British Finance | Western economic crisis and gold price "War Article · Next"!The Federal Reserve's policy error caused the depression in 1929?

Author:China Gold News Time:2022.07.15

How to change the economy in World War I and World War II? What is closely related to gold? British finance continues the sharing of centuries of war in Europe, helping readers to understand the context of Western political games, and learn from ancient times.

Gold has been pushed to the golden -oriented stage since the 18th century, and has the mission of hedging currency and economic risks. Therefore, gold prices are sensitive to inflation, economic recession, and geopolitics. With the strength of the country. And because of the game and changes in World War I and World War II, the United Kingdom finally lost its hegemonic position, and even made the golden standard to the United States. From then on, the US dollar borrowed golden endorsements and became a common trade and foundation currency. After the Bresse Forest Treaty ended in the 1970s, the US dollar lifted the exchanges of the golden stock exchanges and excessively issued. The risk aversion and anti -inflation function of gold prices was even more special.

If you study the history of Western economic history, you can find that the geopolitical crisis in the West has periodic characteristics, which is closely related to history, economic development and political game. Often when the hegemony is facing the challenge, it has triggered the situation and brings stimuli to the price of gold. Each result is rewritten to the economic and political appearance. It can be seen that investment gold cannot ignore the geographical crisis. Just like the British temporarily separated from the golden base of the UK, the cause of the gold price increased significantly, but the cause of the World War I was because Prussia's economy and national strength threatened Britain and France. Terms, and laid seeds for World War II. How to change the economy in World War I and World War II? What is closely related to gold? British finance continues the sharing of centuries of war in Europe, helping readers to understand the context of Western political games, and learn from ancient times.

Introduction to British Finance: American scholar Joseph Niyi, who was the dean of Harvard Kennedy Government College, and was also the US Assistant Secretary of Defense. There was a discussion in its new book discussing the US foreign policy, pointing out that "international relations are anarchy In the ground, no world government provides order. Each country must defend themselves and face the juncture of life and death. It is reflected in Western foreign policy, and subconsciousness is the essence of fighting for power. With this as the essence, how can it not fall into the cycle of war.

The Federal Reserve low -interest policy after the First World War

The United Kingdom and France were the victory over the World War I. In addition to strict punishment against the defeated country and Germany, they divided the German colonies and the Austro -Hungarian empire to develop the colonial economy. Provide war payment for Britain and France, and at the same time, a large amount of gold flows into the United States. In 1921, the gold held by the United States was three times that of the United Kingdom, and in 1932 to 6 times. Become the largest creditor country.

At the same time, in order to give Britain and France the ability to repay after the war, US financial institutions change loans to Germany of the defeated country, so that Germany has the ability to repay to Britain and France, while Britain and France have the US dollar repay the United States and continue to buy the United States. Materials. The US dollar's overseas ecosystem has gradually established and maintained the post -war US overseas trade.

Because of the loss of World War I, Britain, France, and Germany and the United States also vigorously promoted the economy after the war. In order to stabilize the pound in 1920, the United States signed an agreement in 1920 to limit the Federal Reserve to be lower than the United Kingdom when formulating interest rates, so that gold will not be because of the because of the gold, so that gold will not be because of the because of their interest rates, so that gold will not be because of the because The Federal Reserve's high interest difference flows into the United States, allowing the British Gold to repair and operate. Due to the embrace of the golden standard, the price of gold entered a stable cycle from 1920 to the Great Depression.

Introduction to British Finance Advanced: The independence of the United States has been doubtful since its establishment, and in 1920, the situation of the Federal Reserve and the British and French central banks negotiated the interest. It was not a single incident. There are also many historical materials that the Fed and the Non -American Allied Central Bank have to tease the exchange rate and interest rates, and the twisted operation after the epidemic is the most obvious recent example.

Coco's prosperity and bubble

Because of the central bank agreement after the United States and Britain, the Federal Reserve lasted for nearly 10 years at a low interest rate environment. Early low interest stimulus has undoubtedly accelerated a series of scientific and technological revolutions. Economic development, low -interest environment, and technological innovation have brought prosperity to the United States. At the same time, negative pressure on the decline in demand after the war, from 1923 to 1929, it is called the prosperity of the Corolizhi in the history of economic history. The US stock price rose five times from 1924 to 1929, and within 1929, 265 new investment trust companies were added. Industrial output value accounts for 42%of the world's, but at the same time, it can be seen in the state of near -saturation.

However, when the innovation dividend has disappeared, there must be excess capacity, but the low -interest environment continues, and its liabilities are naturally promoted. In addition, the market atmosphere promotes financial leverage, which will inevitably induce bubbles. However, because of the continuous flow of French and British gold, the 1927 Federal Reserve has further lowered interest rates from 4%to 3.5%, and the bubble was pushed to peak. It was not until 1928 that the Fed started to enter the interest rate hike cycle.

From 1919 to 1930

Introduction to British Financial Advanced Tips: Cobe's prosperity is exactly the same as today's Science Network bubble. It also believes that new technology can replace the old economy, and it also believes that the stock price is only recovered and recovered. But in fact, the real economy is dominated by supply and demand, and the market is just overdrawn in the future in exchange for a brief excitement. The Federal Reserve ’s interest rate hike cycle trigger the Great Depression Crisis

As the borrowing market has turned on the red light, in 1928, the Fed began to tighten monetary policy. From February to July, interest rates increased from 1.5%to 5%. Selling instead of cracking down on the economy. In August 1929, the Federal Reserve pushed the interest rate again to 6%. Because holding cash was higher than holding stocks, funds flowed out of the stock market, and the US stock market began to collapse on Thursday, October 24, also known as Black Thursday, but due to a large number of investors entering the market at that time, the stock market returned to the crisis of funding chain and confidence, and it even triggered a spiral spiral on October 29. In November, the US stocks fell more than 50%from the high level, causing banks to fail continuously.

In the early days of Great Depression, because the government injected capital for the market, there was a longing for a stir -up in early 1930, but in mid -1930, the problem of overcapacity and high debt deepened the economy, further cracking down on the economy, and the stock market's upside caused investors to lose money. Treatment of credit crisis and bankruptcy in a large number of banks. At that time, the Fed Chairman just changed his office and trustd liberal economicism at the same time as the new President Hoover. Without betting on the bank's capital, the Federal Reserve made a mistake in governance, the economic recession accelerated, and caused a shrinking spiral. 80%. In the end, 4305 banks closed down, exceeding half of banks in the United States. Due to the collapse of the banking industry, the survivors tightened the borrowing, and the market flow funds were insufficient, which caused the company to fail.

Advanced Financial Finance: It is a often mistake that investors often make because the stock price falls sharply. The price of the past cannot be used as a reference for future price. The investment market will always look at the needs of the future environment. Find out the opportunity, not because of the past price phenomenon. In the past, a large amount of assets were once brilliant, but once they fell into the cold current, they did not see it.

Wrong tariffs and trade war

The Dow began to fall from the level of approaching 400 in 1929. It fell to 50 lows in 1932. The United States had more than 13 million people unemployed, and the unemployment rate was as high as 25%. In order to support the US economy, the US Parliament formulated the "Smtkhole Tariff Act" in 1930 to levy heavy taxes on imported goods, intending to restrict imported products, and maintain the domestic market. However, the high import tax has caused prices to rise, the pressure of inflation in the United States has increased, and exports are also pressured. It can be seen that the current situation in the United States is repeated.

The failure of the customs policy has caused the third wave of financial collapse. Under the pressure of extrusion, the bank was transferred from overseas to funds from overseas to make overseas funds in disguise to crack down on the global economy and trigger a global economic recession. Britain and France cannot be spared. In order to stimulate the economic recovery, the United Kingdom has once again lifted its golden position. The country also depreciates currency to try to promote export trade, which has caused international trade stagnation.

Advanced Financial Finance: Countries around the world are also dragged down by the Federal Reserve policy. One of the reasons is that the US low -interest funds have flowed out of the United States at the time, and the Federal Reserve raised interest rates into global funding. The situation is the same today. Under the interest rate hike cycle of the Federal Reserve, the external flow pressure of emerging market funds increased. In the 1990s, the outbreak of the Asian financial turmoil was related to the US interest rate hike cycle.

Great Depression triggered World War II

The hard landing caused by the Fed's interest rate hike caused the global economic crisis. Global industrial production fell more than 44%and trade declined by 65%. In order to maintain its own colonial empire economy, Britain signed the Ottawa Agreement with British colonial countries with low tariff trade channels, but adopted up to 200%tariff policy for African allies. After that, France also took the same means. Britain, France, and the United States and other large powers all showed the banner of "priority with the country", so that the resources and strengths at that time were relatively weak. In the face of further economic pressure, the pressure of industrial countries, Germany, Japan, and Italy, which the national strength just rose.

Germany, Japan and Italy were ranked out of the door of the trade circle at the time, but they were also imported countries of major commodities. The domestic commodity resources were insufficient and needed to rely on imported goods resources to develop the economy. Essence Coupled with the new hatred and cultural differences of European century -long war, Germany faced harsh fines after the World War Ion, and was bullied by Britain and France, and the grievances gradually promoted Germany to launch a new round of war.

Due to economic dilemma, the Workers' Party Hitler provided the German regime successfully, and promoted Nazism with the premise of expanding the economy to recover the economy. Starting from the United Russia, Poland has gradually borrowed World War II to snatch important economic resources. Regardless of Germany, Japan and Italy, the strategic purpose of the early World War II was to fight for resources first to develop its own economic system.

Advanced Financial Finance: In 1930, the Federal Reserve ’s policy failed, which became an excuse for the Federal Reserve’ s active quantitative easing today. Under the economic crisis, it has become a conventional measure to adopt large and unable to invert and maintain financial institutions. However, it is noted that the amount of width is only the problem of delay, and the operating practice also causes moral risks. The Federal Reserve will only cause a new round of market crisis. World War I and World War I was a topic full of storytelling, and many people have talked about it. Therefore, when writing in this article, try to choose the selection of more people ignored, centered on economic and major political games, and the Global Economic Change after World War II, how the United States becomes overlord through World War II, and stays in a new article. Share with you.

Gold and silver's value preservation capacity has received long historical support. Therefore, whenever the financial market has a crisis or unstable geopolitical situation, the recognition of the local currency or capital market will have the opportunity to decline, and the decline in currency purchasing power will have a chance to trigger inflation and inflation and inflation and inflation and inflation and inflation and the decline in currency. In order to fight inflation, investors will sell local currency or assets in order to fight inflation. Instead, they will hold gold and silver. With the support of risk aversion, anti -inflation, and investment and speculation, gold and silver prices will be further supported. The influence of the central bank cannot be ignored. This is why investing in gold and silver needs to pay attention to changes in the central bank's policy.

British financial trainer Wayne Lai shared: Most of the market crisis did not happen overnight. Even if the trend of the situation and the gold price was good, it may be very dangerous in most of the time before the market broke out. Therefore, investors need to recognize the environment, seize cyclical investment opportunities, and avoid falling into the trap of falling into the economic crisis.

About the Author

Li Yongda

Hong Kong senior financial practitioners, who have served well -known financial public relations, financial media and investment banks. In the past, service objects include Societe General, CMC Market, KVB Kunlun, etc. At the same time, it is a college guest lecturer, financial media regular guests, and financial books. He has repeatedly represented Hong Kong to attend the World Financial Industry Forum. He is currently the research and market director of British Financial Group and British Financial.

The author is taken in the US Federal Reserve in Washington, USA

Disclaimer: The content of this article is for reference only, and does not constitute an offer, suggestion or promoting anyone to submit or subscribe for any securities. Structural products can rise or fall sharply, and investors may suffer a full loss. Past performance does not reflect future performance. Before investing, investors should understand risks and consult professional consultants and consult relevant listing documents. Any content in this article does not constitute investment, law, accounting or tax opinions, and there is no statement that any investment or strategy is suitable or in line with individual situations.

- END -

The husband and wife shop, the economy that cannot be shaken by capital!

In April of this year, the situation of the Shanghai epidemic prevention and contr...

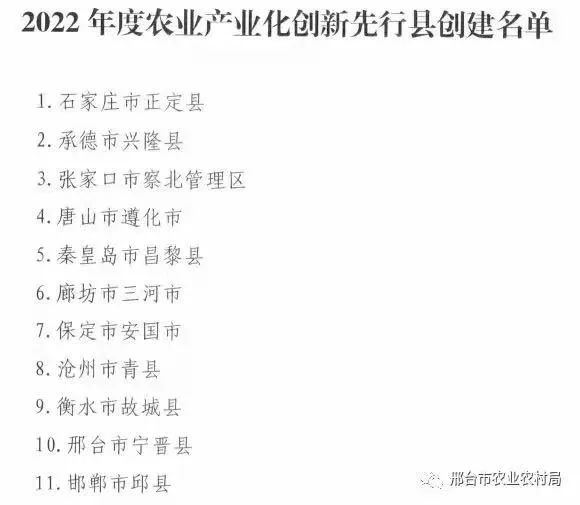

The province's pioneer county!The Ningjin County list is famous!

Recently, the Office of the Hebei Provincial Agricultural Industrialization Work L...