Self -confidence?The U.S. and European Bank of the United States and Europe's inflation expectations in the future

Author:Economic Observer Time:2022.07.06

Wang Jinbin/Wen

The base number is significantly raised, the wage growth rate is less than the growth rate of prices, and the recklessness of the bottleneck of the supply chain has given the central bank's self -confidence that the central bank of the United States and the European Bank of the United States and the European Bank of the United States and Europe. However, the geopolitical conflict of Russia and Ukraine has brought the globalized structure's heavy construction costs, the small cards that prevent economic recession, and the prevention of systemic financial risks prevent the tightening of monetary policy. The two types of factors intertwined each other, determining that the Fed and the European Central Bank's self -confidence in future inflation may be embarrassed.

The U.S. inflation rate (CPI) exceeded 8%for 3 consecutive months, and the euro area inflation rate (HICP) also reached 8.1%in May. It is expected to be 8.6%in June. The high inflation pressure has prompted the Bank of the United States and the European Bank of China to adopt a tightening policy since the 40 years. To suppress inflation. Judging from the recent forecasts of the Fed and the European Central Bank, inflation will decline sharply in the future. The Federal Reserve and the European Central Bank's expectations for future inflation showed that inflation will fall significantly in 2023, and 2024 will gradually return to the long -term inflation target near 2%.

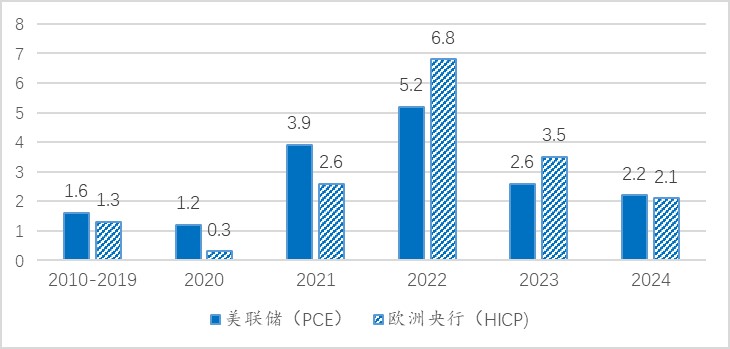

Figure 1. The inflation rate (%) in the United States and the euro area (%)

Data source: Fed and the European Central Bank. Note: The data of 2022 and later came from the forecast of the two central banks. The inflation rate of 2010-2019 is a simple average of ten years, and the annual data comes from the Fed and the European Central Bank.

The data in Figure 1 also gives this information: Compared with the average annual inflation rate of the United States and Europe in the previous ten years, even according to the expected inflation rate level in 2024, the US and Europe inflation center will be significantly moved up. The average annual inflation rate of the euro zone was 1.6%and 1.3%, respectively. As the total economic volume of the United States and Europe accounts for about 40%of the global economy, this also means that the inflation center in the global economy will move significantly. The probability of a low inflation environment in the world in the next 2-3 years is almost gone.

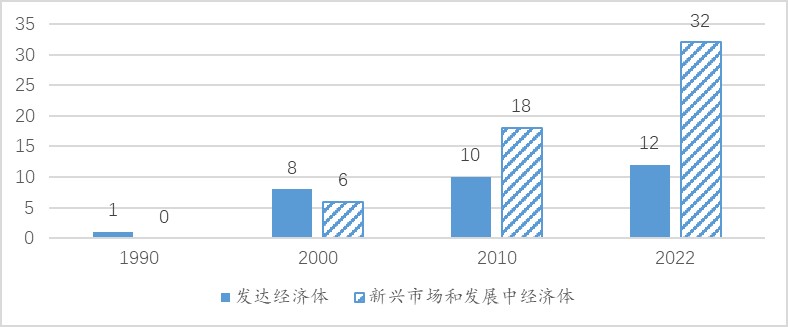

The United States and Europe are open economies, especially in the context of stronger US dollar indexes and the weakening of the euro, Europe has relatively serious risk of importing inflation. Therefore, the global central bank's will to control the control of inflation will also affect the result of the U.S. and European Central Bank of the U.S. and Europe. Compared with the past, the number of central banks that now implement inflation targets in the world have increased significantly. In 2022, 12 developed economies and 32 emerging markets and central banks in developing economies have implemented inflation target systems (Figure 2). This is. In terms of system design, it is conducive to global control over inflation.

Figure 2. The number of economies that implement inflation targets worldwide

Data source: International Monetary Fund; World Bank.

Judging from the statement of the Fed and the central bank, it is said that controlling inflation is the most important task or unconditional task. The Bank of the United States and Europe shows confidence in controlling inflation, but it may be a kind of self -confidence. Confidence mainly comes from the following aspects.

First, the biggest self -confidence comes from the high base. Figure 1 shows that the HICP of the United States PCE and the euro zone in 2022 is as high as 5.2%and 6.8%, and it is above 3.9%and 2.6%in 2021. The base in 2022 is very high. On the basis of such a high base, the year -on -year growth rate of inflation in 2023 decreased significantly.

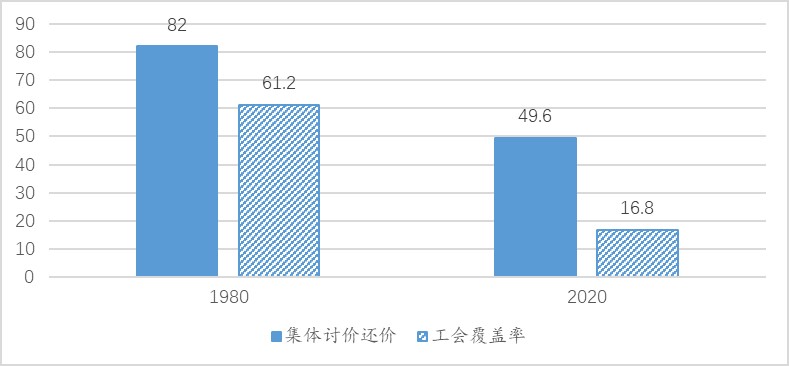

Second, the increase in wages is less than the rise in prices. The decline in the actual purchasing power of residents will suppress the overall demand and gradually bring the slowdown in price increases. Judging from the current data or forecast, according to the prediction of the European Central Bank, the wage growth rate of the euro zone in 2022 will exceed 4%, but in 2022, the price level will significantly exceed the wage growth rate. The current price increase in the United States is also higher than the increase in wages. From the perspective of the labor market structure, the labor market of the entire developed economy is more flexible, and the wage rigid mechanism has been broken to a fairly extent. When the tightening monetary policy brings a decline in total demand, corporate profits will also decline, and the flexibility adjustment of the wage mechanism will help curb the wage-price spiral mechanism. Compared with the 1980s, the ability to bargain on employees in 2020 was only 60%in the 1980s, and the trade union coverage was only 27.5%in the 1980s (Figure 3).

Figure 3. Elasticity of salary of labor market (%)

Data source: OECD. Note: The collective bargaining is a percentage of employees who have negotiating capabilities; the union coverage indicates the percentage of the number of employees in the total number of union members.

Third, the relaxation of the epidemic prevention and control helps to overcome the difficulty and cost of supply brought by the bottleneck of the supply chain. At present, the United States and Europe have basically adopted the release policy. At the same time, the world has a better understanding of the epidemic, the vaccination rate has increased significantly compared to the past, and it is more scientific and reasonable for the prevention and control measures of the epidemic, which helps reduce the cost of the global supply chain bottleneck. However, the low -income economy and low -income economies have a relatively low vaccination rate for vaccination to make the virus mutation uncertain. According to the data of WTO-IMF (COVID-19 Vaccine Trade Tracker) as of the end of March this year, the vaccination rate of low-income economies is only 6.9%and the population is 678 million; There are 2.994 billion people. Therefore, the epidemic may still have an uncertain impact on the global supply chain.

Why is it self -confidence? Because there are some important factors that may exceed the control scope of the central bank, the central bank may have deviations when tightening the policy. At the same time, it is necessary to tighten and avoid the economic recession, which has become a difficult balanced choice for the Bank of the United States and the European Central Bank. These two major factors will lead to the self -confidence of the Bank of the United States and Europe's central bank may be a kind of self -confidence. There are three main factors that lead to self -confidence in the United States and Europe. First, Russian geopolitical conflict will bring a restructuring cost of a global pattern. The continuity of the geopolitical conflict of Russia and Ukraine has led to a break between European and Russia. As an open economy, Russia needs to be redesigned into the path of globalization, and Europe adheres to "getting rid of Russia" and also faces the globalization path planning in the field of energy. The cost of this industrial chain and supply chain is a geopolitical cost, which surpasses the economic cost of the global division of labor. The cost is expensive and has a medium and long -term. At present, the continuous high -level operation of international commodity prices we see is closely related to the energy market segmentation caused by sanctions. Geopolitical conflicts have been limited by the supply impact central bank.

Second, there are not many cards to prevent economic decline. From the forecast data of the two central banks in June, from 2022-2023, the Fed predicted that the actual GDP growth rate of the United States was 1.7%, and the European Central Bank predicted that the actual GDP growth rate of the euro zone was 2.8%and 2.1%, respectively. Compared with the US economic growth rate of 5.7%in 2021 and 5.3%of the economic growth rate of the euro zone, a significant decline has been significantly reduced.

The US and European currency fiscal policies are facing the same situation: on the one hand, the currency tightening; on the other hand, the fiscal deficit has dropped sharply, and there is no friendly factors that improve the total demand on the macro policy. The US fiscal deficit in 2022 is only about 1/3 in 2021; the euro zone budget deficit is expected to decrease from 5.1%of GDP to 3.8%in 2022.

The favorable factor in micro is that the release of the epidemic prevention and control has brought about the comprehensive and re -opening of the service industry. The release of the suppressed demand in the past boosted consumer expenditure. During the epidemic, the low unemployment rate of home savings, financial support measures and labor markets accumulated during the epidemic will help maintain overall labor income and support consumption. However, if inflation continues to significantly exceeds wage growth, it will bring actual income loss. The savings buffer accumulated during the epidemic may be gradually eroded until consumer demand decreases and the unemployment rate rises.

Third, prevent systemic risks in the financial market. Preventing systemic risks is the result of a macro tightening policy that must be considered in advance. Compared with the market segmentation of the financial market in the euro zone, the US financial market seems to be much better. Tightening has brought a significant decline in the US stock market this year. As of July 4, the S & P 500 index fell nearly 20%, Nasdaq fell nearly 29%, and Dow Jones fell about 14%. The European stock market also fell, and the decline in Germany, Italy and the euro zone Stoxx50 was basically around 20%.

Compared with the risk of restructuring of the stock market, the risk of urgency in the European financial market is in the sovereign bond market. The European Central Bank ended the net asset purchase under the asset purchase plan on July 1, and it is expected that the three key interest rates will be increased by 25 basis points at a meeting on July 21. It is expected that the key interest rate will be increased again in September. It has been agreed to take the "progressive but persistent" method to raise interest rates further. As the European financial market is divided, the interest rate of the euro zone has risen sharply, and there is significant asymmetric impact on the government debt market of different economies. The separated fiscal policy of the euro zone determines that the cost of raising funds for unhealthy fiscal economies will rise significantly, such as Italy and Spain, which may trigger a sovereign debt crisis. It is said that the European Central Bank has studied new tools to face such problems.

Finally, we borrowed a recent quotation of European Central Bank officials as the end. Da Vinci said, "Every obstacle will succumb to a firm determination." The European Central Bank will solve every obstacle that may threaten the task of price stability. The Federal Reserve President Powell's recent speech is also very similar, and he is determined that controlling inflation is an unconditional task, but the way to avoid economic recession is getting narrower. It is necessary to control high inflation and not to economic decline, and at the same time, the environment is facing major uncertainty. The confidence in this complex balance cannot be a complete sense of confidence in the complete sense.

- END -

Zhang Leiming emphasized when investigating the construction of the online freight digital economy industrial park in Shilong District: Grasp the transformation and development acceleration of the new track of the digital economy

Wang MinfengOn the morning of July 6, Zhang Leiming, the secretary of the municipal party committee, went to Shilong District to investigate the construction of the online freight digital economy indu

"Tide Fun Jianghai Buy" 2022 Jianghai Summer Consumption Happy Festival will be held from June 17th to 19th

In order to thoroughly implement the spirit of the Sixth Plenary Session of the 19...