Its private equity products are placed by non -company employees and traded.

Author:Capital state Time:2022.07.07

On July 7, Capital State learned that on July 5, the Chongqing Securities Regulatory Bureau issued a decision to take a warning measures for Chongqing Xianshi Investment Management Co., Ltd. (referred to as: Chongqing Xianshi Investment). The content shows that Chongqing Xianshi Investment has been supervised to issue a warning letter to investors due to the failure to fulfill its duties and be cautious; it has not disclosed information to investors in accordance with regulations.

Two major violations, Chongqing Xianshi Investment Police letter

First of all, the management of the product has not fulfilled his duties, cautious and diligent. It is reported that Xian Shihong Apple Private Equity Investment Fund (referred to as Red Apple Fund) is a fund product issued by Chongqing Xianshi Investment. The company handed the product to non -company employees for transaction decisions and order transactions. When the Red Apple Fund signed a supplementary agreement, the company did not agree on the product contract to ensure that the relevant supplementary agreement signed the real and effective signing. After the net value of the Red Apple Fund touched the stop loss line, Chongqing Xianshi Investment did not agree in accordance with the product contract, ensuring that the product was not allowed to open the position, resulting in further decline in net worth.

The above behavior violates the Interim Provisions on the Management Management Management Management Management Management of Securities and Futures Management Institutions "(announcement of the CSRC [2016] No. 13, hereinafter referred to as the" Interim Regulations on Private Equity Management ") and the" Interim Measures for the Supervision and Management of Private Equity Fund "(Hereinafter referred to as the" Administrative Measures for Private Equity ").

Furthermore, the company did not disclose the red Apple Fund from the third quarter of 2020 to the second quarter of 2021. Second, the company did not continue to disclose relevant information to investors during the continuous triggering early warning line. Third, when the Red Apple Fund triggered the stop loss line, the company did not disclose the information to investors within 5 working days in accordance with the contract.

The above behavior violates Article 24 and Article 16 and 18 of the "Administrative Measures for Private Equity Management" and Article 16 and 18 of the "Administrative Measures for Information Disclosure of Private Investment Fund".

In summary, in accordance with Article 33 of the Administrative Measures for Private Equity and Article 12 of the Interim Provisions on Private Equity Management, Chongqing Xianshi Investment has adopted administrative supervision measures with alert letter. Chongqing Xianshi Investment should carefully study and strictly abide by the regulatory laws and regulations of private equity funds, strengthen compliance management, and prevent such problems again.

According to the information of Tianyan Checai, Chongqing Xianshi Investment Management Co., Ltd. was established in October 2013. The registered capital is 10 million yuan, and the operating status is continuing. The scope of business includes general projects: enterprise investment management, corporate asset management.

According to data from the China Securities Investment Fund Industry Association, the registration and filing time of the Chongqing Xianshi Investment Association is September 7, 2017. The institution type is a private equity securities investment fund manager. Essence The company's actual controller Zhao Xingxia, legal representative and deputy general manager Yang Zhiyong. From the perspective of the company's equity structure, Da Fan Industrial Group Co., Ltd. holds 30%of Chongqing Xianshi Investment. Zhao Xingxia holds 31%of the shares, Gang Gang holds 20%, Su Jiawei holds 14%, and Zhang Xuefei holds 5%of the shares.

According to the association data, the management scale of Chongqing Xianshi Investment is less than 500 million yuan. The company has filled 21 private equity products in the association in total, of which 10 products have been liquidated. The Red Apple Fund involved in this time was recorded on July 9, 2020, and the product has now been liquidated in advance.

In July, multiple private equity institutions were punished by regulatory punishment

On July 1, the website announced by the China Securities Regulatory Commission Inner Mongolia Regulatory Bureau's website (hereinafter referred to as: Guangfeng Private Equity) decided to show a warning measures for Inner Mongolia Guangfeng Private Equity Fund Management Co., Ltd. There are many illegal acts.

First, some of the funds of management have set up funds with different income characteristics in accordance with different investment amounts, and there are different investors who treat the same fund unfairly; the second is the actual yield of some private equity funds from the income of some private equity funds from the target assets. Perform the obligation of caution and diligence. According to relevant regulations, the Inner Mongolia Securities Regulatory Bureau decided to take administrative supervision measures with alert letter from Guangfeng.

According to the information of the China Fund Industry Association, Guangfeng Private Equity used to use "Inner Mongolia Equity Investment Management Co., Ltd.", which was established in February 2012. It was registered as a private equity fund manager in April 2014. Investment fund managers, the management scale is 200-5 billion yuan.

From the perspective of the company's equity structure, Guangfeng Private Equity shareholders are China Everbright Industrial (Group) Co., Ltd., Beijing Golden Naming Information Technology Co., Ltd., and Beijing Shengli Investment Management Center (limited partnership). , 30%, 30%.

On July 4, the Xiamen Securities Regulatory Bureau issued a decision on the order of ordering correction on the equity investment of Dongfang Huifu. According to the public information, there are 4 problems in Chongqing Xianshi Investment. One is to manage some of the private equity funds that have not been filed. Among them, individual investors invest in a single private equity fund for less than 1 million yuan; the second is to put some private equity The fund is used to borrow foreign money, and the balance of the loan exceeds 20%of the fund's actual payment amount. At the same time, some fund borrowings provide the borrowing period for the actual controller or third party, and some funds of some funds. Investment has not been confirmed in industrial and commercial, of which the equity of the investment overseas is held by the actual controller or others; the fourth is that the fund has not carried out risk rating on the fund in accordance with regulations.

- END -

Specific implementation methods for social security!These companies and individuals can apply

Picture Source: Wuhan People's SocietyOn May 26, the Wuhan Municipal Human Resourc...

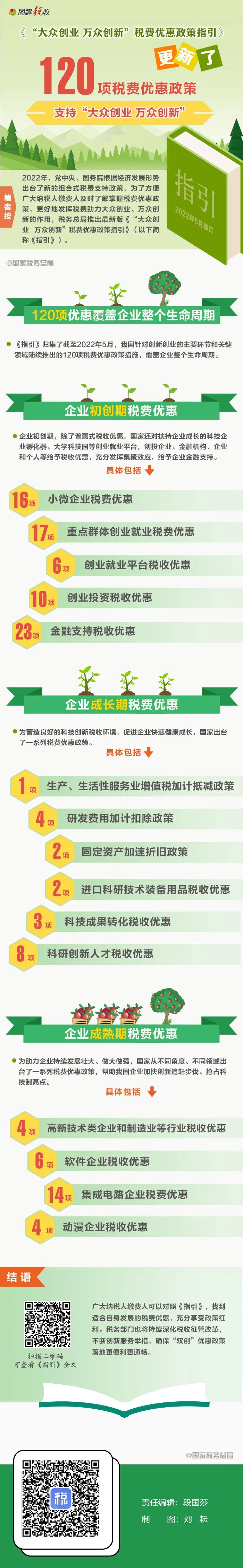

Support "Volkswagen Entrepreneurship and Innovation", please collect these 120 preferential policies

(Source: WeChat of the State Administration of Taxation)