There are big tickets!The central bank was fined more than 4 million!

Author:China Fund News Time:2022.06.14

China Fund reporter Yan Ying

Strong supervision of the trust industry continues.

A few days ago, the Business Management Department of the People's Bank of China (Beijing) announced a number of administrative penalties. Among them, China Foreign Economic and Trade Trust Co., Ltd. was fined 4.071 million yuan for three violations; the general manager of the operation department of the consumer finance department was also fined 55,000 yuan for illegal acts.

Recently, the ticket of trust companies has been increasing, and more than ten trust companies have been punished by regulatory companies. Beijing Trust and Wanxiang Trust have been punished by regulatory for inherent business. Companies such as Aijian Trust, Changan Trust, and Yunnan Trust were held accountable for real estate financing related issues.

Three illegal illegal was fined 4.07 million

The central bank website information shows that the punishment of foreign trade trusts mainly involves three important violations:

The first is to provide personal bad information, not to inform the information of the information in advance;

The second is to deal with the overdue of the objection;

The third is that the inspection and processing results will not be written in writing to the objection applicant.

According to the "Regulations on the Management of the Credit Industry", information providers provide personal bad information to the credit reporting agency, and the information subject should be notified in advance (except for bad information disclosed in accordance with laws and administrative regulations).

In addition, the information main body believes that the information collected, preserved, and provided by the credit reporting agency is incorrect or omitted, and it has the right to obtain objections to the credit reporting agency or information provider and require correction. The main body of the information believes that there is an error or omissions in the information, and it has the right to obtain objections to the credit reporting agency or information provider and require correction.

The credit reporting agency or information provider receives objections, and shall make objections to the relevant information in accordance with the provisions of the Credit Investment Supervision and Administration Department of the State Council. Objury.

Based on this, the Business Management Department of the People's Bank of China (Beijing) imposed a fine of 4.071 million yuan in foreign trade trusts. Zhang Mouting, then the general manager of the operation department of the Foreign Trade Trust Consumer Finance Division, was fined 55,000 yuan for the latter two illegal acts.

Regarding the punishment, foreign trade trusts told the media that the punishment was a specification of irregular operations in the company's personal credit reporting. The company has completed the rectification of related matters, optimizes the system and process, strengthen work details management, and further standardize and upgrade the management system for personal credit reporting.

The golden business is troublesome

It is not difficult to find that foreign trade trusts touch the regulatory red line this time, which is related to its personal consumer financial business.

It is reported that consumer financial trust business refers to financial products and financial services mainly based on consumer credit in order to meet the consumer groups of different customer groups in society. Specifically, consumer loans or installment services provided by trust companies and commercial banks, consumer finance companies, automobile finance companies, e -commerce platforms, installment consumer platforms and other institutions, as well as related asset securitization products.

As early as the concept of "inclusive finance", the consumer finance trust business became the main direction of trust transformation and development. Compared with other business trusts for enterprises, consumer financial trusts serve more consumers.

Among them, the consumer financial business of foreign trade trusts has always been at the forefront of the industry, and there was a title of "Affairs Trust". In the early years, foreign trade trusts had a lot of products such as "PPF Consumer Consumer Consumer Consumer Consumer Consumer Consumer Consumer Consumer Trust Program" and "Huijin" series of consumer credit trust products. In addition, foreign trade trusts have also served as a trustee management agency for ABS products such as consumer finance and other consumer finance companies.

However, in 2020, foreign trade trusts were trapped in controversy of "illegal lending" and "routine loan". At that time, the court asked foreign trade trusts to provide relevant licenses to prove that it could loans to the "unspecified object of society", and foreign trade trusts failed to provide it. Since then, the foreign trade trust issued a statement: Over the years, the company's various loan businesses, including personal loan business, are carried out under the direct supervision and guidance of the regulatory authorities. Essence

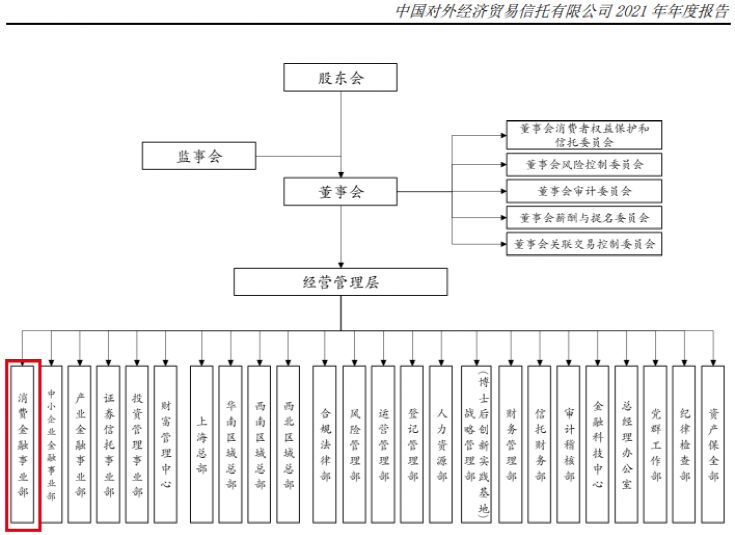

The 2021 annual report shows that the business department of foreign trade trusts includes the consumer finance division, the financial undertakings department of the SME, the industrial finance department, the securities trust division, the investment management department, and the wealth management center. However, foreign trade trusts did not disclose the situation and scale of consumer finance business in the annual report.

The management scale of last year broke trillions

Public information shows that foreign trade trusts were first established in September 1987 and were formerly known as China Foreign Economic Trade Trust Investment Co., Ltd. In 1994, the State Council approved foreign trade trusts to join Sinochem Group.

After a large increase in capital in September 2019, the registered capital of foreign trade trusts rose to 8 billion yuan, which is currently 97.26%of Sinochem Capital's shares; Sinochem's financial holding is 2.74%; the ultimate actual control of human China Sinochem Holdings Co., Ltd.

The annual report of 2021 shows that as of December 31, 2021, the total assets of foreign trade trusts (mergers) were 26.063 billion yuan. In 2021, foreign trade trusts realized operating income (merger) 2.5029 billion yuan, and the total profit (merger) was 2.407 billion yuan.

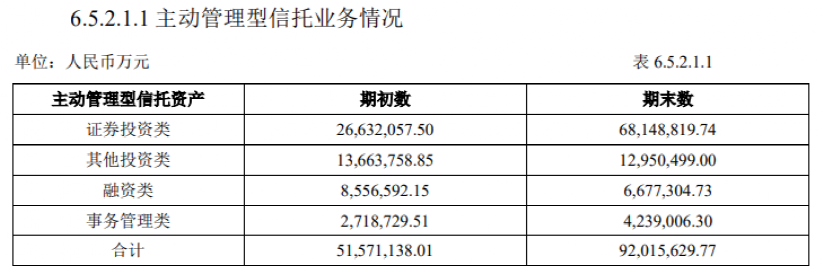

In terms of the scale of management trust assets, foreign trade trusts were 1105.14 billion yuan, an increase of 63.7%year -on -year, of which the active management scale was 920.156 billion yuan, accounting for 83.3%.

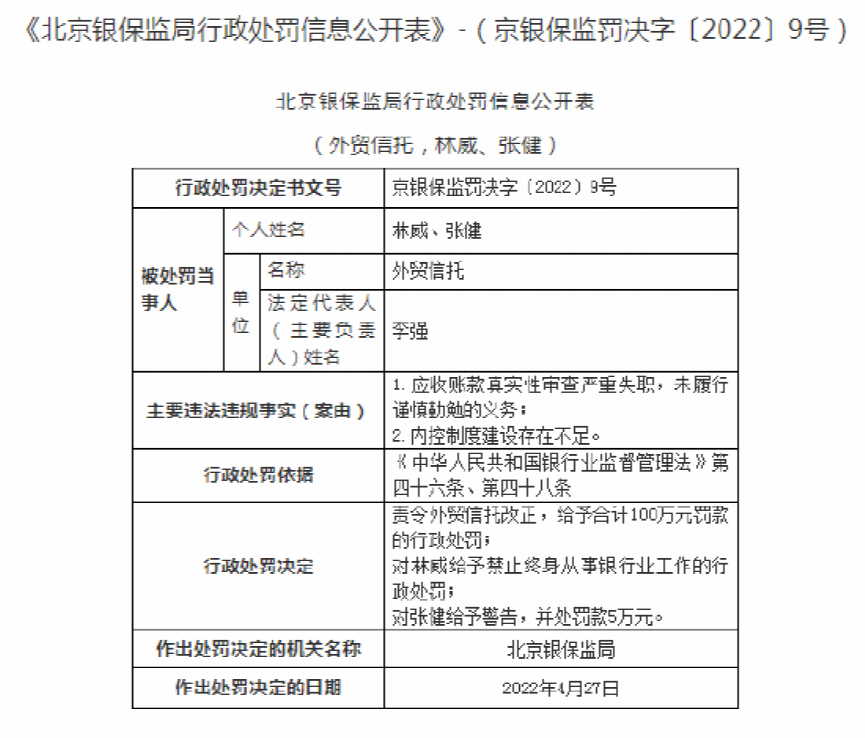

In addition to the rapid progress of the scale, at the end of April this year, the public information on administrative penalties issued by the Beijing Banking Regulatory Bureau showed that the foreign trade trust was seriously negligible for the authenticity of the account receivable and did not fulfill its cautious diligence.Order to correct and give a fine of 1 million yuan; the main person in charge was banned by the lifelong banking industry.Since the beginning of this year, strong supervision of the trust industry has continued.According to statistics, more than ten trust companies have been punished by regulatory companies, involving the company including Wanxiang Trust, Jiangsu Trust, Guotong Trust, Zhongrong Trust, Changan Trust, Shaanxi Guotou, Yunnan Trust, Jilin Trust, etc.10 million yuan.In terms of violations, including providing real estate financing and inherent business problems in violation of regulations.

Edit: Captain

- END -

China International Geographical Mark Brand Cooperation Conference was held

On June 26, the China International Geographic Brand Cooperation Conference, one of the important activities of the China Langfang International Economic and Trade Fair in 2022, was held at the Seven

Municipal Government Procurement Center for "combination boxing" to support the development of small and medium -sized enterprises

On the 22nd, the reporter learned from the Huangshi Municipal Affairs Service and the Big Data Administration that in order to give full play to the guidance function of the government procurement pol