Wind power and photoelectric companies have risen collectively or are related to this tens of billions of dollars energy subsidies.

Author:Cover news Time:2022.07.18

Cover reporter Liu Xuqiang

On Monday, July 18, the A -share market was just opened, and the new energy track became a hot spot in the market. Green power, energy storage, and carbon trading related sectors rose sharply. The rise in this round, or is related to the tens of billions of renewable energy subsidies.

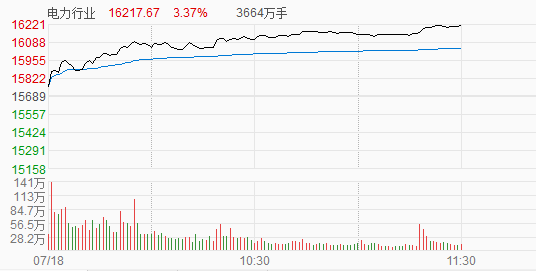

On July 18th, the electric power related sector rose sharply

"True Gold and Silver" is good

Wind, light, biological power generation listed companies welcome 10 billion yuan policy subsidy funds

On July 18th, as of the afternoon closing, the three major indexes of A shares rose collectively. Among them, the Shanghai Index rose 1.49%, the Shenzhen Index rose 1.12%, and the GEM index rose 1.83%.

In terms of sectors, green power, energy storage and other sectors have risen collectively, and individual stocks in the sector rose, and set off a tide of daily limit. Among them, there are many "monster stocks" that seal the daily limit board. In terms of energy storage, Jinzhi Technology 11 days 9 boards, Sega Technology 5 consecutive boards, Chunxing Seiko 7 days 4 boards; in terms of green power, Evergrande High -tech 6 consecutive boards, Evergrande Shunfa Hengye 4 consecutive board.

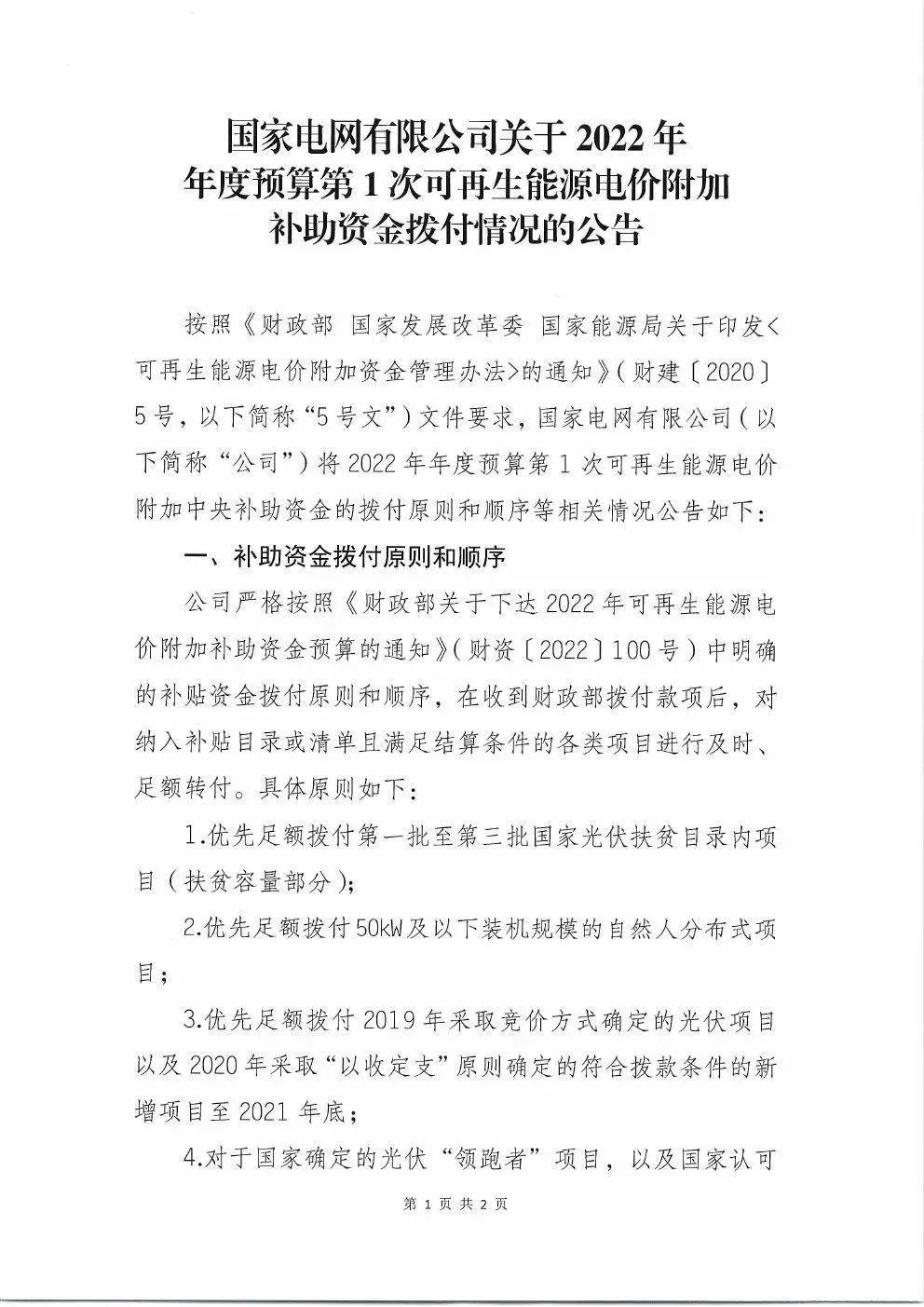

The reporter noticed that this round of market may be related to the news of last Friday. On July 15th, the State Grid issued "Announcement on the Payment of Additional Subsidy Funds for Renewable Energy Electricity Price of 2022 Budget", which mentioned that it will be in time and enough for various types of projects that are included in subsidies or lists and meet the settlement conditions. Surgery.

Specifically, the first annual budget for 2022, the Ministry of Finance is expected to allocate a total of 39.9 billion yuan in the annual budget of the national power grid renewable energy electricity price, of which: 10.5 billion yuan in wind power, 26 billion yuan of solar power generation, biomass biomass Can generate 3.4 billion yuan.

The announcement proposes that the first batch of projects in the first batch of the first batch of national photovoltaic poverty alleviation catalogs (part of the poverty alleviation capacity); priority to allocate natural person distributed projects with 50kW and below installation scale.

National Grid announcement of 39.9 billion yuan renewable energy subsidy is about to be issued soon

Listed company performance differentiation

Fitness performance is bursting and insufficient wind power market demand?

Entering the newspaper season, "performance is king" is the main line of the current market. Occupying the above -mentioned subsidies, the reporter noticed that many photovoltaic companies have disclosed the performance forecast of the first half of 2022. The net profit of GCL Technology increased by 187.5%year -on -year, and the net profit of Shuangliang Energy -saving increased by more than 212%year -on -year. Many other companies have also achieved high performance. Some securities firms believe that in the first five months of this year, the increase in the number of new photovoltaic power generation machines and export volume in China is nearly doubled, which continues to prove that the industry is strong.

In terms of wind power, the performance of listed companies that currently disclose the performance trailer is obvious. Mingyang Smart semi -annual report performance trailer shows that the company's net profit was 2.2 billion yuan in the first half of the year, an increase of 111.25%year -on -year;

Tianshunfeng, Sun Moon shares, etc., have declined with performance. For example, the semi -annual performance trailer shows that due to the lack of market demand in the first half of the year, the company's downstream customer demand is delayed, resulting in a decline in operating income. It is expected to achieve a net profit of 240 million yuan, a year -on -year decrease of 60%.

But looking forward to the second half of the year, some brokers believe that due to the intensive delivery period of entering the wind power project in the second half of the year, the industry is optimistic about the new demand.

Soochow Securities believes that with the first batch of large -scale large -scale bases, the wind power installed machine in the second half of 2022 is expected to increase significantly, stacking 2022 bidding restart to support the large -scale installation in 2023, the wind power industry's prosperity is expected to continue, the competitive pattern is better, profitable, profitable The component links that improve the marginal improvement are expected to benefit in depth.

Huaxin Securities believes that the wind power industry will usher in a dense delivery period in the second half of the year, and the demand for industrial chain is expected to increase rapidly. At present, the price of fan prices has completed the pressure test, and the profitability of the industrial chain is expected to improve. At the same time Synchronous improvement.

[If you have news clues, please report to us. Report WeChat Follow: IHXDSB, Report QQ: 3386405712]

- END -

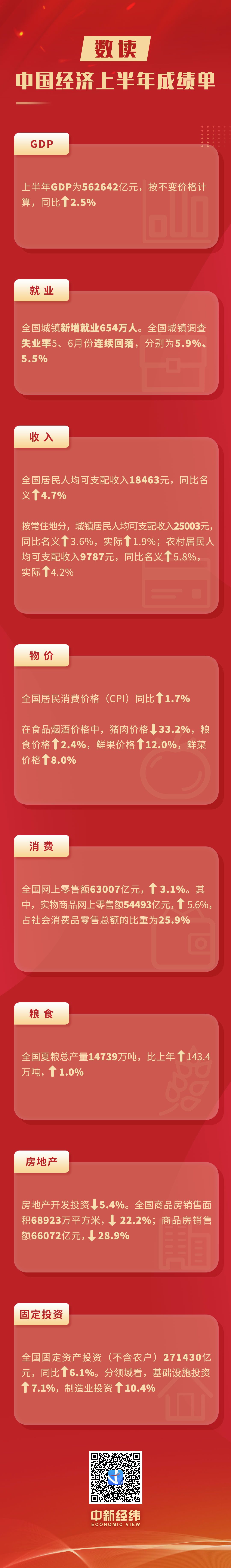

Digital reading 丨 China's economic transcript in the first half of the year

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more...

19 projects signed an investment of over 1.8 billion US dollars!Jinan's gains at the Qingdao Summit of the 3rd multinational company's leader

On the morning of June 20, during the holding of the 3rd multinational company lea...