Sun Zhengyi cannot find the spring of radical investment

Author:Economic Observer Time:2022.08.12

Sun Zhengyi's previously tried and uncomfortable investment philosophy did face the test brought by the changes in the times.

Author: Yuanshan

Figure: Tuwa Creative

A generation of venture capitalists Sun justly admitted mistakes recently, "I feel ashamed of my past greed for huge profits. We are too confident and too good."

The reason why Sun Zhengyi said was because SoftBank Group released the performance report of the first fiscal quarter (second quarter) of the fiscal year (second quarter) of the 2022 fiscal year as of June 30 this year. In the second quarter, a net loss was 3.16 trillion yen (23.4 billion US dollars), which refreshed the record of 1.7 trillion yen in the previous quarter, and continued to set a record high. At this time, SoftBank's stock price fell by more than 60 %.

Of course, he must not be judged to judge his work for a while. Recently, under the continuous interest rate hikes of the Fed, the stock price of technology stocks that are more sensitive to interest rates fluctuated sharply, and SoftBank's holding is basically technology stocks, which is an important reason for the frustration of SoftBank's performance.

In the future, the stock price of the technology stocks held by SoftBank may be adjusted with the stock price of SoftBank.

However, Sun Zhengyi's previously tried and uncomfortable investment philosophy did face the test brought by the changes in the times. The Internet technology track of Sun Zhengyi is facing development bottlenecks. In the past 20 years, China and the United States and other countries have experienced a technological revolution from the PC Internet to the mobile Internet. A disruptive innovation such as e -commerce and mobile payment has spawned a huge blue ocean market. Hundreds of millions of people have become high -frequency use of Internet services. Users, this also proves the high growth of the new Internet economy. The continuous influx of capital has also allowed many Internet startups to become unicorn in just a few years. After leaving one after another myth, venture capitalists represented by Sun Zhengyi have become synonymous with success. Essence

Unfortunately, the traffic growth model of the mobile Internet has been topped, and most of the new economic fields of the Internet have become the Red Sea. Next, the hard technology growth model needs a longer investment cycle and faces more uncertainty. At the same time, the depth and breadth required for the deep integration of the Internet and the real economy far exceeds the previous imagination. According to previous investment logic, Sun Zhengyi invests in Internet technology startups in these fields. wait.

However, when more and more institutions and individual investors begin to pay attention to the profitability of the enterprise, once the performance of the Internet technology stocks invested by Sun Zhengyi is not as good as expected, some investors will leave. As a first -level market investor, Sun Zhengyi, watching the high stock price of the investment company is no longer taken over in the secondary investment market, which is an important reason for the huge losses in SoftBank in recent years.

At the same time, whether it is China -US or other countries, the regulatory attitude of Internet companies is also changing, especially antitrust supervision. Tolerance. This has caused many Internet industry to form such path dependence, which is frequently rectified, which is a greater challenge for Sun Zhengyi. The Internet economy moves from the previous policy "wide door" to the "narrow door" that must be compliant everywhere, which means that Internet entrepreneurship must bear higher legal costs, and the brutal growth mode of using the system vulnerability arbitrage is no longer allowed. A radical investment style will inevitably be pressured.

It can be said that Sun Zhengyi encountered unprecedented investment frustration, which originated from the end of the era of the Internet -any company can get high valuation, high venture capital investment, and continuous investment in the Internet "Jin Yi". The mode of drumming flowers has failed. In the end, the Internet industry must return to the same valuation model as the real economy, and to measure whether a company has an investment value around profit and cash flow. To tell stories, complete the market share of market share with unrestrained burning money, and then go public arbitrage. Instead, we must focus on the forging of the core competitiveness of the enterprise, bring users a truly valuable product and service, and use the financial financial that does not mix water. Data persuades investors for a long time, which is actually more conducive to the formation of mature Internet investment concepts and the long -term development of enterprises.

(Author is senior commentator)

Zhang Weiying, the seventh anniversary of the "conversion" 811 exchange reform of an economist: the toughness and background color of the RMB daily "losing streak": the incumbent account, the money that can not be earned

- END -

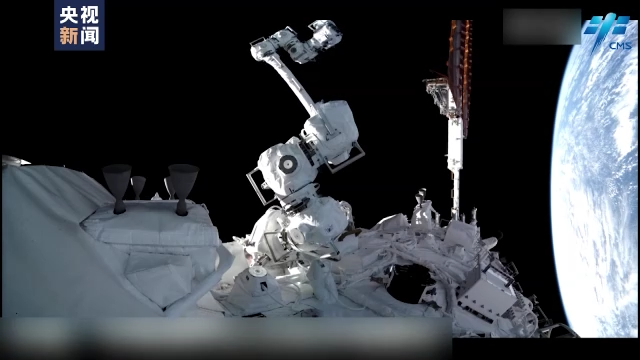

What is the ability to ask the small robotic arm of the sky?

China Space Station has been launched for more than ten days after the launch of t...

Eight hundred customers, easy sales, and enjoy the same way of selling customers

The picture comes from Canva.In recent years, as the popularization rate of my cou...