The IPO application of the Cavaliers Dairy Beijing Stock Exchange is accepted, and the income mainly comes from Inner Mongolia Autonomous Region

Author:Capital state Time:2022.07.04

On July 4th, Capital State learned that the IPO application of the Cavaliers Dairy (832786.NQ) was applied recently.

Picture source: Bei Stock Exchange website

The owner's business of the Cavaliers is pasture, corn and beet planting, cows intensive breeding and organic fresh milk supply and marketing, dairy products and production and sales of milk -containing beverages, as well as the production and sales of white sugar and its by -products.

Financial data shows that the company realized operating income of 636 million yuan, 707 million yuan, and 876 million yuan in 2019, 2020, and 2021, respectively; net profit attributable to the owner of the parent company was 37.418 million yuan, 22.881 million yuan, and 55.727 million yuan Essence

Image Source

The company plans to apply for public offering of no more than 52.27 million RMB ordinary shares (shares without excess sale). After the total amount of funds raised by this issuance is deducted, it is planned to invest in the Cavaliers Dairy Cowbon breeding project. 261 million yuan.

In response to the IPO of the Beijing Stock Exchange, the Cavaliers Dairy admits that there are the following risk factors:

(1) Food safety risk

The company's dairy products, white sugar and other products are facing the final consumers and belong to daily consumer goods. In recent years, government departments at all levels have continuously improved food regulatory laws and regulations; the public has also paid more attention to food safety and quality issues. Consumers' awareness of food safety has continued to deepen, and their awareness of rights and interests has increased. Effective quality management is the lifeline of the enterprise, and food quality and safety have become the top priority of food processing enterprises. The company is committed to providing the market with safe and high -quality milk sources, dairy products, white sugar and its by -products to ensure food quality through advanced management technology and strict quality monitoring methods.

The company has been engaged in food production and sales for many years, and has never occurred in major food safety issues. Although the company has established a perfect product quality control system, product quality monitoring runs through the entire process of procurement, production, and sales. However, the production chain of dairy products has a long production chain and many management links. The company cannot avoid food safety issues caused by negligence or resistance.

If food safety and quality problems occur, the company's reputation and business will not affect the company's reputation and operation, and may cause civil or criminal legal liability caused by it. The company has been engaged in food production and sales for many years, and has never occurred in major food safety problems, but the production chain of dairy products has long production chain and many management links. Reputation and operations have disadvantaged, and may cause civil or criminal legal liabilities.

(2) The risk of negative events in the industry to the dairy industry

Food safety is related to the daily life and health of the people, which is closely related to the vital interests of millions of households. However, as my country's legal system construction is still in the process of continuous improvement, the integrity and moral standards of various types of participating entities in the market still need to be improved. Food safety issues have become the focus of attention from all walks of life and the general public.

Consumers are extremely sensitive to public discussion topics in the dairy industry. For example, risk incidents such as food quality and safety caused by irregular operations in the industry may cause consumers' trust in dairy quality and safety. huge influence. During the reporting period, the company's fresh milk and other dairy products did not have major food safety problems. However, if related adverse incidents occur in the future, it may affect the company's raw material supply link, or due to the shaking of consumer confidence, affecting the product market demand link, which will cause adverse effects on the company and bring risks to the company's operations.

(3) Risk of dairy disease

The company's main operations currently include dairy breeding business. At the end of each period of the reporting period, the company's productive biological assets had the book value of 93.7799 million yuan, 130,468,900 yuan, and 212.75 million yuan, respectively, accounting for 13.35%, 16.30%, and 19.93%of non -current assets at the end of each period. The company's productive biological assets company produces fresh milk into cows. Dairy cows are prone to various epidemic diseases such as hoof disease, foot -and -mouth disease, influenza, breastitis, and uterineitis. The outbreak of these epidemic diseases will seriously affect the yield and quality of milk, and may even cause a large number of dairy dumplings or slaughter. If the company's surrounding areas or their own dairy cows have a disease, the company's raw material milk production will decrease significantly; at the same time, consumers may worry about the quality of raw materials milk and dairy products, reduce procurement or consumption, and directly affect the number of sales of raw milk milk. It has adverse effects on the company.

(4) Natural disaster risk

The issuer's main business involves the fields of agriculture, pastoral, milk, sugar and other fields and industrial chains. Each industry adopts a cooperative cycle development business model. The company's animal husbandry sector is engaged in the scale and intensive breeding business of cows, and the company's agricultural sector is engaged in the planting of corn, pasture and beet. The growth, breeding, and the growth of crops have greater dependence on natural conditions, and changes in natural conditions such as weather will also grow raw materials such as pastoral grass, silage feed and other raw materials required for cows herds. The amount of sugar indicators has an impact. In addition, if there are major natural disasters such as snow disasters, droughts, frost, and flood disasters, it may cause losses to the company's dairy breeding and agricultural planting business, and will have an influence on the company's dairy and sugar industry. Therefore, the adverse changes in natural conditions will have a negative impact on the company's income and profits.

(5) Risk of raw material supply

1. Risk of milk source supply

The important raw materials of the company's dairy plate dairy products are fresh milk. In addition to their own ranch supplies some fresh milk, most of the company's raw milk depends on outsourcing. Although the company has established a stable cooperative relationship with professional pastures and cooperatives, if the demand for raw milk milk companies exceeds the effective supply of raw milk milk, the company will face the risk of insufficient raw material supply.

2. Pet beet supply risk

The raw materials of the company's sugar industry sector mainly come from farm beet planting, but some of them are still derived from the order households planting beets. According to the statistics and forecasts of the China Sugar Industry Association, the 2019/20 squeeze season-2019/2021/22 The planting area of beet sugar in my country is 215,000 hectares, 262,000 hectares, and 160,000 hectares, respectively. If the planting area of beet sugar is continuously crowded by other high -yield crops, the area of sugar planting area is reduced by a large amount, the purchase price of beet sugar materials has risen sharply, and the stability of the company's raw materials will be adversely affected, bringing risks to the company's operations.

(6) Sales regional market dependence risks

During the reporting period, the company's main business revenue mainly came from the Inner Mongolia Autonomous Region. In 2019, 2020 and 2021, the main business income of the region accounted for 57.75%, 64.37%, and 69.44%of the company's main business income. The company's fresh milk and dairy products are less involved in the more developed central and eastern regions. Whether the company can further expand its business has a certain uncertainty. If the business is blocked, the issuer's future business scale and development prospects will face a certain market competition risk due to the greater dependence on the Inner Mongolia regional market.

(7) The risk of high concentration of sales of major customers

During the reporting period, the revenue of the issuer's animal husbandry sector from the company's company's company's revenue accounted for 87.34%, 94.26%, and 93.31%of the publisher's animal husbandry sector revenue. During the reporting period of the issuer's sugar industry sector, the sales of Zhejiang Hangshi Shancheng Industrial Co., Ltd. accounted for 40.76%, 36.91%, and 44.39%of the total revenue of the sugar industry sector. The main products sold by the issuer to China Mengniu Dairy Co., Ltd. are fresh milk, and the main products sold to Zhejiang Hangzhishancheng Industrial Co., Ltd. are white sugar.

The sales of the aforementioned products are more concentrated, which is in line with industry conditions and issuer's business characteristics. Although the issuer and related customers maintain a relatively stable and long -lasting cooperative relationship, if the relevant customers will change their business plans and procurement strategies in the future, they may greatly reduce the purchase of the company's products in the future, which will adversely affect the company's future operating performance.

- END -

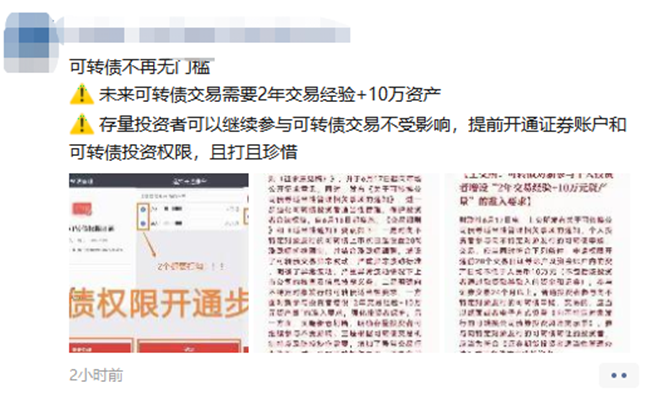

The threshold for convertible bond transactions is raised, and many brokers renovate the renovation system overnight to prevent "stepping on the line"

On June 17, the Shanghai Stock Exchange and Shenzhen Stock Exchange released the I...

Grain production increases 2,000 tons, Ningbo's rectification operation allows Liangtian to "return" grain fields