The offer of more than half of the shares is nearly 8.9 billion!Guosheng Gold Control "takeover" preliminary determination: the Jiangxi State -owned Assets Team Group subscribed

Author:Daily Economic News Time:2022.07.06

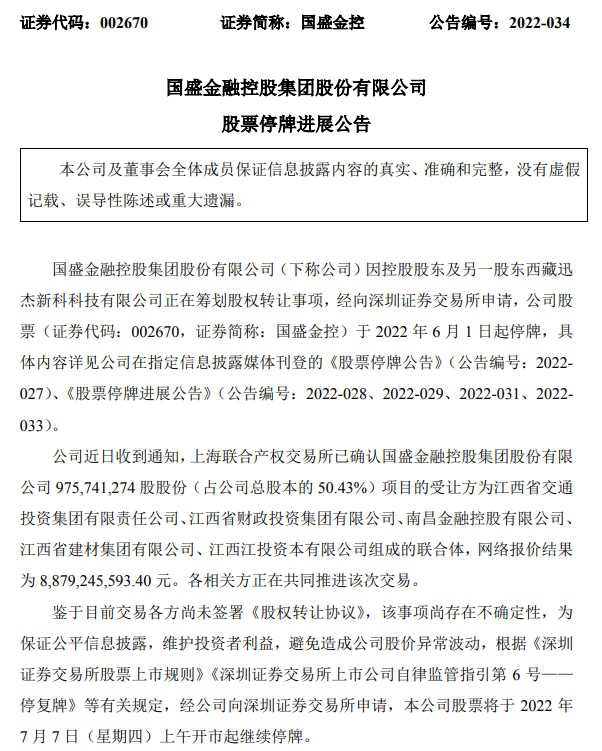

On the evening of July 6, Guosheng Financial Holdings (SZ002670, closing price before suspension: 9.60 yuan, total market value: 18.58 billion yuan) issued an announcement. Investment Group Co., Ltd., Jiangxi Provincial Financial Investment Group Co., Ltd., Nanchang Financial Holdings Co., Ltd., Jiangxi Provincial Building Materials Group Co., Ltd., Jiangxi Jiang Investment Co., Ltd., the network quotation result is 8.879 billion yuan, and the stock continues to suspend trading.

If the acquisition is completed, Guosheng Golden Control will be nationalized

Guosheng Gold Control Stocks have been suspended from June 1, 2022. At that time, the announcement showed that Zhangjiagang Cai Zhi and its consistent actions Shenzhen Qianhai Caizhiyuan Investment Center (limited partnership), Beijing Phoenix Caixin Equity Investment Center (Limited Partnership), Beijing Phoenix Caizhi Innovation Investment Center (limited partnership), limited partnership (limited partnership), It will be with the company's other shareholder Tibet Xunjie New Science and Technology Co., Ltd. (hereinafter referred to as "Xunjie New Science"), which will publicize the collection of 50.43%of the equity transfer party held by the Shanghai United Property Exchange. share. In view of the above matters, there is still significant uncertainty. In order to ensure the disclosure of fair information and safeguard the interests of investors, Guosheng Gold Control Stocks will be suspended from June 1, 2022. It is expected that the suspension time will be 30 trading days.

According to the information of the Shanghai Stock Exchange, the reserve price of 976 million shares of Guosheng Gold is 8.879 billion yuan. This means that the above five acquisitioners will subscribe to Guosheng Gold Control shares at the bottom price.

Qixinbao data shows that the five acquisitions are all state -owned.

Among them, the investors of Jiangxi Provincial Transportation Investment Group Co., Ltd. are Jiangxi Provincial Department of Transportation and Jiangxi Provincial Administrative Business Asset Group Co., Ltd. The investor of Jiangxi Provincial Finance Investment Group Co., Ltd. is the Jiangxi Provincial Department of Finance. The investor of Nanchang Financial Holdings Co., Ltd. is Nanchang Industrial Investment Group Co., Ltd. The investor of Jiangxi Provincial Building Materials Group Co., Ltd. is Jiangxi Investment Group Co., Ltd. The investor of Jiangxijiang Investment Co., Ltd. is also Jiangxi Investment Group Co., Ltd.

This also means that if the equity transfer is currently announced in accordance with the currently announced plan, Guosheng Financial Holdings will be nationalized.

Guosheng Securities has been taken over in the past two years and a loss in the past two years

It is worth mentioning that in the documents of the Shanghai United Property Exchange, Zhangjiagang's financial wisdom and other requirements, the intention of the intention must agree to maintain the relevant work arrangements of Guosheng Securities's stable operation, including but not limited to the place of registration of Guosheng Securities. Promise to maintain the stability of the company's main business and employee team.

Guosheng Securities is the core subsidiary of Guosheng Financial Holdings, which is registered in Nanchang, Jiangxi. From the above -mentioned transferee, it can be seen that the Jiangxi State -owned Assets Team subscribed to meet this condition without suspense.

It is precisely because of the company's corporate governance problems caused by the actual controller that Guosheng Securities has been taken over by the Securities Regulatory Commission for nearly two years.

On July 17, 2020, a total of nine financial institutions were announced by the China Banking Regulatory Commission and the Securities Regulatory Commission. Among them, the China Securities Regulatory Commission issued an announcement that decided to take over the new era of securities, Guosheng Securities and Guosheng Futures, from July 17, 2020 to July 16, 2021.

According to the announcement, the reason why the three brokers or futures companies are taken over to "conceal the actual controller or shareholding ratio, and the company's governance imbalance". In order to protect the legitimate rights and interests of investors, maintain the securities market order, and take over in accordance with relevant regulations.

The China Securities Regulatory Commission organized the establishment of a new era of securities reception group, Guosheng Securities' takeover group, and Guosheng Futures reception group. The leader of the securities takeover group in the new era is Lin Wen; the leader of Guosheng Securities's takeover group is Zhou Jun; the leader of Guosheng Futures reception group is Wang Dengyong.

From the date of taking over, the receiving team exercised the management power of the company's management, and the leader of the reception team exercised the authority of the company's legal representative. New era Securities, Guosheng Securities, Guosheng Futures shareholders 'meeting or shareholders' meeting, board of directors, supervisors, and managers stop performing their duties. During the takeover, the receiving team is responsible for maintaining the company's operations and regulating the company's equity and governance structure.

At the same time, during the reception period, the China Securities Regulatory Commission commissioned China Xinjian Investment to establish a new era securities custodian group, entrusted AVIC Securities and China Merchants Securities to establish Guosheng Securities Custody Team, and entrusted Guotai Junan Futures to set up Guosheng Futures Custody Team. Under the guidance of the hosting team, the hosting team carried out work in accordance with the custody agreement.

On July 16, 2021, the CSRC announced that it will extend the period of taking over Guosheng Securities, New Era, and Guosheng Futures for one year.

According to the first quarterly report disclosed on April 30, 2022, the total operating income in the first quarter of 2022 achieved a total operating income of 523 million yuan, an increase of 0.5%year-on-year; the net profit attributable to the mother was -38.75 million yuan, which was 28.428 million yuan in the same period last year. In 2021, Guosheng Financial Holdings performance is acceptable, and the net profit attributable to shareholders of listed companies is about 76.89 million yuan.

It is still a greater impact on the operation of Guosheng Securities. In the 2021 annual report, Guosheng Financial Holdings also stated in liquidity risk prompts that due to the influence of the core subsidiary Guosheng Securities, the company's main body and debt ratings were continuously reduced, the external financing capacity was significantly weakened, and there may be effective in the short term that may not be effective in the short term. The financing method is timely to get enough funds to pay the liquidity risk of the principal and interest of the bonds this year.

The one -year period is coming today.The new era securities have completed the change of equity, and China Chengtong has obtained 98.24%of the new era securities for 13.135 billion yuan. The new era securities no longer exist, and it is replaced by "Chengtong Securities".Judging from the current situation, Guosheng Securities is likely to complete the change in the future.Daily Economic News

- END -

Until the disclosure of the reduction plan, Vivi Group was supervised and warned

Zhongxin Jingwei, July 18th. Due to the failure to disclose the reduction plan in advance, it was warned by the Shanghai Stock Exchange (referred to as Weiwei Group).The Decision on Supervision and W

Don't eat anymore!Such foods, banned sale

Gold foil ice cream, gold foil cakeGold foil chocolate ...In recent yearsSome merc...