Miya Lei: Life before and after lost contact

Author:Corporate research room Time:2022.07.07

Produced/Company Research Office

Text/Swordsman

On July 6th, Lanhai Medical Industry Investment Co., Ltd. (600896.SH, hereinafter referred to as: Lanhai Medical or delisting sea medicine) disclosed: "From July 7, 2022, Mr. Mi Chunlei fully fulfilled the company normally The duties of the directors and chairman will no longer authorize Mr. Ni Xiaowei to perform the duties of the chairman for generations. "

Since then, Michun Thunder who has lost contact for more than half a year has returned to normal trajectory. Previously, public information showed that the company's company was forced to execute over 700 million.

Right now, the rich man from the suburban town of Chongming Island, who has taken the capital stage of Greater Shanghai, has to face a lot of trouble after returning. It is imminent that the equity frozen of the Lanhai Department is frozen. And the actual control of Luanhai Medical will soon be officially delisted.

Can I return to the public vision, can I turn the tide this time?

01 small town youth

The ancients said: "Small hidden in the wild, hidden in the city, big faint in the DPRK."

For Michunlei, who was once known as invisible rich, life before the age of 30 was roughly like this. How to make the first bucket of gold from Shanghai Chongming Island, it is still the Yunshan Fog.

According to rumors, Michri's parents are ordinary workers, and their family conditions are very general. However, Mi Chunlei believes that the principle of "knowledge changes destiny" has been working hard to study in the process of studying, and later admitted to Tongji University's civil engineering major. After graduating, Mi Chunlei began to engage in maritime transport, so as to earn the first bucket of gold in life.

It sounds like a typical story of a small town of youth inspirational entrepreneurship.

Some people say that Michun Lei is transported by the first reason that the parents are relying on their parents in the local public security transportation department. It is true that this is the case. Then, their parents may not be ordinary workers. It is also reported that on October 8, 1992, Michun Lei established Shanghai Chongming Highway Materials Co., Ltd. Counting it, he was less than 15 years old at the time, which also proved the key role of his parents in his early entrepreneurship from the side.

In fact, Chongming Island is so large, and residents look up and look down. Whoever works in government departments has not been seen. As for who is the company's nominal, it is even more indifferent. What is important is the courage and luck in the operation of the secret and son of the secret family.

It is said that after accumulating a certain capital, Mi Chunlei began to contracted the project, and then the business became bigger and bigger. At the same time, Mi Chunlei married his first love Jin Jing, a local teacher, and a pair of dragons and phoenixes were born shortly after marriage.

Therefore, in the eyes of the locals, the young Miyura thunder is not only happy in the family, both children, but also earning tens of millions of people. It is a standard winner of life.

02 stealth rich

Michimi really has a well -checked wealth life, starting in September 2003.

On September 25 of this year, Mi Chunlei and his father Mi Boyuan invested in the establishment of Shanghai Zhongying Enterprise (Group) Co., Ltd. (referred to as "Shanghai Zhongying", the predecessor of Lanhai Holdings), with a registered capital of 50 million yuan.

At that time, the registration of industrial and commercial registration required actual funds to be injected. Therefore, the secret family could take out or raise the huge amount, showing that they had become a rich class. For this fund, there are rumors that Michunlei made a sum of futures in the early days, but the authenticity was not sophisticated.

After entering the Shanghai Beach, there are no informative information in the current secretary of the secret family. The more credible saying is that they are mainly engaged in real estate development and seized the first wave of gold opportunities for the development of the property market before 2008. In fact, the Mishi family has never left the real estate industry.

With the rapid development of family careers, Shanghai Zhongying is also transformed. On August 29, 2014, Shanghai Zhongying changed to Luanhai Holdings (Group) Co., Ltd. Soon, the company's registered address was relocated from the Shanghai Jinqiao Economic Development Zone to the Shanghai Free Trade Pilot Zone.

According to incomplete statistics, since 2004, Luanhai Holdings has experienced 7 capital increases, and the company's registered capital has also increased from the initial 50 million yuan to 6.5 billion yuan. In 2016, it has made three capital increases, and the amount is huge. By the end of 2018, the company's registered capital had reached 6.5 billion yuan.

From the public information, Lanhai Holdings can be described as a typical family business, holding 100%of Midchun Lei and his father Mi Boyuan and his mother's Qian Champion. Therefore, since November 2013, the secret assets have been hundreds of millions, and the assets have exceeded 1 billion in 2016. By the end of 2018, it has been a proper wealthy family.

The secret family has always been very low -key, making the Michimi family's marriage change. In 2010, some people discovered that CCTV's well -known host Dong Qing began to pat, and the other party was an invisible rich man. Because Dong Qing's popularity was too high, after she was exposed in the United States in 2013, Mi Chunlei, who was Dong Qing's husband, also gradually entered the public vision.

In April 2020, Michun Thunder spent 6 billion yuan to buy Nanjing West Road, Jing'an District, Shanghai. This price ranked second at the highest total land price at that time. This high -profile move allowed Miyanglei and the secret family behind him to expose the water.

03 Capital Layout

Some people noticed that the registered capital of Luanhai Holdings suddenly increased in 2016, with a cumulative capital increase of 5.8 billion yuan in a year. Looking back, behind the company's urgent changes, the Mid family capital map is rapidly expanding, and the financial industry has begun to be involved in depth.

In the capital territory of the Michic family, Shanghai Life Insurance Co., Ltd. (hereinafter referred to as "Shanghai Life") is a core asset and a key fulcrum for the entire seas. The involvement of the opening of Shanghai Life Insurance was before and after the registered capital of Lanhai Company.

In 2015, the insurance industry entered a period of rapid development. In February of this year, Michuna aimed at the opportunity to set up Shanghai Life with China Shipping Investment, Shanghai Electric, and Shanghai City Investment. This is the first large -scale legal person financial institution in the Shanghai Free Trade Zone, with a registered capital of 2 billion yuan. Lanhai Holdings holds 20%of the shares, becoming the largest shareholder of Shanghai Renshou Single, and Mi Chunlei serves as the company's legal person and chairman.

However, in Shanghai Life's 2016 capital increase application, due to the affiliated company of Lanhai Holdings, Cuishaye and Yangning Industrial Holding Relationships and Super Percent, they were required to refund illegal equity by the CBRC in April 2018. After the equity transfer, the shareholding ratio of Lanhai Holdings increased from 20%to 32.8%.

In addition to Shanghai Life, Mi Chunlei also involved in many banks.

In December 2016, Luanhai Holdings was transferred to 4%of the Shanghai Rural Commercial Bank (600606.SH) of Rural Commercial Banks (200 million shares) for the transfer of 1.89 billion yuan. In April 2018, Luanhai Holdings subscribed for 492 million shares of Commercial Bank of Qujing City, accounting for 19.50%of the shares, and tied for the largest shareholders.

Public information shows that there are currently 17 companies or social organizations in Michun Lei, of which 11 are in the existence state, and 11 of the Overlord Holdings (Group), Shanghai Life, and Shanghai Zhongxun. The capital is involved in insurance, medical care, real estate, energy, investment Wait for multiple fields.

04 backdoor listing

In the construction of the Michic family capital, 2015 is very important.

This year, in addition to initiating the establishment of Shanghai Life Insurance, Shanghai Luanshi Shi Life Medical Industry Co., Ltd., a subsidiary of Luanhai Holdings, was transferred to Zhonghaihai Sheng (600896.SH) original controlling shareholders of 82 million shares, becoming the largest shareholder of Zhonghai Haisheng.

Subsequently, the Lanhai Series participated in the China Sea Dingdang again. On the evening of June 10, 2015, China Sea Haisheng announced that it intends to issue 290 million shares to Shanghai Luanhai Investment Co., Ltd. at a price of 6.85 yuan/share. All will be used for loan repayment.

In this backdoor listing, Mi Chunlei has invested approximately 3 billion yuan to win 42.82%of Zhonghaihai Sheng's equity, becoming the actual controller of this old listed company. After being in charge of China Shipping, he gradually cleared the company's original shipping assets and transformed the medical service industry. In 2020, Zhonghai Haisheng was renamed Guanhai Medical.

However, although the backdoor listing was very smooth this time, the transformation of medical treatment was not so successful. Moreover, from the comprehensive analysis of the information of all parties later, the cost of backdooring of nearly 3 billion yuan also laid a big thunder for Shanghai Lanhai Investment Co., Ltd. (hereinafter referred to as "Lanhai Investment") for the core platform of the Equity Investment of the Sea Department.

After the backdoor, the biggest movement of the Lanhai Department was to update and transform some medical property assets of the central hospital (original) of Hefeng Real Estate (formerly Hefeng Hospital), and opened an international high -end comprehensive hospital in the central urban area of Shanghai.

This investment is unsuccessful overall. The annual report shows that the net profit of Henfeng Hospital from 2019 to 2021 is -29.83 million yuan, -35.67 million yuan and -105 million yuan.

Four years after the construction, in November 2020, the 51%equity of the Herfeng Hospital held by the Haifeng Hospital and 512 million yuan of claims held to the controlling shareholder's investment in the controlling shareholder, with a transaction price of 856 million yuan. After the transaction was completed, Lanhai Medical still retained 44%of the equity, and Hefeng Hospital also became its subsidiary.

Lanhai Medical said that due to the excessive investment cost of Hefeng Hospital, the shareholders have great uncertainty about their funding support, and the hospital's own financing capacity is also seriously insufficient. In the process, the controlling shareholder also formed non -operating funds to occupy the medical treatment of Lanhai Medical, attracting punishment from the regulatory authorities.

On the same day of the penalty announcement, that is, June 20, 2022, Luanhai Medical was terminated by the 2020 net profit in 2020 and operating income below RMB 100 million.

05 Lost Discuss Cloud

After 2015, the Mlian family with financial resources began cross -border expansion, and the industry involved multiple fields. However, these cross -border investment brings not profit, but more and more heavy debts, and even employee wages cannot be paid.

It is reported that in November 2021, Mi Chunlei sold a house to employees. Later, frequent debt disputes eventually led to the loss of Michun Thunder.

At the beginning of 2022,*ST Haiyi (Lanhai Medical, 600896.SH) announced that Michun Lei authorized the director of the Sea Medical Directors Ni Xiaowei to fulfill the duties of the chairman. During the period,*ST Haiyi stated in the regulatory reply letter that the company could not get timely contact with Mi Chunlei in a timely manner.

According to Caixin reports, in December 2021, Mi Chunlei was taken away by the local economic investigation department. About two weeks later, the investment director of Shanghai Life in Shanghai Life was also investigated. The last time Michimi appeared in the public vision, on November 26, 2021, attending the official opening ceremony of Shanghai Lanhai Rehabilitation Hospital.

During the period of loss of Michun Thunder, there were many rumors.

At the same time, the Lanhai Department has encountered a number of judicial lawsuits, involving a number of financial institutions such as Western Trust, Tibet Trust, Minsheng Bank Wuhan Branch, etc. Some of the company's subsidiaries have been frozen, and judicial organs have also begun to enforce relevant cases. China ’s execution information disclosure network shows that Michuna, Lanhai Investment, and Lanhai Holdings were listed as the executing person by the Shanghai Financial Court.

The company's research office noticed that in the fourth quarter of 2021, the "Lanhai Series" core financial assets Shanghai Life Life's performance turned to a loss. During the reporting period, Shanghai Life Insurance's business revenue was 3.764 billion yuan, and its net loss was 278 million yuan. Due to judicial assistance, in June 2022, 1 billion shares of Shanghai Life Life held by Lanhai Group were frozen. The official website shows that as of now, the company's 2021 annual report and the first quarter solvency report of the 2022 have not been released as scheduled.

In the previous March, the equity of 492 million yuan held by the Qujing Commercial Bank held by Lanhai Group was frozen for 183 days, and the freezing period was on September 27, 2022. The executive agency was the Qujing Public Security Bureau.

06 Reverse the crisis?

During the period of Michun Thunder, the most anxious in addition to his family, as well as small and medium investors in Luanhai Medical. According to the relevant announcement, the start date of the transaction period of the section of the medical delisting delisting is June 28, 2022, and the final transaction date is expected to be July 18, 2022.

After the reorganization in 2015, the total market value of Lanhai Medical had reached 12 billion yuan. Now the company is about to delist, and the stock price has fallen to 0.88 yuan/share (previous re -right), which has evaporated by more than 95%compared with the peak. Such a decline really made small shareholders dare not believe life.

On July 7th, stimulated by the news of the re -performing duties of Michri, the stock price of the delisting sea doctor opened up the daily limit. The daily limit opened on the market, but then stopped again. Obviously, the return of Mi Chunlei has made some investors quite excited. Many investors also hope that "the chairman returns and leads the company out of the predicament."

Earlier, the delisting sea doctor had submitted a review application to the Shanghai Stock Exchange and a letter of opinions issued by the law firm on the application for review. However, people in the industry said that in terms of previous experience, even if a review application was submitted, I am afraid that it would be hopeless to avoid delisting. Since 2022, many delisting companies have operated such operations, but in the end, they failed to avoid the doom of delisting.

After the Director Director of the Director, what will Michunlei plan for the future development of the delisting sea doctor? To this end, some securities media reporters specifically called the secretary office of the delisting sea doctor to verify, but they had not been connected at the time.

A person who is familiar with the seas of the sea said that after the judicial institution is densely implemented, Mi Chunlei can return, whether it is good for the delisting sea doctor or his other companies. As for how the capital map will be reorganized throughout the sea series, whether Michri can live in the sea system assets in the future, and even let its core assets be re -listed, it is another level.

"When the heavens and the earth are all the same, it is not free to transport the heroes."

At present, compared with around 2015, the economic and financial environment at home and abroad has undergone tremendous changes. The state's regulatory supervision of financial and industrial capital is very strict. Under the new situation, whether Mi Chunlei can reverse the crisis of the sea and even the re -creation of glory , It's all unknown.

- END -

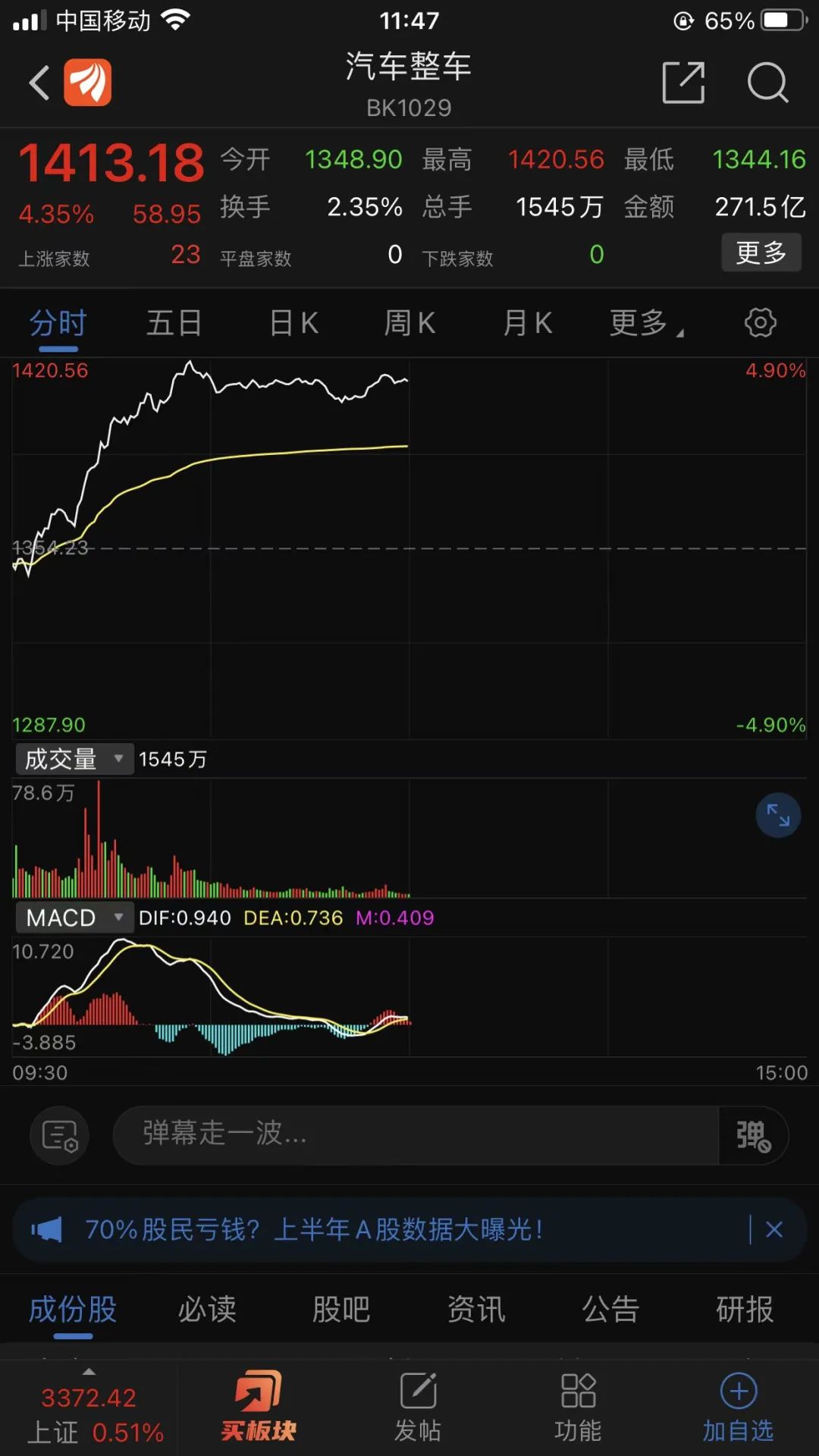

Major benefits!The Ministry of Commerce issued a post!Look at the car and sell cars →

According to the website of the Ministry of Commerce on July 7, 17 departments inc...

Comments | Give full play to the "chain" advantage "chain" to develop new kinetic energy

On June 13, Wu Jin, Secretary of the Jingzhou Municipal Party Committee, emphasized at a special meeting of the city's key industry chain chain long system. The modernization of the industrial chain h...