Open source securities disclosed the IPO prospectus, and the New Third Board business has taken the banner of the star business. Can the "Beijing Stock Exchange Features Specialty Brokerage" become its new business card?

Author:Daily Economic News Time:2022.07.05

The old -fashioned securities firms of Shaanxi -open source securities disclosed the IPO prospectus on July 5. It is expected that the issuance of no more than 1.153 billion shares, accounting for no more than 20%of the company's total share capital after the issuance, and will be listed on the main board of the Shenzhen Stock Exchange. The reporter noticed that among the many businesses, the New Third Board business is definitely the star business of open source securities. Since its qualifications for the New Third Board business in 2016, the performance has steadily increased. The industry is at the forefront. Therefore, open source securities will rely on the leading advantages of the New Third Board business and the North Stock Exchange business to build a comprehensive service broker with the characteristics of the Beijing Stock Exchange.

However, what I have to see is that compared with leading companies in the same industry, open source securities have a large disadvantage in asset size, capital strength, customer foundation, and business balance. Open source securities said that due to capital scale, the company's overall ranking in the industry is not prominent. If it can be successfully listed in the future, it can make up for the shortcomings of net capital, which will help expand business and enhance the overall competitiveness in the industry.

Real -controlled human beings of Shaanxi Provincial SASAC

Open source Securities Co., Ltd. (hereinafter referred to as open source securities) was established in February 1994, with a registered capital of 4.614 billion yuan. The headquarters is located in Xi'an High -tech Zone, Shaanxi. Institutions, 6 controlling subsidiaries, including Changan Futures, Shanghai Kaiyuan Siyuang, Shenzhen Kaishang Investment, and Qianhai Kaiyuan Fund, have initially completed the layout of securities, funds, futures, and private equity investment.

Public information shows that the controlling shareholder of open source securities is Shaanxi Coal Industry Chemical Group Co., Ltd. (hereinafter referred to as Shaanxi Coal Group), and the total share capital before the issuance of open source securities is 58.80%. The Shaanxi SASAC has the actual control of Shaanxi Coal Group and Changan Huitong Investment Management Co., Ltd. (hereinafter referred to as Huitong Investment), and indirectly owns 59.84%of the voting rights of open source securities through Shaanxi Coal Group and Huitong Investment. Essence

It is understood that the company's operating income is mainly due to the securities market, and its operating performance and profitability are directly affected by the fluctuation of the securities market. In 2019, open source securities realized operating income of 2.084 billion yuan and net profit of 407 million yuan. In 2020, open source securities realized operating income of 2.835 billion yuan, an increase of 36.06%year -on -year, and a net profit of 605 million yuan, a year -on -year increase of 48.71%. The increase in operating income is mainly due to the increase in the increasing net income of the handling fee and commission.

In 2021, open source securities realized operating income of 2.70 billion yuan, a year -on -year decrease of 4.76%, and net profit was 533 million yuan, a year -on -year decrease of 11.93%. The reporter learned that the decline in the operating income of open source securities in 2021 was mainly due to the decline in the handling fees and commissions income of its investment banking business.

Positioning the specialty broker of the Bei Stock Exchange

In the prospectus (declaration draft), open source securities stated that the company focuses on the active development of traditional businesses such as securities brokerage business and securities self -operating business, focusing on the new third -board business -based investment bank innovation business, bond underwriting business, assets, assets The emerging business fields such as management business and the company have relatively advantageous businesses. After years of focusing on development, they gradually have a strong competitive advantage in the above fields.

From the data point of view, in many business areas, the New Third Board business is its star business. Since its qualifications for the New Third Board business in 2016, their performance has steadily increased. In 2017, the company's new three -board listing project industry ranked second; in 2018 and 2019, the number of new three -board listing project industry ranked first; in 2020, the New Third Board continued to supervise the number industry in the second place; in 2021, the number of new third boards continued to supervise the number The industry ranks first.

From 2019 to 2021, 56, 33 and 28 companies are listed on the New Third Board of open source securities, and a total of 117 listed homes are recommended, covering multiple industries such as software and information technology, and special equipment manufacturing. As of December 31, 2021, it continued to supervise 616 new three -board companies.

Open source securities said that with the richer customer resource reserves and long -term brand image accumulation, the company guides the brokerage business, research business, self -employed business, investment banking business, asset management business and other business lines under the historical development opportunities of the Peking Stock Exchange Coordinated development, firmly used the Beijing Stock Exchange's sponsor listing and the listing of the New Third Board as a fulcrum, opened up the Beijing Stock Exchange and the New Third Board Market Comprehensive Financial Services Industry Chain, and built a comprehensive service broker with the characteristics of the Beijing Stock Exchange.

Frank the disadvantages in competition

"After years of development, although the company has continuously enhanced the capital scale with shareholder resources and its own development accumulation, the capital scale still needs to be increased compared to head securities firms and listed brokers." Open source securities admitted in the prospectus.

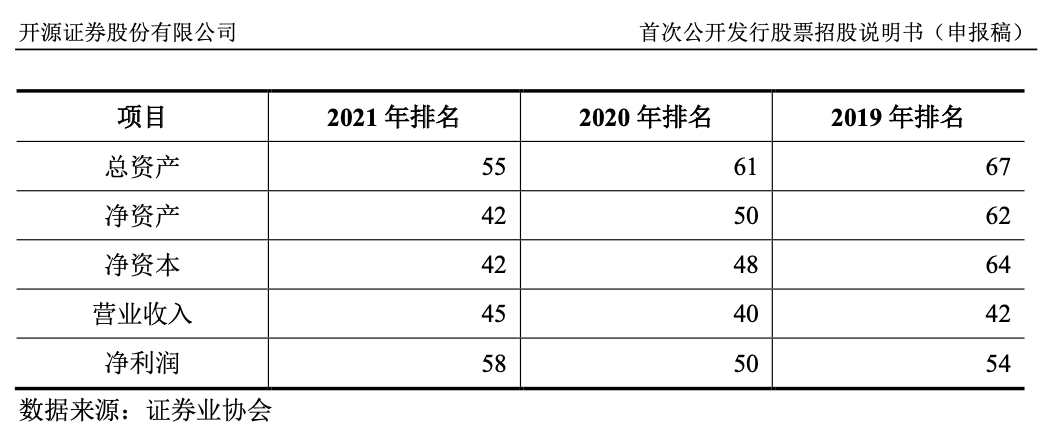

The reporter noticed that compared with leading companies in the same industry, open source securities have a large disadvantage in asset size, capital strength, and customer foundation. According to statistics from the Securities Industry Association, the company's total assets, net assets, and net capital size industries at the end of 2020 are the 61st, 50th and 48th, respectively. At the end of 2021, the company's total assets ranked only 55th in the industry and 42nd in net assets.

Open source securities said that the securities industry is a capital -intensive industry. Compared with head securities firms, the company's net capital scale is large, which is not conducive to business expansion. It may even affect the company's future application for new business qualifications.Faced with fierce market competition and changing regulatory environment, it is urgent to further expand the scale of net capital through this issuance of funds to make up for the disadvantages of insufficient net capital.In addition, it also needs to be improved in terms of business balance, and the income structure needs to be optimized.According to open source securities, although the company has established a diversified business system, the development of business between business is uneven. Compared with the top businesses such as the New Third Board business, the Bei Stock Exchange business, and bond business, the overall level of business and industry.Power and market competitiveness are still insufficient. For example, the poor equity business foundation of investment banks, the international business is still blank, and the financial technology innovation application capabilities need to be broken.In the future, we need to increase investment in weak business, improve business balance, and optimize the revenue structure.

Daily Economic News

- END -

The annual net profit of Dadi in 2021 83.288 million yuan increased by 19.99% year -on -year

On June 29, Capital State learned that Dadi (code: 430034.NQ) released the 2021 annual report performance report.From January 1, 2021-December 31, 2021, the company realized operating income of 3.233

Xinjiang's first national industrial Internet identification analysis second -level node launch to accelerate the digital transformation of the industry

The national industrial Internet identification analysis analysis of the second -l...