Guangzhou Tax Promoting Performance Policy

Author:Guangzhou Daily Time:2022.07.03

This year is the ninth year when the State Administration of Taxation has continuously carried out the "Public Taxation Spring Wind Action". , Innovate the "Twelve Intelligent Tax Spring Breeze", increase its efforts to promote the combined tax support policy, and use the promotion of the "Suitable Tax" grid service tax company communication group, optimize and upgrade the 12366 intelligent consulting function and other service measures to focus Taxpayers' tax -related demands, rapid response, speed up, and make every effort to promote the level of tax taxation services in Guangzhou to a new level. At the same time, the Guangzhou Taxation Department has focused on the opportunity of the first batch of pilot reform of the State Council's first business environment in the State Council to promote the pilot line of innovation in the field of tax -related fields. Optimize and service functions with rich service functions, one -stop intelligent tax service ecosystem, further boost corporate confidence, and better help enterprises cope with the complex and changeable domestic and international environment.

Tax personnel explain "Twelve Spring Breeze Spring Breeze" for the enterprise

Innovative pilot, "transcript" is very eye -catching

Among the 101 reform matters of the State Council's "The First Batch of Pilot Reform of the Business Environment Innovation", 16 tax -related matters were included, of which, the taxation department led 9 and 7 in cooperation. For more than half a year, the Guangzhou Taxation Department has paid a pair of benchmarks, and has not been able to promote the implementation of the reform tasks. As of the end of June, the Guangzhou tax department has completed a total of 11 reforms, nearly 70 % of the completion rate, and a copy of the market players have handed over a copy of the market players. The dazzling "transcript".

In terms of the reform of the "Realizing the Inquiry and Verification of the National Vehicle and Blind Taxation Information Networking Information and Verification", the Guangzhou Taxation Department, with the support of the State Administration of Taxation, rely on the China Vehicle Insurance Information Platform to receive the information library of the Tax and boat tax information library by the State Administration of Taxation, to achieve the national vehicle and ship tax payment information networking networking networking Query and verification. As of May 2022, more than 2,100 vehicles were insured in Guangzhou after paying taxes in different places.

"In the past, because the information was not shared, some car owners paid the taxi tax outside the province. When we insured in our company, we could not identify the authenticity of the taxation certificate provided by the owner. It will also trigger the contradiction between us and the owner of the insurance. Now, the tax authorities will open the country's car and ship tax payment situation to the query and verification function. It can be directly verified by the system to bring great convenience to us and car owners. "Ping An Property & Casualty Insurance. Li Jiawei, the tax manager of Guangdong Branch, said.

Tax Service Operation Center (Cloud Tax Hall)

Smart tax to help enterprises, "Cloud Office" expand again

Following last year in the Huangpu (Guangzhou Development Zone) Taxation Bureau settled in the first batch of tax service operation centers in Guangdong Province. In contact and cloud office, this year, the newly added tax certificate online, real estate transaction "hand -in -hand", and land transfer funds, including the "cloud on the cloud". As of May 2022, the city has "on the cloud" to deal with 26.86 million taxes and fees, and the non -contact rate of the Cloud Taxation Office has reached 93%.

"We are currently preparing for listing, and we need to issue the" Tax Taxation Certificate ". I thought I was going to run the lobby, but the tax department told us that now logging in to the Guangdong Electronic Taxation Bureau The company Lu Zhicong said, "It's too convenient to run at a time."

The "List of the first batch of business environment innovation pilot reform issues" led the reform items "Open Electronic Invoice Function on Personal Stock Housing Transactions" relying on "Cloud Office". , Action of mobile -to -handed personal existing housing transactions VAT electronic invoices. As of May 2022, Guangzhou has opened 597 electronic invoices for personal stock housing transactions on behalf of individual housing transactions, and realized the "online handling" of personal existing housing transactions and the entire process of tax payment.

In addition, in order to optimize the transfer income of state -owned land use rights, special income of mineral resources, the use of gold in the sea area, and the use of gold without residents' islands, non -tax revenue has been transferred from the tax department on January 1, 2022, and the Guangzhou tax department has achieved it. The above four non-tax income is not in contact with the V-TAX, and all operations such as the application, payment, and bill opening of the four income can be completed without leaving the house.

Tax Service Operation Center (Cloud Tax Hall)

"Suitable tax", communication and interaction and upgrade

The communication group of "Sui Tax Lianxin" grid service tax company is a new model of "unified standardized management, accurate publicity and counseling, timely response to demands, background support guarantees, and planting cultural atmosphere" created by the Guangzhou tax department. On the basis of this, the Taxation Bureau of Huangpu District (Guangzhou Development Zone) is also based on classified and constructing groups such as the "Fortune 500" enterprises, listed companies, unicorn companies, glaze enterprises, "specialized new" enterprises in the jurisdiction. The "five specialized" services of "special taxation channels, special demand collection, special communication channels, exclusive tax and fees, and professional appeal response" will be tailored to the enterprise.

As a national specialized "Little Giant" enterprise, Guangzhou Mingzhang Equipment Co., Ltd. has joined the "Suitable Taxation Heart-SME Exclusive Service Group". Active push hot tax and fee policy will also be required every two weeks. There are tax butler in the group. Usually encounter policies and operations issues. As long as they are raised in the group, they can get detailed answers from the tax steward. It can be said that it is a 24 -hour exclusive service, which is very intimate. "Wang Huayan also showed reporters the exclusive service manual tailored by the taxation department for Mingzheng equipment. In addition, the Guangzhou Taxation Department also focuses on the development characteristics and actual needs of various industrial parks in the Bay Area, innovatively launched the "Nine One" Park Service in the "One Park, One Period, One State, One Strategy and One Team, One Topic" Regulating, through refined and personalized tax services, it brings greater vitality to the development of the Bay Area enterprise.

Text/Guangzhou Daily · Xinhua City Reporter: Huang Qing Correspondent: Yang Ruixuan Picture/Guangzhou Daily · Xinhua City Reporter: Huang Qing Correspondent: Yang Ruixuan Guangzhou Daily · Xinhua City Editor: Lin Jing

- END -

Personal income tax annual exchange calculations can be declared tax refund for the end of this month's prepaid tax

The statutory declaration of the annual exchange algorithm of the personal income tax will be cut off at the end of this month. The Municipal Taxation Bureau reminded that if the taxpayer pays more ta

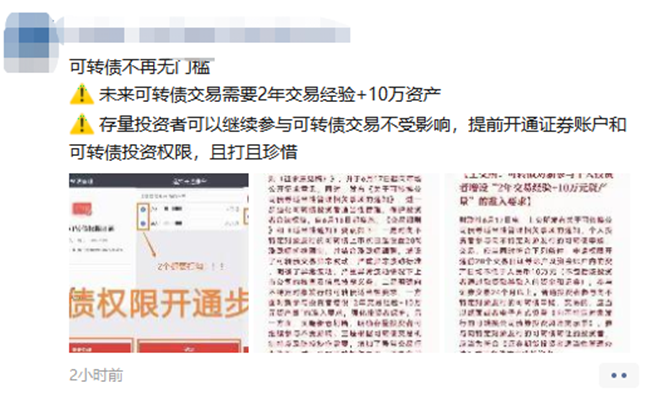

The threshold for convertible bond transactions is raised, and many brokers renovate the renovation system overnight to prevent "stepping on the line"

On June 17, the Shanghai Stock Exchange and Shenzhen Stock Exchange released the I...