Earn 360 million yuan a day!COSCO Maritime Pre -profit is 64.7 billion, and retail investors shouted crazy: When is the central report dividend?

Author:Zhongxin Jingwei Time:2022.07.07

Zhongxin Jingwei, July 7 (Dong Wenbo) The semi -annual performance data of A -share listed companies is being disclosed one after another. According to Wind data, as of now, seven companies have disclosed the first half of the performance fast report; 142 companies have disclosed the first half of the performance forecast.

On the whole, among these 149 companies, the "Neptune" COSCO Maritime Control was ahead of its expected net profit of 64.7 billion yuan.

Earn 360 million yuan a day!

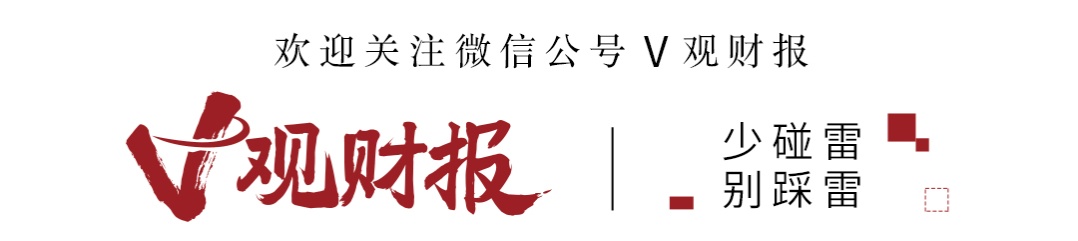

On the evening of July 6, COSCO Maritime Control disclosure showed that the performance forecast showed that it is expected to achieve a net profit attributable to shareholders of listed companies in the first half of 2022, about 64.716 billion yuan, an increase of about 27.618 billion yuan, an increase of about 74.45%year -on -year; The net profit of the shareholders of listed companies was about 64.436 billion yuan, an increase of about 27.416 billion yuan, an increase of about 74.06%year -on -year.

In comparison, the net profit attributable to shareholders of the listed company in the first half of the year (first half of 2021) was 37.098 billion yuan, and the net profit of deducting non -recurring profit and loss attributable to shareholders of listed companies was 37.02 billion yuan.

Source: COSCO Haikong Announcement

According to this calculation, COSCO Haikong earned about 360 million yuan in the first half of the year.

What is the concept of 360 million yuan? According to Wind data, in 2021, A -share listed companies have a net profit of 3,494 net profit of less than 360 million yuan, accounting for 72.43%of all A shares (4824). In other words, 70 % of A -share companies can not make money in a year, COSCO Shipu can do it in one day!

Regarding the reasons for pre -performance, COSCO Haikong said that in the first half of 2022, international container transportation supply and demand relationship was relatively tight, and the export freight of the main routes remained high. During the reporting period, the average value of China's export container freight comprehensive index (CCFI) was 3286.03 points, an increase of 59%year -on -year.

During the reporting period, affected by the epidemic of new coronary pneumonia, the global supply chain was severely lag, and global customers put forward higher requirements for the stability and toughness of the supply chain. COSCO control protection supply supply and box needs, providing flexible alternative solutions such as "water transfer" and "water -rail transportation", and play an important role in scientific and technological innovation and digitalization in the supply chain system to help customers spend a period of challenging. To ensure the stability of the global supply chain.

At the annual shareholders meeting held on May 27 this year, Chen Shuai, deputy general manager of COSCO Maritime Control, also introduced that the company's signing target has been completed this year, and the signing price has also been greatly improved compared to previous years.

In terms of freight rates, Chen Shuai said that at present, the impact of the epidemic in the epidemic has passed. From the perspective of the loading rate and market freight trend of major shipping companies around the world, it is relatively stable. Based on the fundamental judgment of supply and demand, the company's outlook on the market market is generally optimistic throughout the year.

The stock price fell more than 20% during the year

According to the data, COSCO Maritime Control is the flagship company and capital platform of COSCO Shipping Group Shipping and Wharfs. It mainly operates international and domestic sea container transportation services and related businesses. The Chinese coastal routes and more than 80 Pearl River Delta and the Yangtze River branch line have more than 290 ports in more than 90 countries and regions around the world.

COSCO Haikong was established in January 2007. The company's attributes are central state -owned enterprises. The actual controller is the State Council of the State Council. The legal representative is Wan Min.

Not only in the first half of this year, the performance of COSCO Maritime Control in 2021 is also bright.

Data show that throughout the year in 2021, COSCO Maritime Control achieved net profit attributable to mothers of 89.296 billion yuan, an increase of 799.52%year -on -year. , Ping An and PetroChina in China, ranking ninth, hitting a record high.

In contrast to the formation, the stock price of Zhongyuanhai controlled in the secondary market fell all the way.

On July 7, 2021, the stock price of COSCO control rose from 13.43 yuan to 33.40 yuan at the beginning of the year to reach a record high. Since then, the stock price continued to fall, which fell to 13.12 yuan on April 27 this year to reach a record low. As of the closing of July 6, the COSCO Haiki fell 2.11%, the quotation was 13.92 yuan, and the cumulative decline in the past year reached 139.94%. Since this year, COSCO Haikong has fallen by 20.65%.

COSCO Haikong's recent stock price trend Source: Wind

In the morning (July 7), the COSCO Haikong opened more than 7%. As of the afternoon closing of 6.68%, the offer was 14.85 yuan, the turnover was 3.642 billion yuan, and the total market value was 220.7 billion yuan.

In the stock bar, some investors bluntly said: "Why is the stock price .............." "The stock price does not rise."

Source: Stock Bar

However, some investors said: "After all, the performance is good, the stock price will be slowly up, and the institutional views are changing." "Can this performance exceeded the expected growth of the stock price?"

There are also investors analyzed, "The performance is so good, but the stock price cannot be reflected. Is there a hidden deep thunder?"

At the previous annual shareholders' meeting, Guo Huawei, secretary of the board of directors of COSCO Maritime Control, explained that: the stock price rising and falling is affected by various factors. result. Marine control is engaged in serving the trade industry, which is greatly affected by external factors.

Guo Huawei also said that the company will always pay attention to market developments, and combine factors such as the company's annual capital arrangement, capital expenditure needs, and market stock price trend, and flexibly use tools to maintain market value according to needs to make decisions.

Will there be dividends in the middle period?

One of the points of COSCO Haikong's heated discussion among investors is dividends.

In 2021, in the context of 89.296 billion yuan in large earnings, the final cash dividend amount given by COSCO Haikong was 13.932 billion yuan, and the cash bonus per share was 0.87 yuan (including tax), and the dividend ratio was only 15.60%.

The annual dividend ratio of A -share listed companies is generally about 30%. Therefore, many shareholders believe that the proportion of COSCO Maritime is low. However, because the 15th meeting of the 6th board of directors approved 8 votes, 0 votes against 0 votes, and 0 votes of abstaining, the amount of COSCO was settled.

It is worth mentioning that before this dividend, COSCO Maritime Control has not had a dividend in the past ten years.

Source: Same Flower Shun

In the first half of the year, it made 360 million, and investors shouted: dividends.

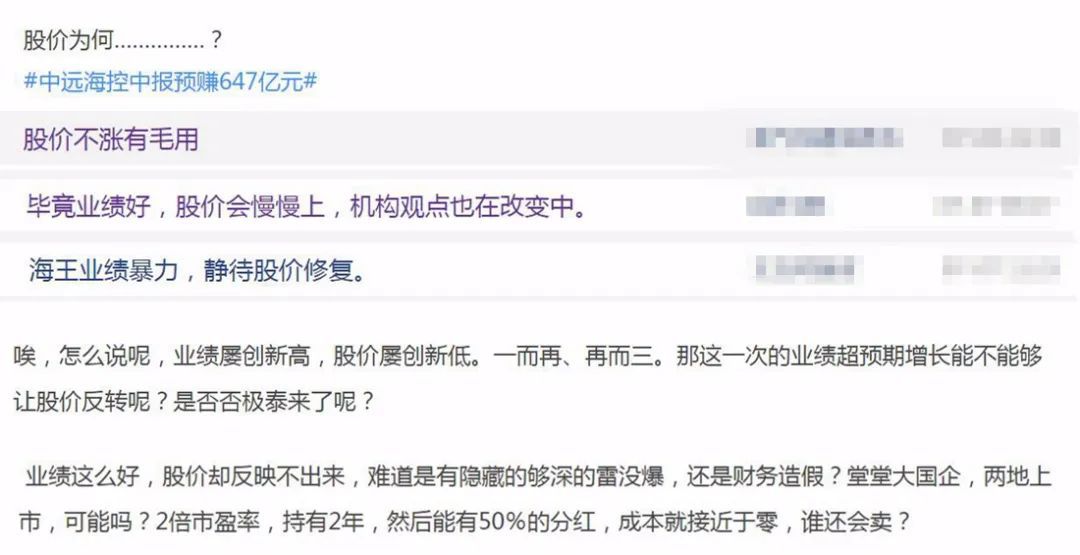

In the interaction of Shanghai Stock Exchange, some investors asked: Is there a dividend plan for the company's 2022 mid -2022?

Source: Shanghai Stock E interactive

As of the afternoon closing, COSCO Haikong did not reply to the above questions.

In the stock bar, many investors said: "Strongly recommend mid -term dividends" and "strongly request the Zhongyuan Intermediate News must be highly dividend." Some investors even bluntly said: "Unreasonable dividends are bad companies."

Source: Stock Bar

Some investors believe that "regardless of the dividend too much, it seems good now, how can other shipping companies have more sea controls in cash reserves."

Source: Stock Bar

Earlier, when facing the question of the amount of dividends in the small and medium investors, Zhang Mingming, COSCO Maritime General Accountant, explained at the annual shareholders' meeting that "As far as the Zhongyuanhai Control Holding platform is concerned, the final monetary funds will be reduced by 2022 that need to be returned in 2022 to return M & A loans and other debt balances (domestic and foreign funds have a total of about 55 billion yuan, about 35 billion meters of mergers and bonds), and a deferred tax of nearly 5 billion yuan at the end of the period. The company's available funds are basically used for annual profit distribution. "

In this interim, does COSCO Marine Control divide? Wait and see. (Zhongxin Jingwei APP)

(The views in the article are for reference only, do not constitute investment suggestions, have risks in investment, and need to be cautious to enter the market.)

Copyright Copyright Copyright, without written authorization, no unit or individual may reprint, extract or use it in other ways.

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Hengchang scale issued about 20 billion private offerings: underlying assets are Hengyi Loan claims, and the borrowing interest rate exceeds 36%

Produced | WEMONEY Research RoomText | Lin XiaolinAs a former offline wealth management giant, Hengchang Wealth and Fortune and Fortune, Shanlin Finance, Yingu Fortune were listed as offline wealth mana...

Safety!Gansu Zhongjin full -speed rescue to guard the tail mine pond

Recently, heavy rainfall weather appeared in the area where Gansu Zhongjin Gold Mi...