The "pig" on the wind flew up again?

Author:Daily Economic News Time:2022.07.05

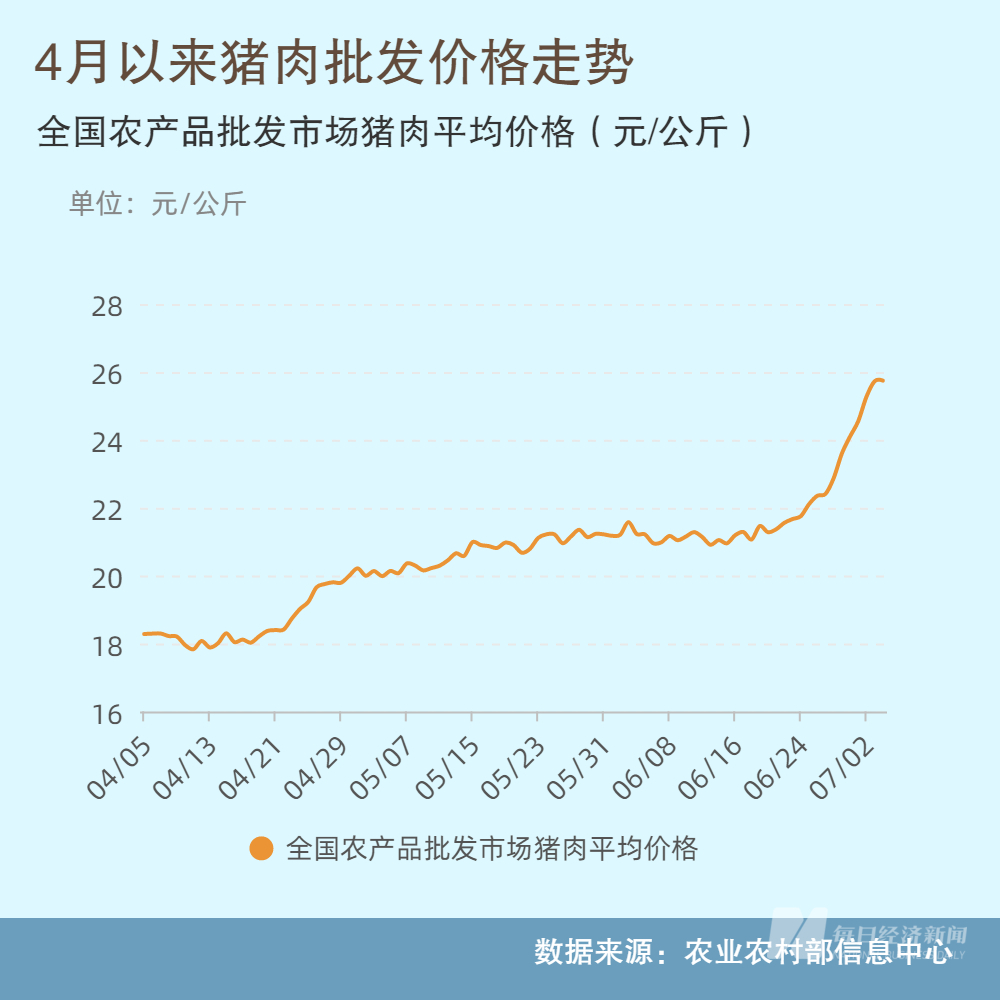

After a year and a half downlink cycle, the domestic pig market has regained its rise in the near future. The monitoring data of the Ministry of Agriculture and Rural Affairs showed that as of July 4, the average price of pork in the national agricultural wholesale market was 25.74 yuan/kg, which was about 41.2%compared to 18.23 yuan/kg on April 1 this year.

The price of pork rose rapidly, so that both sides of the "coin" responded rapidly: From the perspective of pig farming companies, on the 4th, Muyuan (SZ002714, stock price of 63.5 yuan, market value of 338 billion yuan), Wen's shares (SZ300498, stock price 24.45 Yuan, market value of 157.9 billion yuan), the stock price of domestic pig -raising companies rose sharply, and the market value of the sector increased by about 70 billion yuan within one day.

From the perspective of regulatory trends, on the 4th, the National Development and Reform Commission held a special meeting of the pig market to ensure stable prices, which severely warned major pig farmers companies that they must not hoard their prices, coax their prices, and do not collude with prices. Effective measures such as adjustment to prevent the price of pigs from rising too quickly.

When a group of securities firms have spoken the "pig cycle" turning point and a new round of pig cycle starts, a reporter from the "Daily Economic News" reporters found that the judgment of pig markets in the industrial chain seemed to be more. Be cautious.

Pig prices rose rapidly, returning to profit and loss balance line

Since April this year, pork prices have continued to rise, and the sound of a new round of pig cycle has gradually risen. As the price of meat rises, the price of hair pigs has risen.

According to data from the Ministry of Agriculture and Rural Ministry, as of July 1, the average wholesale price of Maogu was 20.60 yuan/kg, which continued to rise by 31.21%from April 1. This price has exceeded the breeding and loss balance line of pig breeding.

The rise in the price of pigs is also reflected in the financial report of pig farming companies. On the 4th, the "June 2022 June 2022 Life Pig Sales Briefing" released by Muyuan shares show that in June this year, the average sales price of the company's commercial pigs was 16.53 yuan/kg, an increase of 21.72%year -on -year, which is about 12.56 yuan/kg in April this year. 31.6%. And Jinxinnong (SZ002548, the stock price of 754 yuan, 5.2 billion yuan) also announced that the company's average sales price of pigs in June was 22.15 yuan/kg (the average price of commercial pigs after the influence of piglets and pigs was 17.26 yuan/kg), an increase of 27.56 year -on -year %.

The market's expectations for pork prices in the later period are reflected in the price trend of pig futures. The price of pig futures contracts expired in September, November, and January next year has gradually risen. On July 4, the price of pig futures continued to rise. Yuan/ton, a new high since the record in September 2021.

Main contract "Pig 2209" since March, price trend picture Source: Wind

The rise in pork prices has also made many pig breeding companies see the hope of profitability.

Tianbang Food (SZ002124, stock price of 7.57 yuan, and a market value of 13.92 billion yuan) Zhang Banghui, chairman of the chairman, said in an interview with "Daily Economic News" in June this year that the rise in pig prices is good for the company. , And predict that the pig prices in the first quarter are not good, and a lot of production capacity will be stopped, resulting in the depreciation of fixed assets, the cost of raising pigs is high, which is nearly 16 yuan/kg. Although the company has not existed much, I believe that the two are two. The quarterly losses will narrow sharply.

Under the strong bullish emotion, on July 4, the A -share pig breeding sector also rose sharply. Yuan, market value of 15.3 billion yuan), Aonon Bio (SH603363, stock price 22.06 yuan, market value of 17.9 billion yuan), Tianbang Food, new hope (SZ000876, stock price 17.36 yuan, market value 78.2 billion yuan), Zhengbang Technology (SZ002157, stock price 7.32 7.32 Yuan, market value of 23 billion yuan), Xinjinnong (SZ002548, stock price of 7.54 yuan, market value of 5.2 billion yuan), etc., etc., all rose daily limit. The market value of the A -share pig raising sector rose about 70 billion yuan a day.

Behind the price increase: Who is selling in the "unreasonable" pressure bar?

Regarding the recent rise in pig prices, a number of people in the industry recently analyzed the reporter of "Daily Economic News" that on the one hand, at the supply side, domestic pig farmers are now optimistic about the rise of pig prices, and there is a mood of selling fences. The shrinking; on the other hand, the state's collection and storage has been closed for 12 batches in the demand side. After the situation of the prevention and control of the epidemic has improved, part of the demand that was previously suppressed was slowly released.

The price of pork prices rose rapidly, and on the 4th, the National Development and Reform Commission held a special meeting of the pig market for the stability price of the pig market. The analysis of the meeting believes that the recent rapid rise in domestic pigs has risen too fast. An important reason is that the market has irrational pressure fences and secondary fattening. Some media, especially self -media, fabricate and spread the price increase information, rendering the price increase atmosphere. In the short term, in the short term It also exacerbated the market for sale.

The National Development and Reform Commission also stated that the current production capacity of pigs is generally reasonable and abundant, and the consumption is not strong. The price of pigs does not have the foundation of continuous rise and sharp rise; blind fences and secondary fertilizers may lead to the concentrated fence in the later period and the price fell rapidly, which will cause market prices to rise and fall Instead, it is not conducive to the normal production and operation of enterprises and the long -term healthy development of the industry. Li Wenxu, a pig product analyst at business club, said in an interview with reporters that the rapid rise of pig prices is not a factor of the pig cycle, but a corporate pressure bar. The more the price increases, the more the price is not selling, and the price increases. "After all, there is no substantial favorable support for supporting pig prices. At present, the school is on vacation, the main consumer exits, the number of pigs and can sow is smooth, and there is no culprit for African swine fever. What can support the price of pigs rising?"

Li Wenxu also said that the relevant state departments hoped that the price of pigs rose steadily, and the profits of farmers rose steadily, rather than ups and downs, and fluctuated sharply. After this meeting, as the fence was released, the supply increased, and some areas will gradually increase the price of pigs. With the comprehensive effect of market supply and demand, cost, and profit of farmers, pig prices will fall to a reasonable range, about 19 yuan/kg.

Picture source: Visual China

"The situation of the industry's internal pressure fences does exist, but more small and medium farmers. Large -scale pig farmers generally do not exist in this situation. For example Our outlet strategy, we have a stable column every month, and even stable. "On the 4th, when" Daily Economic News "called Wen's shares as an investor, the relevant person said.

The source of Wen's shares explained that the reason why the pressure fence strategy does not adopt is mainly based on the consideration of preventing risks. "The price of pigs is no longer low now, right? Then you may think that the price of pigs in the back will be higher, so if your pressure bar is right, if you are wrong, if you bet, your loss will be great." It is said that the company basically adopts the strategy of standard pigs.

The reason why large pig raising companies such as Wen's shares use standard pigs out of the column, because when pigs grow to standard pigs, at this time, for the company, the cost income ratio is the highest. After the standard pigs, if you continue to raise it for the presses, the pigs are already eaten alone, or they only grow very little meat. For the company, the price / performance ratio is not high.

The "Dark Moment" has passed, and the industry's "spelling cost" is still the focus

According to data from the Ministry of Agriculture and Rural Ministry, in mid -March of this year, the average price of pigs nationwide fell to 12.59 yuan/kg, and the weekly average value of the total price index of lean -type white bars was reduced to 15.73 yuan per kilogram. At that time, for major pig farming companies, it was "dark moment".

In fact, before the dark moment arrived, the entire pig farming industry had been hovering for more than a year during the downward cycle. Whether it is industry leader, small and medium -sized enterprises, or even ordinary retail investors, they are working hard. It can be seen from the total amount of losses of listed companies in 14 pigs in 2021 and 2022.

According to Wind data, in 2021, 14 pig -raising companies including Zhengbang Technology, Wen's shares, and new hope returned to the total net profit loss of mother -in -law at 43.941 billion yuan; in the first quarter of 2022, the collective losses of pig -raising companies losses their collective losses There is no profit, with a total loss of 16.237 billion yuan, and the losses expanded by about 267%year -on -year.

In this context, try to reduce costs and become the common choice of major enterprises.

"Daily Economic News" learned that in general, the cost line of 16 yuan/kg is generally a lifeline of pig breeding enterprises. From the data disclosed by the 2021 annual reports of major enterprises, except for Muyuan shares, the cost of most companies is around 20 yuan/kg, of which the new hope is 19.71 yuan/kg, Zhengbang shares are 23.99 yuan/kg, and the sky, and the sky, and the sky Bangbang shares 24.56 yuan/kg.

"For us, the cost is the most fundamental competitiveness." Zhang Banghui said that in order to reduce costs, the company has done a lot of work in the healthy management of pigs, such as biological safety upgrades, air filtration, dehumidification of drainage gases, etc. There are ventilation and ventilation in the inside of the pig house, spraying cooling, and after the healthy level is increased, the yield rate of sow has risen rapidly. The average number of lives for sow is the number of lives in the nest × mammary piglets) more than 30 heads.

“如果我们把'双改'做完了,可能养猪的全成本会低于12元/千克。”张邦辉称,养猪的竞争只存在于成本在什么段位上,因为这是一个资金密集型、 Talent -intensive and technical -intensive industries, the so -called excellent pig species are supported by a large number of technologies, and the cognition of the forest farmers lacks a scientific knowledge foundation for this piece.

From the perspective of superstar farmers and animal husbandry directors, one of the most important reason for the cost of some pig -raising companies is that they are not capable of breeding pigs and need to buy pigs and piglets. "In the first half of last year, the price of pigs and piglets was relatively high, and when the column was released in the second half of last year, the price of pigs had fallen. The cost was high, and the cost was high." Zhou Mi analyzed on the phone on the phone.

Like Muyuan's shares, the superstar farmers and herds who are breeding pigs can realize that pigs and piglets are fully confession, so the cost can be controlled at about 16 yuan/kg.

"Our piglets, the cost of only more than 400 yuan." Zhou Mi said. In 2020 and 2021, when the pig's highest price, the purchase of a piglet would cost 2,400 yuan. In addition to the cost factors of pigs and piglets, sow elimination, epidemic loss, and rising feed prices have further pushed the cost of breeding. Cost means: combined parallel line, parallel time preservation, collection of feed

Reducing costs is the first issue of major pig breeding companies.

A new hoped insider recently told the reporter of "Daily Economic News" on the phone that its cooperative breeding households responded to the pig cycle to deal with the sow, rent the pigpen out to raise chickens, and go out to work by themselves. When the price of the pig rises, come back to raise a pig.

For tens of millions of pig raising companies in the annual outlets, although the response method is not so decisive, it is also the same.

"The measures we have taken are the integration and parallel lines. The provinces with high retail prices, we work hard, and the price of low prices will be raised a little less. Some pig farms have high production costs and low energy efficiency, so turn it off. "The above -mentioned new hope insiders told the" Daily Economic News "reporter that the company's level did not prepare too much for pig prices, but kept pressing the cost and" set the indicator of compression costs for each industrial unit. "

For example, the person has always been higher than that of living pigs, and Guangdong's pork prices have been higher than other provinces. Therefore, the new hope has expanded the layout of the pig farm project in Guangdong.

The superstar farming and animal husbandry also adjusted the proposed pig farm project. "Some projects that were originally wanted to invest are temporarily relieved (invested) according to the market conditions, and also compressed investment projects." Zhou Mi revealed.

On the other hand, with the continuous maturity of the industry and the promulgation of the draft of the Futures Law, more and more pig breeding companies have begun to explore the development of duration preservation business.

"In theory, wearing value preservation is a means of locking in profits and ensuring stable operations. We are also studying." Zhou Mi said.

In his opinion, participants in the pig farming industry fight to the last mile, "they are fighting for costs", who can survive who can survive. "The goal of superstar farmers and animal husbandry is to fall to 15 yuan/kg this year."

Another new hope relevant person also revealed that he hopes to strive to make pig farming less than 16 yuan per kilogram by the end of this year, and say that it is relatively large to be within 16 yuan/kg in December.

On August 23, 2020, every reporter visited the construction of the new hoped building pig farm picture source: Every reporter Zeng Jian

"For us, the pork market is a fully competitive market. It is difficult for us to control this one. The only thing that can be done is to find a way to reduce costs, especially in the context of rising grain and feed prices." According to Wen's shares, Wen's shares Relevant sources introduced that grain prices are an important cost of raising pigs, and the company reduces procurement prices on the one hand through "collection"+long -term contracts; on the other hand, dynamically adjusts in the feed ratio to choose a price more Low replacement.

"When the price of soybean meal is high, we will choose peanut meal, palm meal, etc. to replace; corn or wheat is expensive, we can choose some rice mixture or sorghum instead. On the whole, we are more cost -effective than ordinary retail investors in the industry. The pressure on the rise must be smaller, and it is more advantageous in terms of cost, "said the relevant person in Wen's shares mentioned above.

The "pig cycle" turns? Pig company: we will not go to the "gambling" cycle

The price of pigs and pork rebounded continuously, and brokers took the lead. In recent times, there have been active signals from brokerage research reports.

Guosheng Securities pointed out that pig prices have maintained an upward trend in recent times, "in the medium term, the price center is up upward, and it is easy to rise and difficult." Western securities predict that future pig production capacity will continue to shrink, and industry losses will be effectively improved. As early as May, a broker said that the industry had entered the profit range.

Compared with a lot of brokerage research reports, many pig farming companies are more rational in the reporter's investigation.

"For us, we will not go to the rise and fall of the price of pigs. Because the price of pigs is not what we can control and decide, all we can do is to keep finding ways to reduce costs." Wen's shares above People said.

Picture source: Visual China

On May 12th, the new hope president Zhang Minggui said in the question of investor questions that although the new hoped pig raising sector since the second quarter of 2021, the degree of losses every quarter is narrowing, but the price of pigs will still be in this year. Relatively low, the company's profitability also requires a recovery of the market. At present, "the short -term upward movement is probably difficult to form a trendy reversal."

On May 31, at the New Hope of the 2021 Annual Shareholders' Conference, Liu Chang, the chairman of the New Hope, also asserted that "the pig cycle is still at the bottom."

Zhou Mi's prediction of industry trends is not optimistic. "Everyone's previous understanding is that it will not bottom out in May and June, but it will bottom out in mid -March." Zhou Mi said. This also means that the "pit" of this wave of cycles is not deep enough.

"At that time, the industry generally believed that if this wave fell deeper, retail investors would have more, and the overall supply would decrease. But now it is two or three months earlier than everyone expected, and the rebound will not be so high. "Zhou Mi said.

It can also be seen from the price trend of pigs. From the beginning of May to early June, the price of pigs was maintained around 16 yuan/kg, that is, on the lifeline of pig breeding companies. "So, the trend of the second half of the year is not too much. Our judgment is that it may not rise too high in the second half of this year." Zhou Mi said. According to the monitoring of the 500 counties and collection points of 500 counties across the country, as of the 4th week of June (the collection date was June 22), the average price of pigs in the country was 16.65 yuan/kg, an increase of 3.2%over the previous week. It rose 21.0%year -on -year.

Zhou Mi predicts that by the second half of the year, the price of pigs will be "the best can be 19 yuan/kg, and this price may exceed this price next year."

The differences in the position judgment of the current position of the pig cycle, and the prediction differences of future trends, also reflect the agricultural characteristics represented by pig farming -strong periodicity, but have many influencing factors.

Large -scale pig farming will continue to expand, and the "pig cycle" fluctuations will smooth in the future

At the current stage, the reason why the industry is relatively cautious and optimistic is not to shout the "pig cycle" turning point. To a certain extent, it is also related to the origin of this round of super pig cycle.

"After the outbreak of African swine fever in 2018, the market was very good in 2019 and 2020, but because of the severe swine fever in Africa and rising feed prices, everyone's judgment was to clear the risk of retail investors because of this risk." Zhou Mi said.

In addition, from the structure of the Chinese pig farming market, large -scale farming companies account for only about 20%, and 80%of the market share is still occupied by retail investors. At that time, the general view of the industry was that even if the pig -raising enterprises raced the production, there would be no major problems even if the "military reserve competition" was formed, because the pig -raising enterprise grabbed the market share of retail investors.

Under this consensus, major pig -raising companies have begun to run away vigorously, and the industry is setting up, and the industry is in the crazy expansion of production capacity. In early 2020, the new hopes will continue to increase the investment in pig breeding business, and build 10 pig breeding projects at one time, with a total investment of 4.359 billion yuan. At that time, New Hope proposed the grand goal of 70 million heads for the annual column. In addition, including Wen's shares and Zhengbang Technology are all pioneers of expansion.

According to only 25 pig farming companies in the first half of 2020, the investment factories were released, and the investment amount involved was as high as 165.9 billion yuan. "According to the investment plan of pig -raising enterprises, it is almost incredible. There are hundreds of billions of investment."

However, the development of industrial development did not follow the trajectory of pig breeding enterprises. Later facts proved that retail investors not only did not clear up, but did not decrease. In addition, major enterprises have continuously expand their production, leading to production capacity extrusion. So there were more than two years of super pig cycle.

"This market is too scattered and it is not easy to investigate. At present, domestic markets are still dominated by retail investors. Blind and lagging are the inevitable laws of the market, unless it can change this situation." Zhou Mi believes.

Zhang Banghui also believes that with the continuous expansion of large-scale pigs, the pig cycle will be longer and longer. When 70%-80%of pigs are provided by large-scale enterprises in China, pig prices will stabilize. "In the future, it will be a large enterprise. In case of something, the company can carry it by itself, and after the production capacity reaches that point, everyone will no longer be blindly expanded, because any company has its own capacity margin."

At the same time, Zhang Banghui analyzed that pig prices may fluctuate in 2025-2026. The reason is that large enterprises are a bit overly expanded, resulting in excessive supply of pigs, but the fluctuations will be small, and corporate adjustments will be very rapid.

The era of "huge profits" of pigs has passed, and it will earn reasonable profits in the future

In the survey of the "Daily Economic News" reporter, a universal industry consensus in the future is that the pig farming industry may not be a "profiteering" industry in the future, but will show a state of micro -profit operation.

"We think that a pig can make two or three hundred dollars in the future, which is good, that is, a pound of pork to earn about 1 piece. This industry cannot be as before, as before, a pound of pork is 20 or 30 yuan. Allow, this is not the kind of special industry such as monopoly. "Zhou Mi told the reporter of" Daily Economic News ".

"For the pig breeding industry, it cannot be said that there is no threshold, but the threshold is not as high as expected. Once retail investors will come in, the company will expand production. In the end Tao, for the company, is not to say that the more expensive the pork is sold, but to ensure the stability of cost and profit.

"Unless you are a monopoly industry or an absolute leader in the industry with high thresholds, it is impossible to have huge profits in any industry." Relevant persons of Wen's shares also said that once there is a long time of huge profits or excess In terms of income, people in other industries will definitely influx. For example, when pig raising fires, many people who engage in real estate come to raise pigs.

For the future development of the pig breeding industry to the development of micro -profit business models, Shennong also agrees. "Although in the model of Weili's operation, the return rate of the pig breeding industry will not be as considerable as the pig prices are high before," Shennong said in investor investigations before, and as major pig companies are improving the industry, the industries are improving the industry Chain, make up for shortcomings, in general, there is still a chance for the pig breeding industry.

There will be ups and downs, but in the long run, they will make money. Unless you have a bad raising or the cost is too high. "Zhou Mi said.In

Daily Economic News

- END -

Zhongguancun Software Garden Incubator helps Che Huida "Fanyuan Voyage"

As a scientific and technological innovation highland, Haidian District, Zhongguancun Software Park incubator gives full play to the advantages of platform resources, helps the rapid development of SM

21 securities firms are optimistic about the opportunity to segment the track in the second half of the year?

Editor's note: Last week, the market was still paying attention to the 3300 -point...