More than 130 listed companies preview the interim results of more than 80 % of the "pre -joy"

Author:Xinhuanet Time:2022.07.07

Xinhua News Agency, Beijing, July 7th. Question: More than 130 listed companies previewed more than 80 % of the "pre -joy"

Xinhua News Agency reporters Yao Junfang and Pan Qing

In 2022, the schedule is more than half, and the "transcript" of listed companies in the year is about to be released. By the 6th, more than 130 listed companies previewed mid -term performance, of which more than 80 % were "pre -happy".

Data show that a total of 132 listed companies as of the 6th announced the 2022 interim results preview. Among them, "pre -increase", "continuity" and "slightly increased" were 67, 10, and 25, respectively, and 4 "turned losses". Total 106 "pre -joy", accounting for more than 80%. At the same time, the performance of some listed companies in the first half of the year was not good, and the performance trailers showed "pre -reduction", "first loss" and "continuing loss".

Li Qiaosuo, managing director of the Research Department of CICC, said: "From the perspective of the current disclosed performance trailers, some photovoltaic industry chains and new energy vehicle industry chains in the midstream field have been restored faster and the overall growth is maintained. , Car Electronics has a high degree of boom. "

At the same time, from the perspective of performance trailers, the profitability of the upstream industry of energy raw materials generally maintains a high level. "Companies of coal, natural gas, and new energy -related materials have achieved high growth, but the growth rate of the base effect is slowing down." Li Qiosuo said.

In the new energy industry chain, due to the strong downstream demand, the upstream enterprises upstream of the industrial chain maintain a high level of profit. According to the performance forecast, the number of shipments and sales of many lithium concept stock companies increased significantly compared with the same period of the previous year, driving net profit increases at the forefront.

From the perspective of partial pressure companies, the reasons for the performance trailer mainly include the increase in upstream raw material costs, high international energy prices, limited logistics, delayed project progress, and order fluctuations in order.

According to the regular reporting of the listed company released by the Shanghai Stock Exchange, the first semi -annual report of the Shanghai Stock City will be unveiled on July 15. After one and a half months, the Shanghai and Shenzhen Exchange and the Peking Stock Exchange will usher in a concentrated appearance of the "mid -term transcript" of listed companies.

Institutions generally believe that due to multiple factors, the performance of listed companies in different industries in the first half of the year may have differentiated performance, and the performance of the industry segments in the industry is also different.

Li Qiosuo said that the growth of the financial sector in the second quarter is expected to improve slightly compared with the first quarter of this year. In the second quarter, combined with the relatively high level of global commodity prices, the profitability of upstream industries may still be relatively tough. The middle and lower reaches industries may generally be affected by the high cost of epidemic and raw materials, especially the performance pressure of manufacturing and consumer industry.

In his opinion, the profit growth of non -financial listed companies in the second quarter may be a low level of the year, and the growth rate is expected to rise in the second half of the year.

Chen Guo, chief strategy officer of CITIC Construction Investment Securities, said that in combination with the industry's high -frequency prosperity data and feedback, the sector that is expected to maintain a higher growth rate in the second quarter is still concentrated in new energy, high -end manufacturing, pharmaceuticals, and medicine, and medicine, medicine, medicine, and medicine, and medicine, medicine, medicine, and medicine, and medicine, medicine, medicine, and medicine. A few directions such as resources.

Recently, the policy and measures of the stability of the economy have accelerated the effectiveness of implementation, and my country's economic recovery has accelerated. The China Manufacturing Purchasing Manager Index (PMI), which was announced on June 30, rose to 50.2%, returned to the expansion range after three consecutive months of contraction.

Industry insiders said that with the stabilization of some upstream resource products, the increase in growth policies, the steadily advancement of the resumption of work, and the high probability of domestic demand in the second half of the year. At the same time, industrial machinery and transportation, such as industries that were previously affected by the epidemic, their performance may be approaching the inflection point.

![]()

[Editor in charge: Shi Ge]

- END -

China and South Korea (Changchun) International Cooperation Demonstration Zone held a number of key projects for investment promotion conferences

On July 15, 2022, the China -Korea (Changchun) International Cooperation Demonstra...

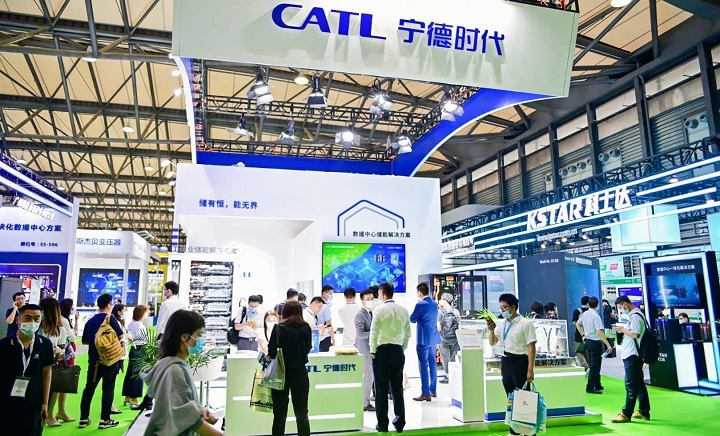

Shareholders fry the pan!Why is the Ningde Times using 2.3 billion to buy a wealth management listed company is keen on this?

Picture source: official website of Ningde TimesOn the evening of June 27, the Nin...