Tianli Lithium Core technical personnel have left 60 million accounts receivables the next month, where is the transfer of accounts receivable

Author:Jin Ziyan Time:2022.07.03

"Golden Syllabus" North Capital Center Song Chu/Author Tto Yin Sanshi/Risk Control

Back to the history, the way to go public in the new township Tianli Lithium Energy Co., Ltd. (hereinafter referred to as "Tianli Lithium"). Since being accepted, Tianli Lithium has undergone four suspension of listing review, accepted 5 rounds of inquiries in the Shenzhen Stock Exchange, and updated the 9th version of the declaration draft. It was not until March 7, 2022 that Tianli Lithium was submitted to registration.

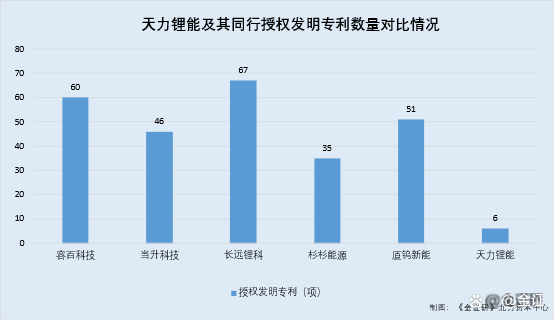

Behind Guantianli Lithium, the number of authorized invention patents of Tianli Lithium is "crane tail" in the peers. It is sighing. On the other hand, Tianli Lithium's independent director also serves as an independent director of the "peer" company, or it is difficult to perform their duties independently.

The problem was not over. During the transaction, the quality management system certification of Tianli Lithium Sanyuan Materials had been suspended, and the supplier supported the purchase amount of over 40 million yuan from 2019-2021. In addition, Tianli Lithium Energy may still have a vision that is selected from the transfer of accounts that over 60 million yuan.

1. The number of invention patents is at the bottom of the peers.

Innovation is the inherent motivation of enterprise growth, and talent is the "cornerstone" of corporate innovation. However, Tianli Lithium's authorized invention patent is the end of the peers, and the core technicians "run away" on the eve of the listing.

1.1 2019-2021 The cash-to-ratio is less than 1, 2020 is in a "blood loss" state

According to the prospectus, from 2019 to 2021, Tianli Lithium's operating income was 1.012 billion yuan, 1.243 billion yuan, and 1.663 billion yuan, respectively. During the same period, Tianli Lithium's net profit was 71.403 million yuan, 57.119 million yuan, and 84.85 million yuan.

According to the prospectus, the net cash flow generated by Tianli Lithium's operating activities was 660.168 million yuan, -412,422,200 yuan, and -144.137 million yuan, respectively. The cash inflow of Tianli Lithium's operating activities was 311 million yuan, 227 million yuan, and 299 million yuan, respectively.

According to the research of the Northern Capital Center of "Jin Securities", from 2019-2021, the cash-c service ratio of Tianli Lithium is 0.31, 0.18, and 0.18. In 2019, the net income ratio of Tianli Lithium was 0.92.

It can be seen that from 2019 to 2021, the Tianli Lithium Cash-to-be-consistent ratio is less than 1. In 2019, the net income of Tianli Lithium is also less than 1, and since 2020, the cash generated by Tianli Lithium can operate activities. The net flow is negative.

In addition, Tianli Lithium has a backward experience of authorized invention patents.

1.2 As of the signing date on March 30, 2022, the authorized invention patent number is the bottom

According to the prospectus signed by Tianli Lithium on March 30, 2022 (hereinafter referred to as the "Prospectus"), Tianli Lithium can select 5 comparable companies in the same industry, namely Ningbo Rongbai New Energy Technology Co., Ltd. Company (hereinafter referred to as "Rongbai Technology"), Beijing Dangsheng Material Technology Co., Ltd. (hereinafter referred to as "Dangsheng Technology"), Hunan Shan Shan Energy Technology Co., Ltd. (hereinafter referred to as "Shanshan Energy") Division Co., Ltd. (hereinafter referred to as "long -term lithium department") and Xiamen Xiamen Tungsten New Energy Materials Co., Ltd. (hereinafter referred to as "Xiamen Tungsten New Energy").

According to the prospectus, as of the date of signing the prospectus, on March 30, 2022, Tianli Lithium has obtained 6 authorized invention patents.

According to the prospectus, the number of authorized invention patents obtained by Rongbai Technology is 60; the number of authorized invention patents obtained by Sheng Technology is 46. The number of authorized invention patents is 35; the number of authorized invention patents obtained by Xiamen Tungsten is 51.

It is worth noting that the number of above invention patents is taken from the regular reports and prospectus of each company, and the number of patents of Shanshan Energy invention is taken from the positive pole material invention patent disclosed by the 2020 annual report of Shanshan.

It can be seen that as of March 30, 2022, the date of signing the prospectus, the number of authorized invention patents obtained by Tianli Lithium can be obtained at the bottom.

Not only that, Cai Bibo, a former core technician of Tianli Lithium, reported to the "eve of" by Yu Tianli Lithium.

1.3 Cai Bibo, who was the deputy general manager at that time, left one month after being identified as the core technician

According to the prospectus, as of March 30, 2022, Cai Bibo was the ninth major natural person shareholder of Tianli Lithium, which holds 0.92%of the shares of Tianli Lithium.

However, Cai Bibo, as the ninth natural person shareholder of Tianli Lithium, has a few positions, but he can apply for the "eve of" in the "eve of" in Tianli Lithium.

According to the prospectus, on March 27, 2020, Tianli Lithium can determine that Cai Bibo is one of its core technicians. On April 30, 2020, Cai Bibo resigned as a director of Tianli Lithium for personal reasons. On May 29, 2020, Cai Bibo resigned as deputy general manager of Tianli Lithium for personal reasons, and did not hold other positions in Tianli Lithium, and no longer served as a core technician of Tianli Lithium.

According to the "Tiaoli Lithium Energy on the Application of Stocks for the first public issuance and listing progress of the stock" signed on December 20, 2021, on July 1, 2020, Tianli Lithium submitted a listing of listing to the Shenzhen Stock Exchange. Material. That is to say, Cai Bibo, a former core technician of Tianli Lithium, resigned all positions he held in Tianli Lithium within 3 months before the listing of Tianli Lithium.

It is important to pay attention to that Tianli Lithium can say that Cai Bibo's main management coordinated research and development work before leaving, and was not responsible for the implementation of specific R & D projects. However, all 6 core technologies, which are also known as Tianli Lithium, include Cai Bibo's research and development results in Tianli Lithium.

1.4 Tianli Lithium can all six core technologies, all include Cai Bibo’s research and development results

According to the "reply to the fourth round of review and inquiry letter of the first round of the shares of Tianli Lithium Publicly issued stocks and the application documents on the GEM" signed on October 21, 2021 (hereinafter referred to as the "Four Rounds Inquiry ") Before Cai Bibo left, he mainly managed the research and development of Tianli Lithium Energy, and was not responsible for the implementation of specific R & D projects.

According to the public transfer instructions signed on July 29, 2015 (hereinafter referred to as the "revolving letter"), as of July 29, 2015, Cai Bibo served as the deputy general manager of Tianli Lithium. The production and technology of Tianli Lithium Energy. From October 2011 to July 29, 2015, Cai Bibo was in Xinxiang Tianli Energy Materials Co., Ltd. (Tianli Lithium Energy, hereinafter referred to as "Tianli Limited"), Tianli Lithium Energy served as the Minister of Technology, Production Director, and Director of Production, and Deputy general manager, director and other positions.

According to the prospectus, as of March 30, 2022, the signing of the prospectus, in the invention patent authorized by Tianli Lithium, Cai Bibo was a total of 5 patents of the inventor.

According to the research of the Northern Capital Center of the "Syllarsians", as of March 30, 2022, the signing of the prospectus, in the authorized invention patent obtained by Tianli Lithium, Cai Bibo's authorized invention patent as an inventor accounted for 83.33%.

In addition, all 6 core technologies that Tianli Lithium have, including Cai Bibo's research and development results in Tianli Lithium.

According to the prospectus, as of March 30, 2022, the date of signing the prospectus, Tianli Lithium has a total of 6 core technologies, namely "accurate control technology of diversified front drives", "high -capacity, high -voltage and solid positive pole material production "Technology", "High Consistent Wet Mixed Mixed Mixed Mixed Techniques", "Surface Modification and Deficiency Reconstruction Technology of Trinity Tripplaysia Purple Materials", "Control Synthetic Technology of Monochrome High Nickel Triplet Materials", "Single Crystal Crystal Control and synthesis of high -voltage three yuan material. " The six core technologies involved Cai Bibo's research and development results in Tianli Lithium.

The above situation shows that as of March 30, 2022, the signing of the prospectus, the number of authorized invention patents at Tianli Lithium was at the end of the industry. At the same time, Cai Bibo, a former core technician of Tianli Lithium and Deputy General Manager, left the "eve of" Yu Tianli Lithium.

In addition, Tianli Lithium's independent directors or part -time "peers" company.

2. Independent Director Tang Youzhi also serves as the independent directory of the "peer" company, or it is difficult to perform his duties independently

As far as the independent directors system is concerned, the core of independent directors play an independence. In 2020, Tang Yougen, an independent director of Tianli Lithium, was part -time, and was similar to the business or similar business of Tianli Lithium.

2.1 From March 2020, Director Tang Youzhi, an independent director, served as an independent director of the long -term lithium family.

According to the "Director of Directors of Tianli Lithium" signed by Tianli Lithium on March 12, 2020, on March 11, 2020, Tianli Lithium's board of directors elected Tang Youzone as an independent director.

According to the prospectus, from March 2020 to March 30, 2022, Tang Yougen served as an independent director of Tianli Lithium. The term of office was June 7, 2021 to June 6, 2024. From March 2020 to March 30, 2022, Tang Yougen also served as an independent director of the long -term lithium family.

That is, from March 2020 to March 30, 2022, Tang Yougen also served as an independent director of Tianli Lithium and Long -term Lithium.

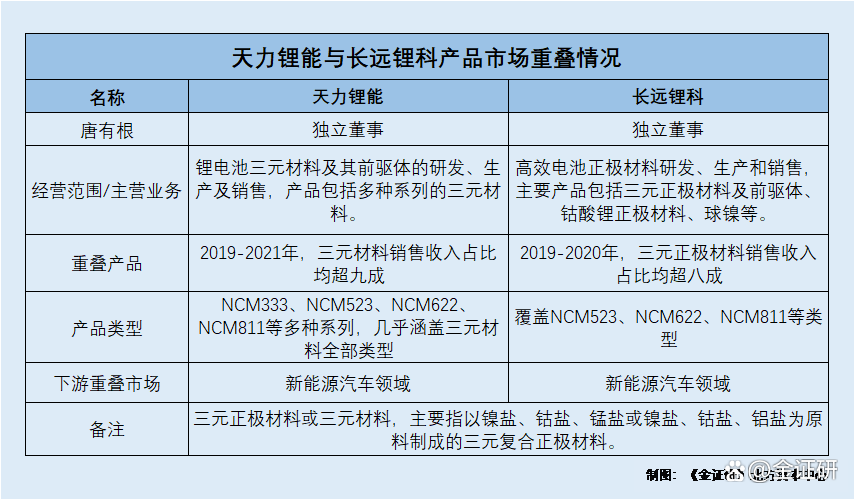

However, the main components of the long -term lithium and Tianli lithium energy operating income are all three yuan.

2.2 Three -yuan orthopedic material revenue accounted for over 90 % of the revenue of Tianli Lithium, accounting for over 80 % of the long -term lithium revenue

According to the prospectus signed by the long -term lithium department on August 5, 2021 (hereinafter referred to as the "long -term lithium prospectus"), the long -term lithium department is mainly engaged in the research and development, production and sales of high -efficiency battery materials. Aterior drive body, lithium cobaltate orthopedic material, ball nickel and so on.

According to the long-term lithium family prospectus, from 2018-2020, the sales revenue of long-term lithium department triple-amed pole materials was 1.681 billion yuan, 2.377 billion yuan, and 1.699 billion yuan, respectively. During the same period, the operating income of the long -term lithium family was 2.639 billion yuan, 2.766 billion yuan, and 2.011 billion yuan, respectively.

According to the research of the Northern Capital Center of the "Syllarsians", from 2018-2020, the sales revenue of long-term lithium department triple-amed pole materials accounted for 63.7%, 85.93%, and 84.51%of its current operating income, respectively.

It can be seen that from 2019 to 2020, the sales revenue of long-term lithium three yuan orthopedic materials accounted for more than 80 % of the current operating income of long-term lithium family.

At the same time, the sales revenue of Tianli Lithium Sanyuan materials accounted for more than 90 % of operating income. According to the prospectus, Tianli Lithium is mainly engaged in the research and development, production and sales of lithium battery three yuan materials and its front -drive body. Its products include a variety of three -round materials. Among them, the ternary positive electrode material or ternary material mainly refers to the ternary composite positive pole material made of nickel salt, cobalt salt, manganese salt or nickel salt, cobalt salt, and aluminum salt as raw materials.

According to the prospectus, from 2019 to 2021, the sales revenue of Tianli Lithium Sanyuan Materials was 983 million yuan, 1.234 billion yuan, and 1.634 billion yuan, respectively. During the same period, Tianli Lithium's operating income was 1.012 billion yuan, 1.243 billion yuan, and 1.663 billion yuan, respectively.

According to the research of the Northern Capital Center of the "Jin Securities", from 2019 to 2021, the sales revenue of Tianli Lithium Sanyuan Materials accounted for 97.12%, 99.3%, and 98.27%of its current operating income, respectively.

In other words, during the reporting period, the three yuan materials were the operating income of more than 90 % of the Tianli Lithium.

On the other hand, Tianli Lithium Energy also selects long -term lithium, which is comparable to its peers.

2.3 Lithium lithium can overlap with long -term lithium products, and the products of both parties "have no essential differences"

According to the prospectus, Tianli Lithium is mainly for the small power market. Its direct competitors are mainly ternary material manufacturers in the small power market. In view of the fact that the Sanyuan material manufacturer's main small power market has not yet been listed or listed, it is impossible to obtain public data. Tianli Lithium can choose the ternary material manufacturer in the new energy vehicle field as the comparable company in the same industry. Among them, Tianli Lithium can choose long -term lithium departments engaged in the three -yuan material business in the new energy vehicle field as comparable companies.

It should be noted that Tianli Lithium can be the same as the product type of long -term lithium family.

According to the prospectus, as of the date of signing the prospectus, on March 30, 2022, the products of Tianli Lithium include NCM333, NCM523, NCM622, NCM811 and other series, covering almost all types of three yuan materials.

According to the long -term lithium family prospectus, as of August 5, 2021, the long -term lithium family prospectus, the single -crystal products of the long -term lithium department covered NCM523, NCM622, NCM811 and other types.

According to the prospectus, Tianli Lithium can be called from the perspective of material composition, production process, and technical parameters of similar products, Tianli Lithium products do not have the essential difference between the same industry's comparison company products.

That is to say, the main products of Tianli Lithium and the long -term lithium family are all three yuan positive materials, and the product models overlap. At the same time, Tianli Lithium and long -term lithium products have no essential differences from the perspective of technical parameters.

Not only that, the long -term lithium department is a manufacturer in the field of new energy vehicles, and during the reporting period, the sales revenue of orthopedic materials for Tianli Lithium New Energy Vehicles exceeded 200 million yuan.

2.4 Tianli Lithium Energy and long -term lithium products application fields all involve new energy vehicles

According to the prospectus, from 2019 to 2021, the ternary materials produced by Tianli Lithium Energy are mainly used in small power fields such as electric bicycles and electric tools, followed by new energy vehicle fields. During the same period, the growth of Tianli Lithium's operating income mainly comes from the increase in the demand for lithium batteries in the field of downstream electric bicycles.

According to the long -term lithium family prospectus, the long -term lithium department is mainly engaged in high -efficiency battery positive material manufacturing business, and operating income mainly comes from lithium battery positive electrode materials. The downstream of lithium battery positive materials is mainly used in electric vehicles, 3C, energy storage and other fields.

In fact, during the reporting period, the sales revenue of orthopedic materials for Tianli Lithium New Energy Vehicles exceeded 200 million yuan.

According to the prospectus, from 2019 to 2021, the sales revenue of orthopedic materials for Tianli Lithium New Energy Vehicles was 110 million yuan, 121 million yuan, and 127 million yuan, respectively, accounting for 10.9% of the current operating income of Tianli Lithium. , 1.71%, 7.62%.

According to the research of the Northern Capital Center of the "Syllarsians", during the reporting period, the sales income of Tianli Lithium New Energy Vehicle Materials was 258 million yuan.

According to the prospectus, Tianli Lithium Energy faced the huge market space in the field of new energy vehicles, and gradually came into contact with manufacturers focusing on new energy vehicle power batteries. As of March 30, 2022, the signing of the prospectus, Tianli Lithium has been able to continue for two years, and the small batches of small -test products are supplied. It is hoped that further breakthroughs will be made in the field of electric vehicles. Since 2021, Tianli Lithium has begun to formally supply downstream customers focusing on the electric vehicle field.

This means that the long -term lithium department is a ternary material manufacturer in the field of new energy vehicles. During the reporting period, the sales revenue of orthopedic materials for Tianli Lithium New Energy Vehicles reached 258 million yuan.

It should be noted that in the case of overlap in the long -term lithium family of lithium lithium, Tang Yougen, an independent director who should perform his duties independently. At the same time, he should work part -time.

2.5 Independent directors should perform their duties independently, and are not affected by other units that have interest relationships with listed companies

According to Article 6 of the Rules of Independent Directors of Listed Companies, independent directors must be independent. Independent directors should perform their duties independently and are not influenced by the major shareholders, actual controllers, or other units or individuals that have a interest relationship with listed companies.

According to Article 13 of the "Rules of Independence Directors of Listed Companies", nominations of independent directors shall sign the consent of the nominated person before nomination. The nominated person should fully understand the situation, education, professional title, detailed work experience, all part -time jobs, etc., and express opinions on their qualifications and independence on their independent directors. The nominated person should issue a public statement on the relationship between them and listed companies without any relationship that affects its independent and objective judgment. In other words, Tang Youzone, as an independent director of Tianli Lithium, is the independent director of the long -term lithium family. However, the main products of Tianli Lithium and long -term lithium are all three yuan material, and the product model of the two sides of the two sides overlap. In addition, Tianli Lithium can also overlap with the downstream market of long -term lithium, which includes the new energy vehicle market. At this point, Tang Yougen, an independent director of Tianli Lithium, is also the independent director of the "peer" company. Can they perform their duties independently? unknown.

The problem has not yet ended, and the quality management system certification of Tianli Lithium Sanyuan Materials has been suspended during the transaction period.

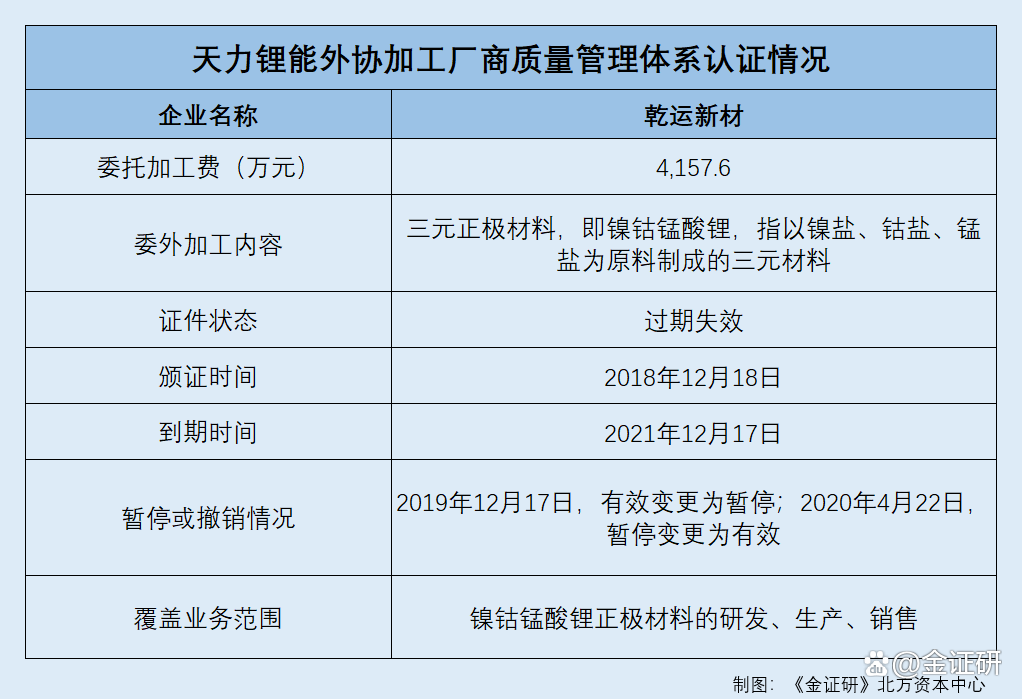

3. Foreign association manufacturers support the purchase amount of more than 40 million yuan, and the quality management system certification during the transaction is suspended

During the transaction, the Quality Management System Certificate of Quality Outsourcing Supplier's supplier may have been suspended.

3.1 From 2019 to 2021, a total of more than 40 million yuan in transactions with foreign association suppliers

According to the prospectus, during the reporting period, the major foreign association processing manufacturers of Tianli Lithium Sanyuan Materials include Shandong Ganyun Hi -Tech New Materials Co., Ltd. (hereinafter referred to as "Gan Yun New Materials").

According to the prospectus, from 2019 to 2021, the processing fee for the entrusted processing paid by Tianli Lithium to the new materials of dry transportation was 5.149 million yuan, 23.16 million yuan, and 13.309 million yuan.

According to the research of the Northern Capital Center of "Jin Securities", from 2019 to 2021, the total amount of Tianli Lithium's commissioned processing fee for dry transportation new materials was 41.5764 million yuan.

It should be pointed out that during the transaction with Tianli Lithium, the quality management system certification of the new materials of dry transportation has been suspended.

3.2 During the transaction with Tianli Lith

According to the national certification and recognition information public service platform, as of April 25, 2022, the new materials of dry transportation have only one quality management system certification. The business scope of this certification is the research and development, production, and sales of lithium cobalt manganticate materials, and the certificate number is 05318Q32868R0M. December 17.

The historical trajectory of the certificate of the certificate shows that on December 17, 2019, the status of the certificate was changed from effective to pause; on April 22, 2020, the status of the certificate was changed from pause to effective. And as of April 25, 2022, the certificate was expired.

According to the prospectus, NCM is the lithium nickel cobalt permanganate, which refers to the ternary material made of nickel salt, cobalt salt, and manganese salt as raw materials.

In other words, the scope of business coverage of the quality management system of dry transportation is overlapped with the scope of the products that can be processed by Tianli Lithium.

That is to say, during the transaction period, from December 17, 2019 to April 22, 2020, and December 17, 2021 to December 31, 2021, Tianli Lithium Foreign Association processing suppliers' new materials The quality management system certification is suspended or failed.

3.3 Quality Management System Certification Certificate is in a state of suspension and revocation, or due to the failure to follow the condition of the tracking supervision

According to the public information of the Ministry of Commerce, the quality management system certification is published to promote international trade, which is a kind of recognition of the buyers and sellers of the buyers and sellers. At the same time, through the quality management system certification, it has become a proof of the quality and work quality of the enterprise.

According to Article 2 and 47 of the "Certification and Accreditation Regulations", the certification referred to in these regulations refers to the qualifications of the certification agency to prove that the product, service, and management system meets the relevant technical specifications, the relevant technical specifications or the standards of the relevant technical specifications or the standards of standards or standards. Evaluation activities. The recognition agency shall implement effective tracking and supervision of the recognized institutions and personnel, and regularly review the institutions that have been recognized to verify whether it continues to meet the recognition conditions. If the institutions and personnel who have obtained the recognition no longer meet the recognition conditions, the recognition agency shall withdraw the recognition certificate and announce it.

According to the "Quality Management System Certification Rules" issued by the State Certification Commission on August 5, 2016, the situation of the certification agency suspended certification includes: (1) the quality management system continues or seriously dissatisfied with the certification requirements, including quality The effective requirements of the management system. (2) The responsibility and obligation stipulated in the certification contract will not be assumed or fulfilled. (3) It was ordered to be suspended and rectified by the relevant law enforcement regulatory authorities. (4) Administrative license certificates, qualification certificates, and compulsory certification certificates related to the scope of the quality management system have expired. The application for re -submitted applications has been accepted but has not yet been renewed. (5) Actively request a suspension. (6) Others who shall suspend certifications.

In addition, the case of the certification certificate of the certification agency includes: (1) the document that is canceled or revoked the legal status certificate. (2) The list of enterprises with severe dishonesty in quality credit by the State Administration of Quality Supervision and Inspection and Quarantine. (3) Reject supervision and inspection of the implementation of the certification supervision department, or to provide false materials or information on the inquiry and investigation of relevant matters. (4) Refusing to receive random inspections of national product quality supervision. (5) A major quality and safety accidents such as products and services have occurred, and the law enforcement supervision department has been confirmed that it is caused by the obtained organization. (6) There are other serious violations of laws and regulations. (7) The period of suspension of certification is full but the suspension problem has not been resolved or corrected. (8) Those who do not run the quality management system or no longer have operating conditions. (9) The certification information obtained in accordance with relevant regulations and the promotional obtained by propaganda causes serious impact or consequences, or the certification agency has requested it to correct it but has not been corrected for more than 2 months. (10) Others who shall revoke the certification. The above situation shows that during the transaction, the major foreign association supplier of Tianli Lithium Energy Sanyuan Materials, the Quality Management System Certification Certificate of the New Materials was suspended and expired; after the transaction Rejected. It is worth noting that the products that Tianli Lithium can be commissioned with new materials and Wulong Power Processing is the product within the scope of the above -mentioned quality management system certification.

At this point, the Quality Management System Certification Certificate of the Quality Management System of the New Materials of the Tianli Lithium Foreign Association was suspended during the transaction.

The problem has not yet ended, and Tianli Lithium can disclose the transfer of account receivables in its prospectus or in detail.

Fourth, more than 60 million yuan of accounts receivable transferred "hiding cats", information disclosure quality or "discount"

Information disclosure is an important window for investors to understand the important window of listed companies, and Tianli Lithium can be transferred to more than 60 million yuan of accounts receivable.

4.1 In 2021, the amount of account receivables signed by the contract transfer contract has accumulated at least 30 million yuan

According to the Central Bank Credit Center, on November 12, 2021, Tianli Lithium registered the financing contract number of the financing contract number RZBH440770000202100269, and the registration certificate number 138468755942048. The transfer party and the transferee of the agreement are Tianli Lithium and CCB Dongguan Branch. The registration date is November 11, 2022, and the amount of financing contract is 7 million yuan.

On November 22, 2021, Tianli Lithium registered the financing contract number Rzbh3229886002021n0015 and the registration certificate number 139473968673361. Lithium and CCB Su Gao Sub -branch, the registration date is November 21, 2022, and the amount of financing contract is 15 million yuan.

On November 22, 2021, Tianli Lithium registered the financing contract number Rzbh3229886002021n0015, the registration certificate number 139473990016673648. The transfer party and the transferee of the agreement are Tianli Lithium and the CCB Su Gao Sub -branch, respectively. The registration date is November 21, 2022, and the amount of financing contract is 10 million yuan.

According to the research of the Northern Capital Center of the "Syllarsians", as of June 27, 2022, in the inquiry date, in 2021, the cumulative amount of the accounts receivable contract signed by Tianli Lithium was more than 30 million yuan.

It should be pointed out that from the end of the reporting period from December 31, 2021 to March 30, 2022, the amount of accounts receivable contract signed by Tianli Lithium also exceeded 30 million yuan.

4.2 From January 1st to March 30, 2022, the amount of transfer receivable is also at least 30 million yuan

According to the Central Bank Credit Center, on January 6, 2022, Tianli Lithium registered the financing contract number of the financing contract number RZBH4407700002022N0010, and the registration certificate number of 14893828001780327736. The transfer party and the transferee of the agreement are Tianli Lithium and CCB Dongguan Branch. The registration date is January 5, 2023, and the amount of financing contract is 4.4028 million yuan.

On January 17, 2022, Tianli Lithium registered the financing contract number Rzbh4407700002022n0010, and the registration certificate number 150405798763461. The transfer party and the transferee of the agreement are Tianli Lithium and CCB Dongguan Branch. The registration date is January 16, 2023, and the amount of financing contract is 5.9861 million yuan.

On January 17, 2022, Tianli Lithium registered the financing contract number of the financing contract number RZBH4407700002022N0010, and the registration certificate number 15040583001798764612. The transfer party and the transferee of the agreement are Tianli Lithium and CCB Dongguan Branch. The registration date is January 16, 2023, and the amount of financing contract is 1.2568 million yuan. On January 19, 2022, Tianli Lithium registered the financing contract number Rzbh4407700002022N0010, and the registration certificate number 15077347003460085. The transfer party and the transferee of the agreement are Tianli Lithium and CCB Dongguan Branch. The registration date is January 18, 2023, and the amount of financing contract is 10 million yuan.

On February 14, 2022, Tianli Lithium registered the financing contract number with the Central Plains Bank Xinxiang Branch (hereinafter referred to as the "Central Plains Bank Xinxiang Branch"). The account receivable transfer agreement with 15366303001838979761. The transfer party and the transferee of the agreement are Tianli Lithium and the Central Plains Bank of Xinxiang Branch. The registration date is June 13, 2025. The amount of financing contract is 10 million yuan, and the value of the transfer of property is 13.1984 million yuan.

According to the research of the Northern Capital Center of "Jin Securities", as of June 27, 2022, from June 27, 2022, and January 1st to March 30, 2022, the accumulated accounts receivables signed by Tianli Lithium can be signed. The amount is 63.6456 million yuan.

However, according to the prospectus, Tianli Lithium can be transferred to its accounts receivable.

4.3 Tianli Lithium can transfer the transfer of accounts receivables above, but only the word is not mentioned

According to the prospectus, Tianli Lithium has not mentioned the transfer of account receivables in the prospectus.

According to Article 80 of Documents [2015] No. 32, the issuer shall disclose the main debt of the last issue, including the main bank borrowings, the debt of the main contract for internal personnel and related parties, or the main contract commitment, or The amount, period, cost, cash, mortgage, and guarantee for debt, duration, cost, billing, mortgage and guarantee. For those who have not repaid debts overdue, it should be explained that its amount, interest rate, loan fund use, reasons for not repayment on time, and expected repayment period, etc.

Secondly, Article 97 of the document stipulates that if the issuer currently has major guarantee, lawsuit, other or there, or major post -issues, it shall explain the impact of the issuer's financial status, profitability and continuous operation.

In this regard, Tianli Lithium can be transferred or hidden in the transfer of accounts that exceed 60 million yuan above, and the quality of the letter is doubtful.

Fog loses the building, and the moon is fascinated. All kinds of questions are in front of them. Can Tianli Lithium be confident to the market?

- END -

144.79 billion yuan!Nanyang signed a contract in June 157

In June, the city signed a total of 157 projects with a total investment of 144.79 billion yuan. This was learned from the Municipal Investment Investment Promotion Bureau on July 6.Of the 157 contrac

Great Wall I want to tell you

The Great Wall of Wanli is a world -famous world cultural heritage and a spiritual...