Can three years lose 800 million yuan?

Author:Sword finger Time:2022.07.23

Text/Yang Jianyong

Thanks to the development of artificial intelligence technology and extensive landing, the AI unicorn has developed rapidly. At the same time, behind high growth still faces the embarrassing situation of continuous losses. For AI unicorn, the most urgent is the technical landing and monetization, thereby improving self -hematopoietic ability. After all, long -term burning money cannot obtain sufficient funds for appropriate conditions, and development may be greatly adversely affected. As a result, AI unicorn needs to keep financing.

In the past year, outside the Hong Kong Stock Exchange, Ge Ling deep pupils and Yunson have landed from the science and technology board, and AI unicorn and other AI unicorn are still in line. Chi also submitted the application. They have a common characteristic of continuous losses, and the scale of losses is increasingly expanded, and their performance in the market is sluggish.

Sibich holds losses, and the AI track competition has intensified

As the AI unicorn on the intelligent voice track, Sibchi is also difficult to escape the fate of losing money. You know, continuous losses are one of the biggest problems of AI unicorn. In 2019, 2020, and 2021, Sibich lost 283 million yuan, 215 million yuan, and 334 million yuan, respectively. The cumulative loss of three years was 832 million yuan. It should be pointed out that the gross profit margin is also declining year by year. The prospectus shows that during the reporting period, the gross profit margin of the main business was 72.17%, 69.74%, and 58.15%, respectively. The gross profit margin showed a downward trend, giving people a feeling that the product was selling and losing losses, showing that in the process of commercialization of artificial intelligence, it was facing a huge market competition pressure.

On the intelligent voice track, many heavyweight players have gathered, including smart voice manufacturers such as HKUST Xunfei and Yunzhisheng, and Internet giants such as BAT. Sibi is in the landing of business and has to face the competition of the giants. According to IDC data, the intelligent semantic market structure of artificial intelligence in my country is increasingly focused on head manufacturers. From the perspective of annual data, HKUST Xunfei is still at the top of the list, and Alibaba Cloud and Baidu Smart Cloud market share has begun to rise. Among other manufacturers, Huawei Cloud and Jingdong Cloud contributed a certain market share, followed by dialogue AI manufacturers and smart customer service manufacturers.

From the perspective of market share, Sibich is ranked fourth and reflects its ability to land in business. At present, the full -link intelligent dialogue system developed by Sibchi DUI platform and artificial intelligence voice chip, which is in the Internet of Things fields such as smart home appliances, smart cars, consumer electronics, and production with digital government and enterprise customers. , Life and social governance fields (covering financial services, transportation, logistics, real estate hotels, medical and health and other industry scenarios), providing smart human -computer interaction software products, software and hard -hard integrated artificial intelligence products, and dialogue artificial intelligence technology services.

From the perspective of revenue structure, software and hard -hard integrated artificial intelligence products are the largest revenue sector to tear up and the fastest growth rate. The revenue in 2021 was 100 million yuan, accounting for 33%of the total revenue. Sibiscus claims that the company is one of the very few companies that have a full -link voice and language interactive technology with human -machine dialogue as the core, the construction capacity of the human -hard -hard integrated man -machine dialogue system, and the ability of large -scale automated artificial intelligence technology to customize one.

With professional AI technology, excellent commercial capabilities, and perfect product layout, Sibi has won praise from many head customers. In the field of smart home appliances, as the Internet of Things terminal continues to develop towards strong intelligence, the interaction methods of smart home appliances have evolved from remote control buttons and mobile APP to voice control, liberating hands, and human -machine interaction methods are becoming simpler and convenient. Sibi is based on the scene of home life. From the three major perspectives of user experience upgrades, product performance improvement, and scene ecological integration, creating a new generation of smart home appliance equipment interactive experience in the entrance, so that smart home appliance voice language interaction solutions can benefit from benefiting Various smart home appliance terminals, including in -depth cooperation with Hisense, Huawei, Midea, Changhong, etc.

In the field of intelligent automobiles, in recent years, smart cars have gradually become popular, and automobiles have gradually evolved from "hardware -based" industrial products to "hard and hard -hard integration" intelligent terminals. The mainstream brands on the market have deployed the AI voice system on the new car. Essence Sib Chi Smart Automobile Voice Language Interaction Solution is a software product solution provided by the company's home factory, Tier1 manufacturer, and equipment manufacturers for car after car. Passengers can control vehicle software such as navigation, music and other vehicle software in real time, as well as windows, air -conditioning and other vehicles to enjoy the smart travel experience. Its customers cover domestic head factories and Tier1 manufacturers such as steam, BAIC, ideal, Nezha, Botai, etc.

In the field of consumer electronics, customers include OPPO, Little Genius, Youxue School, Newman and other industries. In addition, the product plan helps companies such as China Mobile, SF, Guangzhou Metro, Chongqing Rural Commercial Bank, Jiangsu Net Jin and other companies to carry out business intelligence upgrades to achieve cost reduction and efficiency. It can be seen from this that Sibi's artificial intelligence commercial implementation capacity has driven strong growth in revenue. In 2019, the scale of revenue was only 115 million yuan. By 2021, it increased to 307 million yuan. The compound growth rate of operating income reached 63.71%.

In addition, this raising funds will be mainly invested in the full -link dialogue AI platform construction and industry application solution projects, intelligent terminal construction projects for the Internet of Things, research and development center construction projects, and supplementary mobile funds. This will help further promote product iteration and technological innovation, expand the main business scale, and comprehensively improve the core competitiveness and market share of enterprises. Can Sibi, who has not yet been profitable, can be favored in the market?

According to the disclosure documents, it is planned to issue a shares of not more than 10%, and it is planned to raise 1.03 billion yuan. Based on this, Sibi carried out an IPO with a valuation of 10.3 billion. Facing the competition and profit pressure of technology giants, whether it can support the market value of 10 billion yuan in a long -term loss, it remains to be tested. However, it is not optimistic about the performance of the available AI unicorn in the capital market. Artificial intelligence business application scenarios are the core of AI unicorn, which is an important basis for measuring AI strength.

The commercial soup of AI Four Dragons performed well in the early stage of listing. On December 30, 2021, it was listed on the Hong Kong Stock Exchange. It rose sharply on the same day and continued to rise on the following trading days. The market value once exceeded the 320 billion Hong Kong dollar mark. Unfortunately, after the lifting period, it suffered a severe frustration in the capital market. As of July 22, the market value of Shangtang was HK $ 81.4 billion, a decrease of HK $ 230 billion compared with the high market value.

Yuncong Technology is also a four -dragon of AI. Although it has not fallen below the issue price, it is mainly due to the sharp shrinkage of fundraising. According to the data disclosed earlier, it is planned to raise 3.75 billion yuan, actual fundraising of 1.728 billion yuan, deducting issuance costs, and net fundraising is 1.627 billion yuan. Compared with the expected reduction of more than 2 billion yuan, the fundraising has shrunk by more than 50 %, and the embarrassing situation of "applauding" is not applauded. Of course, if there is a loss, compared to the super -funded Guling deep pupils, the difference in the issuance price is different. Because of the low pricing, Yuncong Technology leaves a profit space for investors. Of course, the market is risky, especially the financing securities will exacerbate price fluctuations.

Galing deep pupils are the peak of listing, and the first trading day is lower than the issue price. The current market value is 5.342 billion yuan. The deep pupils were broken, and behind the refraction of the market, the market was worried about the continuous losing money. At the same time, many factors such as the implementation of technology, continuous losses, and intensified competition have not optimistic about the prospects of the AI unicorn for continued losses.

at last

With the increase in investment in artificial intelligence from all walks of life, the application of artificial intelligence has accelerated, and the global artificial intelligence market will show a booming trend. As an important artificial intelligence market in the world, IDC is expected to account for about 8.3%of the world's total by 2025, ranking second in the world. With the continuous landing of AI applications, the size of the Chinese market will grow with a CAGR of 24.4%, which is expected to exceed 18.43 billion US dollars in 2025.

While helping all sectors of digital upgrading and innovation, artificial intelligence companies will also be expected to obtain dividends brought about by the development of artificial intelligence. For AI unicorn, whether it can maintain continuous growth depends on the ability of the AI scene.

Yang Jianyong, a Forbes Chinese writer, is committed to in -depth interpretation of cutting -edge technologies such as the Internet of Things, cloud services and artificial intelligence.

- END -

Academician Longjiang Xing | Provide scientific and technological support for food security

I studied grass, and you studied grass. On July 26, Academician Bai Lianyang, Secr...

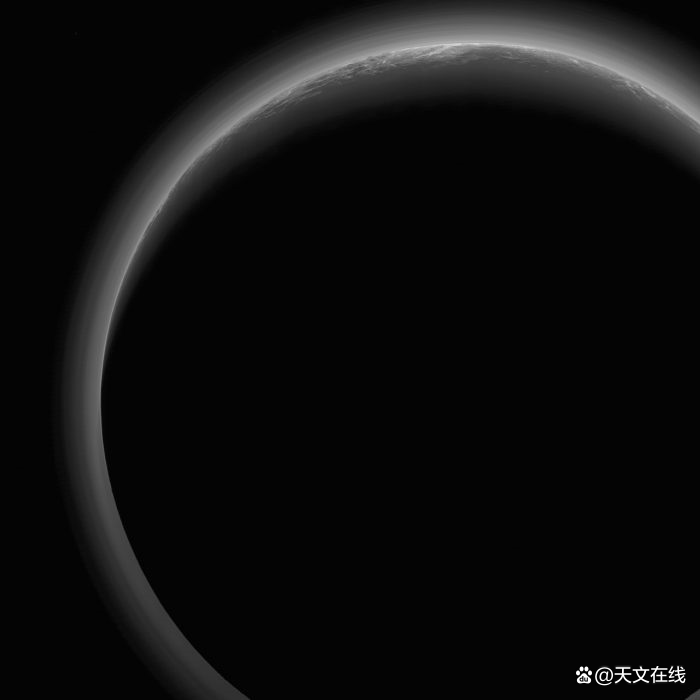

strangeness!Pluto’s atmosphere is actually disappearing, scientists are hurrying to study

How to confirm that Pluto has the atmosphere, how to judge the expansion of the at...