"Four Character Top Stream" cannot save Company No. 9

Author:Financial and economic Time:2022.07.14

Text | Mountain Walnut

This is an important investment conference, but Lei Jun was late for 5 minutes.

When the time returned to September 2014, the founder of a startup was playing a new publicity video of the company. A intelligent short -distance travel product appears in the camera: two wheels, one pedal, and people can stand freely forward and lean forward.

The meeting was related to the subsequent fate of the company. Although the graduated science and engineering man named Beihang, named Gao Lufeng, had previously experienced many entrepreneurship and was a person who was unconvinced, but in the face of Lei Jun, he was still a little nervous. The promotional video was put on for 5 minutes, and before the end, Lei Jun stopped.

"I hope this is a consumer -level product," Lei Jun said. In the following time, Lei Jun and Gao Lufeng were finalized. The startup named NineBot became one of the earliest members of Xiaomi Ecological Chain.

Just one year later, this company became a classic case of "fighting with small fighting" in business textbooks: mergers and acquisitions of the originator of the originator of the car, and listed on the bell on the Science and Technology Board in 2020. Now its business is not only a balanced balance The car, as well as scooter, two -wheeled electric vehicles and service robots.

Just a few days ago, "Top Stream" Yi Yang Qianxi became the global brand spokesperson of this company. The spokesperson had previously been supported by Chinese technology -based enterprises, such as Pcked Rice and Huawei.

Unfortunately, compared with the official announcement of more than 100,000 fan comments, the No. 9 company (689009.SH) on the secondary market did not set off many waves. In the past few months, Shen Nanpeng and Lei Jun have reduced their holdings of nearly 6.5 % of the shares of Company No. 9, cash out of 2.38 billion yuan.

Picture source: Yiyang Qianxi Weibo Screenshot

As of July 14, 2022, the market value of Company No. 9 was 34 billion yuan, and the market value of the market value dropped by nearly 60 %.

Toply, this year happened to be the tenth year of this company. In China, which is only 2.5 years in startups, ten years of ten years, for a company, it means a new stage, just like Lei Jun shouted "one without ahead" and "re -entrepreneurship" in Xiaomi's tenth anniversary.

Standing at the key intersection of ten years, in addition to acquiring Siegee and the governor of the official announcement, No. 9 also needs a new story.

The growth rate slows down, No. 9 bid farewell to "student days"

No. 9 is saying goodbye to his former high growth era. Within two consecutive quarters, key financial indicators such as revenue and net profit are weak.

At the end of revenue, the revenue in the fourth quarter of 2021 was 1.944 billion yuan, a decrease of 21.74%month -on -month; the revenue in the first quarter of 2022 was 1.917 billion yuan, a decrease of 1.39%month -on -month.

In the net profit end, the fourth quarter of 2021 was 22.3091 million yuan, and the previous quarter was 134 million yuan, a decrease of 83.35%from the previous quarter; by the first quarter of 2022, it was 38.4466 million yuan.

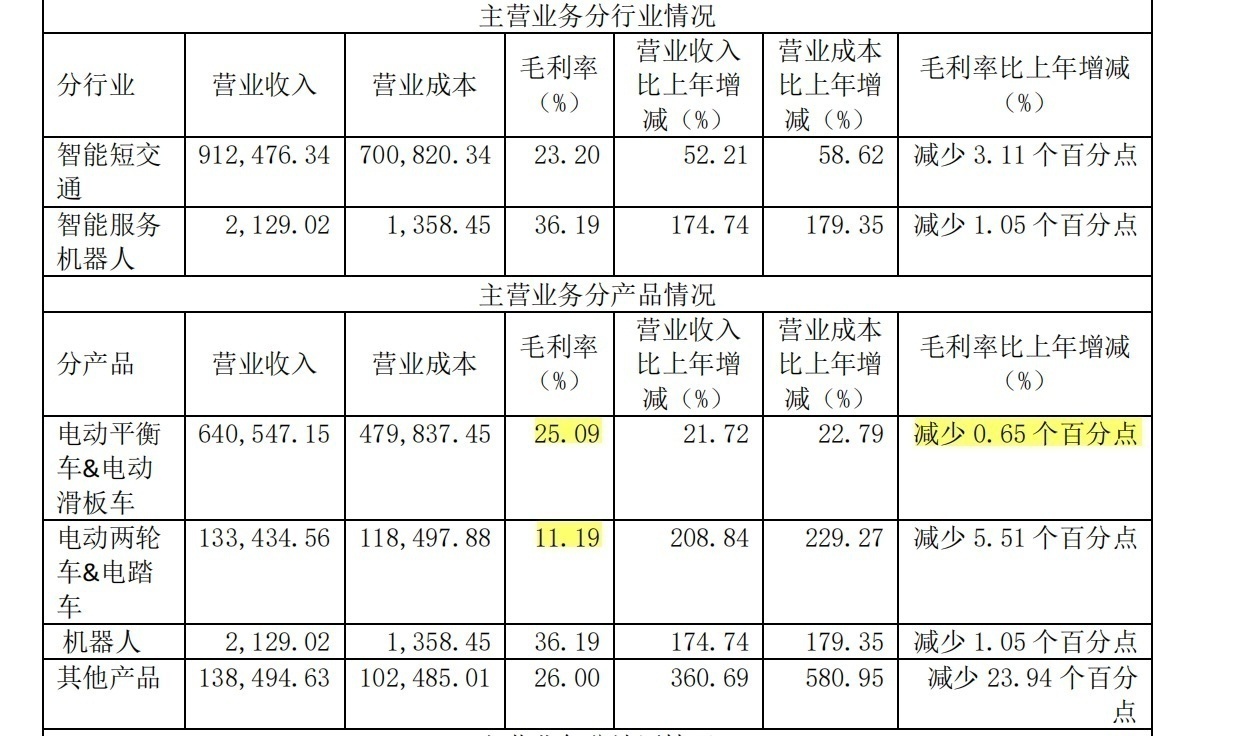

At the same time, the products are divided into four major businesses, including electric balance cars and scooters, electric two -wheels and electric cars, robots, other products (all -terrain cars, etc.).

Photo source: No. 9 Company Financial Report

The reason for weak growth is not difficult to understand.

On the one hand, product structure from No. 9. From the perspective of the business structure, the No. 9 balanced car and scooter are the main revenue, accounting for over 70 %, but due to the main sales channels of balanced cars and skateboarding cars overseas, affected by uncertainties such as epidemic conditions, the cost of the supply chain side is the cost of the supply chain side. rapidly increase.

At the same time, the new business expansion, including the two -wheeled vehicle business, is still in the early stage, and has limited contribution to income. Since entering the two -wheeled track in 2020, the proportion of this business has increased rapidly from 7.2%to 14.6%. Although it has maintained a high growth rate, it has not yet formed a "second curve" that supports enterprise growth.

Intelligent robotic business in 2021 revenue was only 21 million. Although the gross profit was high, the income accounted for relatively low, only 0.2%.

Starting from a balanced car and scooter, although the 9th in recent years has gradually expanded its product matrix and got rid of the single -class product structure dependence, at present, because the second and third curves are still in the early stage of development, the 9th in the short term Growth still depends on the basic disk composed of a balanced car and scooter.

On the other hand, it is the change of channels, which is derived from the cost bearing brought by the No. 9 "de -Xiaomiization".

In terms of channels, the 9th sales model is mainly divided into distribution (Xiaomi custom+independent brand) and direct operation. In the early days of the development of No. 9, with the help of Xiaomi's C -terminal traffic and supply chain advantages, sales breakthroughs were quickly achieved. However, due to Xiaomi's "cost -effective" restrictions, the distribution of gross profit is low, and the overall gross profit margin level is dragged down.

Picture source: China Merchants Securities

In recent years, the proportion of Xiaomi distribution channels has declined year by year. From 2017 to 2021, Xiaomi's sales revenue accounted for 73.8%to 32.3%. In the first quarter of 2022, Xiaomi's distribution revenue decreased by 62%year -on -year.

At the latest performance briefing, the management of No. 9 also clearly stated: "The decline in Xiaomi's procurement is also good for the company's profits, because the net profit of Xiaomi channel is not high."

"Deepening Xiaomi" means that No. 9 needs to gradually build its own supply chain channels, and it will bear greater pressure on the cost side.

From the first star founding of the stars to the listed company that has been established for ten years today, bid farewell to the No. 9 of "Student Generation", it is necessary to have more imaginative development space.

The "Apple Model" is not the optimal solution

In the above -mentioned track, two rounds of electric vehicles are undoubtedly one of the key points of betting on No. 9. In this regard, if you understand the development of the two -wheeled electric vehicle on the 9th, the ambition of the post -hair sender will almost reveal.

At a new product launch conference at the end of 2019, Wang Ye, CEO No. 9, took out a number of Mavericks electric products for the benchmark. Hu Yilin, the founder of Niu Electric Technology, publicly asked the No. 9 new car on Weibo on Weibo. Plagiarism, this unpleasant episode that happened between the two geeks was buried in the next two rounds of electric vehicle rivers and lakes.

Some media commented: "They (No. 9) go from head to toe to the Mavericks."

Two -wheeled electric vehicles are typical Chinese innovations. According to the division of brokerage researchers, the development of two-wheeled electric vehicles in China is mainly divided into three major stages, namely from 1995 to 2004, the low-speed growth period during the market cultivation stage; from 2004 to 2013, the "banning order" was guided by the guidance The reckless growth period; from 2013, the "new national standard" exist in the landing.

In other words, since the 1990s came out of the Tsinghua Lab, from the early scale to the price war, under the guidance of the "new national standard", the demand for the market stock of the domestic two -wheeled electric vehicle is greater than the incremental expansion expansion Essence

This also brings opportunities to No. 9.

On the one hand, the "new national standard" optimizes the supply side of two wheel electric vehicles. With the development of intelligent technology, the two -wheeled electric vehicle gradually moves towards intelligence.

On the other hand, end users' attention to the experience of the two -wheeled electric vehicles also allows brands to have more space for product innovation.

At present, No. 9 wants to rely on creating a "human -car -road -cloud" ecosystem to impress consumers. Simply put, it is integrated hard and hard. Like Apple, it can make money by selling hardware, but also relying on software's value -added services to obtain regular income.

Photo source: No. 9 Company official website

But this may be a distant dream.

First of all, although intelligentization is the trend, the ninth is not born. After the early scale and price war, the first -mover advantage of the two -wheeled electric vehicle head enterprises has gradually transformed into a brand advantage.

From the perspective of price bands and product positioning, the 9th positioning is mid -to -high -end. In the mid -to -high -end market, it will face the competition with the old -fashioned electric vehicles such as Yadi, but under the years of "higher -end" market education, Yadi has accounted for 24%in 2020.

On the other hand, on the intelligent track, the Mavericks, as the earliest entry, are very popular between the two of them, and there is a certain degree of overlap in the brand positioning.

Secondly, the "apple" of the two -wheeled electric vehicles may be just a pseudo -demand.

On the one hand, two -wheeled electric vehicles are not an ideal hardware entrance. They are still a short -distance tool. The tool attributes are greater than the experience attributes. It means that No. 9 must become a service giant like Apple in technology, supply chain, and after -sales service. In the short term, it is difficult for this company that rely on a balanced car.

After all, compared to the balanced vehicle of two wheels and one pedal, two -wheeled electric vehicles, as typical Chinese -style innovations, from birth to development, not only a manufacturing -driven industry, but also a service -driven industry. It is also a one. Channel -driven industry.

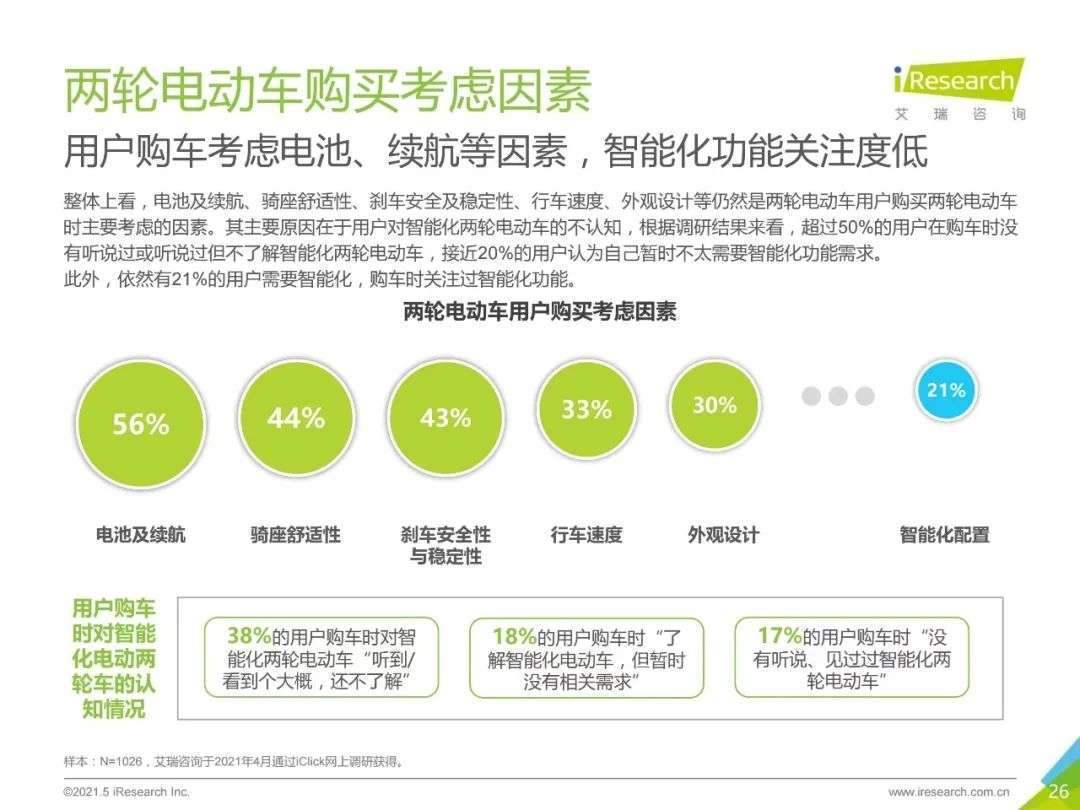

On the other hand, from the perspective of consumption, users' demand for two wheel electric vehicles is still concentrated on battery life and batteries. A survey report from Iri Consulting shows that the main factors for the purchase of car owners in China in 2021 are still batteries and battery life, quality and power performance, and the factor of attention to intelligent functions is only fourth.

Photo source: iResearch

This means that for the intelligence of the two -wheeled electric vehicles, companies, including No. 9, still need to complete market education together, and they still need to return to the original point -offline channels to realize this process.

And offline channels are the pain points of No. 9. As of the end of 2021, the number of two -wheeled shops on the 9th round of the 9th round of the two -wheelers was about 1,700, and the number of Mavericks offline stores exceeded 3,000, while the number of terminal stores such as Yadi and Emma had already exceeded 10,000.

Wang Ye used a sentence to describe the model of the ninth round of electric vehicles: "Users define products, software define hardware." From the current market structure, in this more intense Red Sea, No. 9 is still very long. One way to go.

Get the valuation premium, just like to span the two gaps

On October 29, 2020, an unprecedented scene appeared at the listing ceremony of the Shanghai Stock Exchange:

A delivery robot slowly entered and became a bell who was about to land on the capital. After the crispy gongs, the stock price of the company rose 70%, and the market value of the first day of listing reached 33.696 billion yuan.

This creative company is No. 9.

"Congratulations to the successful listing of the No. 9 company on the science and technology board." As a part of the Xiaomi ecological chain, the day of the launch of No. 9, Lei Jun also expressed his difficult excitement in social media. Nearly 80 billion yuan.

But the good times are not long. In the past few months, Shen Nanpeng and Lei Jun have reduced their holdings of nearly 6.5 % of the shares of companies No. 9, with a total of 2.38 billion yuan.

As of July 14, 2022, the market value of Company No. 9 was 34 billion yuan, and the market value of the market value dropped by nearly 60 %.

Since the 9th company has established a brand advantage in the traditional business part of balanced cars and scooters, with the help of mergers and acquisitions of Saigeway and the development of its own brand, the growth rate of income and profit has stabilized; while two -wheeled vehicles and intelligent service robots are growth. Sexual tracks are currently in the early stages of development. Therefore, the valuation method of broker No. 9 Company No. 9 is generally adopted. According to the calculation of Tianfeng Securities, the reasonable market value of No. 9 Company was 57.5 billion yuan, of which 35 times the PE was given to the traditional business, and the market value of 2022 was 32.3 billion, and the corresponding market value of the growth business was 25.2 billion yuan.

In other words, from the current valuation level, the secondary market still regards the No. 9 company as a traditional hardware company mainly based on a balanced car and scooter manufacturing.

Therefore, a key issue arises. Is the value of the growth business of companies No. 9?

In the book "Crossing The Chasm", Jeffrey Moore proposed a "technology adopting life cycle" model. Generally speaking, users of emerging technology products can be divided into five categories: innovative, early recipients, early recipients, early popular, late Volkswagen, and lasters. Such technology companies need to cross a product from emerging to mature gaps in order to truly win the public market.

Such a gap was once in front of the No. 9 company, but No. 9 successfully crossed. The typical case was a balanced car. Being able to acquire Segeway and the successful promotion of a balanced vehicle to the country is that the uniqueness of No. 9 is that competitions know more about C -end users.

Therefore, with the help of technology research and development and the traffic and cost advantages of Xiaomi ecological chain, the ninth will have 1999 yuan, which was originally 80,000 yuan and a 55 kg balanced car. This is a typical "cost -effective victory".

Obviously, the No. 9 competition is one step closer, pushing the balanced car that was limited to politicians, businessmen and stars to the public market -those programmers wearing plaid shirts, and those white -collar workers in the grid, Those Chinese guests who are at the forefront of technology, they all like such a lightweight and only 1999 yuan balance car.

Photo source: No. 9 Company official website

However, the new question is whether the success of the ninth round of electric vehicles and intelligent service robots can re -engraved the success of the balanced vehicle again, from emerging products to the public market, and there are still two gaps before No. 9.

First of all, can you cross the channel gap on two -wheeled electric vehicles? In the actual purchase process, the offline channels of two -wheeled electric vehicles are still critical due to the actual experience, cards and after -sales service involved in the product. In 2022, the number of special camps on the 9th plan of the 9th plan reached 3500+, close to the current channel level of Mavericks.

In addition to the number of channels, according to the calculation of open source securities, compared with Mavericks and Yadi, the effect of single store No. 9 still has great room for improvement. In 2020, Mavericks' revenue was 1.2557 million yuan/home, and No. 9 was only half.

With the expansion of the channel, the upstream production capacity side has also been accelerating the expansion of production capacity in recent years. In the future, it is necessary to pay attention to the matching of production capacity and demand.

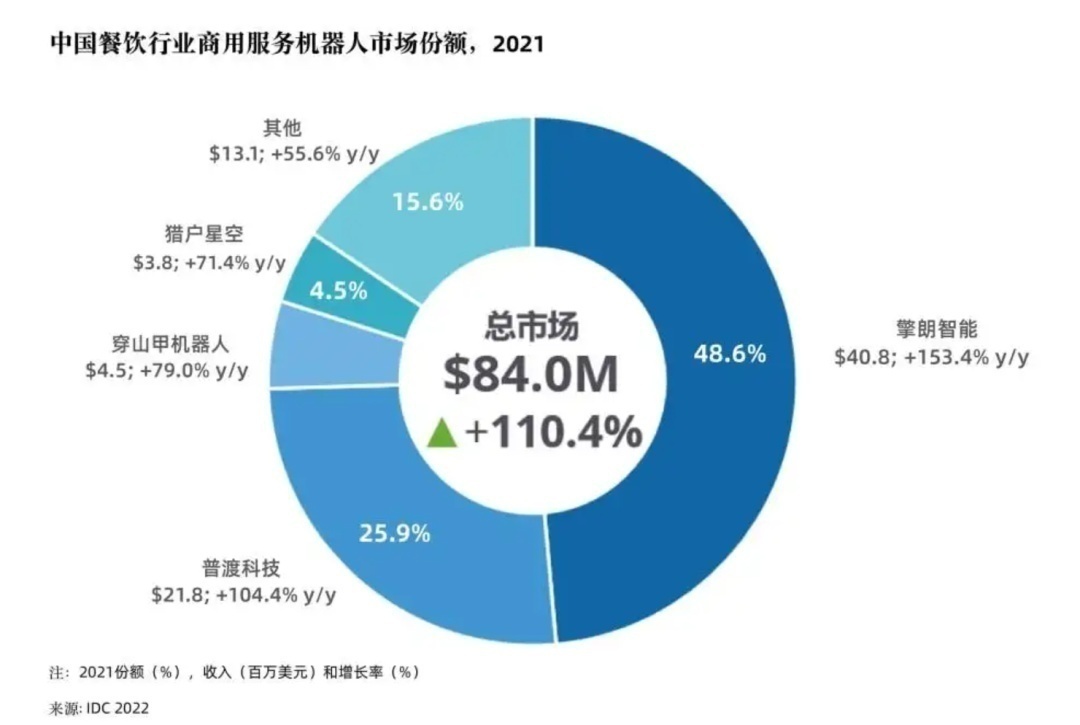

Secondly, under the cold market environment, can the ninth large -scale application gap across the B -end on intelligent service robots? At present, the application scenarios of No. 9 service robots mainly focus on commercial fields, such as hotels, catering, shopping malls and other labor -intensive industries. The main domestic competitions include Purdue Technology, Qinglang Smart, and Cloud Trace Technology.

In the vertical fields such as catering, some star companies have occupied the first advantage. Taking the catering industry as an example, according to the IDC "China Catering Industry Commercial Service Robot Market share report 2021", Qing Lang Smart ranks first with a market share of 48.6%, and the second is Purdue Technology, with a market share of 25.9 %.

Picture source: IDC

Although the prospects for commercial service robots are good, due to the cold and high cost of external financing environment, it has not yet ushered in a real large -scale profit turning point.

Not long ago, Zhang Tao, CEO of Purdue Technology, mentioned in a long email sent to all employees: "All commercial robot companies face a problem permanently, how to run the profit model as soon as possible." Zhang Tao said that commercial robots are currently commercial robots. They are in the "long winter."

In other words, although labor -intensive enterprises need to achieve cost reduction and efficiency through service robots, the general cost of automatic distribution robots is high, and the advantage of replacing artificially has not been fully released. Therefore, for No. 9, the breakthrough is whether it can make products with higher cost performance.

"Cost -effective" is of course a thing that No. 9 is good at, but the "cost -effective" business of the previous No. 9 is mostly around the C end. Therefore, whether the 9th can empower the cost -effective advantage of the TOC to the TOB service robot, it needs to be on the entire article. The industrial chain has greater bargaining capabilities.

There is no doubt that starting from the small category of balanced cars, the small market is bigger, and even the merger and acquisition of overseas giants as startups. From this point of view, No. 9 is undoubtedly successful. But ten years later, it may need to consider how to tear off the labels of Saigway and Xiaomi to write their own story.

To some extent, it is doing this. But at present, whether it is two -wheeled electric vehicles or service robots, it is a track that cannot hear the sound of coins in the short term.

Today, in the office area No. 9, everything is showing its intelligence like the outside world.For example, all the doors have been modified and can even "talk" with the robot. The delivery robot can take the elevator by themselves and send things to the workshop.The ideal is always beautiful.However, from the current valuation point of view, the secondary market still treats No. 9 as a traditional hardware company that only produces balanced cars and scooters. This is an indisputable fact and a reality that No. 9 must face.

- END -

National Bureau of Statistics: Industrial production has increased from decrease to increase, and the equipment manufacturing industry has risen obviously

China Economic Net, Beijing, June 15th. According to the website of the National Bureau of Statistics, in May, the added value of industries above designated size in the country increased by 0.7%year

The Nanyang Branch has strictly reorganized the style of "lying flat cadres"

In order to further strengthen the cadre style rectification, promote party members and cadres to fight, fight tough battles, and win the style of battle. Recently, the Nanyang Branch of Agricultural