21 Global Observation | The "chip and science bill" for more than a year is released, can it cure the "core disease" in the United States?

Author:21st Century Economic report Time:2022.08.09

The 21st Century Business Herald reporter Wu Bin reported that after the game of the two parties for more than a year, the US chip bill was released.

After the Congress voted earlier, on August 9, Eastern time, US President Biden was expected to officially sign the "Chip and Science Act" (also known as the "chip+bill"). This bill mainly covers two important parts: First, to provide $ 52.7 billion in funding support to the semiconductor industry, encourage companies to develop and manufacture chips in the United States, and provide 25%of investment tax for these companies. The authorization provides approximately $ 200 billion in scientific and technical research funds in the next few years, covering many areas of artificial intelligence, robotics, quantum computing, battery technology, biotechnology, etc. in the future.

As a key bill for the United States to promote local chip manufacturing, the United States hopes to attract major chip giants to build factories in the United States by issuing subsidies. But on the other hand, these subsidies cannot invest in advanced production capacity in mainland China.

For different enterprises, the significance of this bill is very different. The most favorable bills are those companies with manufacturers, such as Intel, TSMC and Samsung Electronics. The benefits of chip design manufacturers such as Qualcomm, Nvidia, and AMD are not great.

Although the bill has been approved in the US Congress, some members have expressed concerns that some chip companies have been profitable at present, and the government's subsidy scale is too large. This kind of government's large -scale intervention in the industry does not conform to market concepts and violates basic market laws. The US government's approach will only make a small number of large companies profit.

Regarding the "chip and scientific bill" in the United States, the Ministry of Commerce in China responded on July 29 that the bill provided huge subsidies to the local chip industry in the United States is a typical differentiated industrial support policy. Some clauses restrict the normal economic and trade and investment activities of enterprises in China will distort the global semiconductor supply chain and disturb the international trade. China pays great attention to this. The implementation of the US bill should comply with the relevant rules of the WTO, in accordance with the principles of openness, transparency, and non -discrimination, which is conducive to maintaining the security and stability of the global industrial chain supply chain and avoiding fragmentation. China will continue to pay attention to the progress and implementation of the bill, and take strong measures to safeguard its legitimate rights and interests if necessary.

On July 28, Zhao Lijian, a spokesman for the Chinese Ministry of Foreign Affairs, also expressed an opposition. The so -called "chip and science bill" claimed that it aims to enhance the competitiveness of the American technology and chip industry. China has resolutely opposed it.

Zhao Lijian pointed out how the United States develops its own business, but it should not set up obstacles for the normal scientific and humanistic exchanges and cooperation between China and the United States, let alone deprive and damage the legitimate development rights of China. Sino -US scientific and technological cooperation is conducive to the common interests of the two parties and the common progress of human beings. To restrict "decoupling" can only harm others. At the same time, China adheres to the development of national and nation on its own strength, and any restrictions on suppression cannot stop the pace of China's scientific and technological development and industrial progress.

"Core disease" in the United States is difficult to treat

On the whole, the United States is still the hegemon of the semiconductor industry, and its design and software in the industrial chain are leading positions.

According to data from the US Semiconductor Industry Association (SIA), in 2021, global semiconductor sales reached US $ 556 billion, and US Semiconductor Corporation's sales totaled 258 billion US dollars, accounting for 46%of the global market, the highest in the world. South Korea ’s sales account for 21%of global sales, 9%in Europe and Japan, 8%in Taiwan, China, and 7%in mainland China.

However, American companies have fallen far behind Asian foundries such as TSMC and Samsung in the field of chip manufacturing. According to official US data, the production capacity of US chip in 1990 accounted for about 37%of the world, but now it accounts for only 12%. What is even more disturbed by the United States is that most of the high -end chips used by most US companies are imported from imports, accounting for as high as 90 %.

For American chip design companies, including Apple, Qualcomm, and Broadcom, most chip production relies on Asian foundries. At present, the TSMC alone accounts for about 55%of the global wafer foundry market. TSMC and other foundries in Taiwan occupy about 65%of the world's market share.

Global wafers in the world's third largest semiconductor silicon wafer factory say that by 2025, the production capacity of the existing semiconductor silicon wafers in the United States can only meet 20 % of domestic demand, and these existing semiconductor silicon wafers will be technically behind. The latest advanced chip that cannot be manufactured.

In addition, the global crisis of "lack of cores" after the outbreak of the epidemic, the United States is even more anxious to make up for the shortcomings, which will support the construction of local advanced production capacity as a strategic goal. Due to the huge investment in semiconductor manufacturing, if there are no subsidies, there are almost no companies willing to invest in construction factories at high costs. The United States must use huge financial subsidies and preferential policies such as tax reduction to attract Asian companies to the United States.

However, the problem is that more than 50 billion US dollars budgets can be described as a salary for the semiconductor industry and may not solve long -term problems. It should be noted that the capital expenditure of TSMC alone in 2022 is expected to be as high as US $ 40 billion. According to Gartner statistics, global chip manufacturers' capital expenditure this year is expected to reach $ 146 billion.

The high -manufacturing cost of the United States is still a key obstacle to restrict the development of the chip manufacturing industry. An analyst at East China private equity institution told the 21st Century Economic Herald reporter that the cost of making chips in the United States is relatively high, and the overall competitiveness in the market is not very good. How can the final effect of the chip bill be on a large question mark. In addition, the United States hopes to use subsidies to promote the local chip manufacturing industry. Such behaviors may undermine the global chip industry chain, and at the same time, there is also the risk of exacerbating overcapacity. From the perspective of Liu Dian, a high -end think tank consulting expert at the Peking University Capital Development Research Institute, whether the "chip+" bill or the "chip alliance" cannot cure the "core disease" in the United States. The United States tries to tear the global market layout with political logic, intending to use the means of suppressing the development of the opponent to maximize the interests of the US interests, and the behavior logic is unrealistic and harmful.

Black hand stretches to China

It should be noted that the two fiscal subsidies plans in the "Chip and Science Act" include constrained clauses against China.

On the one hand, for the semiconductor company built in the United States, if it is also built or expanded in the construction or expanded advanced semiconductor manufacturing factories in mainland China or other potential "unwavering countries" at the same time, it will not be subsidized; Chinese military entities shall not participate in the law authorized by the bill. Chip -related plans.

On the other hand, although the bill provides a lot of scientific research funds, universities that have educational cooperative relationships with China will be prohibited from obtaining research funds.

Although Intel has been lobbying before, I hope that the United States will not restrict the investment of chip companies to mainland China, saying that this will "inadvertently weaken the global competitiveness of companies that accept the funds of those funds."

The "Chip and Science Act" clearly stipulates that companies that ban federal funds have a large increase in advanced process chips in mainland China for a period of 10 years. Companies that violate the ban or fail to amend the violation may need to refund the federal subsidy in full. However, if semiconductor companies increase their market semiconductors in order to expand the market, they are not limited by the bill. However, the bill does not clearly clarify the definition of advanced processes and the so -called "traditional semiconductor".

Prior to the announcement of the bill, the United States had previously banned chip and equipment that exported 10 nanometer and below technologies to SMIC without permission, but limited the export of chip equipment without 14 nanometer and below technology.

But now the situation has changed. Two US chip equipment companies have confirmed that the United States' suppression of Chinese chips has expanded from 10 nanometers to 14 nanometers.

Panlin Group CEO Tim Archer said at the end of July to the analyst at the end of July that on the basis of manufacturing 10 nanometer and below chip equipment for Chinese companies, the scope of restrictions on exports in the United States has expanded to 14 nanometer and 14 nanometers and manufacturing The following chip equipment may not be limited to SMIC, and other chip manufacturing companies operating in China, such as TSMC in Taiwan, China. Herchi, President and CEO of Ke Lei, also confirmed the news. He said that the company had received a notice from the US Department of Commerce and asked them not to supply equipment to China for 14 nanometer and below chips.

Liu Dian analyzed that the "chip+" bill will exacerbate global geopolitical competition, further distort the global semiconductor supply chain, and tear the global market network. For example, the United States has forced American companies to relocate the industrial chain with "enjoying the US subsidy within 10 years". Some clauses restrict the selling chips in China, the world's largest market in semiconductor companies.

However, according to previous experience, the United States' suppression operation may anti -Chinese chip industry's firepower. After the United States had imposed sanctions on Chinese local giants such as Huawei and Hikvision, it instead inspired people's demand for Chinese domestic components, and the growth rate of China's chip industry exceeded anywhere in the world.

BBG data shows that 19 of the 20 fastest -growing chip companies in the world have been from China in the past four quarters. In contrast, there were only 8 a year before. Those Chinese suppliers who are vital design software, processors and equipment for chip manufacturing, have a few times the revenue growth rate of several world -class leaders such as TSMC.

The risk of overcapacity of chip may increase

After the outbreak of the epidemic, the world faced the dilemma of "lack of cores", but after that, the global multi -countries increased, the risk of economic recession intensified, and the demand for chips has begun to cool down. Recently, some chip manufacturers have considered reducing investment plans.

A report issued by the US Semiconductor Industry Association in August shows that the sales of global semiconductor chips in June increased by 13.3%year -on -year, below 18%in May, a decrease of 1.9%month -on -month. The global semiconductor chip sales have slowed down for six consecutive months, and it is also the longest time since the Sino -US trade dispute in 2018.

Trade data from South Korea, the world's largest storage chip production country, can undoubtedly reflect the problem. The increase in South Korean chip exports in July dropped sharply from 10.7%in June to 2.1%, slowing down for the fourth consecutive month. In June this year, the increase in semiconductor inventory in South Korea has reached the highest level of more than six years.

To make matters worse, in the periodic semiconductor industry, when the economy is weak in economic weakness, it has increased its investment in semiconductor capacity, which means that the risk of overcapacity in the world may increase.

Compared to the United States, the European Union has passed the European chip bill as early as February this year, providing up to 45 billion euros for the semiconductor industry.The European Union hopes to double its semiconductor manufacturing market share to 20%in 2030.Regarding the future, Zhang Zhongmou, the founder of TSMC, warned that the efforts of governments in the world to establish a domestic chip supply chain may push up costs, but they still cannot achieve self -sufficiency.The free trade in the past few decades has greatly promoted the development of semiconductor technology. More complicated technology has led to the transfer of supply chain to overseas. If you try to drive the car, the cost will rise and the technological development will slow down.

And the supply chain is completely localized.The US Think Tank Strategic International Research Center (CSIS) straightforwardly stated that in the complex and highly dependent global value chain, the US and China semiconductor companies have already been deeply integrated. To make the supply chain fully localized, it will pay huge economic and technical costsTherefore, it is very unrealistic about the global semiconductor industry.

- END -

Inheritance of medical dreams Share inspirational life -Academician Chen Xiaoping walks into Xinzhou dialogue, a middle school student

On the afternoon of June 30, Academician Chen Xiaoping Health Popular Science Stud...

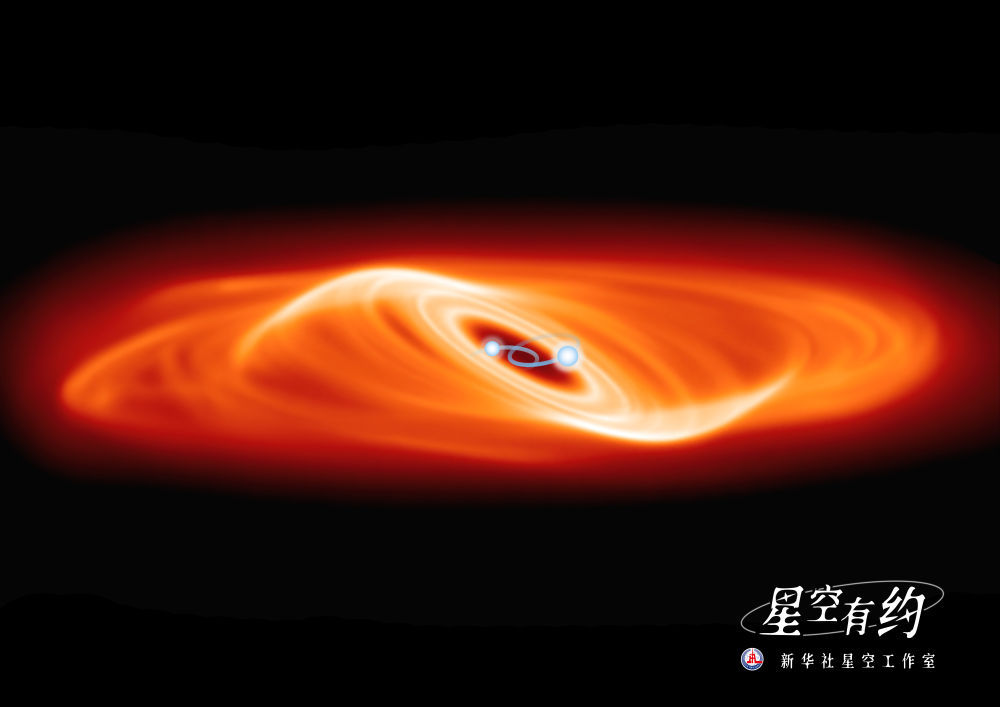

Chinese and foreign scientists have discovered rare "fog around the two -star" star system

The international team led by Professor Zhu Wei's Department of Astronomy of Tsing...