The coal plate broke out, and the coal ETF rose more than 3.5%to lead the two cities

Author:Capital state Time:2022.07.05

On July 5th, affected by the news of the dynamic coal consumption daily, the A -share coal sector rose and the soil came again. As of press time, Yongtai Energy has risen by over 9%, and Shanghai energy rises exceed 7%. Orchid Science and Technology Innovation, Ping Coal Co., Ltd., Shaanxi Coal Industry, China Shenhua and other stocks have risen. Coal ETF (515220) rose more than 3.5%, and the turnover exceeded 360 million.

As of yesterday (July 4), the net inflow of coal ETF over the past 20 trading days exceeded 1.3 billion yuan, with a scale of more than 5 billion yuan. Since the beginning of this year, the coal industry has performed well. The coal ETF (515220) has increased by 31.5%in the first half of the year, ranking first in the market in the market.

The research report of Xingye Securities stated that the peak season is approaching, the daily consumption continues to rise, the price of power coal runs smoothly, the economic recovery continues to use the energy demand, and the downstream consumption continues to rise. As the inventory enters the downward cycle, the coal price will get a new round of upward proceedings. power. At the same time, international coal prices continue to rise, the amount of imported coal has decreased, and global energy is still tense. In terms of double focus: Although the price of coking coal is under pressure, the downstream steel mills are close to the end. As the recovery continues, the turning point of the coking coal price is gradual.

In the short term, the epidemic is almost coming to an end. We emphasize that we must stabilize the economy and grow steadily, and the demand for short -term coal and electricity will not be less. Especially now entering the high temperature period in the summer, the amount of electricity will increase greatly, and the demand for coal is expected to be supported.

In the medium and long term, the investment opportunities in the coal industry are actually from "carbon neutral" and "carbon peaks". The purpose of the dual carbon policy is to increase the proportion of new energy and reduce the proportion of old energy.

In the process of new and old energy conversion, some coal companies will arrange early arrangements to reduce production capacity for consideration of policy prospects. In the case of stable demand, staged supply and demand will be imbalanced, which will drive coal prices to rise. At the same time, the coal industry to carry out energy cleaning or improve energy efficiency will further promote the improvement of performance. Most coal companies hold important resources such as land and raw materials. They have the experience of thermal power and chemical operations, and have innate advantages in transformation. At present, about 1/3 of coal companies involve thermal power operations and have rich experience in power operations. In addition, in the context of the country's vigorous encouragement of "coal cleaning and efficient use", coal companies will extend the current chemical industry chain in accordance with the direction of high -end green and low -carbon development and transform to new chemical materials. Therefore, in the process of "carbon neutralization" and "carbon peaks", the conversion of new and old kinetic energy will continue to provide motivation for the coal industry in the future.

From the perspective of valuation, thanks to the strong fundamental profit data, the valuation level of the coal plate has not risen sharply. The current valuation of the CSI Coal Index is about 30%of the historical division, and the investment is significant. Interested investors can pay attention to coal ETF (515220).

- END -

Li Kezhe: Yellow Land planting "golden eggs"

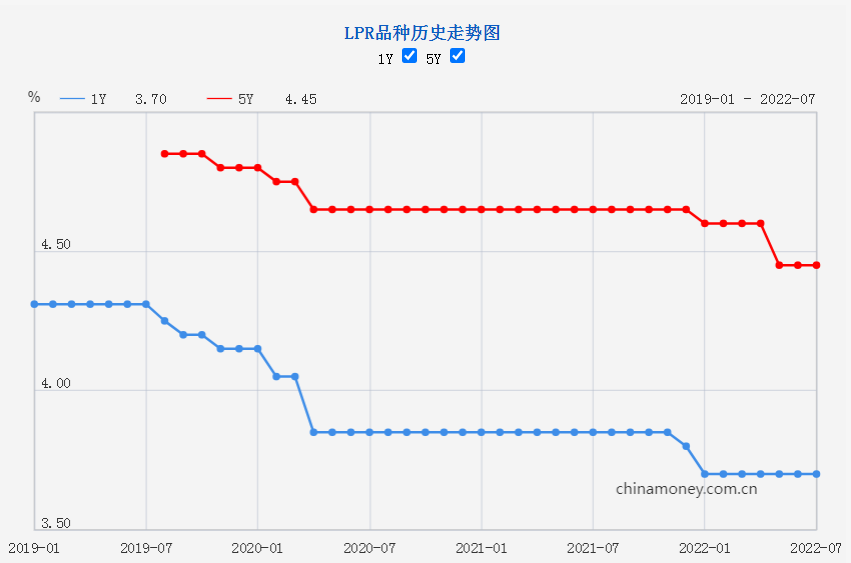

The new phase of the loan market quotation interest rate has not been adjusted

On July 20, the new loan market quotation interest rate (LPR) announced that my co...