Haochen Software performance "changes face" under the IPO: R & D cost rate is lower than the average value of the peers, and the main products support 780 % of the income

Author:Blue Whale Finance Time:2022.07.28

Picture source: Oriental IC

Recently, the results of the results of the Municipal Party Committee's review meeting on the Science and Technology Board showed that Suzhou Haochen Software Co., Ltd. (hereinafter referred to as "Haochen Software") (first distributing) meets the issuance conditions, listing conditions and information disclosure requirements.

Haochen Software's IPO plan raised 747 million yuan, and this time it was used for R & D projects nearly 80%. It is worth noting that at present, the R & D cost rate of Haochen software is lower than the same value.

In fact, affected by the impact of the epidemic, Haochen Software's performance will begin to show a decline this year. It is expected that net profit in the first half of the year will drop by 21.62%-36.7%year-on-year. The main product of Haochen Software 2D CAD revenue accounted for more than 70%, but the overall scale of the 2D CAD market is small.

In the past, there were big factories such as Dasau systems, Siemens, and Outk, and a startup followed by it. Can Haochen Software stand firm in the CAD market?

Faced with the lower risk of actual controller's shareholding ratio, the R & D cost rate is lower than the average value of the peer

Haochen Software was established in 2001. It is positioned as an industrial software provider, which is mainly engaged in the research and development and promotion sales of CAD -related software.

As of the date of signing the prospectus, Hu Lixin, chairman of Haochen Software, directly holding 16.03%of the company's shares, and indirectly controlled 3.57%of the shares through Xing Yongyu partnership. Shareholders, as controlling shareholders and actual controllers. Hu Lixin and its consistent actors in total control 47.12%of the voting rights of the company.

The company has a total of 68 shareholders. Except for the controlling shareholder and actual controller, Hu Lixin, other shareholders holding more than 5%of the shares are: Suzhou Science and Technology, Lu Xiang, Pan Li, Deng Liqun, Liang Jiang, Wu Jiangdong Yun, Shun Rong, Shunrong Rong Venture Capital and Shunrong Phase II. Among them, the legal person shareholders Suzhou Science and Technology and Wu Jiangdong Transport held 11.89%and 5.35%of the shares, respectively, and the total shares of Shunrong Venture Capital and Shunrong II. Natural person shareholders Lu Xiang holds 6.02%of the shares, and Pan Li, Deng Liqun and Liang Jiang each hold 5.82%of the shares.

Haochen Software is facing the risk of low proportion of actual controller's shareholding. After this issuance is completed, the shareholding of the issuer's controlling shareholder and the actual controller will have a certain degree of decline. Further dispersing the equity structure may affect the shareholders' meeting. The decision -making efficiency of major issues has a impact on the company's normal production and operation.

In this IPO, Haochen Software plans to raise 747 million yuan in funds, and will invest in the R & D project of CAD Cloud Platform, 2D CAD Platform Software R & D and upgrading projects, 3D BIM platform software research and development projects, global marketing and service network construction projects. From the calculation of the amount of investment fundraising, nearly 80%will be used for R & D projects.

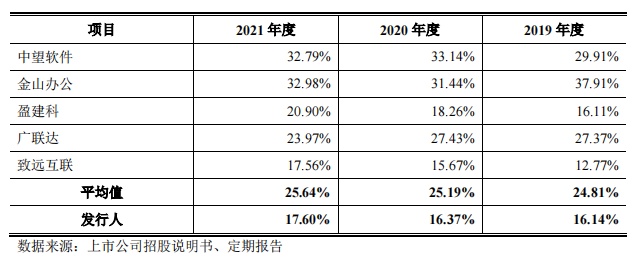

However, it is worth noting that during the reporting period (2019-2021), the R & D cost rate of Haochen Software is similar to Yingjianke and Zhiyuan. Essence

In this regard, Haochen Software stated that comprehensive consideration of development strategies and long -term research cycles such as 3D CAD, BIM and other fields, and the difficulty of R & D and difficulties. The current research and development is mainly focused on the functions and performance of various products of 2D CAD products. Wang's related R & D investment will gradually increase research and development in the fields of 3D CAD, BIM and other fields.

2D CAD product revenue accounts for over 70%, 3D CAD relies on Siemens technology component authorization

The main profit model of Haochen Software includes CAD software business profit model, CAD cloudization business profit model, and Internet advertising promotion business model.

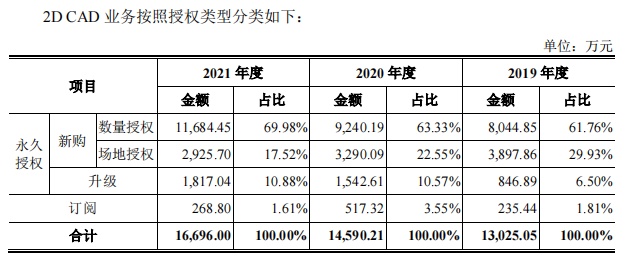

Among them, the profit model of CAD software business is divided into permanent authorization model and subscription model. During the reporting period, the company's CAD software business revenue source is mainly based on the permanent authorization model, and internationally renowned manufacturers such as Outk have transformed from permanent authorization model to subscription model.

Haochen Software said that if it is impossible to promote new customers in the future to promote new customers' development or upgrade of old customers, or the transformation rate of customers to transform the transformation of customers in a permanent authorization model, it may not affect profitability.

The company's main products include 2D CAD software and Haochen CAD to see the King of Tu. During the reporting period, the company's main business revenue mainly came from 2D CAD products, and its revenue was 130 million yuan, 146 million yuan and 167 million yuan, respectively, accounting for 87.11%, 80.08%, and 71.86%of the main business revenue, respectively.

The company's 3D CAD business mainly relies on Siemens's technical component authorization. In 2020 and 2021, Siemens is the company's top five suppliers. Based on the industry's technical level, market status, and their own situation, cooperate with Siemens to sign a five -year term contract with it, and attach automatic renewal clauses.

If Siemens fails to reach an agreement on the business terms in the future, or that Siemens will no longer provide relevant technical component authorization due to other force majeure factors, it will adversely affect the current sales of 3D CAD products.

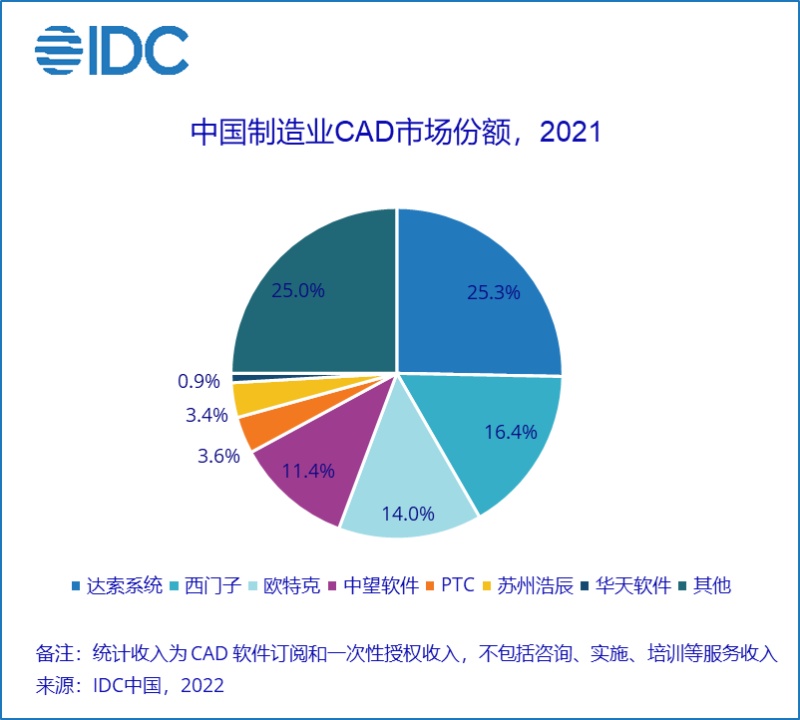

The overall scale of the 2D CAD market is small, and Haochen software is facing multi -faceted pinch

According to IDC data, in 2021, the market share of China's manufacturing CAD market share, Dasau system, Siemens, and Ortak are in the first echelon, and the three are divided into more than 50%of the market share; Zhongwang Software, PTC, Suzhou Haochen (That is, Haochen Software), Huatian Software and other manufacturers are ranked fourth to seventh. In 2021, the total number of Chinese manufacturing 3D CAD markets was 3.09 billion yuan, accounting for 73.4%of the Chinese manufacturing CAD market, with an annual growth rate of 21.5%, slightly higher than the overall CAD market. Among them, manufacturers such as Dasau system, Siemens, PTC, Zhongwang Software, Outk and Huatian Software occupy the main position in the market.

The market size of the 2D CAD product that Haochen Software lives is relatively high. According to iResearch, the global CAD market size was nearly $ 10 billion in 2020, of which the 2D CAD market was about $ 2.6 billion.

At the same time, the calculation of the CAD market for the Chinese CAD market and the calculation of the global 2D CAD and 3D CAD market structures in the CAD market of China. The overall size is small.

It can be seen that Haochen Software's market share in the Chinese manufacturing CAD software market in 2021 is less than 4%. And in 2021, the Chinese manufacturing 3D CAD market ranks in other ranks. At the same time, the rapid development of domestic domestic CAD software companies in recent years has further exacerbated market competition.

Du Yanze, the research manager of IDC China Manufacturing Industry, said, "Industrial software is used, China has the best industrial soil, and rich application scenarios continue to nurture industrial software growth. At present, national policies and capital markets have enough attention to industrial software, industrial software Especially the design and development industrial software with a long R & D cycle has ushered in the best era. But in the end, it can be widely recognized by industry users, and it can continue to obtain the double feedback of industry application knowledge and funds. Development lifeline. "

Haochen Software admits that if you cannot consolidate the existing advantages in subsequent product development and market sales, and expand the scale of sales, it will be in an unfavorable position in market competition.

The performance "face change" in 2022, at least 21.62% of net profit in the first half of the year

The revenue of Haochen Software during the reporting period was 153 million yuan, 186 million yuan, and 236 million yuan, respectively, with net profit of 19.1614 million yuan, 48.193 million yuan, and 70,053,000 yuan, respectively, all rising year by year.

However, its growth momentum stopped abruptly in the first half of 2022. According to the prospectus, according to the financial report of the first quarter of 2022 reviewed by the Economic Accounting Firm, the company's operating income in the first quarter of 2022 was 47.5478 million yuan, a year -on -year decrease of 7.9%; the net profit of the mother was 10.8294 million yuan, a year -on -year decrease of 27.53% Essence

Haochen Software explained that the main reason for the decline in monthly operating income in the first quarter of 2022 was the impact of the current epidemic situation that caused the domestic CAD software business revenue to decline, as well as the adjustment of the domestic advertising positioning strategies, the weak launch demand in the advertising industry market, and the weak launch demand in the advertising industry caused weak launch demand to launch demand for the overall market market. Internet advertising business income has declined.

Due to the decline in operating income in the first quarter of 2022, and the increase in the number of employees increased, the expenses such as salary expenditure increased, resulting in a decline in net profit attributable to mothers in the first quarter of 2022.

It is also for the above reasons that the company is expected to achieve operating income of 90 million yuan to 110 million yuan in the first half of 2022, a year -on -year decrease of 17.83%to an increase of 0.43%. To 36.7%.

Hao Chen Software said that in view of the uncertainty of the epidemic, the weakness of domestic advertising positioning strategies and weak launch demand in the overall market market of the advertising industry may also lead to further decline in Internet advertising business revenue, and there will be risk of decline in business income in the future.

At the same time, the company stated that based on the needs of strategic development, such as expanding the scale of research and development, sales, etc., the expenses of employee salary and other expenses increased, and the failure to promote the increase in operating income in the short term Essence

- END -

How does GNN find new drugs?Dr. MIT's thesis "Molecular Charter Express the Drug Discovery of Learning and Generated"

Source: SpecialtyThis article is introduced in the paper. It is recommended to rea...

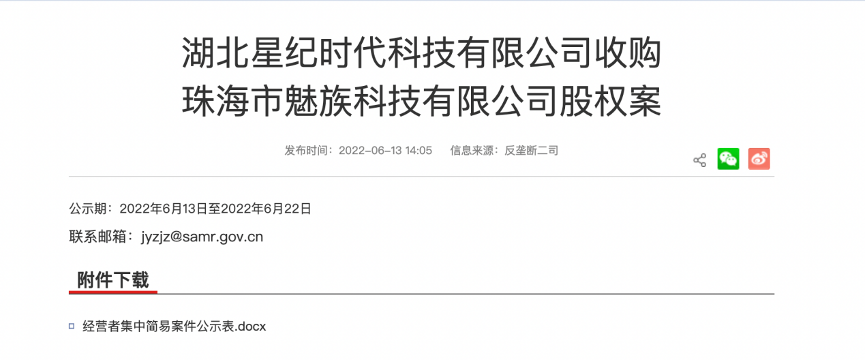

46 years old, Huang Zhang bid farewell to the rivers and lakes: officially sold the company

The rivers and lakes have not been there for a long time.Until this Meizu official...