Cross -border payment industry survey: The institutions have their own duties of "sites"

Author:Securities daily Time:2022.07.04

4Jul

Wen | Li Bing

From July 21st, the new regulations on the "Notice on Supporting the Settlement of Cross -border Renminbi Settlement of New RMB of Foreign Trade" (hereinafter referred to as the "Notice") will be implemented to inject new kinetic energy into cross -border payment business. The "Notice" broadcasted the scope of the cross -border business of the payment institution from the widening of the goods trade and service trade to all the frequent items. The industry generally believes that the "Notice" is important for the payment industry. At the same time, with the continuous acceleration of the implementation of foreign trade, the market is expected to promote more institutions to carry out the business. The latest statistics show that 43 payment institutions have carried out cross -border payment business. The reporter sorted out the cross -border business situation of the payment industry since 2022. In the first half of the year, many institutions have been thinking about the bureau in the cross -border field. Based on years of development, the advantages have become increasingly prominent. In recent years, 43 payment institutions "enrolled", as a new format of foreign trade, cross -border e -commerce has shown strong development vitality, and has played an important role in stabilizing the basic market of foreign trade and the development of high -quality trade. Cross -border e -commerce represented by B2B and B2C has grown rapidly in more than ten years, and has gradually developed into a "new normal" exporting foreign trade. According to statistics from the General Administration of Customs, in 2021, my country's cross -border e -commerce import and export scale reached 1.98 trillion yuan, an increase of 15%; the exports were 1.44 trillion yuan, an increase of 24.5%. Generally speaking, the ability of cross -border RMB business to support the real economy is constantly improving. According to central bank data, from January to April 2022, the scale of cross -border trade RMB receiving and payment was 2.6 trillion yuan, an increase of 24%year -on -year. In this context, payment institutions ushered in new development opportunities in the field of cross -border payment. At present, the cross -border business of my country's payment institutions is promoted in depth, and a new growth engine is constructed through refined operations. According to the latest data of the China Payment Clearance Association, a total of 43 payment institutions in 2021 have carried out cross -border payment business, which handles a total of 7.191 billion cross -border payment business, an increase of 62.55%. Among them, cross -border RMB income of payment institutions increased by 120 billion yuan compared with 2020. The payment giants led by Ant Group Alipay and Tencent WeChat payment have been "deeply cultivated" in the cross -border field. Since 2022, the good news of cross -border business has continued and has been thinking about changes. In February 2022, Worldline, the fourth largest payment and trading service provider in the world, through Alipay+solutions to cooperate with Ant Group to upgrade. It is reported that in September 2020, ALIPAY+Global Cross -border Payment and Technical Solutions launched by Ant Group support dozens of digital payment methods including electronic wallets and mobile banking. Consumers are seamlessly connected; in April 2022, Ant Group reached an in -depth cooperative relationship with Southeast Asia Paying Giant 2C2P in a strategic investment. In fact, as early as 2013, Alipay started the "going to sea" to provide various convenience for Chinese tourists' outbound tour. Since 2015, through the "strategic investment+technology sharing" method, it supports overseas partners to establish 9 9 Electronic wallet. After nearly 10 years of development, the Ant Group has been serving Chinese tourists from the country, to assisting overseas partners to "build" wallets, to try to "open" wallet cross -border, serve the needs of Asian consumers, and continue to upgrade cross -border business. According to data provided by Alipay to the reporter of the Securities Daily, Alipay connects 27 kinds of currencies online, opened up the payment channels in almost all countries and regions around the world, and offline in 56 countries and regions around the world to support Chinese tourists' cross -border Pay and take a taxi. At the same time, Alipay also provided real -time tax refund to Alipay services at airports and urban duty -free shops in more than 35 countries, and services access to public transportation systems in 20 countries and regions. In terms of WeChat Payment, it has developed cross -border business since 2015. It has currently connected to 64 overseas countries and regions and supports 26 settlement currencies. Since 2018, WeChat Pay has been accessing in Southeast Asian countries, covering many scenarios such as catering, scenic spots, and shopping. It can be seen that WeChat payment is also actively deploying the field of cross -border payment. According to data provided by WeChat payment to the "Securities Daily" reporter, the current WeChat Mini Program has grown rapidly in overseas businesses, the number of monthly active applets increases by 268%, and the average number of transactions in the month increases by 897%. Based on the WeChat ecosystem's connection capability, Chinese consumers can use WeChat applets directly to buy Swiss traffic tickets in Switzerland; in Cambodia, WeChat payment not only accesss the famous attraction Angkor Wat, but also can apply directly to apply for visas and so on. Cross -border ecology of payment institutions has gradually improved the reporter's investigation and found that, in addition to passing wallets on the C -side and constructing ecological payment institutions, some institutions are also in depth of business through B -side services and obtaining payment licenses overseas. The industry generally believes that the cross -border ecology of domestic payment institutions is gradually improving, and the division of institutions has also shown the characteristics of "their duties". Taking the payment licenses frequently abroad, the number of continuous numbers of the cross -border market as an example, the reporter found that the data has been published and found that the number of continuous numbers has obtained more than 60 payment licenses and related qualifications in many countries and regions, and the accumulated service exceeds 120 more than 120 Wan China cross -border e -store shop. The relevant person in charge of the Lianlian Digital expressed to the "Securities Daily" reporter that the idea of continuing to develop in the cross -border field in the future.

The person in charge said that with the continuous deepening of a new round of high -level opening strategy, the pace of China's payment and Chinese service "going global" will also be accelerated again. For Chinese companies, "going to sea" is not only the "going global" of goods trade, but also the output of serving trade. The number of continuous numbers will continue to promote the global strategic layout. "At present, Ibao pays multi -service Amazon, EBAY and other overseas e -commerce platforms, as well as receiving service providers of independent stations to help Chinese sellers settle in foreign exchange. In the future, the pace of cross -border business layout will also be further depth." Ren Ning Fusheng said. The joint director, researcher Pan and Lin told the Securities Daily that the "Notice" and the implementation of foreign trade in the "Notice" and the implementation of stabilizing foreign trade in the market are accelerating, and the market is expected to promote more with the implementation of the "Notice". The institution has carried out this business. Fortunately, the ecology of domestic payment institutions is gradually improving. In the future, the convenience of cross -border receipts will be further enhanced, which will also help my country's new foreign trade new format development to accelerate. "New models such as cross -border e -commerce and other new formats are a living force for the development of foreign trade in my country and an important trend of international trade development." Wang Pengbo, a senior analyst at the financial industry, told the Securities Daily reporter that it can predict that the cross under the blessing of policy blessings can be predicted that the cross under policy blessing The border payment will soon enter the new demand explosion period. At the same time, the number of new entrants will gradually increase, especially when the domestic payment market is gradually saturated, opening up the sea to find new growth points will become the goal of many payment institutions. Recommended reading

In July, the combination of the securities firm's gold stocks was released, and this stock became a "big brother"!

Suddenly the announcement was investigated, what happened to the lithium industry with a market value of more than 220 billion?

Picture | Site Cool Hero Bao Map Network Production | Zhang Xin

- END -

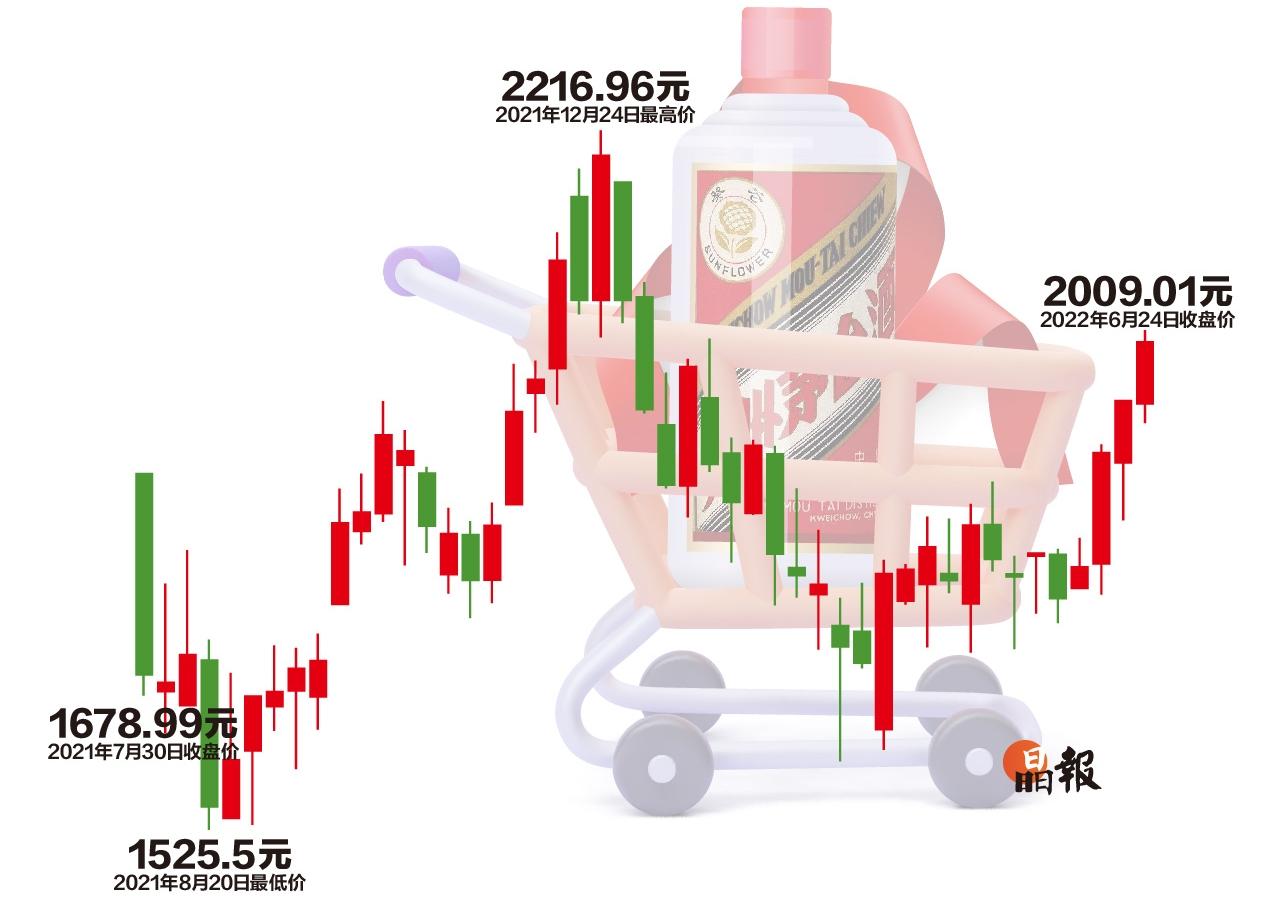

Wen Finance (58) | What does Moutai return to 2,000 yuan?

On June 24, Shanghai Stock Exchange rose 0.89%to close 3349.75 points. A total of ...