The euro, it fell to this ...

Author:Global Times Time:2022.07.12

Luzi

The euro fell again! On the 12th, the exchange rate of the euro fell to 1: 1. This can be said to be a time to witness history. For 20 years, the exchange rate between the euro and the US dollar is almost the same for the first time. What caused the euro as the world's second largest currency to be so weak?

According to CNN statistics, since the beginning of this year, the euro has fallen 12%against the US dollar. It is reported that the European continent is full of concerns about economic recession, and "Russia's invasion of Ukraine's high inflation and uncertainty of energy supply have intensified this concern."

Russia and Ukraine may have an impact, but did Europe follow the policies adopted by the United States without impact?

The euro was officially born in 1999. On January 1 of that year, the euro was officially launched in 11 EU member states, marking the birth of the euro. From the following "New York Times", the exchange rate chart can be seen that only from 2000 to 2002, the euro exchange rate to the US exchange rate was below 1, and the euro exchange rate rose all the way. 1.6 dollars. However, since then, the euro exchange rate has continued to decline, and now it has come to nearly 1: 1.

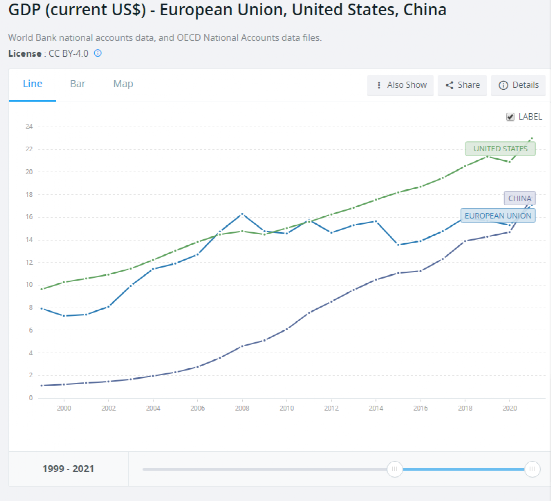

Consistent with the trend of the euro exchange rate, the proportion of the EU economy in the world is also down. The chart of the World Bank website shows that the total EU economy in 2008 was US $ 16.3 trillion, surpassing US $ 14.77 trillion. However, by 2021, the EU's total economy was US $ 1.709 trillion, and it rarely increased. Not only was it exceeded China ($ 17.73 trillion), but also the United States (US $ 23 trillion) opened a lot.

Right now, public opinion is generally pessimistic about the European economy, which means that the euro may decline further. The New York Times said in the report that the European economy is facing high inflation, labor market and energy market turmoil. "Europe is the weakest part of the global economy." Merrillin and Bank of America's private bank market strategy director Joe Quinlan said, "They are the focus of war and energy crisis."

The report also said that in Europe, the turbulence of the energy industry and the Ukrainian war brought tremendous pressure on the region. Germany announced its first monthly trade deficit since 1991. The tension of supply chain is expected to lead to a slowdown in the growth of the largest economy of the euro area that depends on exports, and may even lead to economic recession.

Whether it is the Russian -Ukraine conflict or the energy crisis, Europe's own policies are difficult to get rid of the department. Especially in the absence of energy, Europe also impose sanctions on the Russian energy industry, which can only further exacerbate the crisis.

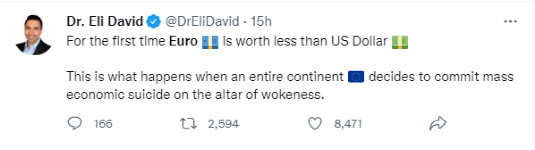

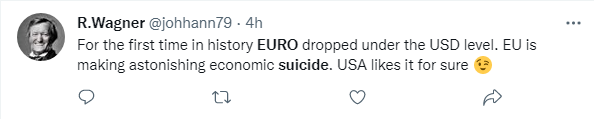

The "historical moment" of the euro is not a wonderful "historical moment" also caused warm discussions on social media. Many people described the European Union on "economic suicide" and said that "the United States will definitely like it."

There are also people posted the following picture. The people representing the EU in the picture shot and killed the people representing the euro, and then asked, "Why do Putin do this?"

- END -

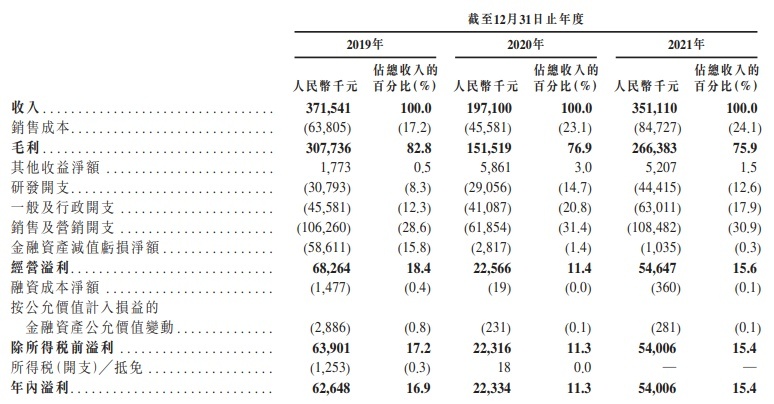

Most of the income from a small number of large customers from the Hong Kong Stock Exchange

On June 30, Capital State learned that Qianghua School of Technology Co., Ltd. was...

Steady growth insurance supply!The "cluster operation" of the Plateau Railway for China Railway Industry Tunnel!

In the past few days, the country has introduced a policy of stabilizing the econo...