Online information securities have been faked for 6 consecutive years, and they have been fined 430,000 yuan

Author:Red Star News Time:2022.07.12

According to the Red Star Capital Bureau, recently, the China Securities Regulatory Commission announced the administrative penalty decision of the six responsible subjects of the Internet information securities and Liu Ping. The decision shows that online information securities have been falsified for 6 consecutive years, and the total profit increases in total exceed 5.1 billion.

Specifically, from 2012 to 2017, when the Internet Credit Securities ended the purchase of bonds to sell bonds, the financial assets they sold, and did not confirm the corresponding financial obligations for their repurchase obligations. Liabilities have not accounted for profit or loss at the end of the year.

The above behavior caused the company's annual report from the 2012 to 2017 annual report to the Securities Regulatory Supervision's financial statements, financial liabilities, fair value changes, profit or loss, financial expenses, investment income, and total amount of profit. 10,000 yuan, the total profit increase in 2013 was 347 million yuan, the total amount of profits decreased in 2014 was 256 million yuan, the total profit reduction in 2015 was 359 million yuan, the total profit increase in 2016 was 2.26 billion yuan. 100 million yuan.

In response, the China Securities Regulatory Commission decided to warn online information securities and imposed a fine of 300,000 yuan. At the same time, 5 people including then chairman Liu Ping and then general manager Wang Yan were warned, and 20,000 were separated by five. Fines ranging from 30,000 yuan. The six responsible subjects were fined 430,000 yuan.

The Red Star Capital Bureau noticed that in March this year, the listed company Guide Point (300803.SZ) announced the draft plan for reorganization of online information securities. Calculate and obtain 100%equity of post -online information securities. In April this year, the CSRC approved the compass as the qualifications of the main shareholders of the Internet Securities. Recently, Internet Securities is applying for industrial and commercial changes.

Earlier, the operation of the Internet Securities faced a serious problem of incompetence and debt, and was once considered to be "sick."

Prior to 2018, the Internet Securities faced bankruptcy due to the sharp loss and severe funding of some businesses, and faced bankruptcy. In May 2019, the Internet Securities was taken over by the Liaoning Securities Regulatory Bureau. In July 2021, Internet Securities embarked on the road of bankruptcy and reorganization.

In 2021, Internet information securities lost 508 million yuan, total assets were 867 million yuan, total liabilities were 50 billion yuan, and cumulative losses were 4.717 billion yuan. Online information securities only operate normally, and other businesses have basically suspended.

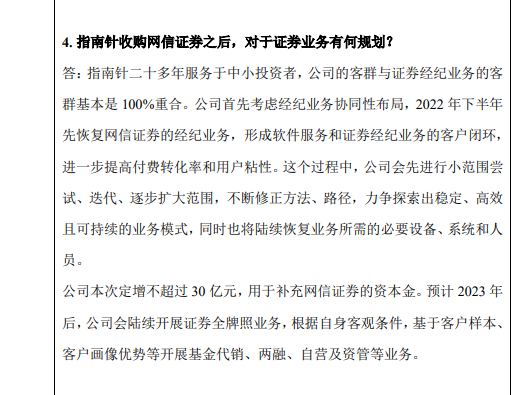

After taking over, the compass stated in early July this year that this fixed increase does not exceed 3 billion yuan, which is used to supplement the capital of online information securities. It is estimated that after 2023, the company will carry out a full -scale securities license business. According to its own objective conditions, it will carry out fund sales, two -financing, self -employment and asset management business based on customer samples and customer portrait advantages.

Screenshot of the compass announcement

Red Star News reporter Yu Yao Xie Yutong

Edit Yang Cheng

- END -

Agricultural issuance of Longnan Branch to carry out the "Popularization of Financial Knowledge Keeping 'Capsule Bags'" propaganda monthly activity

Agricultural issuance of Longnan Branch to carry out the Popularization of Financial Knowledge Keeping 'Capsule Bags' propaganda monthly activityIn order to continue to promote the popularization of...

Jiangsu uses the "four most stringent" standard regulatory collection of drugs to guard the safety bottom line of the people for medication

The purchasing volume procurement of drugs has attracted much attention. The repor...