Regulatory shots, many private equity is planted!

Author:China Fund News Time:2022.07.06

China Fund reporter Zhang Yanbei

The strict supervision of the private equity fund industry is still continuing.

Unfair treated investors who treat the same fund and their products are actually placed by non -company employees, the product touches the stop loss line continues to transaction, the loss of losses expands, manages some of the private equity funds that have not been filed, and fail to conduct risk rating of the fund in accordance with regulations ... … In response to various violations of the private equity industry, in July, regulators in Inner Mongolia, Chongqing, Xiamen, and other regulators issued a ticket to many private equity institutions to rectify the chaotic operation of the private equity industry.

The industry said that since this year, the regulatory layer has frequently "bright swords" for the private equity market chaos, aiming to improve the standardized operation level of private equity institutions, and promote the continuous improvement of private equity institutions' practical capacity and compliance operation level.

Chongqing Xianshi Investment Police letter:

Its products are placed by non -centers employees

On July 5, the Chongqing Securities Regulatory Bureau issued a decision on taking a warning measures for Chongqing Xianshi Investment. According to the public information, Chongqing Xianshi Investment has the following two major problems.

First of all, the management of the product has not fulfilled his duties, cautious and diligent. Xian Shihong Apple Private Equity Securities Investment Fund (Red Apple Fund) is a fund product issued by the company, but it is submitted to non -company employees for transaction decisions and order transactions. When the Red Apple Fund signed a supplementary agreement, the company did not agree on the product contract to ensure that the relevant supplementary agreement signed the real and effective signing.

In addition, after the net value of the Red Apple Fund touched the stop loss line, Chongqing Xianshi Investment did not agree in accordance with the product contract, ensuring that the product was not allowed to open the position, resulting in further decline in net worth. The above behavior violated Article 5 of the "Interim Provisions on the Management Management Management Management Management of Securities Futures Management Institutions" and Article 4 of the "Interim Measures for the Supervision and Management of Private Investment Fund".

Second, the information was not disclosed to investors in accordance with regulations. The Red Apple Fund was not disclosed from the third quarter of 2020 to the second quarter of 2021. During the continuous triggering early warning line of Red Apple Fund, Chongqing Xianshi Investment did not continue to disclose relevant information to investors. When the product triggers the stop loss line, the company did not disclose the information to investors within 5 working days in accordance with the contract.

The above behavior violates Article 24 and Article 16 and 18 of the "Administrative Measures for Private Equity Management" and Article 16 and 18 of the "Administrative Measures for Information Disclosure of Private Investment Fund". According to Article 33 of the "Administrative Measures for Private Equity" and Article 12 of the "Interim Provisions on Private Equity Management", Chongqing Xianshi Investment was adopted an administrative supervision measure with alert letter.

Regarding the private equity violations, an industry insider in South China said, "Pay the company's internal products to non -company employees for transaction decisions and order transactions, or because the company does not have corresponding capabilities, entrusts others to seek higher investment income It is equivalent to 'outsourcing'. I noticed that this company's performance has not achieved good performance this year, and many products have lost more than 10%during the year. "

"Another case is that this fund is‘ lended 'as a shell, which is actually used by other agencies or individuals, and naturally it is traded by external people. "He further said.

It is understood that the original intention of the early warning line and stop loss line is to protect investors, reduce investment risks, and control the maximum loss within a certain range. The early warning line is that when the fund's net worth is as low as a certain level, the private equity institution needs to reduce the position to increase the cash ratio in the account. This is to avoid irrational operations to avoid managers from being influenced by their own emotions. Essence After the stop loss line is touched by the price, the fund must stop operation in accordance with regulations and enter the liquidation.

Chongqing Xianshi invested in the "ignoring" early warning line and stop loss line, so he was punished by supervision. In fact, the stock market has fluctuated violently this year, and private equity funds are facing the pressure of retracement. Many institutions have received widespread attention because their products have touched the early warning line.

It is understood that Chongqing Xianshi Investment mainly focuses on the quantification of FOF, and invests in secondary market investment based on stock rights, stock T0, and secondary market private equity funds.

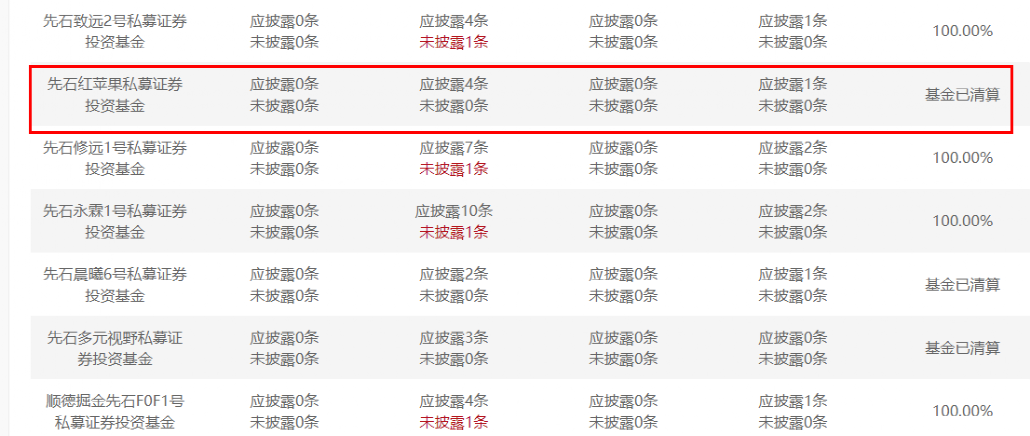

According to the association data, the management scale of Chongqing Xianshi Investment is less than 500 million yuan. The company has filled 21 private equity products in the association in total, of which 10 products have been liquidated. Among them, the Red Apple Fund involved in this time was recorded on July 9, 2020, and the product has also been liquidated in advance.

It is worth noting that the association data shows that as of the first quarter of this year, the scale of multiple product management of the agency was less than 5 million yuan.

Oriental Huifu's equity investment was ordered to make corrections:

Part of the private equity is used for foreign borrowing

On July 4, the Xiamen Securities Regulatory Bureau issued a decision on the order of ordering correction on the equity investment of Dongfang Huifu. According to the public information, Chongqing Xianshi Investment has the following four problems.

First, it manages some of the unpacking private equity funds. Among them, individual investors invest in a single private equity fund below 1 million yuan.

Second, some private equity funds are used for external borrowings, and the balance of loans exceeds 20%of the fund's actual payment amount, and the borrowing period exceeds 1 year.

Third, some funds have not invested in business to confirm the power, of which the equity of the investment of overseas bids is held by the actual controller or others.

Fourth, no risk rating of the fund was conducted in accordance with regulations.

In addition, Lu Moumou, as the actual controller of Dongfang Huifu's equity investment, and then executive transaction partner (appointment representative), failed to abide by professional ethics and behavioral norms, and was responsible for the above -mentioned violations. The Xiamen Securities Regulatory Bureau decided to adopt administrative supervision measures with a warning letter to Lu Yali and record the relevant situation into the integrity file. According to the information of the China Fund Industry Association, Xiamen Dongfang Huifu Equity Investment Management Partnership (Limited Partnership) was established in August 2010. It was registered as a private equity fund manager on May 4, 2014. people. He joined the China Fund Industry Association on March 3, 2015 to become a member of observation.

The company has accumulated 14 private equity funds products, including 1 liquidation and 13 storage. According to Tianyancha, the company has a total of 16 partnerships as partners in executive affairs.

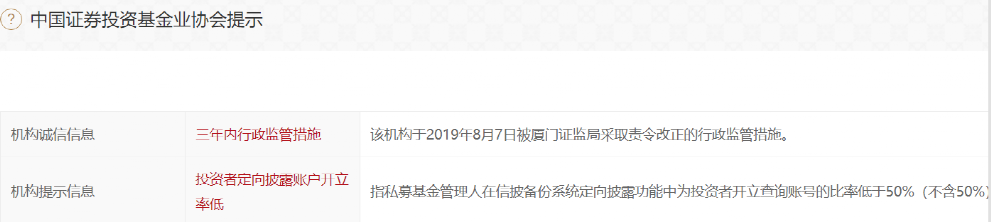

According to the announcement of the association, on August 7, 2019, Xiamen Dongfang Huifu was adopted by the Xiamen Securities Regulatory Bureau to order administrative supervision measures because of the fact that the fund's investment decision -making decision -making was not properly preserved. The institutional prompt information shows that the institutional investor's targeted disclosure account opening rate is low, that is, the proportion of private equity fund managers in the directional disclosure function of the letter backup system is less than 50%(excluding 50%of the 50%containing 50%, excluding 50% )

Light Fengfeng Private Equity Police Letter:

Unexpectedly treat different investors in the same fund

On July 1, the website announced by the China Securities Regulatory Commission Inner Mongolia Regulatory Bureau's website (hereinafter referred to as: Guangfeng Private Equity) decided to show a warning measures for Inner Mongolia Guangfeng Private Equity Fund Management Co., Ltd. There is the following behavior.

The first is that some of the funds of the management shall set up fund shares with different income characteristics in accordance with different investment amounts, and there are different investors in the same fund.

Secondly, the actual yield of the income of some private equity funds from the management of the private equity fund failed to fulfill his duties and fulfill his caution and diligence.

In this regard, there are private equity people who believe that "the different investors who treat different private equity funds in the same private equity fund are a bit strange. The supervision clearly stipulates that when the fund manager manages multiple private equity funds at the same time, it should treat each fund fairly. Only the maximum interests of all the fund holders to manage the fund's property. It is the benefit of one fund, and the benefit of the other fund is harmful to the principle of maximizing the interests of the beneficiary, and it also violates the obligation of the trustee. "

The above behavior violates the "Interim Measures for the Supervision and Management of Private Investment Fund" (Order No. 105 of the CSRC, hereinafter referred to as the "Private Equity Measures") Article 4 and Article 23 (9) (9). According to Article 33 of the "Private Equity Measures", the Inner Mongolia Securities Regulatory Bureau decided to take administrative supervision measures with a warning letter to Guangfeng Private Equity.

The reporter noticed that Guangfeng Private Equity used to use "Inner Mongolia Equity Investment Management Co., Ltd.". According to the data, Guangfeng Private Equity shareholders are China Everbright Industrial (Group) Co., Ltd., Beijing Golden Naming Information Technology Co., Ltd., and Beijing Shengli Investment Management Center (limited partnership). 30%. China Everbright Industrial (Group) Co., Ltd. is a wholly -owned subsidiary of China Everbright Group Co., Ltd.

The industry said that the high -quality development of the private equity industry is inseparable from the "escort" of effective supervision. Next, the regulatory level should continue to improve the legal equity laws and regulations system in accordance with the requirements of "building a system, non -intervention, and zero tolerance", consolidate the system foundation for strengthening the supervision of private equity funds, and further increase the crackdown on violations of laws and regulations.

Edit: Captain

- END -

Kenli Economic Development Zone: "Service Secretary" full coverage targeted precision solution problem

Thank you Kenli Economic Development Zone for its strong support for our enterprises, especially by introducing the project industry chain 'chain long system' and 'project helping commissioner' respo...

The Chinese men's volleyball team is positive for many people; wheat garlic is compensated?Biden said it is unlikely to visit Wu; pig prices have been rebounded for 11 consecutive weeks

01Nationwide primary school net enrollment rate is 99.9%or moreOn June 21, the Min...