ETF interconnection "Big Age" is opened!The first batch of 20 mainland fund companies benefited

Author:China Fund News Time:2022.07.03

The "big era" of ETF interconnection is here, affecting the market and investors' geometry?

China Fund reporter Cao Wenzheng Lu Huijing

On July 4, the "ETF Interconnection" transaction was officially launched. It is reported that there are 87 joint ventures that are included in ETF pass, including 4 Hong Kong stock ETFs and 83 A -share ETFs. Many fund industry insiders said that the income of ETF is undoubtedly another iconic incident of accelerating the acceleration of high -level two -way openness, deepening interconnection, and optimizing the Shanghai -Shenzhen -Hong Kong -General mechanism, which is of multiple significance for the further development of my country's capital market. Essence

87 ETF is the first to be shortlisted for interconnection

20 mainland fund companies first drink "head soup"

On July 4, the ETF market officially ushered in the "big era" of interconnection.

On July 1, the Ministry of Finance, the State Administration of Taxation, and the Securities and Futures Commission issued an announcement on the application of transaction -type open -type funds to the mainland and Hong Kong stock market transaction interconnection mechanism. After the stock market transaction interconnection mechanism, the current mainland and Hong Kong funds are applied to the relevant tax policies of the Mainland and Hong Kong funds. China Securities Registration and Settlement Co., Ltd. is responsible for the deduction of personal income tax for the distribution of mainland investors from Hong Kong Fund allocation.

As early as June 28, the China Securities Regulatory Commission, the Hong Kong Securities and Futures Affairs Supervision Commission jointly issued an announcement saying that the interconnection mechanism of the mainland and the Hong Kong stock market transaction (hereinafter referred to as "interconnection") (hereinafter referred to as "interconnection") The trading fund, hereinafter referred to as "ETF") transactions will begin on July 4, 2022.

The CSRC pointed out that since the China Securities Regulatory Commission and the Hong Kong Securities Regulatory Commission issued a joint announcement on May 27 this year, the two places regulatory agencies have worked together in the preparation of ETFs into the preparation of interconnection. At present, related business rules, operating plans, and supervision arrangements have been determined, and the technical system is ready. Investors should fully understand the differences in market laws and regulations, business rules and practical operations of the two places, carefully evaluate and control risks, and rationally carry out interconnected investment related investment.

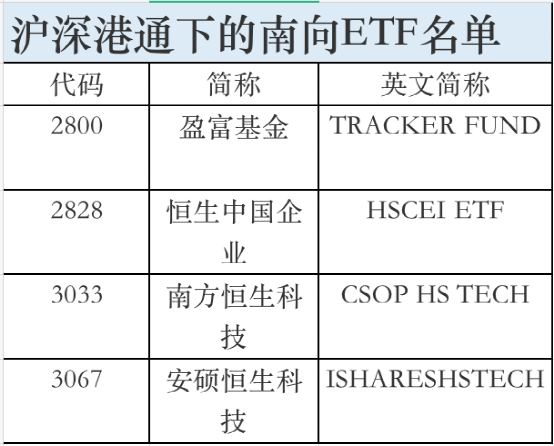

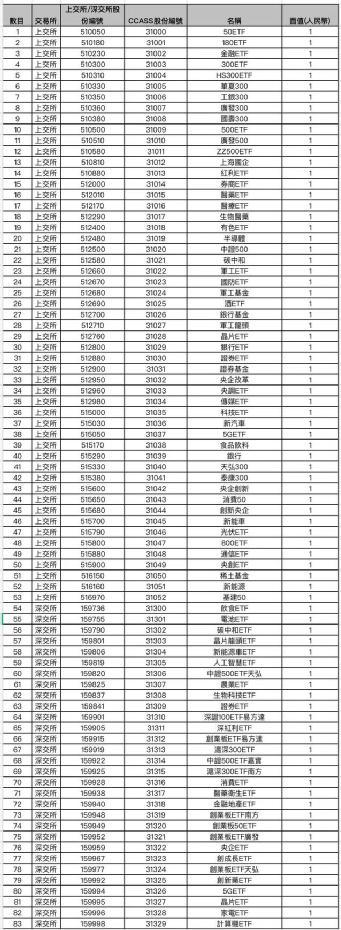

On the same day, the Shanghai and Shenzhen Stock Exchange and the Hong Kong Stock Exchange announced the first batch of ETF lists of the Shanghai -Shenzhen -Hong Kong Standard. Among them, there were 83 initial lists of ETF ETFs in the northbound qualifications (in detail the list at the end of the article). The Shenzhen Stock Exchange is listed. The Hong Kong Stock Connect ETFs under the Shanghai -Shenzhen -Hong Kong Stock Connect include 4 stock ETFs including Yingfu Fund, Hang Seng Chinese Enterprise, Southern Hang Seng Technology, and Anshuo Hang Seng Technology.

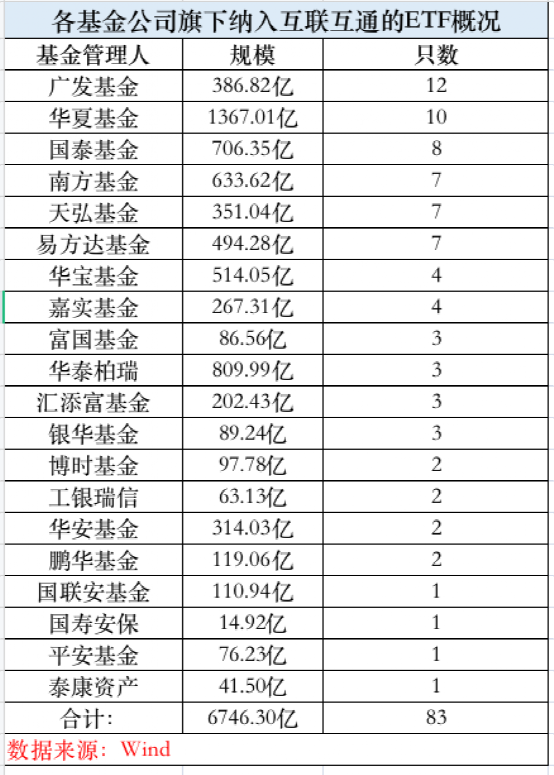

Fund Jun statistics found that there were 20 fund companies' products in the Northbound Qualification ETF of this time, of which 12 products including the Guangfa Fund include the infrastructure 50ETF, the media ETF Fund, the Medical and Health ETF, and the CSI 500ETF Fund were shortlisted. Fund companies that are shortlisted for ETF interconnected products, Huaxia Fund also has 10 products including Shanghai SSE 50ETF, chip ETF, new energy vehicle ETF, 5GETF, including the list. In addition to the Guangfa Fund, the other shortlisted products reached 10 Fund company. Cathay, Southern, and Tianhong's three funds have been selected for more than 5 products.

As of July 1, the total asset size of 83 ETFs exceeded 670 billion yuan, the scale of more than 70 % in the entire Mainland ETF market, of which there were many Huaxia Shanghai Stock Exchange 50ETF, Huatai Berry CSI 300ETF, Southern CSI 500ETF, etc. 40 billion yuan of "Big Mac" products.

From the perspective of product types, the north -north qualification ETF coverage is also very rich. Not only does the Shanghai Stock Exchange 50ETF, CSI 300ETF, GEM ETF, and CSI 500ETF, etc. ETFs such as ETFs and other major types of segmented industries. From the perspective of Guangyin International assets, the above -mentioned representative industry theme products are mainly concentrated in advanced manufacturing, digital economy and green low -carbon. Due to the relevant investment products and sectors in the Hong Kong stock market More scarce, "ETF Interconnection" can help international investors to invest more conveniently to invest in the mainland market, and at the same time drive the international development of the RMB.

Guangyin International Assets also pointed out that earlier, the Hong Kong Stock Exchange announced the finalist threshold standard for the south to ETF. The qualified ETF must be priced at the Hong Kong dollar and the average annual asset scale in the past 6 months. And reverse products, and the weight of the stock market that tracks the index is not less than 90%. Therefore, the number of south -facing funds that are included in the "ETF interconnection" this time is limited, but it is expected that the future "ETF" will slowly expand and help to activate the Hong Kong ETF market.

Beibei, assistant to the director of Huitianfu Fund Index and Quantitative Investment Department, and Senior Index Fund Manager, said that the first batch of interconnected ETF products contain both the Broad -based Index ETF and many ETF varieties of the industry, themes, and style indexes. Investors provide very rich asset allocation varieties. In particular, there are many industries and industries with global characteristics and competitive advantages, such as consumption, new energy, etc., combined with the current northbound capital configuration preference for individual stocks. Configuration Tool.

Wang Lele, the investment director of the ETF Investment Department of Fargo Fund, also said that in the first batch of interconnection ETFs, these domestic ETFs not only cover ETF products with strong market representatives such as CSI 300, but also have many different high -quality different high quality listed on the market. Products in the industry segmented areas are in line with China's long -term development theme, such as: consumption 50ETF, agricultural ETF, etc., and there are also unique directions in China, such as military leader ETFs. Therefore, interconnection into the industry ETF is conducive to overseas investors more convenient and refinedly deployed the A -share subdivided industry and popular tracks, and supplemented the direction of investment in the industrial chain of the two places. Zhao Yunyang, the investment director and fund manager of the Boshi Fund Index and Quantitative Investment Department, said that except for the tightening and recession of inflation in the world, except for major countries in China facing inflation, and thanks to the relatively successful resistance policies in the early stage and the stable currency finance Policies, China is currently relatively small compared to overseas inflation pressure, and the policy and currency space are relatively large. Therefore, the current Chinese capital market has better configuration value compared to overseas markets. At the same time, domestic enterprises have stronger competitive advantages in some industries with large future development spaces, such as new energy. Overseas investors want to deploy such popular industries to turn around the Chinese market. In addition, some industries in China, such as liquor, also have a strong scarcity for overseas investors.

Liu Jun, director of the Investment Department of the Huatai Berry Index Index, said that because the A -share ETF is included in the interconnection, there is a rigid standard. It is the common characteristics of the main investment target. From the perspective of product structure, the number of ETFs in the industry theme reflects the main characteristics of the domestic ETF market. (Data source: Wind, as of 20220701) For Hong Kong investors, the domestic ETF has three aspects of attractiveness: First, there are many industry -themed ETFs unique to the A -share market to invest, and the selection range is very wide; second, this year's A -share The market performance has a relatively obvious independence, and the correlation with other markets, especially the European and American markets, is low. From the perspective of risk budget, it can effectively optimize the combined risk income index of overseas investors; More active, the arbitrage mechanism of Shanghai and Shenzhen has high efficiency, and the hidden costs such as impact costs and premium costs in the investment process are relatively low.

Luo Guoqing, the person in charge of the investment department of the Guangfa Fund Index, said that the number of ETF interconnection is 83 in accordance with the qualified A -share ETF, and there are 4 qualified Hong Kong ETFs. Therefore, in the initial stage, the A -share ETF may benefit more. The attraction of the Mainland ETF to the Hong Kong market is mainly reflected in the richness and scarcity of investment targets. At present, the A -share ETF issued by the Hong Kong market is mainly concentrated in a few core broad -foundation indexes. A shares have more broad -foundation ETFs, industry ETFs, theme ETFs, and strategic ETF options. Rich investment categories and more fine industry tracks.

"The domestic ETFs are concentrated in high -tech fields such as advanced manufacturing, digital economy and carbon neutralization. The market space is large and the investment opportunities are good. . "Cathay Fund said.

ETF is included in the economic development of the two places

It is of great significance to investors

The "ETF Interconnection" transaction was officially launched on July 4. When talking about ETF's meaning in the economic development and investors of the two places, many fund companies stated that ETFs are included in the economic development of interconnection to the economic development of the two places to the economic development of the two places. It is of great significance to investors.

Beibei, assistant to the director of the Huitianfu Fund Index and the Investment Department and the senior index fund manager, said that ETF's inclusion of interconnection will enrich investment varieties, which is conducive to the long -term and convenient allocation of international investors in A shares. ETF costs, high efficiency, high transparency, and convenient transaction. It is also a very familiar fund variety of international investors. It has a very large scale and cognition overseas. The ETF interconnection will become another milestone in the capital market of the two places. It is also the milestone of domestic fund products to internationalization. It is believed that it can have a positive and profound impact on the markets of the two places.

富国基金量化投资部ETF投资总监王乐乐表示,沪深港通是中国资本市场实现双向开放的重要通道,目前的资金载体主要是股票,而ETF作为一揽子股票的集合,具有低成本、高效率、高The characteristics such as transparency, which are in line with the steady investment logic of large funds, can improve the liquidity of ETF products between the two places, improve the structure of investors in the A -share market, bring more long -term funds to China's economic transformation and upgrading, and enhance the international status of China's capital market. She pointed out that the ETF interconnection marks that the internationalization of the RMB will deepen the expansion of investment products. Hong Kong may attract more RMB funds to precipitate, strengthen the status of offshore RMB wealth management center, and long -term acceleration of the internationalization of the RMB.

"For overseas investors, the comprehensive product line in the ETF field in the Mainland involves not only domestic core assets, but also covers the target of scarce industrial investment in Hong Kong stocks and even the world. The scarce mainland ETF is especially conducive to those overseas investors who are "difficult to study A -share stocks but want to allocate the A -share market".

For mainland investors, Hong Kong ETFs, which are currently incorporated into Hong Kong Stock Connect, have the following advantages: there is no restrictions on the decline in the daily rising decline, and the discount premium is lower than that of the same mainland listing ETF; due to the stronger liquidity, the larger scale, the rate rate It will also be lower. Directly trading the Hong Kong listing ETF has the opportunity to get higher benefits. At the same time, professional institutions in the Mainland can track and analyze the long -term configuration behavior of overseas market investors, within day or day trading behavior, and track and analyze recent relevant investment viewpoints to promote domestic investors 'learning and deep understanding of overseas institutions' investment philosophy and configuration ideas Essence Wang Lele mentioned. "The current average daily transaction volume of funds south has accounted for about 1/4 of the Hong Kong Stock Exchange's single -day transaction volume. It can be said that this mechanism provides important opportunities for the division of labor and cooperation between the capital markets of the two places. For mainland investors, the use of ETFs to achieve a more efficient global asset layout has been just around the corner. Wang Yang, general manager of Jingshun Great Wall ETF and Innovation Investment Department.

Huaxia Fund stated that under the arrangement of ETF interconnection mechanism, domestic investors can invest in the mainstream ETF products of the Hong Kong market, which provides diversified investment channels for mainland investors to provide cross -border asset allocation and sharing the operating results of the high -quality listed companies of the Stock Exchange ; Global investors can also use Hong Kong to directly invest in the domestic ETF, expanding the scope of the target of overseas investors to invest in the A -share market, and effectively and effectively realize two -way cross -border investment.

"The scale of domestic ETF products and customer groups are expected to expand. Overseas investors can directly invest in the Mainland ETF through Hong Kong Stock Connect, especially for some of the resources limited by resources that cannot be deepened by A -share stocks, but hope to use the investment in tools to allocate the investment in the A -share market. The person helps to increase the international influence of China's ETF products, "Cathay Fund said.

The Celene Fund said that the ETF interconnection bid is an important step in the integration of the three major stock exchanges of Shanghai and Shenzhen and Hong Kong in my country in business Unicom and consolidating strategic joint efforts. Core competitiveness is of great significance. ETF is included in the interconnection mechanism that meets the common interests of the mainland and Hong Kong markets in China, and has further deepened the coordination between the Hong Kong Stock Exchange and the Mainland and Shanghai and Shenzhen Exchange. It is an important achievement in the latest strategy of the Hong Kong Stock Exchange. It is also expected to strengthen the unique strategic position of the Hong Kong Stock Exchange as a "super contact person".

Boshi International emphasized that in the short term, the current standard of ETF pass is high. In addition, there are already many ETFs in the two markets. In the early stages of ETF, it may take more time to cultivate market cultivation. However, from the long -term perspective, ETF has given more investment tools with investors, which is of far -reaching significance for further opening up and promotion of China's capital market.

The Southern Fund Investment Department said that in the short term, it takes a certain amount of time for foreign investors to recognize and recognize the ETF of the Mainland market, and there are differences from the mainland in terms of investment variety preferences. For overseas investors, interconnection and QFII/RQFII have their own advantages and complement each other. Interconnected transactions are convenient and flexible in mechanisms, eliminating the time of cross -border and the cost of exchange exchange.

"Due to the differentiation of ETF products in the A shares and the Hong Kong market, investors in the two places can increase the investment targets, especially the A -share ETF market has increased significantly in recent years. The relatively scarce products in the market have greatly expanded the ETF optional scope of the Hong Kong stock market investors. "Liu Jun, director of the investment department of the Huatai Berry Index Index.

"Incorporate ETFs into interconnection and further enrich the investment varieties of interconnection. In the future, it will be expected to increase the liquidity of markets in the two places and increase the overall size of ETF. Overseas investors can be more convenient and efficiently investing in A shares with ETFs. It is expected to bring with it. Come to a certain amount of incremental funds. "Luo Guoqing, the head of the investment department of the Guangfa Fund Index Index, also said.

Zhang Yuxiang, the fund manager of Penghua quantitativeization and derivatives investment department, mentioned that the interconnection mechanism is an important reform of the follow -up system of Hong Kong stocks. In particular, it helps international long -term investors to allocate A shares to allocate investment in A shares. Hong Kong stocks.

ETF is included in interconnection

It is conducive to the mainland public offering to increase international influence and popularity

There were 87 joint venture targets incorporated into the ETF pass. Among them, mainland investors can buy 4 Hong Kong stock ETFs through the south -Shanghai -Hong Kong Stock Connect and southbound Shenzhen -Hong Kong Stock Connect. Hong Kong investors can buy 83 A -share ETFs through the North to Shanghai -Shenzhen Stock Connect. Many fund companies said that more investors participating in ETF can bring richer investment strategies and further improve the liquidity of related products. For fund companies, we can also take this opportunity to contact international investors and increase our perception of overseas markets.

Wang Lele, an ETF Investment Director of Wells Farm Fund's Quantitative Investment Department, said that for Mainland fund companies, ETFs are included in interconnection, which is conducive to improving international influence and popularity. On the one hand, the Mainland ETF is listed on the Hong Kong Stock Exchange, on the one hand, it is the publicity and promotion of the ETF manager, and it is another step for the "going global" of the mainland fund companies, which is conducive to enhancing the international influence and popularity of the Mainland fund company. On the other hand, it is conducive to expanding the international business of mainland fund companies, expanding overseas customer groups, and cultivating cross -border service capabilities. In the future, the Hong Kong market will also become another important battlefield for ETFs.

Wang Yang, general manager of Jingshun Great Wall ETF and Innovation Investment Department, said that overseas markets, in addition to their domestic investors, overseas investors, especially different types, different types of investors who hold long -term periods are the cornerstone of ETF further and development. As the first choice for overseas investors to participate in the Chinese capital market, Hong Kong is an excellent place for China's public offering industry to export foreign export brands and export investment and research capabilities. "ETF interconnection will bring long -term sources of overseas funds to the domestic market. While participating in the northbound stock transaction, overseas asset management institutions may also use the north -facing ETF transaction to do some liquidity management. Gradually improve. At the same time, some domestic investors may follow the funds north to configure related ETFs. "Huaxia Fund believes.

"From the perspective of incorporated standards, there is a large scale of ETFs that have been included in interconnection, and the investment fields are relatively balanced (the industry wide base) is a better reference for investors to choose ETFs. Mainland investors also You can choose Hong Kong's ETF through the Hong Kong Stock Connect, thereby reducing the effects of ups and downs restrictions and fluctuations in premium fluctuations. "Cathay Fund said.

"ETF interconnection for fund companies, while expanding the user group, competition is also increasing. For some head fund companies that have established Hong Kong subsidiaries, they can use its cross -border advantages accumulated in the two places in the past. Flexible layout. "Castrol Fund mentioned.

Zhao Yunyang, the investment director and fund manager of the Boshi Fund Index and Quantitative Investment Department, said that through ETF, domestic institutions have the opportunity to learn the research ideas of overseas buyers' institutions, and at the same time they can also understand the needs of overseas investors in time, so as to invest in research on investment research The product layout has been improved in all directions.

"For Mainland fund companies, it is conducive to improving international influence and popularity. The Mainland ETF is traded on the Hong Kong Stock Exchange, on the one hand, it is also the promotion and promotion of the ETF manager. It is conducive to improving the international influence and popularity of mainland fund companies. On the other hand, it is conducive to expanding the international business of Mainland fund companies, expanding overseas customer groups, and cultivating cross -border service capabilities. In the future, the Hong Kong market will become another important battlefield of ETF "Southern Fund Index Investment Department also mentioned.

Liu Jun, director of the Investment Department of the Huatai Berry Index, said that ETF's incorporated into interconnection has increased the convenience and investment quota for foreign customers to invest in A shares ETF, providing an incremental customer group for various fund companies, and opened up a new one. Cooperation and competition direction. Through cross -strait exchanges, foreign investors can more intuitive and profoundly understand the A -share ETF market and products, enhance their willingness to invest, and at the same time include a lot of homogeneous products in the 83 A -share ETFs that are incorporated into interconnection. Fund companies also It is necessary to fully tap its own competitive advantage and strive to get greater market share.

Luo Guoqing, the person in charge of the investment department of the Guangfa Fund Index, believes that the income of the Hong Kong stocks ETF has made the Mainland public fundraising funds compete with the Hong Kong Fund Corporation to promote the high -quality development of the mainland public offering industry. For various fund companies, direct benefits can increase the overall scale of ETF, increase the overall liquidity of ETF, expand the ETF investor group, and increase the allocation of foreign investors to the Mainland ETF.

ETF Tong July 4th Sailing Fund Co., Ltd.

China Fund reporter Fang Li

The long -awaited ETF through the market has finally come!

According to June 28, the China Securities Regulatory Commission and the Hong Kong Securities Regulatory Commission issued an announcement that ETF transactions under interconnection will begin on July 4, 2022. At the same time, the Shanghai -Shenzhen Exchange announced the list of eligible Hong Kong Stock Connect ETFs, a total of 4; the Hong Kong Stock Exchange also announced the initial list of 83 northern -oriented ETFs on the same day. Only.

Faced with the set sail of ETF, major funds companies have responded to their fists, and they are fulfilled from the aspects of systems, talents, products, and channels. At present, fund companies such as Huaxia and Wells Country have begun related marketing activities, and fund companies such as rich countries and Huabao have set up overseas exhibition department to expand their business.

A system, talent, product, and channels cannot be less

Multi -dimensional preparation for ETF to pass

As a provider of ETF, the fund company is also preparing for ETF interconnection, which involves systems, talents, products, channels, etc. Many fund companies have set up overseas exhibition ministry to expand their business.

Relevant sources of Huaxia Fund said that for ETFs into interconnection, the Huaxia Fund has fully prepared for the project's feasibility demonstration, business system preparation, technical system preparation, talent reserves, market research, and sales channel communication.

"In the early stage, we made preparatory work based on the rules released by the Shanghai -Shenzhen -Hong Kong Exchange in the early period of the Shanghai -Shenzhen -Hong Kong Exchange that can be included in the target of the target, and carried out the preparations from various aspects such as investment transactions, risk control compliance, and system operations, and the communication with overseas investors in the future The exchange prepared related English materials. "Liu Jun, director of the investment department of Huatai Berry Index.

Luo Guoqing, the person in charge of the investment department of the Guangfa Fund Index Index, also said that the company is currently working together to make relevant preparations. Do a good job of investing in ETF products, ensure the stable operation of the product, and do a good job of ETF's basic skills; for the incorporated ETF products, do a good job of investor education, deepen investors' understanding of the Mainland ETF operation mechanism, deepen the positioning of the investor's target index index And the understanding of investment value. At the same time, it also actively promotes more valuable products into interconnection and provides investors with more configuration tools. Wang Lele, an ETF Investment Director of Wells Fund Fund Quantitative Investment Department, said that on the one hand, it is on the one hand to promote product promotion for overseas customers in the Hong Kong market; on the other hand, it cooperates with securities firms, exchanges, etc. And the revision of related business systems, customer protocols, etc.

And Beibei, the assistant director of the Huitianfu Fund Index and the Investment Department and the senior index fund manager, also said that in order to ensure that ETF interconnection is online, the company has been participating in the transaction testing and data reporting test of ETF interconnection. The technical system is ready.

It is worth mentioning that many fund companies have also set up the overseas exhibition department to expand their business. For example, Hu Jie, general manager of the R & D investment department of Huabao Fund Index, said that Huabao Fund also set up a sales team with a long -term connection with overseas investment institutions to prepare for ETF interconnection.

Wang Lele also said that the wealthy foundation company has set up an overseas exhibition industry departments. Relevant sales teams have rich experience in overseas investment institutions and sales staff to make full -scale preparations for the landing of ETF interconnection, so as to fully attract more attractive more Overseas investors shared the dividends brought by China's long -term growth through the Fargo Fund's characteristic ETF products.

ETF targeted marketing opening

Strengthen mutual understanding

"For domestic ETF publishers, interconnection is a step for ETF to go out. Like stocks, domestic ETFs will become the choice of north -direction investors. Fund companies should face targeted marketing of ETFs on how to make ETFs for overseas investors." A fund manager's point of view revealed the focus of the future business of the fund company.

Liu Jun, director of the Investment Department of the Huatai Berry Index Index, also bluntly stated that the main challenge of the ETF communication business is that the understanding of domestic fund companies and overseas investors' understanding of each other's ETF market and ETF products are a process of gradually familiar. Continuous research, in the future, we will also deepen understanding and master targeted working methods in the future.

"It takes a certain amount of time to recognize and recognize the ETF cognition and recognition of the mainland market. It may be different from the mainland in terms of investment variety preferences, trading rules and market structures." It also talks about the joint exploration of investment demand and business demand for overseas customers in a targeted manner, provide relevant investment or business solutions, cultivate the cross -border service capabilities of mainland fund companies, and expand overseas customer groups and nationalized business. Investor education in overseas customers also needs to be cultivated for a long time. The development and layout of future index products can also provide corresponding ideas and directions.

In this regard, relevant persons from Boshi International said that the interconnection mechanism requires the joint promotion of policy and market participants to achieve long -term development. In this process, on the one hand, asset management institutions need to shoulder the work of more market construction and investor education, truly use the business opportunities given by the policy, and do a good job of the relevant category of sales and services abroad; on the other hand, Under the circumstances of mature conditions, it is necessary to gradually relax the restrictions on existing interconnection business and further promote the high -level development of China's capital market.

In fact, based on these difficulties, many fund companies have launched relevant investors' education work. For example, the Huaxia Fund issued a draft on the interconnection of interconnection from the China Securities Regulatory Commission. Explain and explain related knowledge. After the ETF was included in the interconnection list, the relevant theme live broadcast was also held as soon as possible. ETF Fund Manager introduced the relevant basic knowledge, market impact, and precautions participating in investment.

Wang Lele, an ETF Investment Director of Wells Fund Fund Quantitative Investment Department, also said that wealthy country has conducted product propaganda for overseas customers in the Hong Kong market, such as the company's official website, WeChat public account, brokerage bank and Internet platform channels Reveal the communication and publicity of relevant information disclosure, related transactions or operation agreements, and the investment value of related targets, and continue to carry out rich and diverse publicity and publicity activities.

From the current point of view, many fund companies have promoted the business operation mechanism, differences, and target index positioning, etc. in the early investor education work.

For example, Luo Guoqing, the person in charge of the investment department of the Guangfa Fund Index, said that investor education will mainly focus on investing in education in the Mainland ETF transaction operation mechanism, the differences between the ETF operation mechanisms of the two places, the targeting index positioning and investment value.

Wang Lele also said that investment and teaching work is mainly aimed at overseas investors to conduct disclosure of relevant Shanghai -Shenzhen Stock Connect ETF transfer regulations, trading rules, pricing methods, and risk disclosure agreements. Analysis of the investment value of core assets and scarce industrial sectors related investment targets; short -term customers more focused on sorting out the domestic market transaction structure, trading rules and mechanisms. Interconnection and interoperability provides more options

Pay attention to the differences in product elements, transaction time and other differences

Following the cross -border wealth management of the mainland and the Hong Kong market stocks, bonds and the Greater Bay Area, the income of ETF has enabled the interconnection mechanism to expand again. ETF interconnection will enrich the trading varieties of the two markets and provide investors with a lot of new choices. However, the currently included ETF products are mainly stock funds and fluctuate. It is also recommended that investors lay out in batches.

For how to lay out ETF, Liu Jun, director of the Investment Department of the Huatai Berry Index, introduced that ETF, which is incorporated into the interconnection, is located in the regulatory framework of Shanghai -Shenzhen -Shenzhen -Hong Kong Connect. Investors' appropriate requirements, that is, individual investors "securities accounts and capital account assets are not less than RMB 500,000." The current number of products in the Hong Kong stock market is relatively small, and its tracking index has a rearrassment with the Mainland cross -border ETF. For such products, investors should pay attention to the two in terms of product elements, trading time, capital settlement, exchange rate conversion, etc. Differences, and choose a product that is more suitable for you.

Wang Lele, the investment director of the ETF Investment Department of Fargo Fund, also said that for the participation of interconnection ETFs, on the one hand, the overseas allocation funds will have the opportunity to participate in the investment of A -share core assets and domestic scarce industrial sectors. Bonus with corporate growth. On the other hand, for trading funds, including some arbitrage strategies or quantitative strategies hedge funds, short -term participation in unreasonable arbitrage opportunities in the market will further increase the liquidity of relevant ETF targets and promote reasonable pricing of ETF.

"On the whole, the Hong Kong Stock Connect ETF is basically the same as the existing stock mechanism of Shanghai -Hong Kong Stock Connect in the transaction mechanism, daily limit control, investor appropriate management, liquidation settlement and risk control arrangements." ETF has special institutional arrangements in replacing fund managers, termination of listing, or liquidation business. There are certain differences from the mainland securities market. Investors should pay attention to possible risks.

Huaxia Fund also reminded that if mainland investors hope to participate in the four Hong Kong stock ETF investors through the south -Shanghai -Hong Kong Stock Connect and the south to Shenzhen and Hong Kong -Shenzhen -Shenzhen -Hong Kong Connect, because the ETF interconnection is an infrastructure connection based on stock interoperability, the main institutional arrangements are reference to stocks. Interconnection, following the current fund operation, trading settlement laws and regulations and operating models, investors need to pay attention to the Hong Kong stock market and Hong Kong stock ETF -related investment risks.

"For investors, it is important to note that the included ETF products are mainly stock funds, with high positions and certain volatility. I hope that investors understand the risk characteristics of the product. The layout of the Cathay Fund also reminded.

In addition, the industry's prospects for ETF are expected to be optimistic. Some institutions predict that the Mainland ETF transaction volume and overseas long-term configuration ratio will gradually increase. It is expected that about 150 billion to 20 billion to the Northbound Fund will be allocated to the ETF in the Mainland.

Edit: Xiao Mo

- END -

Agricultural issuance of Baise Branch Services to stabilize the balance of loans to the economic market exceeding 20 billion yuan

Agricultural issuance of Baise Branch Services to stabilize the balance of loans to the economic market exceeding 20 billion yuanThe colorful June is colorful in June. As a 25 -year -old Agricultural

[Heavy forward -looking] Domestic refined oil prices may be reduced; the new rules in July began to implement

Zhongxin Jingwei, June 26 (Zhao Jiaran) next week (June 27 to July 3), China ’s PMI will be announced in June. What other things will be concerned next week, let's take a look!domesticOil prices or t...