ETF officially "compiled" today's interconnection and Hong Kong interconnection to start a new journey

Author:Securities daily Time:2022.07.04

Securities Daily reporter Wu Xiaolu Xing Meng

On July 4, ETF was officially launched in the interconnection mechanism of the mainland and the Hong Kong stock market transaction interoperability (hereinafter referred to as "interconnected interoperability"). There are 53, 30 and 4 ETF products including Shanghai -Hong Kong Stock Connect, Shenzhen -Hong Kong Stock Connect, and Hong Kong Stock Connect.

"Incorporate ETF into the interconnection, expand the breadth and depth of markets in the two places, and achieve further integration of the Mainland and the Hong Kong market, which will help the internationalization process of my country's capital market and the stable development of the Hong Kong market." For the "Securities Daily" reporter, after the ETF was included in the interconnection of ETFs in the Mainland, it enriched foreign investment varieties and improved its investment convenience. It will bring more incremental funds to the ETF market in the Mainland. Healthy and stable development. At the same time, the purchase of ETFs of the Hong Kong Stock Connect of Mainland funds will also effectively help the Hong Kong stock market stability. More importantly, the incorporation of ETFs into interconnection can also increase the attraction of RMB assets to foreign capital and help internationalization of the RMB.

83 ETFs totaling a total of over 670 billion yuan

Chen Li, chief economist of Chuancai Securities and director of the Institute of Research, told a reporter from the Securities Daily that the incorporation of ETFs into interconnection is further deepening reform in the original mechanism, which is conducive to promoting the common development of the Mainland financial market and the Hong Kong financial market. For the Hong Kong stock market, the current domestic Internet companies are carried by most domestic Internet companies, which have strong vitality and investment value; for the A -share market, ETF interconnection provides convenient channels for foreign investment in the Mainland assets. It is expected to attract more in the future to attract more Overseas funds are involved.

According to the statistics of Wind Information Daily, "Securities Daily" reporters were included in 83 ETFs of Land Stock Connect (Shanghai -Hong Kong Stock Connect+Shenzhen -Hong Kong Stock Connect) as of July 1, with a total scale of 674.63 billion yuan. The scale of 21 ETFs exceeded 10 billion yuan. Among them, Huaxia Shangzhi 50ETF topped the list for 52.270 billion yuan. Huatai Berry 300ETF and Southern CSI 500ETF followed closely, with the scale of 47.373 billion yuan and 42.251 billion yuan.

从ETF类型来看,26只宽基类ETF规模2984.12亿元,主要为沪深300、中证500和创业板指等;行业主题基金57只,合计规模3762.18亿元,主要为金融、消费、 Medicine, new energy, chips, defense military industry, etc..

Xu Meng, executive general manager of the Huaxia Fund Investment Department, told a reporter from the Securities Daily that after ETF is included in interconnection, it will further promote the development of the domestic ETF market. First, the sources of long -term overseas funds will be expanded for the domestic ETF market. The domestic ETF transaction volume and the proportion of overseas long -term configuration will gradually increase; the second is to enhance the influence of the domestic ETF in the international capital market; Related ETFs; Fourth, further enhance the concentration of the domestic ETF industry.

Chen Li said that the 83 ETFs basically cover most industries in the market, and investors can choose according to their own investment preferences. With the improvement of the relevant trading system, more different types of ETFs are expected to include more different types of ETFs into interconnection to further enrich the product types that investors can choose.

"After the 83 ETFs in the territory are included in the interconnection, its liquidity and transaction activity will increase, and the scale of the purchase of the first -level market for ETF is expected to expand." Tian Lihui said.

ETF transactions have two major advantages

Since the opening of the Shanghai -Hong Kong Stock Connect in 2014 and the opening of the Shenzhen -Hong Kong Stock Connect in 2016, the Shanghai -Shenzhen -Hong Kong -Hong Kong stock mechanism has continued to optimize and has become an important channel for Northbound capital to invest in A shares. According to Wind information data, as of July 3, the total market value of the total market value was 7.1585 trillion yuan, accounting for 84.41%of the total market value of A shares, and a total of 1.7 trillion yuan in net purchases in the northbound funds.

Xu Meng said that compared to stocks, ETF transactions have two major advantages under the interconnection mechanism: First, compared with individual stocks, ETF risks are scattered, flow risks are small, and investment risks are low; second, ETF is higher transparency.

Chen Li said that investment stocks are more focused on micro -factor, such as the company's financial status, valuation, development prospects, etc., while ETF investment is more concerned about macro or mid -view situation, such as investment in Shanghai 50ETF, Shanghai Stock Exchange 180ETF, Shanghai and Shenzhen 300ETF and other representative index -class ETFs, focusing more on domestic macroeconomic situations, while investing in industries such as ETF, food and beverage ETF, carbon neutral and ETF, etc., need to focus on the situation of the industry and judge the development prospects of the industry.

"Generally speaking, compared to stock investment, ETFs are weaker than stocks due to their losses. However, if ETF segmentation, industry ETFs are very concentrated in asset categories and industrial categories. At that time, industry ETFs may also face large retracements, so the industry -class ETF risk is higher than the index class ETF. "Chen Li further said.

For the future northbound capital preferences, Xu Meng believes that its demand for industry theme ETF may be stronger than broad -based ETFs. There are many theme ETFs and good liquidity in the mainland industry, and there are no similar alternatives in the Hong Kong market. ETFs and new energy vehicles ETFs are expected to be favored.

- END -

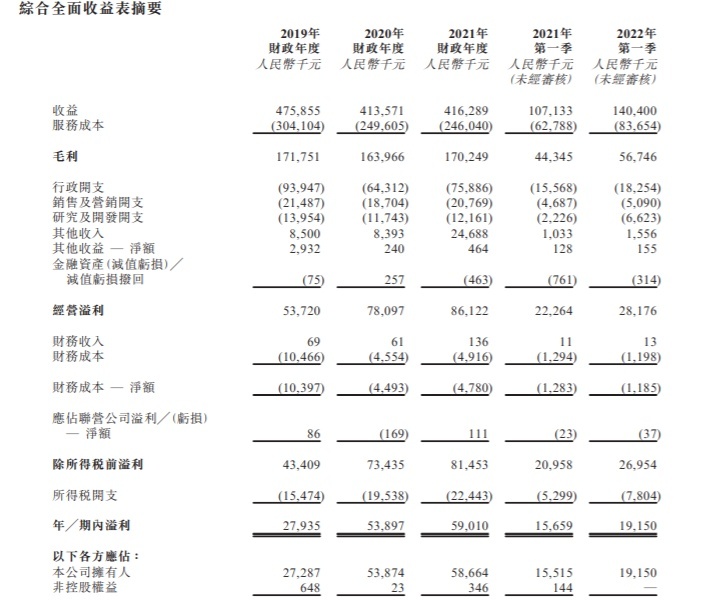

Digital Marketing and SAAS+Service Provider Pulas Digital Technology Digital Technology Delivery Table Exchange

On July 21, 2022, Pulan Digital Technology submitted a prospectus to the Hong Kong...

[Follow] Reasonable rents!Eight departments issued notice

recentlyThe Ministry of Housing and Urban -Rural Development and the National Deve...