The bulk bull market has ended?Colors, agricultural products, and energyization are all falling, but A shares are "good on the scenery"

Author:Daily Economic News Time:2022.07.06

Since April 2020, the Reuters CRB product index has gone out of the bull market for two consecutive years, with the largest increase of 225%during the period.

However, after entering June, the inflection point of the CRB product index gradually emerged. Recently, domestic and foreign commodities, including non -ferrous metals, agricultural products, and energyization, have a collective decline in the price.

The changes in macroeconomic warmth have always been more sensitive to the "Dr. Bronze". A wave of rapid decline in the past month seems to be a microcosm of the performance of commodities. "Daily Economic News" reporter noticed that many industry people today discussed the recent decline and market outlook.

On the other hand, although the prices of commodities have generally fallen sharply in the near future, in general, A shares have recently showed a strong trend. A shares have led the world since May.

The price of commodities at home and abroad appears universal decline

Since the end of April 2020, the Reuters CRB product index has gone out of the bull market for two consecutive years, with the largest increase of 225%.

CRB Commodity Index Moon Line

However, since June, the inflection point of the CRB product index seems to have gradually emerged. Since the index was topped in early June this year, it has fallen by nearly 15%.

Correspondingly, in recent times, a round of collective declines in commodity prices at home and abroad, involving the scope of major categories such as non -ferrous metals, agricultural products, and energyization.

Yesterday evening, the price of international commodity futures fell sharply, of which nearly 8%of Brent crude oil plummeted.

Today, domestic commodity futures also closes to a large area, which can fell sharply, fuel oil fell more than 8%, low -sulfur fuel oil, palm oil, and crude oil fell more than 7%, asphalt fell nearly 6%, liquefied gas, Shanghai tin, Soy oil, Shanghai copper, international copper, and urea fell more than 5%.

Recently, non -ferrous metals are a category that has fallen more among commodities. After seeing a historical high in March this year, Shanghai and Xi opened a round of large -scale callbacks. In the past 4 months The maximum decline is as high as 54%. The changes in macroeconomic warmth have always been more sensitive to the "Dr. Bronze". Recently, a wave of rapid declines have also appeared, which has a certain representativeness in recent commodities. Today, the price of Shanghai copper has fallen to 55510 yuan/ton, and the main contract has fallen by more than 7%, and the price is new low. According to statistics, since the beginning of the year, copper prices have fallen by nearly 20%.

Regarding the cause of the decline in copper prices, Dapeng, Director of Everbright Futures Research Director, published a comment today, arguing that there are the following reasons:

1. Overseas aspects, with the densely interest rate hikes of the Fed, it has a greater inhibitory effect on the US economy. Overseas markets are expected to trade economy decline in advance. The demand prospects are dim and liquid tension. Essence In addition, the Federal Reserve's policy sword finger inflation, and the recession itself is also a stage of rapid decline in inflation. The prediction of inflation expectations is positively related to copper prices. Finally, the current strong upward trend of the US dollar also means that risk factors are gradually accumulating.

2. Domestic aspects, the epidemic is more repeated and affects the normal operation of the economy. Even if the domestic stable growth policy continues to land, the epidemic has restricted economic vitality, and market sentiment has become more cautious from expecting.

3. At the level of funding, in the first half of the year, regardless of domestic and overseas investors, the interest of copper holders is declining. The change shows how much funds are interested and then decreased.

Looking into the market outlook, Zhan Dapeng said that there are the following points to pay attention:

1. There are two positive and negative aspects in the macro expectation. First of all, with the collective recovery of commodities, inflation and inflation expectations will appear to fall, and the US economic data that will be fell rapidly, and the Federal Reserve's hawks may change. At the stage of the stage or the completion, the market emotions will improve; secondly, under the repeated epidemics of my country's epidemic, the corresponding stable growth policies will also increase their efforts to introduce and implement, and have a lagging response on economic impact or lag.

2. The current macro and fundamental sides begin to split. The static fundamentals have not changed significantly. From the existing economic data, it is difficult to improve the traditional color demand, and negative growth is inevitable; Insufficient needs. From the domestic supply and demand balanced forecast, combined with the macro prediction, the demand in the third quarter is expected to increase significantly compared with the second quarter. The first half of the year was significant and continuous.

3. In summary, the focus of market investment was pulled back to the real dilemma faced in 2022 from the distant 2030. The high primary product prices caused the backstream demand to reflect, and the authorities of the authorities were unable to tolerate the high inflation. In the end As a result, the copper price is periodic. The fastest stage of copper prices will be completed in mid -June to mid -July, and it is also the fastest stage of the air emotions. After that, with the slowdown of the Fed's monetary policy and the acceleration of domestic stable growth rhythm, emotion will improve, copper prices will be improved. It may have a certain rebound performance, but the height of the rebound is limited in the European and American tightening cycle. In the third quarter, the operating rhythm must be paid attention to. The price operating range is expected to be around 55,000 ~ 67,000 yuan/ton.

However, in contrast, the energy price declines represented by crude oil in the near future are relatively limited, and currently major institutions have a large difference in judgment on the trend of oil prices in the future. Hu Yifan, the investment director of the Asia -Pacific region and the macroeconomic director of the Asia -Pacific region, also looked forward to the international crude oil price market outlook in the media meeting held this morning. She believes that now, the main contradiction of commodities is the conflict between Russia and Ukraine, and now the Russian -Ukraine conflict has not seen signs of obvious relief. In particular, the increase in crude oil supply is relatively limited recently. In Western developed economies, especially Europe, the reserves of crude oil business are also declining sharply. Therefore, the price of crude oil is expected to remain at a high level.

Recently A -share leaders have risen globally

Although the prices of commodities have generally fallen sharply in the near future, overall, in addition to the individual cycle industry, the current trend of A shares is quite strong. From new energy to biomedicine to semiconductor, the market hotspot sector has risen.

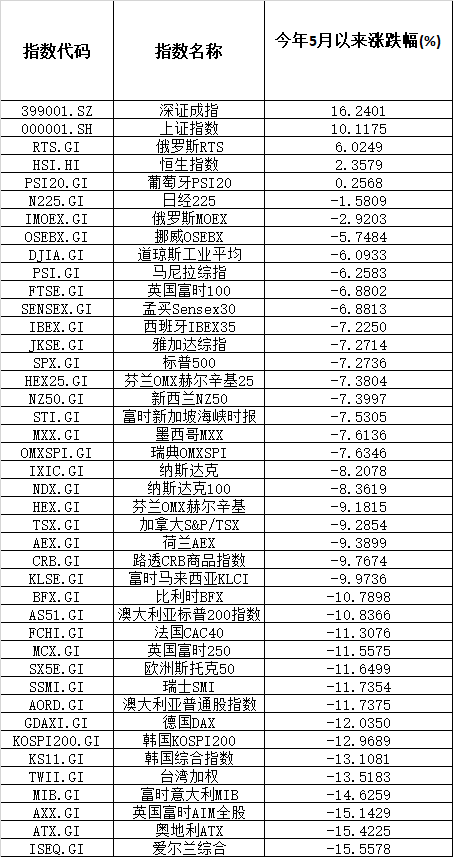

Since May of this year, 42 major indexes in the world rose and decline (data source: Oriental Fortune Choice data)

In fact, in recent stages, the performance of A shares is also unique in the horizontal scope. According to CHOICE statistics, since May of this year, of the 42 major indexes around the world, the Shenzhen Stock Exchange Index and the Shanghai Stock Exchange Index have ranked among the top two in the world with 16.24%and 10.12%. The third place is the Russian RTS index with a range of 6%. During this period, 37 major indexes in the world fell.

It is worth noting that some large foreign institutions have recently released their views that they are optimistic about the Chinese market. Just last week, Mixodas, an analyst of Morgan Chase Asia Securities Strategy, compared the Chinese stock market to "global market -shelter paradise."

Hu Yifan also looked forward to the investment strategy of the Chinese market in the second half of 2022 in the media meeting today.

For the Chinese market, she said, "We see the global market, in general, there are many uncertainty in the second half of this year, so we have given a neutral strategy to the stock market and bond market. Very optimistic about the Chinese market in the world. "

"The most important reason is that the economy is gradually recovering. The recovery of the Chinese economy in the second half of the year is a very certain event. The difference is that the range of recovery is not the same as other economies in the world. Stress. Second, China's inflation is relatively mild, both CPI and PPI's inflation are kept at a relatively gentle level. China ’s CPI we predict this year is 2.5%, PPI has the pressure of continuing downward. In fact In the context of global interest rate hikes, the possibility of raising interest rates in China in the second half of the year is reduced, but we feel that we will continue to be reduced. At the same time The reason for the optimism of the Chinese market also includes a great attraction of valuation. Last year, the Chinese market ran to lose the global market, but in June of this year, MSCI (China) has begun to stabilize the global market. Continue. "Hu Yifan pointed out.

Daily Economic News

- END -

Low -key but powerful Southwest Town!Behind the rise of the industry, what is it right?

◎ Zhigu Trend (ID: ZGTREND) | RainstormThis year, Russia's conflict has led the w...

Light up the "Firefly Forest", the new brand of Tiantai Mountain is grandly released

On June 23, the construction conference of the Tiantai Mountain Fire Forest Brand ...