Nearly half a year after "loss", Dong Qing's husband Mi Chunlei "appeared"!Last year's wealth exceeded 10 billion, and now its listed companies are about to delist

Author:Daily Economic News Time:2022.07.06

"Shanghai Invisible Rich" and "Husband Dong Qing" ... Mich Lei has multiple labels. In the past six months, A -share company delisted Haisao (600896, the stock price was 1.01 yuan, and the original stock was referred to as Lanhai Medical) on the evening of July 6 disclosed the news of the return of Michunlei.

The company stated that since July 7, Mi Chunlei has fulfilled the duties and chairman of the company's chairmanship normally, and no longer authorizes Ni Xiaowei to fulfill the duties of the chairman. However, in the past six months of "lost contact", Lanhai Medical has undergone significant changes. The company has become a delisting stock, which has been terminated to the market. It is currently in the period of delisting.

The return of Mi Chunlei made some investors in the delisting sea doctor a little excited, with a view to the chairman led the company out of the predicament. Earlier, on the evening of June 20, the delisting sea doctor announced that the company received the Shanghai Stock Exchange's "Decision on Termination of the Stocks of the Haihai Medical Industry Investment Co., Ltd." on the same day, and the Shanghai Stock Exchange decided to terminate the company's stock listing.

Since the beginning of 2022, Mi Chunlei has been unknown. According to upstream news reports, another well -known identity of Mi Chunlei is the husband of the famous host Dong Qing. The Hurun Rich List in 2021 showed that Michuna's wealth exceeded 10 billion yuan.

Image source: Ji Mu News Video Screenshot

Michun Lei is back

In the past six months, Mic Chunlei, chairman of the delisting sea doctor, returned.

Image source: Ji Mu News Video Screenshot

On the evening of July 6, the delisting sea doctor disclosed that the director and chairman Mi Chunlei authorized the company Ni Xiaowei to fulfill the duties of the chairman of the chairman for personal reasons. Mi Chunlei fulfilled the duties and chairman of the company normally, and no longer authorized Ni Xiaowei to perform the duties of the chairman.

Recently, news about Michuna's "loss" has been fermenting in the market. In early 2022, Mi Chunlei was unknown and was in a state of loss.

On January 29 this year, the delisting sea doctor issued the "Announcement on Promoting the Responsibilities of Chairman Ni Xiaowei Chairman Ni Xiaowei", saying that the company recently received written authorization from the chairman Mi Chunlei, authorized the company's director Ni Xiaowei to fulfill the duties of the chairman. After review and approval by the 20th (temporary) meeting of the 10th board of directors of the company, they agreed to recommend the duties of the chairman of the company's director Ni Xiaowei.

However, 3 months later, on April 12 this year, the delisting sea doctor released the "Announcement on the Progress of the Chairman's Authorization", saying that the company has recently received written authorization, recommendation and authorization issued by the company's chairman Mi Chunlei again, recommending and authorization. In order to fulfill the duties of the chairman, Ni Xiaowei, the company's director, has the authorization period from April 7, 2022.

On April 27, the delisting sea doctor said in the announcement of the regulatory letter of the Shanghai Stock Exchange that the company could not get in touch with Mi Chunlei. The delisting sea doctor said that the company's high attention to the situation that Mr. Mi Chunlei could not perform his duties normally. Unveiled information. Given that the company cannot get in touch with Mr. Mi Chunlei, the company will continue to pay attention to the progress of the matter, and to fulfill the information disclosure obligations in a timely manner according to the progress of subsequent verification.

Once again authorized Ni Xiaowei's duties of the chairman of the bank, which made Mi Chunlei's "lost contact" remarks began to be very arrogant. Now, after nearly half a year, Michun Lei has finally "appeared".

In addition to serving as the chairman of the company, Mi Chunlei is also the actual controller of the delisting sea doctor.

According to the equity relationship, as of the end of the first quarter of 2022, Shanghai Lanhai Investment Co., Ltd. and Shanghai Laid Life Medical Industry Co., Ltd. ranked first and second largest shareholders of the seller and the second largest shareholder, respectively. %And 8%of the shares, while Shanghai Lanhai Investment Co., Ltd. and Shanghai Luanshou Medical Industry Co., Ltd. are the actual control enterprises in Lanhai Holdings (Group) Co., Ltd.

The equity relationship shows that Luanhai Holdings (Group) Co., Ltd. was directly held by Michun Lei by 91.38%, so Michunlei was the actual controller of the delisting sea doctor.

In addition, the whereabouts of Michuna's whereabouts have attracted much attention from the market, which is also related to his other identity. It is the husband of Dong Qing, a well -known host.

The Securities Times reported earlier. According to reports, Michuna was born in Chongming, Shanghai. In 2003, it was founded by Lahai Holdings (Group) Co., Ltd., which is quite low -key and mysterious. On the Hurun Rich List in 2019, Michri ranked 684 yuan for RMB 6 billion. Miya Lei was on the list again in 2020, with a net worth of more than 10 billion yuan. The Hurun Rich List in 2021 showed that Michuna's wealth exceeded 10 billion yuan.

The company has entered the period of delisting

Chairman Mi Chunlei receipt alarm letter

Nearly half of the "disappearance" of Michunlei, the delisting sea doctor also changed a lot, and the company has become a delisting stock.

On June 21 this year, the delisting sea doctor disclosed that the company received the stock to terminate the listing decision, and the Shanghai Stock Exchange decided to terminate the company's stock listing. It is understood that due to the negative value of the audit in 2020 and the operating income of less than RMB 100 million, the delisting sea doctor has been implemented by the delisting risk since May 6, 2021. On April 30, 2022, the delisting sea doctor disclosed the annual report of 2021, and the 2021 financial report was issued a audit report for reserved opinions. According to relevant regulations, Lanhai Medical Stocks will enter the delisting period on June 28. The simplicity of the securities will be changed from "*ST Sea Doctor" to "delisting sea doctor". The last trading day is July 18.

Image source: Daily Economic News (Data Map)

On June 20, the regulatory agency was punished by the regulatory agency with the delisting announcement of the delisting sea doctor.

According to the "Administrative Supervision Measures Decision" presented by the Hainan Supervision Bureau of the China Securities Supervision and Administration Hainan Regulatory Commission, the management level of the delisting maritime medicine and the company's chairman Mi Chunlei For information such as the creditor's rights, the Hainan Securities Regulatory Bureau decided to use Liu Lei, then the executive vice president and chief financial officer, Cai Zehua, and the secretary of the board of directors, and He Yongxiang, the secretary of the board of directors. Information database.

After investigation, there are illegal matters such as failure to disclose the funds occupation of related party funds and not disclosed the claims of the affiliated party in time in accordance with regulations. In 2021, the company's non -operating funds occupied by the controlling shareholder and its related parties, with a cumulative amount of 575 million yuan, and the funds and corresponding interest occupied by related parties were returned on June 7, 2022. The company did not perform the information disclosure obligations in accordance with the provisions of the funds occupation of the relevant parties.

In addition, in November 2020, the delisting sea doctor and the controlling shareholder Shanghai Lanhai signed an agreement to transfer 51%equity of Shanghai Hefeng Hospital and 512 million yuan of 5.12 billion yuan of debt to Shanghai Lanhai. In order to confirm the relevant creditor's rights, the company signed the "Loan Agreement" with Hefeng Hospital, which agreed that the repayment period of the remaining loan was one year after the transaction was completed. The company completed the asset transfer procedures for 51%of the equity of Hefeng Hospital on January 25, 2021. The above claims have expired on January 24, 2022. The company failed to recover in time, nor did they not recover the announcement of the issuance of the issuance in time.

In addition, according to the "Announcement on the Progress of the Occupation of Non -operating Funds Occupation of the controlling shareholders and related parties" issued by the delisting sea doctor on June 7. At present, the company's borrowing of 441 million yuan in shareholders of Hefeng Hospital and the interest should be The recycling plan is still in consultation with relevant parties.

According to the Daily Economic News, in response to this incident, the delisting sea doctor responded to reporters that given that the asset quality of Hefeng Hospital is very good, it is still in an advantageous location such as Shanghai Bund. Reach with other shareholders of Hefeng Hospital.

It should be pointed out that the delisting sea doctor has submitted a review application to the Shanghai Stock Exchange and the opinions issued by the law firm on the application for review. After the return of Michun Lei, the company investors were also quite excited. Many shareholders said that "the director said that the director Long return to lead the company out of the predicament. "

According to the Beijing Commercial Daily, Song Yixin, a lawyer of Shanghai Hankan Law Firm, told reporters that according to the "Self -Regulatory Hearing Procedure Rules" issued by the exchange, during the process of disciplinary sanctions or termination of the listing audit, the parties could apply for a hearing, and the exchange should should Listen to the parties' statements and defense opinions.

However, in terms of previous experience, even if a review application is submitted, the company wants to avoid delisting. It has been basically hopeless. Since this year, many delisting companies have submitted a review application, but they have not avoided the fate of delisting.

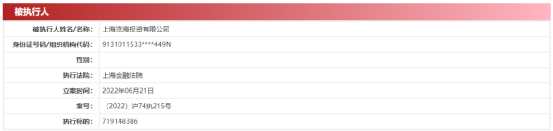

Miyanglei and Lanhai Holdings have been forced to execute over 700 million yuan

Earlier, China Executive Information Disclosure Network showed that on June 21, Michimi, Shanghai Lanhai Investment Co., Ltd., and Lanhai Holdings (Group) Co., Ltd. were newly executed, and the implementation of about 719 million yuan. The executive court was Shanghai. The financial court, the case number (2022) Shanghai 74 is No. 215.

In addition, due to judicial assistance, the relevant equity held by Lanhai Holdings was frozen.

Qixinbao showed that Shanghai Lanhai Investment Co., Ltd. was holding 100%of the shares of Lanhai Holdings (Group) Co., Ltd., and finally controlled the human Michun Thunder. Lahai Holdings (Group) Co., Ltd. was established in 2003 with a registered capital of 6.5 billion yuan. Michuna is the company's legal representative and executive director. The shareholding accounts for 91.38%.

Edit | Cheng Peng Dubo Gai Yuanyuan

School pair | Duan Lian

Cover picture source: video screenshot

Daily Economic News integrated from an app (Reporter: Xu Libo), Beijing Commercial Daily

Daily Economic News

- END -

Li Yaxu: Grid Grid Supervision, implement the four "strictest" "the most stringent" to protect the "Nong'an" | County Mayor Rong'an ②

Editor's note: Zhaoqing City is the third batch of national agricultural product q...

Why can these bank services be recognized by Hangzhou small and micro enterprises?

Economy is the body and finance is blood. How to make financial blood flow through...