"Finance and Economics" Wang Zhongmin: Establish an independent, clear, and full process of personal pension accounts to improve the scale accumulation of personal pensions that start to get rid of individual taxes and fees

Author:Chang'an Street Reading Club Time:2022.07.05

Wang Zhongmin: Establish an independent, clear, and full process of personal pension accounts to improve the scale accumulation of personal pensions that start to get rid of individual taxes and fees

Finance

★★★★★

1 Development status of the third pillar of the elderly

During the development of global pensions, the third pillar gradually formed with the evolution of social pension problems. In the process of promoting the first pillar pension guarantee system, a huge capital gap caused a huge funding gap due to deepening population aging, at this time the third pillar appeared in the form of personal pensions. At the same time, with the rapid development of urbanization and industrialization, the spatial displacement, role transformation, and cross -industry development trend of labor force have been greatly enhanced. These changes have caused people to have a demand for the third pillar. The third pillar has a faster growth rate. At present, in the third pillar of the country where mature countries, the third pillar accounts for all pensions, has reached 1/3 or more, and most countries have reached more than ten percent. The process only took less than 30 years. my country has only begun to attach importance to the third pillar of the development in recent years. At present, the third pillar accounts for a low proportion of all pensions.

2 The difference in the positioning of the third pillar at home and abroad

First, my country defines the third pillar as the logic of personal commercial pension insurance or individual savings pension insurance, tending to the logic of income allocation after tax fees. The world's more situations are developing the third pillar with the logic of pre -tax, and a certain percentage of a certain percentage of total revenue before tax will be put in a personal pension account. Developing personal endowment insurance according to the disposable income before taxes before taxes before tax will generate a large gap of counting foundation.

Second, from the perspective of tax discounts and investment income, my country has tried tax extension commercial pension insurance in some regions. In the future, it may explore tax delayed pension financial products in the fields of pension funds, pension financial management and other fields. If tax delayed financial products such as insurance and public funds are selected, affected by factors such as tax extension, tax delay mechanism, and investment scope, the marginal income growth may not be as good as some non -tax delay financial products. Affected by this, residents' disposable income will flow more to independent investment channels, rather than flowing to tax extension pension commercial insurance, funds, wealth management and other channels.

3 Logic positioning and logical scenario of personal pension insurance in my country

The first is to clarify the institutional arrangement of the third pillar accumulation system. my country uses a accumulated system in personal endowment insurance, which has a logical scenario that across the entire life cycle, rather than the first -pillar collection system. If the impact of the aging aging of the population structure and the impact of the fluctuations of financial assets and the impact of inflation, the current payment system cannot solve the problem, and the accumulation system needs to be used at this time.

The second is that the third pillar particle size needs to be refined to individuals. The larger the particle size of the first pillar, the greater the particle size, the wider the urban and rural residents. The third pillar particle size must be refined to the individual. It is recommended to establish a personal pension account. It continuously accumulates funds through tax exemption and tax extension. logic. The third is to establish an independent personal pension account. This account is not only independent of other pension accounts, but also independent of other financial asset accounts, personal non -financial asset accounts and corporate legal person accounts. This independence enables account holders to fully enjoy various social policies, social and exemption and social services.

The fourth is to ensure the independent taxation and pre -tuition structure arrangement of personal pension accounts. Only before tax and before the fees can individuals truly generate tax and extension effects, can individuals encourage individuals to join the third pillar. Society will obtain other income for reducing personal income tax and implementation of tax delay (such as more long -term stable funds to enter the market to promote the increase in the proportion of direct financing and maintain the stability of the financial market). This is a win -win strategy that is good for macroeconomics and favorable for personal protection.

4 Use international comparison logic to analyze the current problem

First, in the age of epidemic, the pressure of enterprises should continue to pay "five insurances and one gold". my country has continued for about 7 years to reduce the rate of social security to account for the total cost of corporate costs to reduce the pressure on the rate of rates borne by the enterprise. Another feasible solution is to change some of the costs of social overall accounts and unified collection management to taxes, and delay the effect of delayed taxation policies, so that this part of the funds can enter the personal pension account. Enterprises have not increased any burden on pension taxes, and corporate employees have obtained funds in personal pension accounts, increasing the initial accumulation scale of personal pension accounts, and increasing the social effects of personal account income.

The second is to seize the opportunity of financial reform and give play to the allocation and investment value -added effect of personal pension accounts. If you can seize the marketization, finance, and equity securitization of China's economic system reform, it will bring asset investment allocation effects. The National Social Security Fund has collected 40%of its funds in fixed income in the past, and grasped the benefits of credit bonds, corporate bonds and national financial bonds, which is higher than that of ordinary bonds.

The third is to promote the formation of a logical ecology of the Fund for the formation of social investment management. Only under the accumulation system can people invest in the wealth accumulated in life to the third pillar of the financial credit cycle, the short -term and long -term impact of fixed income, and the long -term impact of the first -level market risks and the secondary market risk. From the perspective of international experience such as the United States, after the rise of the third pillar, a large number of LPs from the third pillar pension have been formed, and most of these LPs choose the governance model of the parent fund and choose the best funds worldwide to invest Investment in specific projects, specific enterprises, and specific technical fields just strengthened the concept of professionalization of asset management. In addition, multi -level LP can greatly increase risk dispersal and avoid risks directly to the investment target. From the perspective of the full cycle, full scene, and logic of investment, personal pensions as the third pillar will play an active and important role. The third pillar has a personal income tax reduction and exemption of special logical scenarios, and provides the income delay of the entire life cycle during the investment management process. The reference model of the governance mode.

Wang Zhongmin: The lecturer of the Chang'an Street Reading Club, the former vice chairman of the National Social Security Fund Council

For more exciting, please click

New Book Recommend Chang'an Street Reading Club No. 20220701 Cadres to Learn the New Book List

Chang'an Street Good Book Changan Street Reading Club Annual Recommended Cadre Learning Book List (Classic, Popular Articles)

- END -

Jiuquan City has accelerated the pace of certification to consolidate the foundation of agricultural product brand development

Recently, the reporter learned from the Municipal Agricultural Product Quality and Safety Supervision and Management Station that since this year, Jiuquan has accelerated the pace of agricultural prod

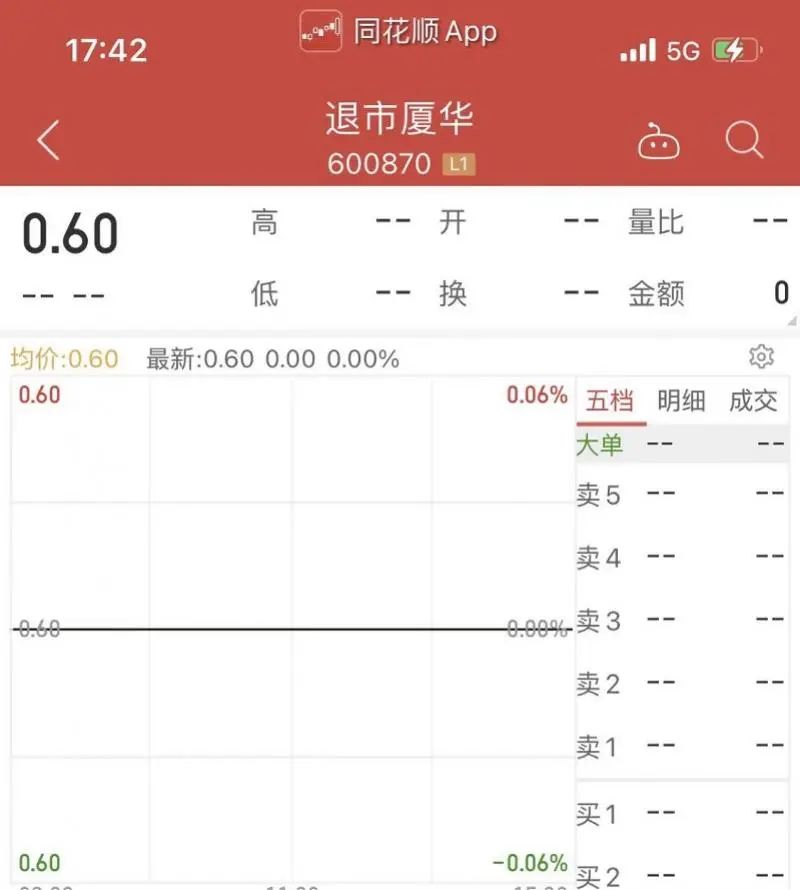

Former color TV giants, delisted!

On June 23, the retreat from Xiahua (600870, the original securities Xiahua Elect...