Just now, the central bank announced two major news!The "swap" was born, and the Senate Swap Agreement was signed for the first time!

Author:Dahe Cai Cube Time:2022.07.04

On the fifth anniversary of the opening of the "Bond Connect", two measures to deepen the cooperation between the Mainland and the Hong Kong financial market were announced!

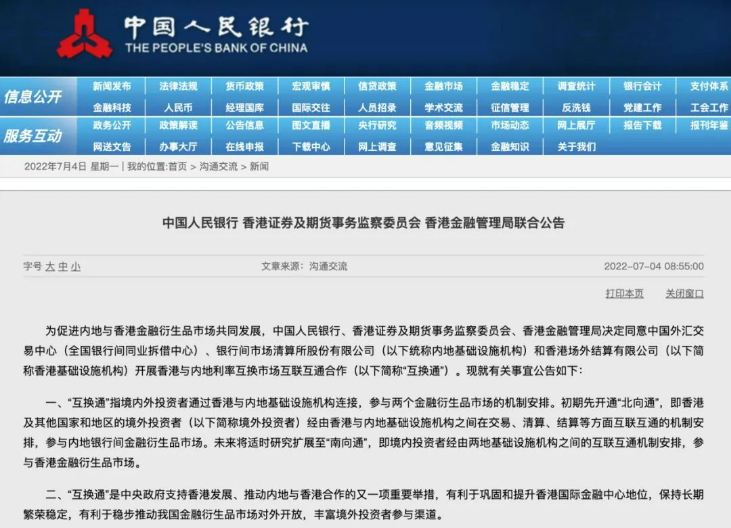

The People's Bank of China, the Hong Kong Securities Regulatory Commission, and the Hong Kong Financial Management Bureau issued a joint announcement on July 4 to carry out the interconnection and cooperation of the interest rate exchange market and the mainland interest rate exchange market (hereinafter referred to as the "interchange"). "Swap" will be officially launched after 6 months from the date of the announcement.

"Conversion" is an innovative measure to promote the high level of financial markets in the Mainland. It is reported that the "swap and communication" business has been connected through the financial market infrastructure of the two places, so that domestic and foreign investors can easily complete the transaction of RMB interest rate interchange without changing trading habits and effectively comply with relevant market laws and regulations of the two places. And concentrated liquidation.

Institutions say that this move will not only enrich the risk management tools that investors can use, but also provide more choices for their diversified investment portfolio. The significance is to expand the possibility of opening more derivatives, which will further release overseas investment overseas investment Participants participate in the potential of the Chinese bond market.

On the same day, the People's Bank of China also issued news that the People's Bank of China and the Hong Kong HKMA recently signed a RMB/Hong Kong dollar standby exchange agreement to upgrade the currency swap arrangement established by the two parties from 2009 to a stand -up exchange arrangement. The scale of exchange has expanded from the original 500 billion yuan/590 billion Hong Kong dollars to 800 billion yuan/940 billion Hong Kong dollars.

This is the first time that the People's Bank of China has signed a stand -up exchange agreement to meet the needs of deep financial cooperation and development in the Mainland and Hong Kong. "Standardous" mainly refers to the long -term effectiveness of the agreement. It does not need to be renewed regularly. At the same time, the exchange process will be further optimized, and the use of funds is more convenient. Yu Weiwen, president of the Hong Kong Financial Administration, said that the standing currency exchange agreement can lay a stable foundation for the further development of RMB products in Hong Kong, thereby consolidating Hong Kong's position as a global offshore RMB business hub.

Major innovation

In recent years, my country's interbank bond market has been increasing to the outside world. Especially since 2017, the "Bond Tong" north -south has been launched, which has become an important milestone for China's financial market opening.

In 2021, foreign investors reached RMB 11.47 trillion. As of the end of 2021, foreign investors holding RMB bonds reached 4 trillion yuan, accounting for about 3.5%of the total number of custody in the market.

With the expansion of the debt holdings of overseas investors and the increase in transaction activity, the demand for the risk of derivatives management interest rates has continued to increase. Since the launch of the inter -bank market in 2006, the RMB interest rate exchange has been the main variety. After years of steady and healthy development, the scale of transaction has gradually expanded, the participation of the subject is increasingly enriched, and the risk management functions have been effectively exerted.

"Conversion" was launched in the above background. In order to further facilitate foreign investors to participate in derivatives such as inter -bank interest rate swaps, the People's Bank of China continues to promote the steady opening of the inter -bank interest rate derivative market. The financial market infrastructure connection method allows overseas investors to participate in the domestic RMB interest rate exchange market through the interconnection of electronic trading platforms at home and abroad and central opponents.

According to the announcement information, "SCT" refers to the arrangement of the mechanism of two financial derivatives markets through the connection between domestic and foreign investors to connect with the mainland infrastructure institutions through Hong Kong.

The People's Bank of China, the Hong Kong Securities Regulatory Commission, and the Hong Kong Financial Management Bureau decided to agree to the China Foreign Exchange Trading Center (the National Bank of China Interbank Borrowing Center), the interbank market liquidation center (hereinafter collectively referred to as the mainland infrastructure institution) and the Hong Kong Overseas Settlement Co., Ltd. For short, Hong Kong Infrastructure Institutions) The interconnection of Hong Kong and the mainland interest rate exchange market cooperation.

The launch of the "swap" is a major innovation of the RMB interest rate derivative business. It is an effective supplement to the existing settlement agent model of RMB interest rate exchange products. Another important milestone of development and internationalization of the renminbi.

The person in charge of Bank of China Shanghai RMB Trading Business Headquarters believes that for the bond market in my country, "swap" brings risk hedging efficiency and optimization of the cross -border investment environment, which will attract more overseas investors to enter the market and enrich the type of investor. Improve the scale of transaction, improve transaction liquidity in market expansion, improve the system environment in business interaction, deepen market open development and cross -border cooperation, and promote the internationalization of the RMB.

"In the international market, interest rate exchange has always been the largest transaction volume and the most active trading interest rate derivatives, which plays an important role in risk hedging and asset portfolio management." Zou Yingguang, member of the CITIC Securities Executive Committee The introduction of the RMB interest rate exchange has officially entered the international financial market. It provides a convenient channel for overseas investors to participate in the domestic RMB interest rate exchange market, which will greatly increase the transaction volume and liquidity of RMB interest rate exchange products.

Zhu Xi, Executive Director of the RMB business of BOC Hong Kong and deputy general manager of the global market, said that the "swap" business not only effectively meets the trading needs of the RMB interest rate derivatives of overseas investors trading, but also innovates the Unicom liquidation of the two CCPs. , Respect the market habits to the greatest extent, marking that the Mainland and the Hong Kong financial market interconnected and two -way openness reached a higher level. At this stage, Unicom liquidation is exchanged for the starting point with RMB interest rates, and it is expected that the types of derivatives can be further expanded in the future. "North Ventopated" in the early stage

In the early days of "swap", the "north direction" was opened, that is, overseas investors (hereinafter referred to as overseas investors) in Hong Kong, and other countries and regions (hereinafter referred to as overseas investors) interconnected in terms of transactions, liquidation, and settlement between Hong Kong and Mainland infrastructure institutions The mechanism arrangement is involved in the financial derivative market between the Mainland.

The initial stage of "Northbound" trading is interest -rate swap products, and other varieties will be opened in time according to market conditions.

In the future, it will be extended to "south direction" in a timely manner, that is, domestic investors will participate in the Hong Kong financial derivative market through the interconnection mechanism arrangements between the two places infrastructure institutions.

It is reported that the financial derivatives market supervision agencies in Hong Kong and the Mainland will take all necessary measures to ensure that the two parties will establish an effective mechanism under "swap" and deal with illegal and violations in a timely manner.

Innovation derivative clearing mechanism interconnection mode

So, what innovations did "Swap" have launched under the current inter -bank derivative market framework?

It is understood that on the basis of adhering to the development of the current inter -bank derivative market development, the "interchange" comprehensively borrowed from the mature experience and overall framework of the bond market opening to the outside world, and connected the latest development trend of the overseas derivative market. The central opponent's square liquidation has optimized the existing process and improved the efficiency of transaction liquidation.

Under the "swap", domestic and foreign investors can conduct transactions through the connection of related electronic trading platforms without changing the trading habits. At the same time, the "SCT Tong" innovates the interconnection mode of the derivative clearing institution, and the two central opponents will provide central and foreign investors with centralized liquidation services for RMB interest rate swaps.

Investors at home and abroad can easily complete the transactions and centralized liquidation of RMB interest rate exchange on the premise of complying with market laws and regulations of the two places.

The reporter learned that the foreign exchange trading center provides derivatives trading services for domestic and foreign investors. It will not only change domestic and overseas derivatives and electronic transaction habits as the starting point. The trading system of foreign exchange trading centers reached derivative transactions with domestic quotation agencies. The foreign exchange trading center sends the transaction reached in real time to the central opponent's party clearing institution (hereinafter referred to as CCP) for centralized liquidation to achieve the transaction liquidation and direct processing and efficient connection of the whole process.

The Shanghai Clearance Institute and the Hong Kong Overseas Settlement Company interconnected through the central opponent's Clear Institute (CCP) to jointly provide centralized liquidation services. Among them, the Shanghai Clearance Institute serves domestic investors, the Hong Kong Overseas Settlement Company serves overseas investors; the two parties jointly conduct daily margins And funds settlement, and establish potential losses for special risk preparation resources to cover each other.

Foreign exchange trading centers, Shanghai Clearance Institute, and Hong Kong Overseas Settlement Company will gradually promote the construction of system construction and supporting rules in accordance with the principles of stable, orderly, controllable risks, and actively create a market environment that facilitates domestic and foreign investors to enter the market. Improve the interconnection mechanism and ensure the smooth go online.

Using a quotation agency trading model

Initial implementation of total management

Effective prevention of risks is the basis for the high -quality development of the financial derivative market, and it is also the core principle that we must adhere to the "interchange" work.

The arrangement of three aspects will be woven "protective network":

The first is to ensure the order of transaction order and the overall risk of the market. The "swap" adopts the transaction model of the quotation agency to give play to the role of the quotation agency to stabilize the market. With reference to the Shanghai -Shenzhen -Hong Kong -Hong Kong link mechanism, the initial implementation of total management, while meeting the needs of investor risk management while preventing market risks.

The second is to strengthen the risk management arrangements between the financial market infrastructure of the two places. Considering the actual situations of international financial derivatives, liquidation settlement, and risk management, we will combine electronic transactions with the central opponent's square settlement to formulate a stable and reasonable system connection arrangement to ensure that the "swap" business strictly abides by strictly abide by the business In the principle of macro prudence, risk control measures are adopted in multiple levels to focus on preventing cross -market risks overflow.

The third is to deepen regulatory cooperation. The People's Bank of China will maintain close communication with the Hong Kong Securities Regulatory Commission, the Hong Kong HKMA and other departments, sign a memorandum of regulatory cooperation, and work closely in information sharing and emergency disposal.

The project is online after 6 months

It will advance steadily and orderly

"Swap" will be advanced steadily and orderly under the overall planning and deployment of my country's financial markets.

At present, the People's Bank of China will jointly formulate institutional methods with the Hong Kong Securities Regulatory Commission, Hong Kong HKMA and other departments, strengthen supervision and cooperation and information sharing, guide relevant financial market infrastructure to prepare for rules, business, and technology, and strengthen market communication and cultivation , Guide market members to prepare before the transaction, and go online after 6 months.

Infrastructure institutions in Hong Kong and Mainland shall actively promote the various preparations of "interchange and communication" in accordance with the principles of stable, orderly, and controllable risks. After the license and all other necessary job preparations are ready, the "swap" is officially launched. "Welcome to the People's Bank of China, the Hong Kong Securities Regulatory Commission, and the Hong Kong HKMA jointly announced that the Hong Kong and the mainland interest rate exchange market is connected." Li Bing, president of Bloomberg Asia Pacific, said that global investors are encouraged Essence

Li Bing said that this move will not only enrich the risk management tools that investors can use, but also provide more options for their diversified investment portfolio. The significance is to expand the possibility of opening more derivatives, which will further release overseas investors Participate in the potential of the Chinese bond market. At the same time, the domestic city -based institutions are also facing important opportunities for continuous improvement of service levels, which will eventually promote the development of China's financial market. For Hong Kong, this move will help consolidate its unique position as the Unicom mainland market and international market portals.

It is conducive to consolidating the status of Hong Kong's international financial center

"Conversion" is another important measure for the central government to support the development of Hong Kong and promote the cooperation between the Mainland and Hong Kong, which is conducive to consolidating and enhancing the status of Hong Kong's international financial center, maintaining long -term prosperity and stability, and it is conducive to steadily promoting my country's financial derivative market to the outside world. Open and enrich the channels for overseas investors.

The launch of "swap and communication" has multiple positive significance:

First, it is conducive to the management interest rate risk of overseas investors. The launch of the "SCT" can facilitate the management risk of interest rate interchange between foreign investors, reducing the impact of interest rate fluctuations on the value of bonds, cross -border flow of funds, and further promoting the internationalization of the RMB.

The second is to promote the development of the domestic interest rate derivative market. After the launch of the "interchange", overseas institutions have increased their differentiated demand, supplemented by the advantages of high -efficiency electronic transactions and closely connected transactions, etc., helping to improve market liquidity, promote the market interest rate derivative market for further bank interest rate derivatives market Development and form a virtuous cycle.

Third, it is conducive to consolidating the status of Hong Kong's international financial center. As an important measure for my country's financial derivative market to open to the outside world, the launch of "Conversion" is the specific implementation of the "14th Five -Year Plan" plan to strengthen the function of Hong Kong International Asset Management Center and Risk Management Center, which is conducive to enhancing Hong Kong as an international financial financial as an international financial financial The attractiveness of the center deepen the cooperation between the Mainland and the Hong Kong financial market.

The Champions League of the President of the Hong Kong Stock Exchange Group stated that interchange is another important milestone to deepen the interconnection of the Mainland and the international market. Just as the Shanghai -Shenzhen -Hong Kong Stock Connect and Bonds have changed the genes of the mainland and the Hong Kong stocks and the fixed income market, swapping will also change the appearance of the inter -bank derivative product market.

The Champions League believes that the exchange of interchange will facilitate international investors to manage related investment in the Mainland and promote the further development of the Mainland capital market. The Hong Kong Stock Exchange is committed to connecting China and the world, and I am glad to play an important role in this project. Hope to continue to work with all partners to continue to expand and enhance the interconnection mechanism.

Yu Weiwen said that the launch of interchange and communication is very timely. It is an important measure to promote the deepening of financial cooperation between the two places, so that international investors can more conveniently manage the risk of interest rates in bond investment, which is conducive to further improving international investors' in the Mainland bond market for the mainland bond market. Participation.

Responsible editor: Shao Yuxiang | Audit: Li Zhen | Director: Wan Junwei

- END -

Who will relay the "tornado" of Everbright Securities, the main funds raised Red Tower Securities by 22%of the "Brokerage Ranking"

China Times (chinatimes.net.cn) reporter Wang Zhaohuan Beijing reportIn the past w...

alert!Ministry of Education: During the admission period of colleges and universities, beware of fraud

Zhongxin Jingwei, July 7th. The website of the Ministry of Education issued an early warning on the 7th, saying that during the admissions of colleges and universities, they would beware of fraud.The