Big Fund participated in the combat investment. Can this new stock become a big meat sign?Recently,

Author:Broker China Time:2022.06.14

Source: Securities Times ID: wwwstcncom

The effect of making money for new shares is bursting, and investors have a new enthusiasm and high.

On June 14, the new shares of the science and technology board Longxin Zhongke and the China Drone released the first public offering of shares and announced the announcement on the Science and Technology Board. The issue price of Longxin Zhongke is 60.06 yuan/share, and the issue price -earnings ratio is 141.68 times, which is higher than the company's industry in the past month average static price -earnings ratio. The issuance price of the China UAV is 32.35 yuan/share, and the issuance price -earnings ratio is 75.62 times, which is also higher than that of the company's industry in the past month average static price -earnings ratio.

Recently, the new shares of Ya Xiang and Huaru Technology, which are issued in GEM, have also higher than the industry's price -earnings ratio. As the new stocks listed in May rarely occurred, and high -priced high price -earnings ratios such as Huahai Qingke and Yuneng Technology, such as Huahai Qingke, Yuneng Technology, have received considerable new revenue after listing, and investors' enthusiasm for new shares is obviously stimulated again.

Huajin Securities analysis pointed out that in the context of continued to climb and register for new stocks in the first -level market, the new shares have reached a hundred times PE, and the pricing of the first day of the new shares has gradually become fully sufficient. Investment opportunities or gradually decrease, emotional drivers are more important for improving the yield of the secondary market for new shares.

100 times P / E ratio new shares reproduce

Following Huahai Qingke and Yuneng Technology, the science and technology board reappeared for the issue of new shares of P / E ratio.

Longxin Zhongke announced that the issue price was 60.06 yuan/share, and the corresponding issuer was deducted from 2021 unless the diluted diluted before and after the diluted of regular gains and losses was 141.68 times. In the past month, the industry has an average static price -earnings ratio, which is higher than the comparable company average static price -earnings ratio.

The company's main business is the development, sales and services of processors and supporting chips, including processor and supporting chip products and software and hardware solutions. The company's "Dragon Coss" series is one of the earliest general processor series developed by my country. In recent years, the domestic CPU market has risen, and a number of domestic processors such as Longxin, Huawei, Feiteng, Haiguang, Zhaoxin, and Shenwei have appeared. Longxin Zhongke took the lead in grabbing Shanghai Science and Technology Board to issue an IPO listing.

Performance data show that the company achieved operating income of 486 million yuan, 1.082 billion yuan, and 1.201 billion yuan from 2019 to 2021, respectively, with a year -on -year increase of 151.30%, 122.87%, and 10.99%. From 2019 to 2021, the net profit distribution of mother-in-law was 193 million yuan, 72 million yuan, and 237 million yuan. The year-on-year increase was 2343.54%, -62.82%, and 229.82%.

In the first quarter of this year, the company's operating income and net profit declined year -on -year, with operating income of 181 million yuan, a decrease of 37.08%; net profit attributable to mother was 36 million yuan, a decrease of 41.74%.

The company's IPO plan does not exceed 41 million shares, and plans to raise 3.512 billion yuan to invest in advanced process chips research and development and industrialization, high -performance universal graphics processor (GPU) chip and system development and supplementary mobile funds.

Based on the issue price of 60.06 yuan/share and 410 million shares of this issuance, the total amount of funds raised by the issuer's raised funds is 2.462 billion yuan.

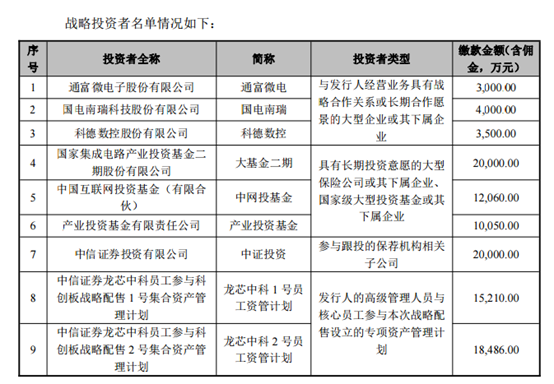

It is worth mentioning that the company's issuance also attracted long -term funds such as the second phase of the Great Fund, the China Internet Investment Fund, and the Industrial Investment Fund, as well as the combat investment of Tongfu Microelectronics, Guodian Nanrui, and Kotor CNC.

The second phase of the Great Fund's investment reached 200 million yuan, the China Internet Investment Fund contributed 120.6 million yuan, and the industrial investment fund contributed 100 million yuan. In addition, CISIC Investment, a subsidiary of CITIC Securities, has also invested 200 million yuan this time. Longxinzhongzhong's salary management plan to invest 337 million yuan.

The P / E ratio of new shares issued is generally higher than the industry's price -earnings ratio

In addition to Longxin Zhongke, the China Drone issued on the science and technology board, as well as the P / E -P / E ratio of the new shares of the new shares of the GEM and the new shares of the GEM, and the issuance of Huaru Technology is also higher than the industry's price -earnings ratio.

The issuance price of the China UAV is 32.35 yuan/share. The corresponding issuer deducts the price -earnings ratio of 75.62 times after the diluted diluted before and after the frequent profit or loss. The monthly average static price -earnings ratio is lower than the average level of static price -earnings ratios in the same industry.

Yaxiang's issuance price of 35.98 yuan/share in 2021 is deducted in 2021 unless the diluted of the net profit attributable to shareholders of the parent company's shareholders before and after the diluted price -earnings ratio is 32.71 times higher than the static price -earnings ratio of comparable listed companies. In the last month of the industry, the average static price -earnings ratio.

The issuer with a price of 52.03 yuan per share of this issue price of Huaru Technology is deducted in 2021 unless the diluted and low diluted price of the P/E ratio is 51.64 times after the low diluted before and after the frequent profit or loss, which is also higher than that of the industry in the last month. The company's average static price -earnings ratio in 2021.

Huajin Securities analysis pointed out that with the recovery of new stocks, more pricing on the first day of the new stock listing, the investment opportunities brought by the price deviation of the first trading date of the new stock market may decrease. From the perspective, industry heat may be an important catalyst for increasing investment income.

Huajin Securities recommends that actively pay attention to the new market, while investment in the secondary market recommends that it will focus on "the main line of rarity and emerging growth leading lines with high prosperity" and "high prosperity or stable growth industry mapping main line". New institutions return to the Internet

With the implementation of the new regulations for the registration system and the improvement of the "Bosumi" of the online institutions, institutional investors are more inclined to use fundamentals such as the company's industry status, development potential, technical barriers and other fundamental factor and secondary market conditions, and the secondary market conditions, and the secondary market conditions, and the secondary market conditions. After the listing, the reasonable income and other transaction factors were comprehensively quoted. Therefore, after the break in April, the number of institutions involved in the quotation had continued to be low, but recently, it has been significantly recovered.

Data announced by new shares such as Longxin Zhongke, Zhongdang drone, Huaru Technology, and Sanyo Nengxian show that the institutional investors participating in the quotation are more than 300, and the offline quotation agencies of Yaxiang shares are also approaching 300, basically, basically, basically, basically The level has been restored to the eve of the tide of breaking, but compared to the hot degree of the quotation of over 500 institutions, the current quotation institution is still relatively low.

According to statistics from Dongxing Securities, the entire market for A, B, and C in May of A, B, and C was new yields of 0.116%, 0.093%, and 0.075%, respectively, which were significantly improved from April. As of the end of May 2022, from January to May of 2022, the cumulative yields of the entire market for the total markets of A, B, and C were 0.71%, 0.52%, and 0.33%, respectively, far lower than the level of the same period last year.

After the listing of new shares in May, the performance of the new shares, especially the high -priced and high price -earnings ratio of Huahai Qingke, Yuneng Technology, and other high -priced and high price -earnings ratios.

Huajin Securities said that from the perspective of the valuation premium of the near -end stocks that have been listed in the past three months, the proportion of the recent new stock market for the near -end new stock market in the past week is 0.97, the valuation premium has begun to rise margin, and the investment preferences of near -end new stocks Textwatting. From a historical comparison, the ratio of the earnings ratio of the near -end new stock market will regain the rise in the low -level area of 0.8, and it is expected to correct the extremely pessimistic investment emotions around April in April. The level market shows a small valuation discount, or jointly promotes the investment preferences of near -end new shares. But at the same time, it is necessary to point out that because the proportion of new stocks is reduced to 0.94, it is advanced in advance. It does not rule out that the stock price driving force brought by the relative advantage of valuation will be slightly weaker.

Responsible editor: Yang Yucheng

- END -

New cycle of online movies, more "big" competition

At the recent 2022 Tencent Video Film and Television Conference, Tencent Video rel...

The Federal Reserve ’s interest rate hike is expected to hear the heating up

On June 14, in Washington, USA, a man walked from a food supermarket under a shopp...