Caixin Wen | The collective decline of commodities affects A shares, 3,400 stocks flutter green

Author:Poster news Time:2022.07.06

Popular Network · Poster Journalist Shen Tong Jinan Report

On July 6, the collapse of the commodity of the commodity was transmitted to A shares, bringing the entire resource sector with a decline in the entire resource sector. The energy sector fell more than 5%, ranking first in the sector, and dragged A shares to weaken. At the same time, Liangrong's funds continued to flow into the trend, and foreign capital began to flow slightly. As of the closing, 3,400 stocks in the two cities fluttered, the Shanghai Stock Exchange Index fell 1.43%, the Shenzhen -Chengxin Index fell 1.25%, and the GEM index fell 0.79%. Although the transaction volume has shrunk slightly, it still maintains a trillion level to 109 trillion. As of July 6, the A -share transaction volume has remained more than trillion -dollar levels for 10 consecutive trading days.

In fact, from June 6, the market volume can be maintained at an average of more than trillion -dollar levels, which is significantly enlarged from April and May. Judging from the recent trading volume, the market high volume has risen, and the short -term signs of the heads have emerged.

(3,400 stocks of two cities fluttering green, the car sector fell sharply)

The commodity collapse, the resource sector is weakened as a whole

On July 6, the A -share market fell as a whole. Most of the industry sectors were green. Auto and automotive parts, semiconductor and semiconductor production equipment sectors turned red, ranking among the forefront of the sector.

According to the weekly report data reported by the China Automobile Association, the sales volume of the automotive industry is expected to complete 2.447 million units in June, an increase of 34.4%month -on -month, and a year -on -year increase of 20.9%; from January to June Essence

From the perspective of the cars and car parts sections in the first increase, Wanzhong Control, Tiancheng Self -Control, Zhejiang Xiantong, Jiangling Automobile, Wencan, Chunfeng Power, Shanghai Everbright Co., Ltd., Southern Seiko %, Xinrui Technology, Guangdong Hongtu, Jinzhong Co., Ltd., Linglong Tire, Kaizhong Shares, Tianqi Model and other stocks also increased.

From the perspective of the decline section, the energy sector declined by 5.21%, ranking first in the sector; consumer services, transportation, media, real estate, food and beverages and other sectors also declined.

The decline in the energy sector is mainly closely related to weakening the price of international commodities. Overnight Beauty Oil's contract fell 8.19%in August to $ 99.55/barrel; cloth oil September contract fell 7.67%to $ 104.8/barrel. Earlier, Citi Bank warned that due to economic recession, oil prices may fall to $ 65/barrel at the end of the year; in all recession, oil prices will fall to "marginal costs"; By the end of 2023, it will drop to $ 45/barrel; the demand for global crude oil will be further softened, which should lead to increased inventory and soft prices.

The main funds of the main funds are more than 50 billion yuan, and the funds of the north are sold slightly.

From the perspective of industry funds, the net outflow of the main funds on July 6 was more than 50 billion yuan, and all sections were net out of net. Among them, the net outflow of the material sector exceeded 17 billion yuan, ranking first; There are also a lot of outflows; 1.382 billion yuan in net sales of funds in the north, a small net sales for two consecutive days. The cumulative net purchase amount this week was 1.771 billion yuan. Judging from the recent trend of capital changes in the north, with the high level of the index, the buying intensity of the north funds has weakened significantly.

In terms of the two merits, as of July 5, the balance of A -share financing and securities lending was 1614.662 billion yuan, an increase of 3.997 billion yuan from 1610.665 billion yuan from the previous trading day, and the 1.6 trillion mark was on the 4 consecutive days. From the perspective of the changes in the balance of the two meling, with the recovery of the market, leverage funds have quickly increased their positions. Since the low in early June, the balance of the two financing balances has increased by more than 100 billion yuan.

The maximum pre -increased performance of 38 companies' interim reports is over 100%, and the material sector is expected to become a half -year report performance pre -increased.

At present, the disclosure of the listed company's interim reporting period is affected by the industry cycle and market prosperity, and the performance growth rate of individual stocks in different sectors is quite different.

Wind statistics show that in the first quarter of 2022, 693 companies had a net profit growth rate of more than 50%, and net profit exceeded 20 million yuan, of which 194 was the material sector company , Accounting for 18%; 55 companies in biopharmaceutical sectors, accounting for 8%; 54 technical hardware and equipment sectors, accounting for 8%; 48 semiconductor and production equipment sector companies, accounting for 7%. It is not difficult to see that the material sector is expected to become a popular section of the semi -annual report.

Specifically, in the first quarter of 2022, 84 companies' net profit exceeded 500 million yuan, and the growth rate exceeded 100%. Among them, Jiu'an Medical, Anxu Biology, Yonghui Supermarket, Jinjiang Online, Tianqi Lithium Industry, German Nanim, Yahuilong, Yahua Group, Andong Holdings and other companies have exceeded 1000%in the first quarter; Tianhua Chaoping, Shengxin Lithium, China Mining Resources, Jiangte Electric, Duofluoro, Daquan Energy, Ganfeng Lithium Industry and other companies in the first quarter also exceeded 600%. Some companies have released the semi -annual report From the perspective of the relevant company industry, the material sector company occupies the majority.

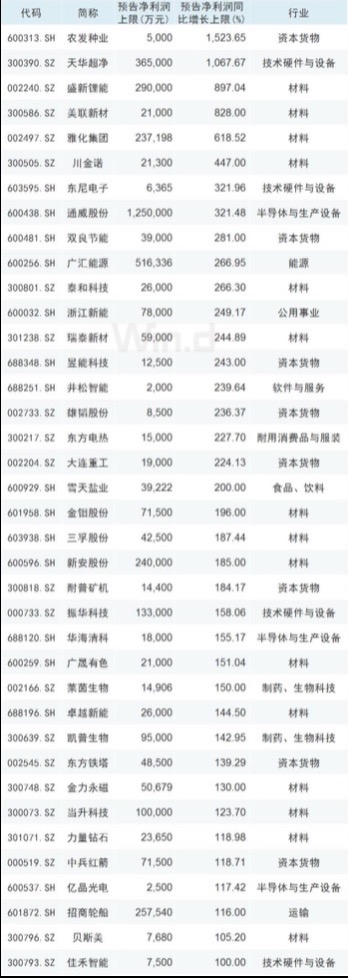

According to Wind statistics, more than 100 companies have issued the interim performance previews. From the perspective of the performance of relevant companies, most companies' performance has shown a significant growth trend. Among them From the perspective of a large -scale pre -increased company's industry, the material sector is still a gathering place for high pre -increased companies. The performance of the interim reported increased by more than 200%. (Ranking of net profit growth in the semi -annual report of 2020)

The institution is optimistic about the six main sectors of the scenery, military, consumption, medicine and tourism

Zhang Jiqiang and Yin Chao, researchers of Huatai Securities, believe that the overall support of the stock market is still supported. First, the economic recovery continues, and the risk preferences are still improved. With the bottom of the stock base sales, the cooperation of institutions and other funds is increasing. However, at the same time, the vacuum period of performance is over, and the investor mentality of the reporters is generally relatively cautious; and the cost performance of the stock market has decreased, the valuation attractiveness is not obvious, and the fastest stage of the stock index may have passed. Based on this, Zhang Jiqiang suggested that the current configuration main line may be transferred from the outside, recovery acceleration ## _FORMAT_GT_ ## 基 基 ## _ FORMAT_GT _ ## Overseas disturbance, the sector revolves around the interim report and policy mining, the subdivision of landscapes, military industry, consumption and medicine in medicine Chance. Looking to the market outlook, we are optimistic about the six main sections of the scenery, military, consumption, medicine and tourism.

(Risk reminder: Investment is risky, information is for reference only. The listed companies listed above only state that it is related to the incident and does not act as a specific recommendation. Investors should make investment decisions and bear investment risks by themselves.)

- END -

Rural Revitalization | "Township Jug" series of melancholy media programs blowing "three -rural cultural wheat incense"

Since June 6, the Central Radio and Television General Taiwan Agricultural and Rur...

In May 2022, local government bonds issuance and debt balance

1. The issuance of local government bonds in the country(1) The issuance of the mo...