The full refund of the policy industry of VAT tax deduction is expanded!Pay attention to these new c

Author:State Administration of Taxati Time:2022.06.13

In order to further increase the implementation of the VAT tax refund policy and strive to stabilize the employment of market entities to stabilize, the Ministry of Finance and the State Administration of Taxation recently issued the "Announcement on the Scope of Expanding the Followers of Value Value Tax Tax Tax Dustering Policy" ( Announcement No. 21, 2022, hereinafter referred to as "Announcement of No. 21"), from July 1, 2022, expanded the full refund of the policy industry in the policy industry. Compared with the previous policy, the following new changes should be followed

• The industry scope has changed

7 industries including new wholesale retail industry

In order to thoroughly implement the decision -making and deployment of the Party Central Committee and the State Council, the Ministry of Finance and the State Administration of Taxation jointly issued the announcement of announcement No. 21 and expanded the "Announcement on the Implementation of the State Administration of Taxation on Further Increasing the Value -added Taxation Period" 2022) The scope of tax refund policy for manufacturing and other industries such as manufacturing and other industries, increase "wholesale and retail industry", "agriculture, forestry, animal husbandry, fisheries", "accommodation and catering", "residential services, repair, repair "," Education "," Education "," Health and Social Work "and" Culture, Sports, and Entertainment "(hereinafter referred to as wholesale and retail industry and other industries), and implement the monthly refund of the total amount of incremental retention tax and retention tax, and The tax refund policy for one -time refund of the tax refund tax refund.

• The tax refund time has changed

Eligible companies can apply for tax refund from July

Eligible enterprises such as wholesale and retail industry and other industries can apply to the competent tax authority from the tax declaration period in July 2022 to refund the incremental tax on the tax.

Eligible enterprises such as wholesale and retail industry and other industries can apply to the competent tax authority from the tax declaration period in July 2022 to apply for a one -time refund of the existing reserved tax.

It should be noted that the above time is the beginning of the tax refund and increased tax refund of the application for a disposable stock. If the current period is not applied, the tax declaration period can also be applied in accordance with regulations.

• "Application Form for Retreat (Valuation) Tax" changes

Corresponding supplementary file basis and other content

The manufacturing, wholesale and retail industry and other industries have applied for tax refund policies stipulated in the announcement of the announcement of the announcement of No. 21, and the tax refund application information submitted when applying for tax refund has not changed. Essence It should be noted that the "Retreat (Ventilation) Tax Application Form" can be submitted online through the Electronic Taxation Bureau, or it can be submitted offline through the tax service hall. Combining the tax refund policy provisions this time, some of the reporting contents in the original "refund) tax application form were adjusted accordingly. When the taxpayer applied for reserved tax refund, it could combine its applicable specific policies and actual production of actual production. Fill in operations and other conditions.

Combined with the content of the tax refund policy stipulated in the announcement of announcement No. 21, the "Return (Discount) Tax Application Form" has supplemented the document basis, industry scope and other columns accordingly. The specific modification content includes:

First, add "Announcement on the Scope of the General Administration of Taxation of the Ministry of Finance on expanding the full refund of the full refund of VAT tax deduction policy industry" in the "State Administration of Taxation of the Ministry of Finance" (announcement of the General Administration of Taxation of the Ministry of Finance No. 21).

The second is to add "wholesale and retail industry" in the "specific industry" of "tax refund enterprises", "agriculture, forestry, pastoral, fisheries", "accommodation and catering", "residential services, repair and other service industries", and other service industries, and other service industries, and "Education", "Health and Social Work", "Culture, Sports and Entertainment" options.

Third, the value -added tax sales of "specific industries" in the "specific industry" in the calculation formula of the "specific industry" in the "specific industry" also increased accordingly increased the value -added tax sales including the wholesale and retail industry.

From July, the scope of the policy industry

- END -

Hunan posting supports "passenger and shipping" integration and development

Recently, the Hunan Provincial Development and Reform Commission issued the Hunan Province to Promoting the Life Service Industry to make up for the shortcomings of the shortcomings to improve the qu

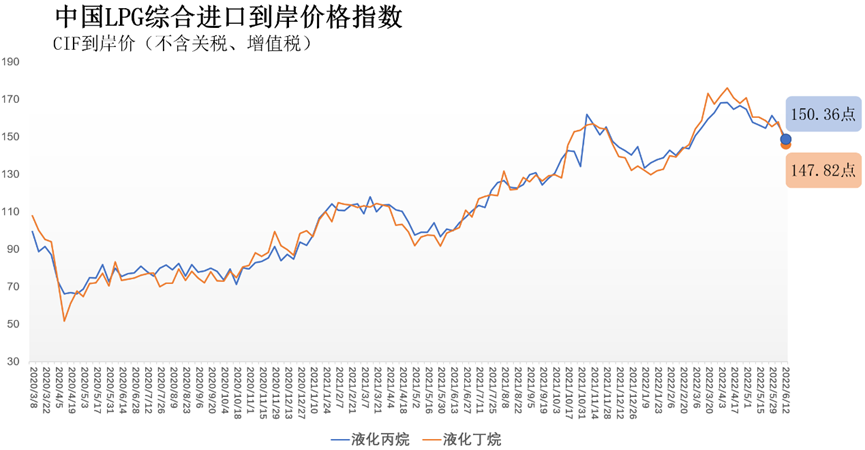

From June 6th to 12th, China LPG's comprehensive import to the shore price index was 150.36 points, 147.82 points

On June 15th, the comprehensive import of China LNPG (LPG) released by the Global ...