Many housing companies have disclosed the progress of repurchase shares, Vanke and other accumulated repurchase scale exceeds 100 million yuan

Author:Capital state Time:2022.07.06

On July 6, Capital State learned that recently, many large listed real estate companies have disclosed the progress of repurchase shares, and a number of housing companies have accumulated a total of exceeding 100 million yuan.

For the purpose of repurchase shares, many housing companies have mentioned the value of the company's value, shareholders' rights and interests, and boosting investor confidence.

On July 2, 2022, Vanke A disclosed the announcement on the company's A -share repurchase results and changes in shares. As of June 30, 2022, the company accumulated a total of 72.956 million A shares of the company's A -shares by concentrated bidding, accounting for 0.63%of the company's total share capital (including the number of shares repurchased this time), and the highest transaction price was 18.27 yuan/share The minimum transaction price is 17.01 yuan/share, and the total transaction amount is about 1.292 billion yuan (excluding transaction costs).

Vanke A held the fifteenth meeting of the 19th board of directors on March 30, 2022 to review and approve the "Proposal on Part of the A shares in the repurchase company". The funds repurchased the company's RMB ordinary shares (A shares) in a concentrated bidding method. The total amount of repurchase funds exceeded RMB 2.5 billion and no less than RMB 2 billion. The repurchase price does not exceed 18.27 yuan/share. The company's board of directors reviewed and passed the date of the repurchase of the share plan (March 30, 2022 to June 30, 2022).

Vanke A said that the final repurchase share situation is different from the repurchase plan, mainly because the repurchase trading day is limited, and the company's stock price continues to higher than the repurchase limit at the later period of the repurchase period.

On July 2, 2022, Daming City disclosed the announcement on the implementation of the shares in the form of concentrated bidding transactions. As of June 30, 2022, the company accumulated a total of 55.9979 million shares by concentrating bidding transactions, accounting for 2.26%of the company's total share capital. The total amount of the transaction is 201 million yuan (excluding transaction costs).

Daming City held the thirteenth meeting of the 8th Supervisory Board on April 1, 2022 to review and approve the "Proposal on Building Company Stocks with a concentrated bidding transaction". The total amount of this repurchase funds is not less than 200 million yuan (Including the number), not more than 400 million yuan (including the number). The company has completed the repurchase plan, and the actual implementation of the repurchase plan is consistent with the original repurchase solution.

In addition, some housing companies stated that repurchase shares aims to implement employee shareholding plans or equity incentive plans.

On July 2, 2022, Jinke disclosed the announcement of the progress of some public shares of the repurchase of some public shares. As of June 30, 2022, the company accumulated a total of 42,997,900 shares by repurchasing special securities accounts by concentrated bidding transactions, accounting for about 0.8%of the company's total share capital. The price is 4.03 yuan/share, and the total transaction amount is 190 million yuan (excluding transaction costs).

It is reported that the Ninth Meeting of the 11th Board of Directors held on July 12, 2021, which was held on July 12, 2021, reviewed and approved the "Proposal on the Company to Bad in a concentrated bidding method", and agreed to the company's concentrated bidding transaction method. Use its own funds to repurchase the company's shares, the repurchase of shares does not exceed RMB 7.90/share, the total amount of funds for repurchase shares is not less than RMB 500 million (including 500 million yuan), and no more than RMB 1 billion (including including RMB 1 billion) (including including RMB 500 million) ) The period of repurchase was within 12 months from the date of reviewing and approved by the board of directors.

- END -

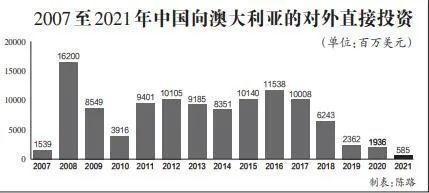

"Chinese investors are quickly abandoning this country"

Australian media: Chinese investors quickly abandon Australia.Australian Broadcast...

WPS completely close the advertisement?Why don't you even advertise for free WPS?

If you want to ask which office software is most controversial recently, the old -...