A shares over 70 % of the stocks have fallen, have you stepped on the mine?

Author:Zhuzhou Daily Time:2022.07.08

Zhuzhou Evening News reporter/Liao Xichang

A shares completed the "half run" in 2022. A "fall" word becomes a keyword. Wind data shows that the main index of the A -share market closed down in the first half of the year. The Shanghai Stock Exchange Index, Shenzhen Stock Exchange Index, and GEM Index fell by 6.63%, 13.20%, and 15.41%respectively. Zhuzhou listed companies are also downturn, and the effect of making money is very average.

Under such a plate, 77%of individual stocks fell. Are you stepping on the thunder?

▲ Hongda Electronic Week K -line diagram. Zhuzhou Evening News reporter/provided by Liao Xishang

See Hunan Stocks

"Leading Sheep" actual control of people Zhuzhouwa

In the first half of the year, due to factors such as the conflict between Russia and Ukraine, the Federal Reserve's interest rate hikes, and epidemic raging, most of the global stock markets fell. Among the global important indexes, the Nasdaq Index performed at the bottom, and the cumulative decline in the first half of the year exceeded 28%.

In contrast, the A -share market is relatively small, but investors are also very uncomfortable. According to Wind data, as of the close of June 30, 3,718 stocks in the A -share market fell, and only 1089 stocks rose, and the proportion of stocks accounted for less than 23%.

Hunan stocks also failed to get rid of the influence of the entire market. Of the 134 listed companies in Hunan, only 34 listed companies rose, and the other 100 listed companies received "green" in the first half, and the proportion of stocks accounted for 25.37%, which was slightly better than the performance of the entire A -share market.

It is worth mentioning that among Hunan stocks rising more than 20%of the stocks, there are 6 stocks with more than 50%of the stocks, but only 1 of the stock price doubles. The only double stock of this is the new material of Daller, which rose 121.02%in half a year. Hualian Hotels followed by 70.48%, and Hunan's development rose 61.16%.

The relationship between the three Hunan stocks and Zhuzhou are very close. Among them, the new Materials of Telle is the first domestic manufacturer to master the core technology of diamond lines and achieve scale production. It is the second largest supplier of diamond cutting line in the world. What many people do not know is that the actual controller Duan Zhiming of the new material of Daller is actually an authentic "Zhuzhouwa" and was born in ordinary rural families in Chaling County. In January 2018, Duan Zhiming returned to Zhuzhou and invested in the founding of Zhuzhou Dalle New Materials Co., Ltd.. Today, this company has grown into a high -tech enterprise specializing in the research and development, manufacturing and service of hard crisp materials cutting tools.

The development of Hunan is also an old friend of Zhuzhou, and Zhuzhou Aviation Power Hydropower Station is managed by the company. In February of this year, Hunan Development and Zhuzhou Economic Development Zone Industrial Development Group Co., Ltd. jointly cooperated to develop the roof distributed photovoltaic project in the roof of Nanzhou Industrial Park. On the evening of July 6, the development of Hunan issued an announcement that it plans to launch the Zhuzhou Aviation Power Hub (Kongzhou Hydropower Station) expansion project. The total static investment of the project is about 364 million yuan.

Look at plant stocks

Only Tangshen and Zhuye Group rose

On the list of listed companies in Hunan area, the most rowing stocks are the Tang Dynasty. In half a year, a total of 13.92%increased. That's right, the Tang god who lost 1.147 billion yuan in 2021. Although the loss is serious, the Tang Dynasty has not done much in the past few years. By continuously expanding production, this Zhuzhou listed company is rapidly expanding pig production capacity. In 2021, the number of raw pigs had reached 1.5423 million, an increase of 50.56%year -on -year. In the next three years, this number will be further improved, and the plan is planned to produce 2 million pigs, 3.5 million heads, and 5 million heads.

This year, the effect of expanding production has gradually appeared. As the "pig cycle" was reversed, the price of pigs bottomed out, and the losses of the Tang Dynasty in the first quarter had narrowed to 149 million yuan. At the same time, the stock price of the Tang Dynasty rose 40.56%in the first quarter. 65 funds flocked, and the funds bought the Tang Dynasty and the gods of the Top Ten Wenden, holding a total of 154 million shares. In the second quarter, although the stock price of the Tang and gods was sharply adjusted, the institutional investor's popularity continued and still intensively investigated it. It used practical actions to show the attention of the Tangshen.

However, the Tang Dynasty gods who led Zhuzhou listed companies were only 20th on the list of listed companies in the province. This also illustrates the overall downturn of the stock price of Zhuzhou listed companies in the first half of the year: only 2 companies in Zhuzhou listed companies have risen, 10 companies have fallen, and their proportion of stocks accounts for only 16.67%, which is disappointing.

In addition to the Tang Dynasty, the other in the first half of the year was Zhuye Group, which rose slightly by 0.54%.

Zhuye Group has added the concept of local state -owned assets reform this year. The reason is that the company is undergoing capital operation, and the actual controller and its affiliated parties intend to inject high -quality minerals into Zhuye Group. For example, through this transaction, Zhuye Group will obtain 100%equity of Shuikou Mountain and directly owns upstream lead -zinc ore resources, becoming a comprehensive company that integrates non -ferrous metals such as lead zinc and other colored metals.

However, investors do not seem to buy it very much. The Zhuye Group wearing a halo of local state -owned assets reform only closed in the first half of the year.

Decline

The cumulative decline of 8 plant stocks exceeds 10%

On the list of increase in Hunan, Zhuzhou listed companies are difficult to find. But embarrassing is that there are many companies on the list.

In the first half of the year, the stock price of 10 Lisu listed companies closed down. Among them, the most severe falling is HTC Electronics, which has just won the honor of Hunan stocks, which has just won the honor of Hunan stocks, plummeted by 38.50%. 10 bits. Hongda Electronics is the second stock price of the stock price of Zhuzhou listed companies that touch the 100 yuan area. On January 4 this year, it has shortly stayed at the highest price of 101.25 yuan/share. However, since then, its stock price has fallen all the way, and by April 27, the minimum fell to 44.65 yuan/share, and the stock price was "cut" in less than 4 months. Although it has a background rebound, it has just returned to the 60 yuan range, and it takes time to return to the highest price in history.

Many investors are confused. Since 2016, HTE's historical net profit has achieved a significant increase in 6 consecutive years. In 2021, it has reached a record high with a performance of 816 million yuan. Essence However, if we stretch time, we will find that since the listing on November 21, 2017, HT Electronics has risen from a issue price of 11.16 yuan/share to 101.25 yuan/share, which has an amazing increase, and rarely calls back sharply during the period.

In addition to Hongda Electronics, there are 7 of Zhuzhou listed companies that have fallen by more than 10%, namely Times New Materials, Hua Po Co., Ltd., Qi Bin Group, Time Electric, Qianjin Pharmaceutical, Fei Lu and West Rui Precision, of which After Time's new material followed Handa Electronics, it fell 28.83%, Hua Po shares fell 22.12%, and Qi Bin Group fell 20.74%.

One of the important reasons for the large area of plant stocks is the influence of the environment, which is caused by the large market fluctuations. Of course, this is also related to the popular concept of individual stocks. In the first half of the year, the concepts of infrastructure, new energy sources were sought after in the first half of the year. Zhuzhou listed companies are rarely involved. Therefore, short -term funds have not paid much attention to Zhuzhou listed companies.

Market value

Times Electric Sitting Stable Hunan Stock Market Value Second

Affected by the plunge of the stock price, the market value of Zhuzhou listed companies is also shrinking.

At present, the highest market value of Zhuzhou listed companies is Time Electric, which is 74.585 billion yuan (data on June 30). Qi Bin Group and HTC have shrunk to 34.251 billion yuan and 25.192 billion yuan, respectively. It is very regrettable that the three Zhuzhou listed companies, which were squeezed into the "Top 500 market value of China's listed enterprises" last year. This year, the electricity was still on the top 500.

On the latest 2022 semi -2022 "Chinese listed enterprise market value of 500" list, Times electrical row is 247, an increase of 213 digits from the previous year. It is worth mentioning that Times Electric has been in the throne of the market value list of the Hunan stocks, second only to the El Eye Department, which is known as the "eye." However, in the first half of the year, the market value of Elber's ophthalmology has increased to 230.456 billion yuan. If the electrical electricity wants to compete for the top of the list, it will work harder.

Similar to Hongda Electronics, Qi Bin Group also handed over the best performance in history last year: realizing net profit of 4.234 billion yuan, an increase of 133.38%year -on -year. The adjustment of its stock price was one step earlier. After the highest touches of 28.93 yuan/share in the third quarter of last year, it had begun. By June 30 this year, it had fallen to 12.75 yuan/share. In just two years before, Qibin Group's stock price rose 9.2 times.

A relevant person in charge of a securities company in our city reminded: "There is no stock that is not rising or not, and it is naturally necessary to call back. After the rise, it has plummeted. This is the normal phenomenon of the stock market. Investors may wish to calmly look at it."

Source: Zhuzhou Evening News

Review: Luo Xiaoling

Edit: Chen Chen

- END -

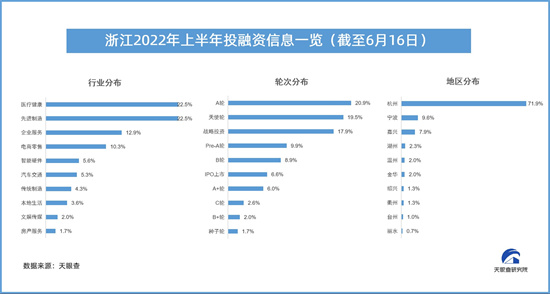

In the first half of 2022, Zhejiang Investment and Financing Incidents started from 302, led by advanced manufacturing, Hangzhou is the area TOP1

On June 24, the reporter learned from the Tianyan Inspection Research Institute th...

Kuancheng: condense the front -line "tax power", benefit the enterprise and the people to take the responsibility

In order to implement the new combined tax support policies, the unblocking preferential tax policies landed the last mile, allowing policy dividends to quickly benefit the market entity, and the Gu