Unicom (SH600050, the stock price of 3.54 yuan, a market value of 109.62 billion yuan) 18.9%and 18.7%of the net profit growth rate of 18.7%year -on -year growth rates year -on -year growth rates year -on -year growth rate increased year -on -year growth rate. Compared with, the increase in net profit of China Telecom has a significant increase in net profit, and some investors have asked at the performance briefing meeting.

In this regard, Coriwen explained that in the first half of 2021, the company's sale of subsidiaries brought about 1.416 billion yuan of one -time after -tax revenue. After excluding the above influence, the company's comparison net profit in the first half of this year increased by 12.0%year -on -year.

In terms of mobile business, as of the end of June, China Telecom mobile users were 384 million, with a net increase of 11.79 million; the mobile ARPU was 46.0 yuan, and the wired broadband users were 175 million, with a net increase of 5.73 million. In terms of industrial digital business, the revenue in the first half of the year was 58.9 billion yuan, a year -on -year increase of 19.0%; IDC revenue was 17.9 billion yuan, an increase of 11.1%year -on -year.

In terms of 5G businesses, China Telecom has a total of 180,000 5G base stations in the first half of the year. It uses 5G base station 870,000 stations, and 5G package users are 232 million households, with an penetration rate of 60.3%. In addition, according to the introduction of Shao Guanglu, the executive director, president and chief operating officer of China Telecom, at the performance explanation meeting, the company's newly signed customized custom network project exceeded 1,300 in the first half of the year. A total of about 9,000.

It is worth mentioning that many of the "headaches" stock price issues that have made listed companies in the telecommunications industry, China Telecom also faces the same. Some investors asked at the explanation meeting that China Telecom's stock was below the issuance price shortly after the listing. At present, China -signed investors will lose 14%. I hope the company executives will explain.

In this regard, the company executive explained that due to the multiple factors, the market value of the operator was seriously underestimated. The company insisted on laying the foundation for the steady increase of the stock price with good operating performance, and attaches great importance to the return of shareholders. Including plans such as repurchase shares, I believe that the market will fully recognize the company's stock price and value in the future.

Cloud business becomes a new growth point

What other "key actions" are China Telecom? According to the half -annual report of 2022, China Telecom fully implemented the "cloud reform" strategy in the first half of the year, and continued to develop the digitalization of the industry, and assumed the heavy responsibility of sharing the country. This can be seen from the investment amount and intensity.

Picture source: China Telecom's performance description will be screenshot

"Daily Economic News" reporter noticed that China Telecom's capital expenditure was 41.7 billion yuan in the first half of the year, and R & D expenses were 3.25 billion yuan. According to Shao Guanglu, in the first half of this year, the company's cloud business investment amount was 5.2 billion yuan, an increase of nearly 300%compared with the same period last year; the IDC investment amount was 2.6 billion yuan, an increase of 150%compared with the same period last year.

As for the next investment plan, Shao Guanglu further revealed that in the second half of this year, it will further increase the investment ratio of the digital economy sector, which will generally exceed the proportion of revenue growth.

Why focus on this aspect business? Shao Guanglu gave two reasons. One is the strong market demand, and the second is the industrialization of the digital economy. The new technology has grown rapidly, and the input -output is very good.

In fact, the "money -making benefits" of the digital economy sector have been reflected in the semi -annual report of China Telecom. It is worth mentioning that the performance of the "cloud business" is particularly prominent. In the first half of the year, Tianyi Cloud revenue reached 28.1 billion yuan, an increase of 100.8%year -on -year, and it increased rapidly for several years.

In fact, since the slowdown in the growth of the traditional telecommunications business, operators are trying to find new growth points. From the perspective of China Telecom, its own resources and localized operating service organizations are a major advantage of its development cloud business.However, Corwen also made it clear that the company soberly realized that the amount of income and resources is not a key capability, and the competitiveness of the cloud business is in technology.At the 5th Digital China Construction Summit · Cloud Ecological Conference in July of this year, the relevant person in charge of China Telecom Cloud Business Platform said in an interview with the reporter of the Daily Economic News that the biggest advantage of the head of the head of the track in the trackIt is technology.Especially in the segmentation of digital governments and network security, a group of head -of -headed Internet companies have held a lot of share and R & D technology.How the market will evolve in the future, it remains to be observed.

Daily Economic News

- END -

Zhejiang science and technology state -owned enterprise: stimulate talent vitality surging and innovative driving force

Not long ago, Zhejiang High Specification held a provincial scientific and technol...

Don't be fooled!

618 Mid -year Shopping Festival comesIt's the season of Chop Hand Party carnivalDo...