Japanese media: The "independence" of the dollar becomes a world economic risk

Author:Global Times Time:2022.07.08

The US dollar index continues to be strong and set a new high in nearly 20 years. On July 7, the US dollar index reached the highest point of 107.13 after the strong rise in the morning, and fell around 106.9 around 15:00, but still maintained the highest level of 20 years. At the same time, the exchange rate of the euro to the US dollar has fallen to the lowest position in 20 years. On the afternoon of July 7, the exchange rate of the euro exchanged for the US dollar was about 1.02, which was slightly higher than the historical low of 1.016 set by the previous trading day. Bloomberg reports that the voice of the market is increasingly convinced that the US dollar may reach the level of cheapness with the euro.

"The global economy is shrouded in the pessimistic expectations of recession. Investors are evacuating golden risks, and the US dollar has soared significantly." Bloomberg quoted the French Agricultural Credit Banking strategist on the 6th that "the US dollar continues to benefit As a role as a high -yield security safe, the US economy is believed to be influenced by the energy crisis like Europe, which allows the Federal Reserve to insist on tightening the monetary policy and increase the attraction Waiting for risk -free assets, Hungarian Forest, Columbia Peso and other high -risk currencies have been severely damaged.

Analysts of domestic institutions Pacific Securities believe that the main reason for the continued strengthening of the US dollar index since the end of June is the weakening of the euro because the US dollar index constitutes 60%of the euro. The major economic indicators of several important countries in the euro zone in Germany and France are not satisfactory, and the European economic recession is worried about their emotions.

"The US dollar's independence is becoming a new risk of the world economy." The Japan Economic News reported on the 7th that the appreciation of the US dollar will exacerbate the inflation of emerging market countries and promote the risk of deceleration of the world economy. It is reported that the appreciation of the US dollar is conducive to inhibiting inflation for the United States, but the U.S. dollar monopoly is affected by the world economy that is plagued by the higher resource prices. Most of the global trade transactions are settled in the US dollar. The appreciation of the US dollar will lead to the decline in the purchasing power of other currencies and exacerbate inflation in various countries. In countries that lack resources, the rise in resource prices will lead to the expansion of the trade deficit and easily exacerbate the depreciation of the currency of the country. At the same time, the depreciation of the currency in emerging market countries will increase the burden of repayment of the US dollar valuation debt.

After the RMB's exchange rate ended a strong rise in mid -May, it began to fluctuate. It is currently depreciating about 5%compared to the beginning of the year. Industry insiders believe that the internal support factors of the RMB exchange rate are increasing. In the second half of the year, China's economy has continued to recover, and the pressure of US economic adjustment has increased, which is expected to support the RMB exchange rate to the US dollar at a reasonable level. ▲ (Ni Hao)

- END -

Help migrant workers entrepreneurship "Shu Zhongxing" migrant workers' entrepreneurial guidance in the field tour in Da Ying, Sichuan

Cover reporter Liu Hu intern Du XiaoyuThe integration of agricultural and cultural...

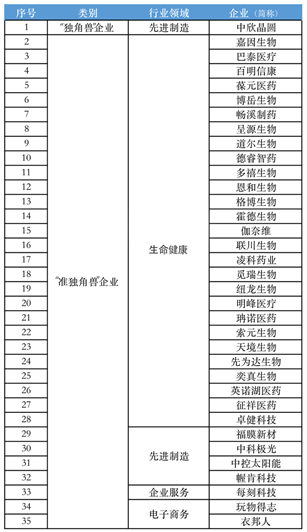

35 Qiantang companies are on the list of 2022 two "unicorn" lists!

A few days ago, the 2022 Hangzhou Unicorn (Quasi -Unicorn) List was released in th...