There is not much time left for Netflix, it may add advertising like this

Author:Generous movie Time:2022.07.13

Netflix is experiencing the "dark moment" since its establishment.

This streaming giant touched the highest stock price of nearly $ 700 in November last year, "flying down three thousand feet", and fell to less than 180 US dollars in just over 6 months, with only a quarter of the peak.

△ In the past 5 years, Netflix's stock price changes

The reason is that one of the new users has touched the ceiling, and the other is that the simplicity of subscription income is not enough to support the rapid growth of profit.

In pain and pain, Netflix decided to take two important business transformation measures, hoping to reverse the current weak growth.

One is to start introducing advertising revenue, and the other is to reduce the sharing of account sharing of non -family members.

The former's income pull ability is obviously much stronger than the latter, and it is also the long -term goal of the future Netflix business model change.

In the past, Netflix was "a hole in one hole". You only need to serve the subscribers. The pure 2C business now needs to earn advertising revenue at the same time.

This is not as simple as the advertising period in the beginning and the middle, and it involves the transformation of the entire business model behind it.

How to turn?

In the streaming industry, we generally divide the video on -demand (VOD, Video on Demand) in three categories according to the income model:

SVOD (subscribing video on -demand), AVOD (advertising video on demand) and TVOD (transaction video on -demand).

△ Video on -demand (VOD) According to the different types divided by the income mode

Subscribe to the simplest business model, which is the simplest business model, which is currently adopted by Netflix.

User payment subscription fees are used to obtain the viewing permissions of streaming media. The subscription payment cycle is usually monthly or year -on -year.

Advertising-Based Video on Demand is the most attractive business model for users.

Streaming platforms insert ads into video to get income, and video content can usually be viewed for free. This is similar to the traditional TV model, which is completely dependent on the income.

The representatives are Pluto TV and free movie platform Vudu of "Drop in. Watch Free".

Trading video on-demand (TRANSACTION-BASED VIDEO On Demand) is viewed by selling a single (or in a short time) to obtain income.

Most sports events streaming media services adopt this method.

Of course, the current content on iTune and Google Play also provides such a single viewing fee.

In fact, competitive players are now operating across models, or mixed mode operations.

For example, the Apple TV+ platform itself charges subscribing fees, which belongs to SVOD; but some of the contents of them need to be paid separately, so it is also regarded as TVOD.

As for Disney+, the situation is more complicated.

Disney+ offers two types of subscription versions: advertising and advertising without advertising, spanning SVOD and AVOD modes.

For some popular movies, such as the "Mulan" released last fall, users need to pay an additional $ 29.99 to watch, which is superimposed with the TVOD model.

For Netflix, the future strategic direction must be a steering mixed mode, but how to start with AVOD in the first step. In fact, Netflix lacks four capabilities:

Ability 1 │ Advertising Sales Team

Advertising sales, like other corporate services, follow the "two -eight principles" -the 20%of large customers bring 80%of their income.

The needs of large customers are often coordinated by multi -marketing channels, and even collaborative online and offline, so Netflix's advertisement will only be a puzzle in large customer advertising solutions.

How to build a sophisticated advertising sales team and cooperate with other advertising agents to sell a seafood price to high -quality advertising positions? This is Netflix's first challenge.

Capability 2 │ Advertising Auction Platform

If NETFLIX is compared to airlines, big customers are first -class business class passengers.

The core high -quality advertising position (advertising in popular episodes) was taken away by large customers, but a large number of ordinary advertising positions still need small and medium advertisers to buy. Although the gross profit is not high, it is indispensable to fill the operating cost.

Therefore, Netflix also needs to find an advertising auction platform that is suitable for you to sell all the advertisements in real -time (auction, called RTB).

Capability 3 │ Valid audience positioning and launch strategies

"Half of the advertising costs are wasted." But if the target audience of accurate and high -quality targets can be identified, then such advertising exposure value is high.

As a streaming platform for more than ten years, Netflix has accumulated a large number of users' viewing habits, so it can design advertising content matching and launch strategies.

This part will be the core competitiveness of Netflix, and it is also the ability to rely on its own construction.

Capability 4 │ Support smart programming system for intelligence

A core difference between digital advertising and traditional advertising is that digital advertising is often generated in real time, rather than designed in advance. When you opened the NETFLIX app and clicked on a movie, Netflix learned that the viewing of "You" created an advertising position. At this time, Netflix will complete the distribution or even auction of advertising sites within a few hundred milliseconds. This is the programmatic release of advertising.

Netflix is starting to provide advertising services, and it is necessary to build or introduce a set of advertising proceeding system.

At present, who can help Netflix build these four core capabilities quickly?

There are three "advertising mages" that start to surface, and they are NBC Universal, COMCAST, and ROKU manufacturers of Internet giants, Google, and set -top boxes.

Cooperation with mature advertising agents (Media Agency), and quickly build a system for launching, monitoring and evaluation of advertisers, is the key to forming advertising service capabilities as soon as possible, and the lowest cost of cost.

Compared with the self -built team or the acquisition of mature service agencies, it is undoubtedly a solution with the least risk and the fastest delivery speed.

NBC Universal and Google are undoubtedly the best in the "old mage".

Let's talk about NBC Universal first. The company has one of the five major film factories, and has its own streaming media service Peacock. It should be said that it should be the competitors of Netflix.

However, from the time of consumption of users in 2022, PEACOCK is currently far behind Disney+ and HBO MAX, which is also the same as the five major film factories.

So the competition between NBC Universal and Netflix is far from the level of heat.

△ In the first quarter of 2022, American streaming users spent a long time comparison

The current NBC Universal video advertising service is provided by the brother company of NBC Universal, the video advertising subsidiary Freewhel.

△ FreeWheel's business

As the industry's leading video advertising service company, Freewheel covers almost all the capabilities areas needed by Netflix -of course, everyone has a direct competition, although it is not fierce.

NETFLIX is the fastest and convenient way to choose NBC Universal / Freewheel.

Another legendary partner Google, its advantages are even more prominent.

On the one hand, Google's streaming media service YouTube and Netflix competition is more indirect, and on the other hand, Google's video advertising capacity is fully verified on YouTube.

At present, the two major income giants of the world's online video advertising are Facebook and YouTube. All the video advertising revenue of all media groups are not as good as any of these two.

Coupled with the huge advantage of Google in the field of advertising and search for advertising, it has become an important part of the Google advertising industry chain, and it is also an important guarantee for Netflix to sell its high -quality advertising.

△ 2015-2024 Global Online Advertising Market Profit Source (YouTube belongs to Google Family)

But one thing needs to be reminded:

Netflix has always chosen Amazon's AWS as the main cloud platform. If the final Netflix and Google cooperation in the advertising business may promote Netflix to put the 2B business on the Google Cloud.

If this happens, Amazon will not stand by.

As for Roku, although it is not a big company in the entire video industry, it is subdivided into the field of streaming/ OTT, and its programmatic advertising accounts for nearly half of the entire market (in the first half of 2021). This is a very convincing Market share.

△ ROKU's programmatic launch advertisement accounted for 45% of the entire market in the first half of 2021

Unlike the NBC Universal and Google, the current industry is not that Netflix cooperates with Roku, but Netflix considers the acquisition of Roku.

Is it possible for Netflix to acquire Roku? My point of view is: unlikely.

Although Roku has a mature AVOD platform and has a mature advertising sales team and business, if the real acquisition, it will still make Netflix and Roku face huge challenges.

The first is that the neutrality of Roku will disappear. As one of the core competitiveness of ROKU as a small company that grows between multiple streaming platforms, Internet companies and content giants, one of the core competitiveness of Roku is the neutrality of the platform.

If Roku is acquired by any streaming media or content giant of Netflix, its commercial value will be greatly reduced. This is the key to why Roku keeps survival and development independently. Followed by Netflix's own acquisition ability. Although Roku is not a large company, its market value is also $ 12.7 billion, which is nearly one -sixth of Netflix's market value. Netflix is now only less than $ 6 billion in cash, and it must be acquired -it is difficult.

Moreover, now Netflix's stock price has fallen all the way, and user development has stagnated. It is definitely not a good time to acquire Roku.

The third is Roku's hardware business. Everyone knows that Roku's set -top box / smart TV stick market share accounted for the first in the North American market, and 14%of the income came from hardware sales. This is the foundation of Roku's business operation and it is impossible to get rid of it.

But Netflix, as a pure Internet company, does not want to get involved in hardware research and development and sales. So this is also an important reason why I think Netflix will not consider acquiring Roku.

Netflix has been deliberately avoiding major acquisitions in the past development, and now it seems to have always tended to maintain this approach. The company's CEO TED Sarandos has recently denied that the market's guess on Netflix's acquisition of Roku in the market.

In fact, the acquisition is both time -consuming and expensive, and also faces the challenge of business integration. Especially for Netflix, which must be used to keep the content continuously updated, acquisition is a completely short -term option.

But it is undeniable that Roku is now increasingly handy in the field of streaming media advertising. Inserting advertisements from menu to content, this is also the ability that Netflix needs to be replenished as soon as possible.

△ Roku's ads insertion

Although Roku seems to be a "pitch" to solve Netflix's challenge, it is probably troublesome to really eat it.

Just like what I said earlier: Netflix is a pure consumer service company, just like Apple. Enterprises from organizational structures to business processes are all 2C decentralized services. They are inherently no ability to provide corporate services.

Although the acquisition seems to be a shortcut, Netflix really wants to form its own 2B business capabilities, and the shortcut shortcut will only bring greater risks.

In the face of reborn change, there is no fast solution to choose from. NETFLIX may take a long period of exploration to truly become a media giant spanning 2c and 2B.

But there is not much time left for Netflix.

On the one hand, the global economy is exhausted after saying goodbye to low interest rates and currency over issuance. Both the United States and Europe are likely to enter a state of recession;

On the other hand, the return of the real economy has slowed down the digital industry running.

According to predictions provided by US media, Internet advertising giants such as Google, Facebook and Amazon will decline significantly from the previous quarter of advertising revenue in the second quarter of 2022.

As a Netflix actively preparing to enter the Internet advertising business, it is likely to break into a market that gradually starts to cool down.

△ 2022 network advertising revenue composition, in the second quarter

Finally, Netflix's own user base contraction will also bring greater difficulties to the transformation.

Last Wednesday (July 6) Kannan Venkateshwar, an analyst at Barclays Bank, predicts that the number of users of Netflix in the second quarter may be lower than the first quarter forecast.

Previously, the company's expectation of the number of users in the second quarter would decrease by 2 million. The number of analysts of the Barclays Bank predicted that the number of users was 2.8 million. He also specifically pointed out that the company's number of users in North America continued to decline -the value of this part of the user is particularly high. Essence According to the statistics of Barclays Bank, the average daily user growth in North America will grow in May.

The house leaks all over the rain. Now Netflix can only be found as soon as possible "advertising old mage" and build its own advertising inventory management and distribution team as soon as possible, can the advertising subscription version go online as soon as possible and complete the rapid construction of 2B capabilities.

If you ca n’t hurry up, when the economy really enters the recession in the fourth quarter, the market environment will become more difficult, and there is really no time to leave Netflix.

-End-

Special author@夫 夫

For more than 20 years of experience in IT and high -tech industries, I have worked in science and technology companies such as Essen, Oracle, Microsoft, etc., and deeply cultivate communication, media, Internet and e -commerce fields.

- END -

Huitai Medical plans to acquire 37.33%equity of Shanghai Hongtong

Titanium Media APP June 14th news, Shenzhen Huitai Medical Device Co., Ltd. announ...

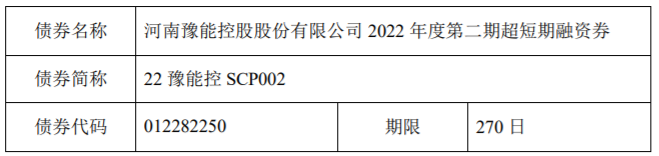

Yuneng controls 500 million yuan super short -term integration to complete the issuance, with a interest rate of 2.7 %

[Dahecai Cube News] On June 27, Henan Yuneng Holdings Co., Ltd. disclosed the resu...