The China Banking Regulatory Commission and the People's Bank of China issued the "Notice on Further Promoting the Standardous Healthy Development of Credit Card Business"

Author:Bank of China Insurance Superv Time:2022.07.07

In recent years, my country's banking financial institution's credit card business has developed rapidly, and it has played an important role in facilitation of payment and daily consumption. However, in recent periods, some banking financial institutions' credit card business business philosophy is extensive, the service awareness is not strong, the risk control is not in place, and the existence of damage to the interests of customers. In order to promote the implementation of new development concepts in the banking financial institutions, firmly establish the people -centered development ideas, improve the quality and efficiency of credit card business benefits the people, effectively protect the legitimate rights and interests of financial consumers, and better support scientific and rational consumption with high quality development Recently, the China Banking Regulatory Commission and the People's Bank of China issued the "Notice on Further Promoting the Standardous Healthy Development of Credit Card Business" (hereinafter referred to as the "Notice").

The "Notice" has eight chapters and 39 articles, which are divided into enhanced credit card business management, strictly standardized card marketing behavior, strict credit management and risk management and control, strict management and control of funds flow, comprehensively strengthening credit card installment business standardized management, strict cooperation agencies management, and strict cooperation agencies, and strict cooperation agencies, and strict cooperation agencies management, strict cooperation agencies, and strict cooperation agencies, and strict cooperation agencies management, strict cooperation agencies, and strict cooperation agencies, and strict cooperation agencies, and strict cooperation agencies management, strict cooperation agencies, Strengthen the protection of the legitimate rights and interests of consumers and strengthen the supervision and management of credit card business. The main contents are:

The first is to standardize the credit card rate charging. The disclosure of the level of interest and fees in some banking industry is not clear, and the low interest rate and low rate of publicity are promoted in disguise in disguise in the name of the handling fees. The customer autonomously confirmed the implementation of automatic staging and other issues, which made it difficult for customers to judge the cost of use of funds and even increase the burden on the customer's interest fee. The "Notice" requires banking financial institutions to effectively improve the standardization and transparency of credit card interest management, strictly fulfill the obligations of the interest fee explanation in the contract, show the highest annualized interest rate level in a clear way, and continue to take effective measures to reduce the customer interest fee fees Affordinate and actively promote the level of credit card rates rationally. In response to the credit card installment business, the banking financial institutions are required to clarify the minimum starting amount and maximum amount of the upper limit, and uniformly use interest forms to display the use of installment business funds in the form of interest.

The second is to effectively strengthen the protection of consumer rights. At present, consumers in the field of credit cards are mainly concentrated in non -standard marketing publicity, poor complaints, improper collection of customer information, and improper collection. Focusing on the prominent issues of the masses' complaints, the "Notice" is regulated for the targetedness and requires banking financial institutions: the legal risks and legal responsibilities involved in credit cards must be strictly strictly strictly strictly strictly strictly strictly strictly explicitly responsible for credit cards involved in, and fraudulent publicity shall be performed. Dedication documents and showing them to customers beforehand. It is necessary to strictly publish the channels for complaints to customers, and equip resources such as sufficient positions according to the number of complaints. Customer data security management must be strictly implemented, and customer information is collected through the self -operated channels of the Bank. It is necessary to strictly regulate the collection of behaviors, and must not be collected by the third party that has nothing to do with the debt.

The third is to change the extensive development model. The operating philosophy of some banking financial institutions is unscientific, blindly pursuing scale effects and market share. The abuse of card issuance and repeated card issuance are prominent. The "Notice" requires that the banking financial institutions do not use card volume and number of customers as a single or main assessment indicator. Banking financial institutions with long -term sleep card rates exceeding 20%shall not issue new cards. Reasonably set up the total credit limit of a single customer credit card. When the credit approval and adjustment of the credit line, the customer shall be deducted from the credit card of the credit card of other institutions.

The fourth is to regulate the management of external cooperation. Some banking financial institutions have problems such as irregular credit card business cooperation behaviors, inadequate control, and unclear power and responsibilities of both parties. The "Notice" requires the banking financial institution headquarters to implement a unified list of listing systems for cooperation institutions, strictly manage approval standards and procedures, and shall not carry out the core business links of credit cards through the Internet platform controlled by cooperation agencies. The credit balance shall meet the concentration index limit. In response to the joint -name card business, the "Notice" prohibits banking financial institutions directly or disguised by the co -branded unit to exercise the credit card business responsibilities. The business scope of cooperation between joint cards is limited to the promotion and promotion of joint units and providing equity services in its main business areas.

Fifth, further promoting the facilitation of online services for credit cards. The "Notice" encourages qualified banking financial institutions to actively adapt to the upgrading and changes of economic development and consumer financial needs. In accordance with the principle of controllable risks, stable and orderly, explore the development of online credit card business and other models. Dynamic vitality of development, enrich credit card service functions and product supply, and continuously enhance the people's sense of obtaining, convenience, and security of the people's cards.

In the next step, the China Banking Regulatory Commission and the People's Bank of China will urge banking financial institutions to earnestly implement the requirements of the "Notice" to promote the credit card industry to better support scientific and rational consumption with high -quality development.

- END -

2022 blue international cooperative entrepreneurs and youth scientists forums were held in the West Coast New District of Qingdao

Popular Network · Poster Journalist Pan Chao Liu Hang Correspondent Wang Wei Qing...

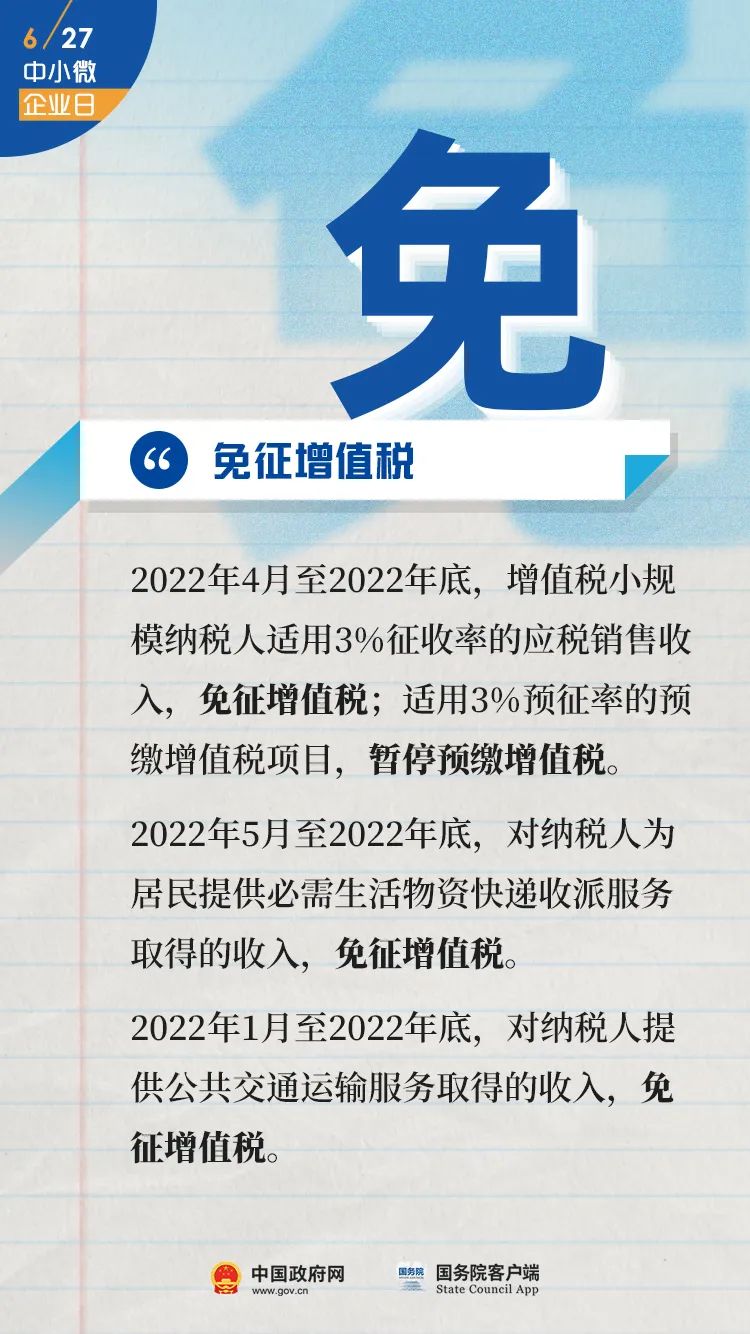

@企业, these policies support you →

Small, medium and micro enterprise dayToday (June 27) is the Small and Medium and ...