Ganfeng Lithium Industry suspected insider transactions was raised by Jiangte Electric to respond

Author:Cover news Time:2022.07.04

Cover reporter Liu Xuqiang

On July 4, Jiangxi Ganfeng Lithium Co., Ltd. (hereinafter referred to as "Ganfeng Lithium") opened 7.07%. Last night, the company announced that the company was investigated by the China Securities Regulatory Commission for suspected A -share listed company's stock secondary market transaction.

Li Liangbin, chairman of Ganfeng Lithium, said that the listed company was Jiangte Electric, a lithium battery company. On the morning of July 4th, the reporter called the Ganfeng Lithium Securities Department. The other party said that it is now based on the announcement, which is not convenient to say. At the same time, Jiangte Electric stated through an interactive platform that no information about Ganfeng Lithium was not received.

The suspected insider trading Ganfeng Lithium was filed by the lithium industry

Ganfeng lithium industry involved insider trading was investigated

Jiangte Electric is implicated

It is worth mentioning that Ganfeng Lithium Announcement showed that on January 24 this year, the CSRC launched a investigation of the Ganfeng Lithium, and the company received the "Notice of File C case" on July 1. The announcement states that the above matters will not affect the company's normal production and operation activities. The company will continue to pay attention to the progress of matters and fulfill the obligation of letters.

It is reported that Li Liangbin, chairman of Ganfeng Lithium, said that the listed company was Jiangte Electric, a lithium battery company. Because Ganfeng Lithium Industry and Jiangte Electric bought the latter company stock during the M & A in 2020, they were considered by the Securities Regulatory Commission to form a insider transaction.

On July 4, the reporter called Ganfeng Lithium Securities Department. The other party claims that it is not convenient to say that it is prevailed now.

According to the Ganfeng Lithium Industry Announcement, in August 2020, Ganfeng Lithium Industry and Jiangte Electric and its subsidiaries signed a lithium salt production line cooperation agreement. But two months later, in October 2020, Ganfeng Lithium Industry announced that the cooperation was terminated due to failure to reach an agreement on the technical transformation plan of the lithium salt production line.

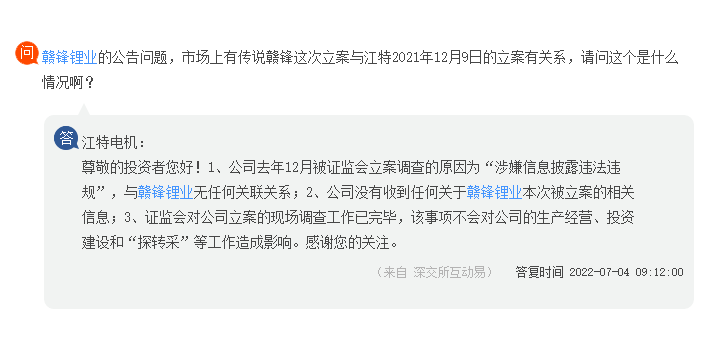

At the same time, there were market voices guessing that Ganfeng Lithium was filed this case this time, which was related to Jiangte Electric on December 9, 2021. On the morning of July 4, Jiangte Electric responded through the interactive platform. The company's investigation by the CSRC was investigated in December last year that "suspected information disclosure illegal and violations", which has no relationship with Ganfeng Lithium industry; Regarding the relevant information about Ganfeng Lithium this case; the CSRC's on -site investigation work on the company's case has been completed, and the matter will not affect the company's production and operation.

Jiangte Electric responded through interactive response on July 4

Ganfeng Lithium "Love Stocks"?

Multi -time investment in A -share listed companies

The reporter sorted out the annual report of Ganfeng Lithium Industry and found that the company does have a tendency to invest in A shares. In the past two years, A -share listed companies invested by Ganfeng Lithium have been Sanan Optoelectronics, Ma Yinglong, Dabeong, and Tengyuan Cobalt. The half -annual report of 2021 shows that Ganfeng Lithium holds two A -share stocks of Ma Yinglong and Sanan Optoelectronics. By the annual report of 2021, the company purchased the stock of Dabei Nong. In addition, Ganfeng Lithium is currently ranked among the third largest shareholders of Tengyuan Cobalt.

It is understood that Ganfeng Lithium landed in the A -share market in August 2010. The company is one of the most complete manufacturers of lithium -series products. Products are widely used in applications such as electric vehicles, aerospace, functional materials and pharmaceuticals.

It is worth noting that with the heat of the lithium -wire track market, Ganfeng Lithium Industry has recently achieved good performance. The financial report shows that the net profit of Ganfeng Lithium in 2021 was 5.228 billion yuan, an increase of 410.26%year -on -year; the net profit in the first quarter of 2022 was 3.525 billion yuan, an increase of 640.41%year -on -year.

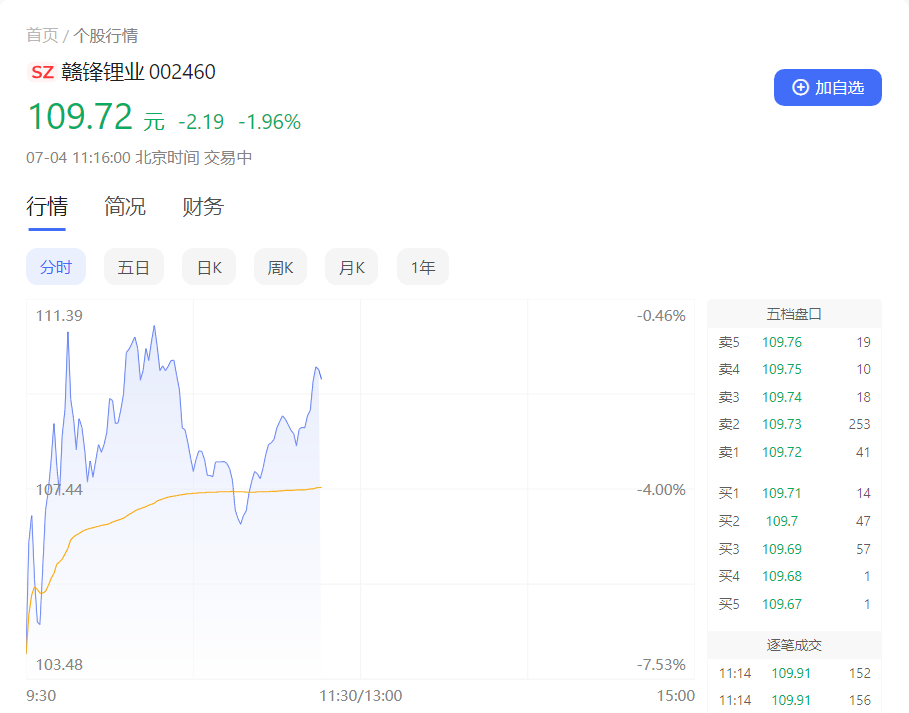

Ganfeng Lithium opened 7%on July 4, and the decline in the lunch was narrowed

In terms of stock price, Oriental Wealth data shows that Ganfeng Lithium has reached a low point of 89.9 yuan/share on April 27, and the company's stock price began to rebound. From April 27th to July 1st, the cumulative increase in Ganfeng Lithium industry increased by 70.18%. As of July 1st, Ganfeng Lithium Industry's stock price was reported at 156.97 yuan/share, with a total market value of 226 billion yuan.

As of 11:00 on July 4, Ganfeng's lithium industry declined to 2.6%to 108.7 yuan/share, with a market value of 219.6 billion yuan; Jiangte Electric rose 2.88%.

Jiangte Electric's stock price rose on July 4

Lawyer: It is difficult for investors to distinguish insider transactions

Starting from industry self -discipline and punishment

The inside trading of listed companies has always troubled investors. What are the characteristics of insider trading? How do you distinguish as ordinary investors?

Zhang Liwen, a lawyer of Jingshi Law Firm, believes that insider trading is abnormal, short -term, and trading behaviors before major information release, which in turn causes the abnormal performance of specific securities. This is also an important clue to discover and investigate inside trading behavior discovery and investigating insider trading.

All insider trading behaviors are super concealment. Listed companies or trading entities involving insider trading behaviors generally do not actively clarify before being noticeable by regulatory agencies. Only during the survey of regulators, the necessary situation will clarify and prove the focus of the investigation behavior.

For investors, insider information revolves around the group of major information associated people, leading to the channels for obtaining information and the number of people who have mastered the information, the number of information is small, and the information is hidden. Therefore, it is difficult for investors to distinguish inside information and false information.

Zhang Liwen mentioned that since the securities market, inside information and insider trading behavior exist objectively.At present, it can only strengthen industry self -discipline and impose administrative penalties and criminal penalties.Fortunately, in recent years, the administrative supervision and national criminal law legislation of the Securities Regulatory Commission has increased the investigation and punishment of inside story transactions.

- END -

Yancheng: From January to May, the growth and export of foreign trade maintains a stable growth and export of import and export.

According to the statistics of Yancheng Customs, from January to May this year, Ya...

78 major projects in Hangzhou concentrated in total investment exceeding 100 billion yuan

Zhejiang News Client reporter Tang Junzheng Correspondent Zhou HaonanRunfeng Group...