After nine daily limit, three limit!Songzhi Co., Ltd. Directors and affiliated personnel cash more than 18 million a day?

Author:Investment Times Time:2022.07.08

In the first quarter of this year, Songzhi Co., Ltd. achieved operating income of 883 million yuan, a decrease of 6.19%year -on -year, and the net profit attributable to the mother was 200 million yuan, a decrease of 31.91%year -on -year.

"Investment Times" researcher Zhuoma

Affected by multiple factors, since this year, new energy vehicles related areas have been hot. Whether it is the production of vehicles, parts or batteries, it has gained the favor of capital to varying degrees. The strong pull.

Recently, Shanghai Geli Songzhi Automotive Air Conditioning Co., Ltd. (hereinafter referred to as Songzhi, 002454.SZ), which has no obvious good news, has caused market attention due to the 9 -game consecutive consecutive decline after 9 consecutive boards. In just a dozen trading days Go out a wave of roller coaster.

Wind data shows that the stock price of Songzhi has risen violently from June 17, and closed on June 29. It successfully walked out of 9 consecutive boards and closed at 14.55 yuan/share. Rising 135.06%. However, from June 30th to July 4th, the company's stock price increased another momentum, eating three limits, and the stock price fell 27.08%during the period.

As of the closing of July 7th, Songzhi has closed at 10.10 yuan/share, with a total market value of 6.349 billion yuan.

Songzhi Shares' stock price trend since 2020 (yuan)

Data source: wind

Over 18 million yuan per day

Faced with the rise in stock prices, Songzhi shares issued the announcement of stock transactions on June 21, 26, and 29, respectively. In terms of the company's controlling shareholder and actual controller, there is no behavior of buying and selling the company's stock during the stock change.

It is worth noting that there is also a reduction plan at the same time as the announcement of the stock price on June 29.

In the announcement, Songzhi stated that the company's vice president, secretary of the board of directors, and chief financial officer Chen Rui and the chairman of the board of supervisors Xie Hao, holding 1693,35 million shares (0.0269%of the company's total share capital) and 128,300 shares (accounting for the company's total share capital 0.0204%), due to personal funding needs, the total reduction of a total of not more than 7,300 shares through centralized bidding transactions in the next 6 months, that is, not exceeding 0.0118%of the company's total share capital. Among them, Chen Rui intends to reduce its holdings of no more than 42,300 shares, and Xie Hao plans to reduce its holdings not more than 320,000 shares.

Just one hour after the above -mentioned announcement announcement was released, the two listed companies of the Shenzhen Stock Exchange Managed the second department, that is, the letter of attention issued 4 questions contained 4 questions, requiring the company to confirm whether there is a major information that should be disclosed but not disclosed. Whether there are matters that violate the principle of fair disclosure, whether there are suspected insider trading, and fully risk prompts on the company's stock transactions abnormal fluctuations.

At present, on June 30, Songzhi shares again issued an announcement of the company's director and supervisor, saying that the company's vice chairman, president Ji Ankang and vice president Huang Guoqiang also spent personal funds. On the day, the 465,800 and 143,700 company shares held through the large transaction method, which accounted for 0.0741%and 0.0229%of the company's total share capital, respectively.

The announcement shows that the average reduction of the above -mentioned two -person holdings was 14.26 yuan/share. Based on this calculation, the amount involved in this reduction involved was about 86.9147 million yuan.

After closing on July 4, Songzhi issued a reply announcement of the Shenzhen Stock Exchange's follow -up letter.

"Investment Times" researcher noticed that in this 7 -page reply, Songzhi shares used 5 pages of the company's market development, production and operation, and the company's situation of the company. There are no major matters that should not be disclosed but not disclosed, there are no matters that violate the principles of fair disclosure, nor are there any suspected insider transactions.

It is worth noting that in this reply, Songzhi shares supplemented disclosed a information that had not been released before -Chen Fuquan, the father of the company's director Chen Zhizhan, reduced its holdings of 682,500 shares on June 29, accounting for the company's total share capital 0.1086%. If it is also calculated at the average price of 14.26 yuan/share, it involves a amount of about 9.73245 million yuan.

That is, the director of Songzhi Co., Ltd. and the affiliated personnel have reduced their holdings by more than 18 million yuan in one day.

The rise in the stock price or is related to the Ningde era BYD

Public information shows that the predecessor of Songzhi Co., Ltd. was established in June 2002, Shanghai Jiaxiang Songzhi Automobile Air Conditioning Co., Ltd., and the company landed on the Shenzhen Stock Exchange in July 2010.

After years of development, Songzhi Co., Ltd. is currently mainly engaged in the research and development, production and sales of hot management related products in the fields of cars, rail transit and cold chain logistics. The products are widely used in large and medium -sized passenger cars, passenger cars, special vehicles, trucks and other types Vehicles have included products such as automotive air -conditioning related core components, automotive air -conditioning systems, vehicle battery thermal management related components and systems, ATS engine cooling systems in the field of vehicle air conditioning. In 2021, Songzhi Co., Ltd. began to enter the battery thermal management industry of the energy storage power station, mainly providing the water -storage power station with water -cold battery thermal management system -related products.

At present, the disclosure of the A -share interim report is approaching. Although many companies have issued the first half of the performance forecast, Songzhi shares have not issued relevant announcements. As far as 2021 and this year's report, the company's performance was not dazzling. According to the 2021 report, Songzhi achieved operating income of 4.124 billion yuan throughout the year, a year -on -year increase of 21.86%; the net profit of the mother was 113 million yuan, a decrease of 54.41%year -on -year, the lowest value since 2010; the real profit of deducting non -returned mother 0.55 0.55 100 million yuan, a year -on -year decrease of 54.16%, the overall performance is not to increase the income.

The company said that the production and sales of passenger cars in 2021 have risen, commercial vehicles have fallen significantly, and the automotive and automotive parts industries are facing multiple pressures, including rising prices of raw materials and serious chips.

In the first quarter of this year, Songzhi achieved operating income of 883 million yuan, a decrease of 6.19%year -on -year; net profit attributable to the mother was 20 million yuan, a year -on -year decrease of 31.91%; the net profit of deducting non -returnees was 120 million yuan, a year -on -year decrease of 45.46%, and the camp was a year -on -year. Receiving profit doubled. The company attributed profits to the decline in sales revenue.

In fact, the recent rise in the stock price of Songzhi shares has a greater connection with the Ningde Times (300750.SZ) and BYD (002594.SZ). Recently, on the company's investor interactive platform, multiple questions involved these two new energy giants.

On the news, on June 23, the Ningde Times released the third -generation CTP (Cell to Pack) "Kirin Battery" that will be mass -produced next year. It is reported that the integration of the battery system reached a global high, with a volume utilization rate of exceeding 72%, and the energy density can reach 255Wh/kg, which can achieve a 1000km battery life of the vehicle. Rap the fast hot start and 10 minutes fast charging.

According to statistics from GGII, the shipments of my country's power storage system in 2021 were 29GWH (including exporting overseas), an increase of 341%year -on -year, 4.39 times of 6.6GWh in 2020. The scale of scale, as well as the management policy of strong domestic landscape energy storage. According to GGII, the shipping volume of the power storage system in my country in 2022 may be close to 60GWh, and the market space of energy storage temperature control in 2022 to 2025 is 4.66 billion yuan, 7.48 billion yuan, 10.98 billion yuan, and 16.46 billion yuan.

Based on the above situation, some investors asked Songzhi whether to supply Songzhi in the Ningde Times Kirin battery thermal management on the investor interactive platform. Songzhi said that it is mainly cooperating with Ningde Times in the battery heating product of energy storage systems. The supply relationship was established in the Ningde era.

As for BYD, Songzhi Co., Ltd. replied that BYD is an important strategic customer of the company, mainly supplying car thermal management products for BYD.

However, most of these questions appeared after June 17, that is, after Songzhi shares opened the board market.

Songzhi shares in the first quarter of 2022

Data Source: Company's 2022 First Report

- END -

"Conversion" will appear after 6 months to facilitate the management risk of foreign investors' usage interest rate swap management

On July 4th, Pan Gongsheng, Vice President of the People's Bank of China and direc...

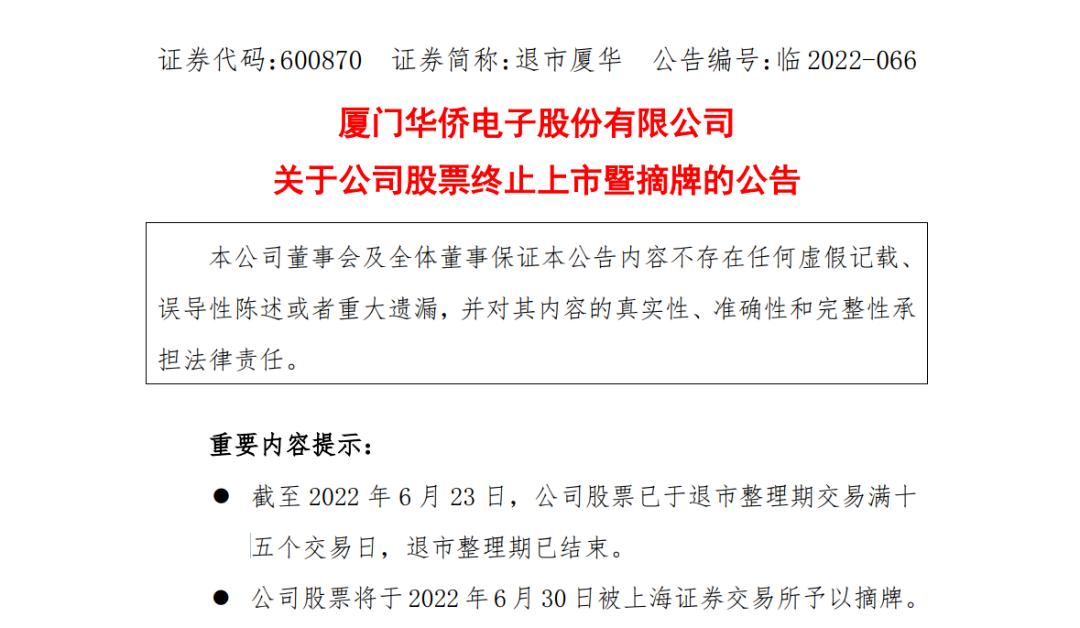

It plummeted nearly 90%in a single day!One -generation color TV giant farewell to A shares

On the evening of June 23, Xiamen Overseas Chinese Electronics Co., Ltd. (Turning ...