Discovery 1001 | 618 Special TOP30: Tide Play, Coffee category rushes out of the "black horse"; new brands are fiercely confrontation, refined operations become mainstream

Author:Daily Economic News Time:2022.07.06

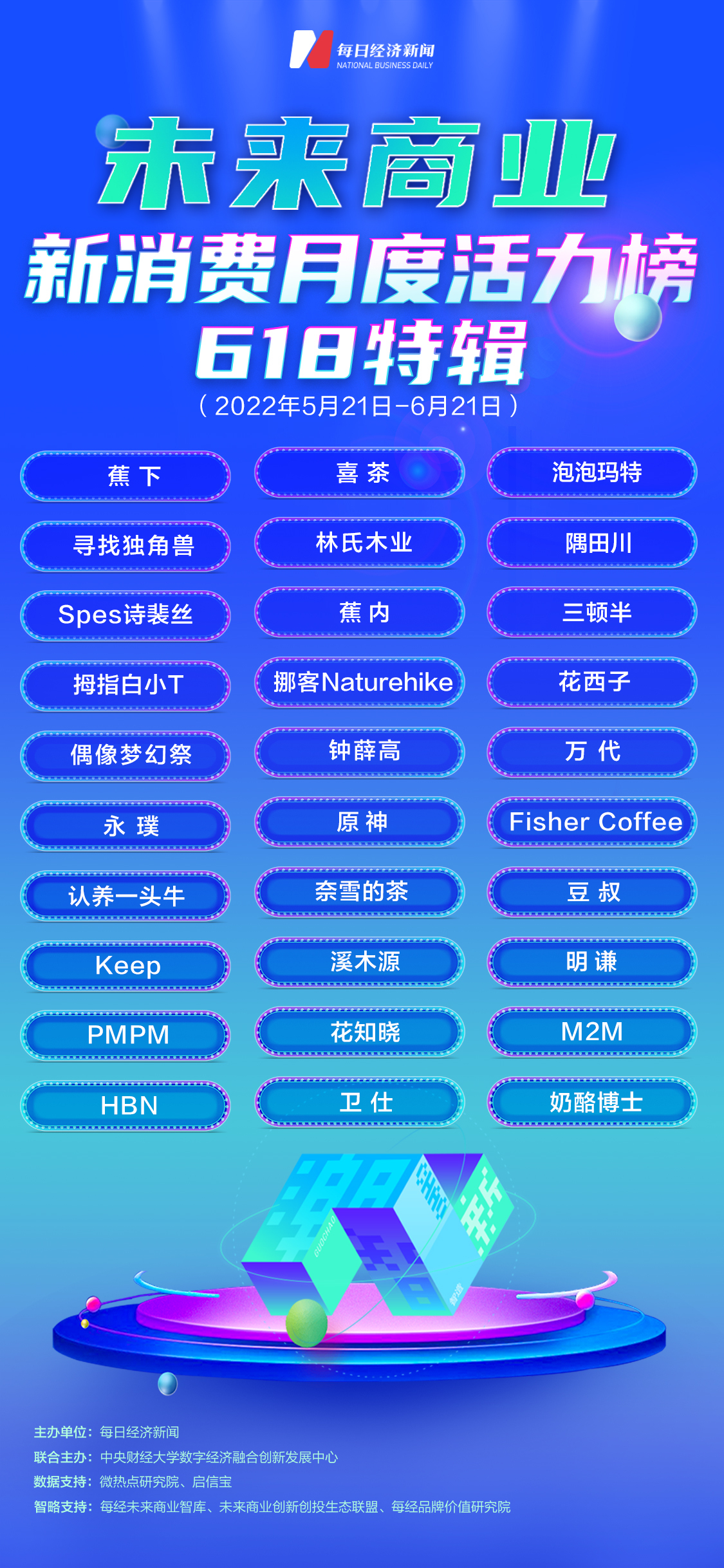

It was discovered that 1001-2022 618 special "Future Business-New Consumer Monthly Vitality List TOP30" was hot.

This is the launch of "Find 1001 • Future Commercial-New Consumption 'Following Light Plan" in September 2021 and continuously released a series of monthly lists (with special links).

Compared with previous years, it was very different from previous years, and it was even regarded as "the most difficult 618 in history" by the industry. On the one hand, affected by the epidemic, before 618, some cities, including Shanghai, had poor delivery on online shopping. Special hopes for boosting consumption confidence.

On the other hand, the main participants of 618 this year also changed: JD defines 2022 as the "first year of supply chain value"; this year is the first 618 ushered in the Taobao Tmall's movement. Consumption; in addition, 618 this year, Douyin e -commerce was upgraded to a global e -commerce for the first time, and the WeChat video number also participated in the first battle for the first time.

On the whole, although this year's 618 is full of challenges, it still reveals the vitality of consumption. JD data shows that in 2022, the 618 platform accumulated an order amount reached 379.3 billion yuan, a year -on -year increase of 10.3%compared with last year, setting a new record. This year, Tmall 618, 410 new brands have a growth rate of more than 100%.

Under the complex situation, what is the difference between this year's new consumer brand? Each year 618, the new consumer brand has to try a small test to prove its strength to the outside world. The list of this issue has therefore focused on new consumer brands that emerged during the 618 period, and analyzed the new consumer map behind the new brand trend.

The participation time of the list on the list of the list was uniformly selected from May 21st to June 21st, covering the overall cycle from the starting to the end of the pre-sale of 618. Participating companies are mainly based on the independent registration of new consumer brands, platform/investment institutions, and combined with media platform surveys. Through our system and multi -dimensional scoring system, they finally get the ranking.

During the 618 period, each platform disclosed to varying degrees of segmented tracks and sales data of some new consumer brands; however, Volkswagen's point of view is very important for us. Continuing the previous monthly vitality list score system, Volkswagen's voting weight accounted for 50%. This time, the Volkswagen voting we recovered was effectively filled in 1642 votes.

Based on the network communication heat index algorithm provided by the micro -heat dot research institute, the weight of the new brand "industry influence" score provided by the new brand provided by 40%. This index refers to the use of a large amount of information such as website, interactive forum, Weibo, public account, client, video, digital newspaper, evaluation and other Internet platforms, extract related information, characters, brands, regions, etc. After the extraction information is standardized, the index that can reflect its attention on the Internet can be concluded. The popularity of the network communication pointed out that the information in the information does not distinguish positive and negative information, but a brand that obviously produces negative public opinion for incidents such as operational, quality control or consumer rights protection, and the evaluation team evaluates it to cancel the qualifications of the month of the month.

Considering the growth of the new brand, the financing scoring of the new brand provided by Qixinbao's data support also accounts for 10%of the weight of the list.

As a professional media that has long cultivated the field of listed companies and pays attention to the development of new economic development, the future business think tank under the Daily Economic News continues to launch the new monthly vitality list of the new consumption. True business ecology and development trends. Through the incubation and tracking of the sustainable and qualitative changes of the new brand, the big waves and sand, removing the Wu Cunjing, and the new consumption, new national tide, and new intellectual manufacturing under the historical opportunities of the pulse era.

【Highlights in this issue】

Tide play, coffee categories are rushing out of the "dark horse"

618 each year is an important window for displaying new products, new brands and new consumption trends. From the record of major new brands, it can be found that no matter how the situation changes, the change of consumer concepts continues.

在本期618特辑TOP30里,新品牌品类越发多元,包括但不限于美妆大品类(含彩妆、肌肤护理、以及美妆需求延伸垂类品牌)、服饰大品类(含运动内衣、潮流运动、 Two -dimensional clothing, as well as vertical brands with demand); drinks (tea rushing, coffee, wine), and tide play categories, pet categories, etc.

From the perspective of the overall classification of the list of brands, the category of Chaowan products and drinking beverages jumped into dazzling categories, accounting for 5 of the 30 on the list of the list, respectively, accounting for 16.7%and 30%. Beauty categories have stable performance, with 5 on the list of 16.7%.

The strong sense of presence of the Chao Play brand cannot be ignored. Obviously, more and more emerging play brands are rising after Bubble Mart.

It is understood that during this year's Tmall 618, the tide game market showed higher quality, intelligent, and IP consumption characteristics, as well as artistic, playable, and collectible consumption trends. From the post -80s to the 10th, all the "big friends" and "children" circle of interests and needs, sales performed more segmented during the 618 period.

Interestingly, from the perspective of IP and playability, the surrounding game has become a "dark horse" in the 618 tide market this year. Data show that during the Tmall 618 period, the sales of the game of the game increased by 120%year -on -year. Among them, the surroundings of the idol development game "Idol Fantasy Festival" were more than 5 times year -on -year, and the transaction of the open world adventure game "The original God" was 1.2 times year -on -year. Some "outsiders" people's preferences that cannot be understood by the people can drive the sales of new brands.

During the Tmall 618, the "Idol Fantasy Festival 2 Stars of the Idol Fantasy Festival 2 Stars" caused a heated discussion on the game circle. The original flagship store's explosion of "Ning Light · Hidden Moon Heaven", the sales during the 618 period exceeded 10 million, of which the post -95s and post -00 consumers accounted for more than 60 %.

In addition to the tide, the coffee category also rushed out of this 618. Except for the long time and half -famous and Yongyu, the rise of Sagita Ichikawa, Fisher Coffee, Uncle Dou (Beijing Haofang Coffee Co., Ltd.), and Mingqian and M2M are all surprised.

According to Kun Cheng, the person in charge of the Tmall Coffee Rushing Industry, from the consumption of 618 this year, we can also see the new pattern of the coffee market development: while the boutique portable coffee represented by Santun and Penchen Kawa continues to sing, the boutique Niche coffee bean brands are also emerging. M2M, Mingqian, Uncle Dou, Fisher Coffee, etc. are all among the industry's head brands.

Banskawa Coffee provides Tmall as its main position.

As far as the categories of beauty products are concerned, it is also the emergence of emerging. Except for Hua Xizi, Ximuyuan, PMPM, Hua Zhi and HBN are all emerging forces on the list.

This year, Tmall 618 pre -sale of the opening, the full set of crystal gift boxes that are known to be known to be sold out, Xinrui skin care brand Ximuiyuan sold the classic camellia water milk set, the main HBN, which focuses on skin care, has exceeded 100 million yuan with explosive products. Essence

Founded in April 2020, Spes Poetic Peishe has also become a climate. It is understood that SPES Poetry's sales in Tmall 618 increased by more than 5 times year -on -year, and efficient head care products were further increased among young people in the Z era.

According to the data provided by Tmall, the List of Tmall 618 in the Banana and Bananas is top3. According to the data provided by JD.com, during the 618 period, the overall turnover of the new trend category represented by bananas increased by more than 200%year -on -year.

The people use food as the sky, Zhong Xuegao, the three food brands of the natto and Dr. Cheese, also on the list.

During the 618th promotion of 2022, Zhong Xue Gao ranked first in the 618 Tmall ice category for the third consecutive year. Sales first. Adopting a cow said that as of June 20, the sales of a cow (including pre -sale) were 92.491 million yuan, ranking in the daily sales list (as of June 20) in the "coffee/oatmeal/drinking drink" Seventh.

Dr. Cheese can also be called the "dark horse" in food brands. In the opening one hour, he ranked first in Tmall 618 baby snacks and cheese categories. Elected to the two lists of Douyin E -Commerce Brands and TOP5. In JD Supermarket 618, the turnover of Dr. Cheese's official flagship store increased 24 times year -on -year.

Lin's wood industry, which is outstanding in Tmall 618 this year, is also among the top in TOP30 in this issue. Lin's Wood Industry ’s 618 turnover of this year is 1.11 billion yuan, and once again, TOP1, the TOP1 of the Tmall Home Furniture Furniture List, TOP1 in the whole network residential furniture industry.

【Data mining】

New brands have fierce confrontation, camping, health, and slow life lead the new trend of consumption

618 this year, combined with the related search and consumer data of JD.com and Tmall, consumers not only outline a new trend of camping, health, and slow life in their own shopping carts, but also show "value -based purchase "Reverse shopping" two trends.

Baidu X's "Baidu X X -Jingdong 618 Consumption Trends Insight Report" released by Baidu JD shows that more and more netizens are pursuing the functional value of the product, and strive to make the buying things not ashamed, for love and need to buy.

Earlier, the "2022 Taobao Tmall Camping Trends White Paper" released by Taobao Tmall showed that the camping method upgraded from traditional park camping and hiking camping to exquisite camping consumption. Tents, sky curtains, folding tables, folding chairs, moisture -proof pads, and camp cars have become standard six -piece set for many camping youths.

The emerging brand NatureHike seized the trend of exquisite camping and won the first result of Tmall 618 outdoor camping brand sales. Tmall 618 During the 618, the turnover of the sky curtain, camp car, and folding chairs exceeded one million yuan. From the obscure to the brand, the rise of NatureHike also reflects the changes in consumer demand.

NatureHike's explosion original tent picture launched at 618 Source: Corporate Figure Conferry

With the arrival of the national sports boom, the sports brand has also gained opportunities for development. The sports fitness brand Keep was selected for this list. During 618 this year, Keep was not limited to online channels, but participated in 618 in two lines in an online+offline manner. It is reported that the KEEP dynamic bicycles have sold more than 10,000 during the 618 period.

We analyze that the lifestyle of the new generation of consumers has driven the rapid rise of the new brand of "Houlang". According to the data provided by Tmall, this year Tmall 618, the new brand continued to outbreak, and the transaction growth rate of 410 new brands exceeded 100%. Among them, the pet brand "Wei Shi" is among TOP30 of the list in this issue. This domestic brand brand that focuses on pet nutrition food is strong. It ranks among the top five on the 618 pet industry sales list released by Tmall.

Wei Shi said that 618 this year, the overall turnover of Weishi Tmall flagship store reached 201%of the same period last year. During the Tmall 618, members of the pet brand increased strongly, and during the 618 period, membership transactions increased by nearly 50%year -on -year.

From 618 this year, it can also be seen that Chinese clothing consumption is diversified and personalized. Young consumers want to use clothing to show their own personality. This demand has spawned the emergence of many new styles and new technology products, and also formed a new blue ocean.

The thumb white small T is the new race of this new blue ocean. According to public information on the Internet, the "white small T" brand was founded in 2019 by the thumb wardrobe, and the brand focuses on male basic T -shirts. Bai Xiaoti believes that the basic model is simple and there is no complex design, so there are higher requirements for versions, fabrics, and craftsmanship.

It is this extremely subdivided positioning that helps Bai Xiao T's emergence. It is reported that from the establishment of the brand to the Q1 quarter of 2022, the entire network was exposed 7.2 billion times, sold 6.87 million pieces, and GMV was close to 1.1 billion.

It can be seen that the rise of new brands with more accurate positioning of consumer demand support positioning may also be the reason why the 618 emerging brand this year.

It is worth mentioning that 618 this year, the performance of some "stars" new consumer brands is not as good as in previous years. As the traffic is tide, some doubts also hit some new consumer brands. It can be seen that even the new consumption field has appeared in the situation of "new" and "old" forces. The new forces that focus on new concepts have begun to impact with new consumer brands that have become famous.

UBRAS without size underwear brand is selected in this issue of TOP30. Xu Liang, investors in the new consumer field, told the media that the concepts of "no size", "sense of technology", and "comfort" are more of the marketing "gimmick" used to attract consumers. The power will decline, and the company needs to propose updated products and new concepts.

It is worth mentioning that among the clothing categories, the underna, the banana, and the thumb white small T are all on the list, and under the banana that is sprinting the IPO, it also reached the list of this issue.

According to the prospectus submitted by Banana ’s recently submitted by Hong Kong stocks, from 2019 to 2021, Banana has achieved operating income of 385 million yuan, 794 million yuan, and 2.407 billion yuan, respectively, with a compound annual growth rate of 150.1%.

Behind the high growth rate, there are problems that are difficult to conceal. Re -marketing and development of marketing has almost become a common problem in the entire new consumer field.

Looking closely at the banana prospectus, it can be found that the marketing costs exceed the sales cost and become the most important expenditure content under the banana. From 2019 to 2021, the sales costs under banana were 192 million yuan, 338 million yuan, and 986 million yuan, respectively, accounting for 49.3%, 42%and 40.3%, respectively. However, the distribution and sales expenditure were 125 million yuan, 323 million yuan, and 1.104 billion yuan, respectively, accounting for 32.4%, 40.7%, and 45.9%of the revenue, showing a rising trend year by year.

In addition, the R & D investment in banana is relatively small.

The prospectus states that the banana has 123 patents in China, and 72 patents are in the application. According to relevant information, most of the 186 patents applied for bananas are designed with the appearance design, while less than 10 patents related to sun protection and authorized.

Recently, due to the high price of the product line, Zhong Xuegao, who became famous for many years, was also generally questioned by netizens. He was titled "Ice Cream Assassin", and the brand's praise was impacted.

We noticed that even a new brand that has achieved a certain achievement in the consumer market has problems that have not developed after listing. From the 0 to 1 stage, the new consumer brand needs to use its efforts to "marketing" to rise, but after the development to a certain stage, the new consumer brand still needs to return to the quality of product quality.

【Financing Window】

The overall investment in the new consumption is cold: TOP30 exceeds 80%of the financing record, only 4 of the financing this year

After the number of investment in the consumer industry reached its peak in August last year, new consumer investment showed a rapid decline.

In this context, in this period of TOP30, "Thumb White T" is the only brand that officially announced its financing during the 618 period. On June 18, "Thumb White T" announced that it had completed 170 million yuan B financing. This round of financing was led by Meihua Chuang Investment.

Zhang Yong, the founder of the thumb white little T, said that this round of financing will be used to build a laboratory and help brands develop high -tech fabrics. At the same time, it will also cover the business layout of brand building, overall digital transformation, product matrix expansion and offline stores and overseas markets.

Qixinbao showed that as of now, the thumb white small T completed a total of three rounds of financing. The last round of A round of financing occurred in March 2021. It was led by Huaying Capital and plum blossom capital.

According to the statistics of Qixinbao, 25 new brands on the list of this issue have recorded financing records. However, only 4 new brands were made in financing records in 2022. In addition to the thumb white T, in April this year, the outdoor equipment brand Mo Naturehike announced that it had completed nearly 100 million yuan in financing, which was exclusively invested by Zhong Ding Capital. This is the first time that the company has received external investment.

In March of this year, PMPM, a skin care product R & D producer, completed tens of millions of RMB strategic financing. The investors were Tencent Investment and Amber Capital.

In addition, Qixinbao data shows that in January this year, Dr. Cheese (Shanghai) Technology Co., Ltd. has a new round of equity investment. The investor is today's capital, Scep Holding; before, Dr. Cheese received the challengers of 20 million yuan in 2020 Angel round investment. In 2021, he obtained an follow -up investment from the Owato China Seed Fund's 150 million yuan, Xingnanh Capital, Wanbu Capital and other institutions.

Public information shows that Dr. Cheese was founded in May 2019. It is a cheese product brand. It is committed to creating a pure natural cheese retail brand platform.

Since the beginning of this year, the new consumer track has repeatedly revealed the saying of "bubble is clearing". In this context, carefully observing can find that these four new brands that have received financing in the first half of 2022 have matched new ones. Consumption trends also reflect the new trend of capital this year: the small finger white T compounds the general trend of diversified and personalized Chinese clothing consumption; Naturehike in Naturehike has caught up with the upsurge of outdoor sports and camping; It reflects that capital has begun to favors skin care; and the children's Jiankang Food Circuit is also a consumption point for capital recognition.

It is worth mentioning that, in addition to the new consumer brands that have favored capital, several brands that have never been publicly funded not only performed well in 618 this year, but also selected the TOP30 list in this issue.

Mingqian, Uncle Dou, Fisher Coffee, Idol Fantasy Festival and Bandai have not received the help of capital. It can be seen that even if the new brand is still opportunities to take advantage of the wind, even if it lacks capital.

[Trend insight]

Content marketing and private domain construction have become the focus of oversupply, and refined operations become mainstream

618 this year, the new brands have made "hard work". Most of the new brands with dazzling performance adopt tricks to attract consumers and increase sales. Among them, the content marketing methods and private domain membership construction of live broadcasts have become the focus of new brands.

It is understood that during the Tmall 618 period, members of the pet brand increased strongly, and the live broadcast performance of merchant brand stores exceeded expectations. There were 23 merchants who guided more than one million transactions through live broadcasts. Among the top 20 brands of Tmall 618, most of them have achieved considerable growth through members and store broadcasts.

From the perspective of specific brands, this year 618, Wei Shi focused on the fields of store live broadcasts, members and other fields. On the Tmall platform, Wei Shi's store broadcast reached 258%of the same period last year, and the membership turnover reached 268%of the same period last year.

"The live broadcast room is no longer a simple selling yard, but has become a" second flagship store "that transmits brand concepts and enhance brand influence. Li Haobo, the person in charge of the Communication Department.

Thumb white small T is also a skilled player in this set. According to the data given by the thumb white small T, the brand's entire network transformed 400,000 paid users in 2020, with revenue of nearly 100 million yuan. The annual revenue of 2021 was about 600 million yuan, an increase of more than 6 times. At the same time, Bai Xiaoti's private domain reown has exceeded 10 million a month, and the comprehensive repurchase rate of various channels exceeds 20%.

Rowling, the person in charge of the unicorn marketing center, said: "We continue to innovate gameplay, from drawing to self -broadcasting, from the box machine to more tools, providing more scenarios to allow consumers The fun brought. "

Find the island series of pictures launched by unicorns: Corporate picture confession

In Rowling's view, the outbreak of the brand in Tmall 618 is not accidental. In recent years, the existing public domain traffic resources of the unicorn use platform have been found to refine operations, and precipitated traffic has taken out the characteristic model of combining the "brand+IP".

Contentization is also the focus of these brands. It is reported that this year's Tmall 618, the Lin's wood industry layout short videos increased the live broadcast duration, uninterrupted from morning to 12pm, and interacted more with consumers; it also promoted the combination of store live broadcasts and offline, from the full -chain of consumption full -chain, from the consumer full -chain The road improves the user experience.

Liming Wood Industry Offline Stores Same products Synchronous Synchronization of Tmall 618 Source: Interviewee provided

Li Chengze, vice president of Lin's Wood Industry, introduced: "In the past two years, we can make 3D model rooms through each house and each house, use technology to improve the physical feelings of online shopping, give consumers more immersive shopping experience, and the overall effect is not bad. ","

Except for innovation in play, although I do n’t know how the prospects, many new brands on the list have the action of “fishing” in sea.

In early 2022, the thumb white small T opened the first offline store. Currently, offline stores are distributed in Shangbai, Cultural Tourism, and Community. The founder Zhang Yong said that the overseas market has also completed its business construction from 0 to 1, and the business exit business has been expanding the US market for three months in the TIKTOK British market for three months.

Hua Xizi was not idle. Since last year, the Huaxi brand has settled in a number of cross -border e -commerce platforms such as Amazon and Shopee, and its overseas independent stands in 46 countries and regions to open services. On the whole, in the adversity, 618 this year, the overall brand play of the new brand is diversified. If you want to get the sales data you have ever, the new consumer brand needs to spend more thoughts.

Many new categories run out of the "dark horse", on the one hand, it shows that the new consumer brand needs to be renamed from time to time to grow. On the other hand, in the context of the return of new consumer investment to reason, there are still opportunities in the new consumer field, but it is just The outside world will be more "high", and the evaluation standards will be more "harsh".

【Expert Reviews】

Chen Duan, director of the Digital Economy Innovation and Development Center of the University of Central Finance and Economics: Chen Duan:

Since August last year, the investment in the new consumer field has cool down, which is also a baptism of the large waves of sand bubbles for the entire industry. The competition is the innovation and evolution of the company.

Judging from the changes in the new consumption field since 2022, first, the intelligent and technological content of product innovation has continued to increase, and the second is that the IP content at the marketing level has continued to increase. The third is to combine scene iteration and product innovation. Gaowei's business innovation may become the development engine of the new consumer field in the future, especially the development of immersive commerce brings different judgment dimensions to consumer value. Broken cocoons into butterflies in competition.

Every time the brand value research institute Fukouyou:

On the list of 618 specials, many dark horses have emerged, and the "old and new forces" have been fiercely intertwined and dazzling. The categories, drinks and beauty categories occupying most of the mountains and mountains are all emerging and continued circle. This gives people a impression: the new consumer brand goes off the horse lights, and the waves of the Yangtze River push forward. The brand stability and sustainability are disappointing.

In terms of financing, the overall investment in the new consumption has further strengthened this impression. TOP30 exceeds 80%of financing records, but only 4 financing this year seems to have a sensitive capital, which has also doubted the investment value of new consumer brands.

However, if it is skeptical of the new consumer brand, and even think that capital has abandoned new consumer brands, it is not necessary and there is no sufficient basis.

Since it is new consumption, it is not the same as traditional consumption. At least two characteristics cannot be ignored. One is the new track and new categories, which emerge in endless emergence. They respond to the need for renovation of the new generation of consumer groups. It is the process of trying and exploring. The category of Dao Lao is as stable as Taishan; the second is the brand that was born, and more refined operations. In a large market in China, as long as the narrow track is positioned accurately, it may emerge. The flow of dark horses is exactly a manifestation of the prosperity of the new consumer market.

As for the stages of financing, it cannot prove anything. New consumption is a continuous and fiery market. Capital cannot be blinded. Sooner or later, they will turn over and enter the venue. This wait -and -see attitude is just a new requirement for the new consumer brand, that is, the brand needs to precipitate. No matter how new the new consumer brand is new, it also needs to prove a future that is reliable and sustainable. Therefore, instead of the capital withdrawal from the three houses, it is better to say that they are carefully selected with a profit -seeking vision to discover the future.

Daily Economic News

- END -

Dazhu County: Summer tube does not make mistakes to ensure food safety when farming

Sichuan high -quality agricultural product Hangzhou Bank: 7 projects will be signed in concentrated to help the "Sichuan character" sell to the Yangtze River Delta

From July 19th to 21st, the three-day Sichuan high-quality agricultural product Ha...