The price of pigs rose again!Officially request severe punishment to raise prices!Listed companies suggest risk

Author:Zhongxin Jingwei Time:2022.07.04

Zhongxin Jingwei, July 4th. The price of pigs has risen rapidly in the near future. On the 4th, the four major listed pig companies rose daily limit. The main force 09 contract of pig futures exceeded 22,000 yuan/ton. In this regard, listed companies have responded.

The Shenzhen Stock Exchange Interactive Platform shows that some investors asked Wen's shares that the price of pigs has recently risen sharply. Has the company increased the number of outlets?

Screenshot of the Shenzhen Stock Exchange Interactive Platform

Wen's shares said that the company insists on steady production and does not bet the market. According to the established production plan, balanced organizational arrangements to arrange production, reasonably arrange the rhythm of the column sales, and less large -scale use of a large scale or a early column strategy to adjust the rhythm of the column.

Regarding this year's pig prices, Muyuan shares said at the Shenzhen Stock Exchange's interactive easy platform that the market price of the pigs from April to the present has a significant rise in continuous recovery, combined with the data of the Ministry of Agriculture and Rural Ministry and the duration of the rise of the price of the pig price. It can be roughly judged that the rise in pig prices is mainly due to the improvement of the margin of supply and demand, not being driven by simple emotions or short -term expectations.

Screenshot of the Shenzhen Stock Exchange Interactive Platform

On the evening of the 6th, Muyuan shares released a briefing in June in June that 5.279 million pigs were sold in June (of which 986,000 pigs were sold), with sales revenue of 8.754 billion yuan. In June, the price of commercial pigs showed an upward trend. The average sales price of commercial pigs was 16.53 yuan/kg, an increase of 11.16%over May 2022. As of the end of June, the company's sow can survive 2.473 million heads.

Muyuan shares also remind the three major risks: the sharp fluctuation (decrease or rise) of the market price of the pigs may have a significant impact on the company's operating performance. If the market price of the pig market has fallen sharply in the future, it may still cause the company's performance to decline. Please Investors are carefully decided and pay attention to investment risks. The risk of changes in the market price of the pig is the system risk of the entire pig production industry. For any pig producer, it is an objective, controlled external risk; animal epidemic is the main risk facing the development of the animal husbandry industry, and it may be right. The company's operating performance has had a significant impact. Investors are requested to make prudent decisions and pay attention to investment risks.

On July 4, pork stocks almost collectively "daily limit". As of the close of the day, among the five major listed pig companies, Muyuan's shares, new hope, Tianbang Food, and Zhengbang Technology have risen, and Wen's shares have risen by more than 11%.

Not only that, on July 4, the main force 09 contract of pig futures exceeded 22,000 yuan/ton upwards. This is also a new high since the first 20,000 mark on June 27th.

In terms of price, data disclosed by the Ministry of Agriculture and Rural Affairs showed that as of 14:00 on the 4th, the average price of pork in the national agricultural wholesale market was 25.74 yuan/kg, an increase of 4.8%over Friday.

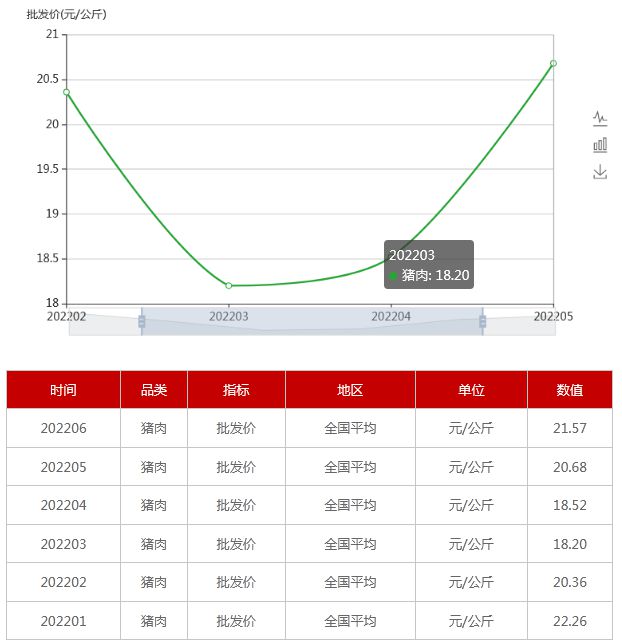

Screenshot of the Ministry of Agriculture and Rural Affairs

Zhongxin Jingwei noticed that according to the monthly data disclosed by the Ministry of Agriculture and Rural Affairs, from January to June this year, the pork wholesale price was "V-type" trend, and the prices in March and April were low, both around 18 yuan.

According to WeChat signal of the National Development and Reform Commission on the 4th, in response to the recent rapid rise in the price of pigs, the Price Department of the National Development and Reform Commission organized industry associations, some breeding enterprises and slaughtering enterprises to hold a meeting to analyze the supply and demand and price situation of pig markets, and study the later period of judgment and judgment. In price trend, study and do a good job of stabilizing the price of the pig market.

According to the analysis of the relevant parties, the important reason for the recent rapid rise in domestic pigs is that the market has irrational pressure fences and secondary fattening. Some media, especially self -media, fabricate and spread the price increase information, rendered the price increase atmosphere. In the short term, in the short term The market has exacerbated the market for sale; the current pig production capacity is generally reasonable and abundant, and the consumption is not strong, and the price of pigs does not have the foundation of continuously rising; blind barriers and secondary fertilizers may lead to the fate of concentrated columns in the later period, and the price fell rapidly again, resulting in market price The ups and downs are not conducive to the normal production and operation of enterprises and the long -term healthy development of the industry.

The Price Department of the National Development and Reform Commission stated that the country has always paid close attention to the changes in the market price of raw pork and pork, strive to prevent sharp fluctuations in prices, and maintain the smooth operation of the market; require large -scale breeding companies to take the lead in maintaining the rhythm of normal columns, adopting the fence for fertilizer, and not blindly pressing fences, reminds reminders Enterprises must not hoard their stories, coax their prices, and shall not collude prices; it is clearly stated that effective measures such as reserve adjustment and supply and demand adjustment will be taken to prevent the price of pigs from rising excessively. Violations such as price and other illegal acts, maintain the normal market order, and promote the long -term healthy development of the industry. (Zhongxin Jingwei APP)

Pay attention to the official WeChat public account of JWVIEW (JWVIEW) to get more elite financial information.

- END -

Xingfa Group: It is expected to make a profit of 3.62 billion to 3.720 billion yuan in the semi -annual profit of 2022

On July 6, Capital State learned that the A-share listed company Xingfa Group (code: 600141.SH) released the semi-annual report performance forecast. It was 3.620 billion to 3.72 billion yuan, and net

Breaking the circle to break a loneliness, station B has to make money by "two -dimensional"

Instead of burning money, it is better to return to the original intention, operat...