ETF interconnection is officially traded today.

Author:Changjiang Daily Time:2022.07.04

On the evening of June 28, the China Securities Supervision and Administration Commission, the Hong Kong Securities and Futures Affairs Supervision Committee issued a joint announcement stating that in order to promote the common development of the capital market and the Hong Kong capital market, it was decided to approve the exchanges of the two places. , Referred to as ETF, incorporated into the interconnection mechanism of the Mainland and Hong Kong stock market transaction. ETFs under the interconnection began to be officially traded today (4th). Among them, the Shanghai Stock Connect ETF53, including Shanghai Stock Exchange 50ETF, Financial ETF, Bonus ETF, etc.; A total of 30 ETFs in Shenzhen Stock Connect, covering core broad -foundation products such as GEM ETF, CSI 300ETF, as well as biotechnology, home appliance ETF, carbon China China The theme products of representative industries such as ETF are mainly concentrated in the fields of advanced manufacturing, digital economy and green low -carbon. There are 4 Hong Kong Stock Connect ETFs, including ETFs such as Yingfu Fund.

What is ETF? How to interconnect?

According to the latest announcements of Shanghai, Shenzhen, and Hong Kong Exchange, there are 87 targets included in the Shanghai -Shenzhen -Hong Kong Stock Connect ETF, of which mainland investors can buy 4 Hong Kong stock ETFs, and Hong Kong investors can buy 83 A -share ETFs. ETF, as a much -watched fund product, is of great significance to be included in the interconnection. Let's first understand the characteristics of ETF.

In terms of ETF Fund, it is an index fund containing a basket of stocks. If this basket of stocks are a certain industry, the industry ETF, such as pharmaceutical ETF, if a basket of stocks are in front of the market, it is a wide -based ETF, such as for example, for example 50ETF. The current ETF fund of A shares has exceeded five hundred, and there are more and more industries.

Interconnection is better to understand, which refers to the mechanism of Shanghai -Shenzhen market and the Hong Kong stock market interoperability, including land stocks and Hong Kong stocks. The funds are called southbound funds. Through land stocks, Hong Kong and overseas investors invest in A shares. This channel was opened in 2014. The incorporation of ETFs into the Shanghai -Shenzhen -Hong Kong interconnection means that investors in the two places can invest in ETF products in the other market, which is of profound significance.

Tan Yueheng, chairman of Jiaotong International: From the opening of Shanghai and Hong Kong in 2014, the opening of Shenzhen -Hong Kongtong in 2016, the north of 2017 bonds, the south of the bond market in 2021, and the Guangdong -Hong Kong -Macao Greater Bay Area in 2021 last year. The pilot of cross -border financial management, until today, interconnection has been extended to extension and connotation. The mechanism is gradually improving, varieties are constantly increasing, and channels are constantly deepening.

Trading Hong Kong Stock Connect ETF Investor Threshold of 500,000 yuan

For new investors who want to participate in the Hong Kong Stock Connect ETF transaction, we need to have a certain investment threshold for investment. Let's understand the specific situation.

First of all, old investors who have already trading permissions in Hong Kong Stocks have no need to open an account, and can directly trade Hong Kong Stock Connect ETF. For new investors, participating in the Hong Kong Stock Connect ETF transaction needs to have a notice of not less than 500,000 yuan in securities assets in the account, and sign a risk unveiling with the securities company. It is worth noting that the ETFs incorporated into the interconnection project this time are also considered in terms of setting threshold. Including the average asset scale of the past 6 months reached 1.5 billion yuan; the average asset size of the Stock Exchange ETF has reached hard requirements such as HK $ 1.7 billion in the past 6 months.

Zhu Ning, deputy dean of Shanghai Advanced Finance College of Shanghai Jiaotong University: On the one hand, for the ETF index fund, a requirement for management scale is a relatively large fund; on the other hand At the same time, the tracking index is relatively long, allowing investors to invest in relatively stable and mature products.

Wen Tianna, a professional member of the Hong Kong Securities Society: Different ETFs have different investment themes, containing different weights or leading stocks. The investment concept is clear, so that investors will facilitate risk control management while diversified investment.

The Hong Kong Stock Exchange ETF has no rise and fall restriction

In addition, the Hong Kong stock market has a large difference in the trading rules and other aspects. Investors should pay special attention to investors.

The Stock ETF of the Shanghai and Shenzhen Exchange adopts a T+1 trading mechanism, and the Hong Kong Stock Exchange shares ETF uses the T+0 transaction mechanism. In addition, the ratio of stock ETF rising declines on the Shanghai and Shenzhen Exchange is usually 10%, while the Hong Kong Stock Exchange's stock ETF has no rising decline restriction. There are also restrictions on the daily lines of Shanghai, Shenzhen, and Hong Kong. The daily amount of Hong Kong Stock Connect and ETFs is 42 billion yuan.

Zhang Yuewen, a researcher at the Institute of Finance of the Chinese Academy of Social Sciences: The Hong Kong stock market has no restrictions on rising declines. Sometimes the market fluctuations will be relatively large, resulting in corresponding fluctuations in the net value of ETF. Secondly, due to the large fluctuations of the ETF tracking index, the net value of ETF may not reflect the fluctuation of the index in time, which will form a lagging effect, resulting in changes in investor asset value. Finally, the exchange rate risk and transaction quota risk related to the Hong Kong Stock Connect are also what mainland investors need to pay attention to.

The Hong Kong Stock Exchange launched the first ETF in 1999 and is currently one of the most important ETF markets in Asia. As of March 2022, a total of 160 ETFs (including leverage and reverse products) in the Hong Kong market, with a market value of 430.6 billion Hong Kong dollars. Among them, there are 23 ETFs in Hong Kong stocks, with a market value of 219.9 billion Hong Kong dollars, accounting for about 51%of the total scale of Hong Kong ETF products; 37 A -share ETFs, a market value of 61.5 billion Hong Kong dollars, accounting for about 14%of Hong Kong ETF products. The capital market is high -level open to the outside world steadily.

The ETF interconnection has a milestone significance, which is the first time that the interconnection mechanism has expanded to an area outside the stock transaction. Experts said that this will further broaden the investment channels for A shares and Hong Kong stocks and enhance the level of opening up the capital market.

First of all, the ETF interconnection helps to further promote the in -depth integration of the Mainland and the Hong Kong capital market, ensure the stable and healthy development of the capital markets between the two places, and promote the healthy and stable and high -quality development of the capital market and the asset management industry.

Zhu Ning, deputy dean of Shanghai High School of Finance, Shanghai Jiaotong University: Incorporating ETF into interconnection will further promote the two -way opening of the entire Chinese capital market to the public, further enhance the intensity and interest of overseas investors in investment in Chinese enterprises, and can further reduce The cost of financing of Chinese enterprises.

According to data from the official website of the CSRC, the current foreign investment has invested more than 1.6 trillion yuan in A shares through the CSICS, and the proportion of foreign investment holding the A -share circulation market is about 5%. The ETF is included in the interconnection, and the northbound capital is required to be settled in A shares to buy and sell. From the middle and long term, it is expected to further increase the attraction of RMB assets to foreign capital and help the advancement of the internationalization process of the RMB.

Tan Yueheng, chairman of Jiaotong International: It reflects the firm confidence of China's capital market opening to the outside world; the second is the firm support of the central government's competitiveness of the central government to consolidate the competitiveness of the Hong Kong International Financial Center; the third reflects the financial management department's practice of practicing New development concepts guide the capital market to the emerging strategic industrial resources and promote high -quality economic development.

(Source: CCTV News Client)

【Edit: Wang Yujin】

For more exciting content, please download the "Da Wuhan" client in the major application markets.

- END -

2022 "Qilu Grain and Oil" Fuzhou Promotion Conference was successfully held

Qilu.com · Lightning News, June 18, Shanhai Tongyun, Lu Minrong. On the morning o...

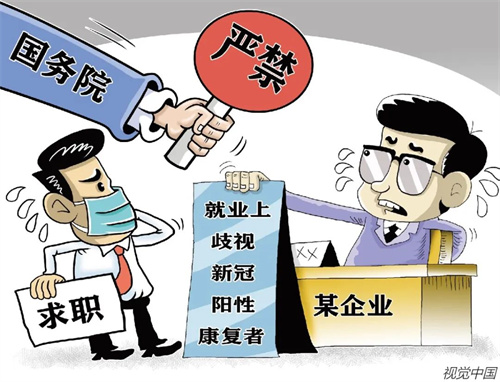

"History Yang" is discriminated against?We went to touch the situation offline

China Economic Weekly reporter Song Jie | Shanghai reportHistory has Yang can't wa...